TLDR: Covid has exposed joint underlying crises in our hospital system and our labour market, which were created by a 30-year long mantra of low public debt and low taxes adopted across the machinery of local and central Government, and accepted by politicians and median voters either tacitly or directly.

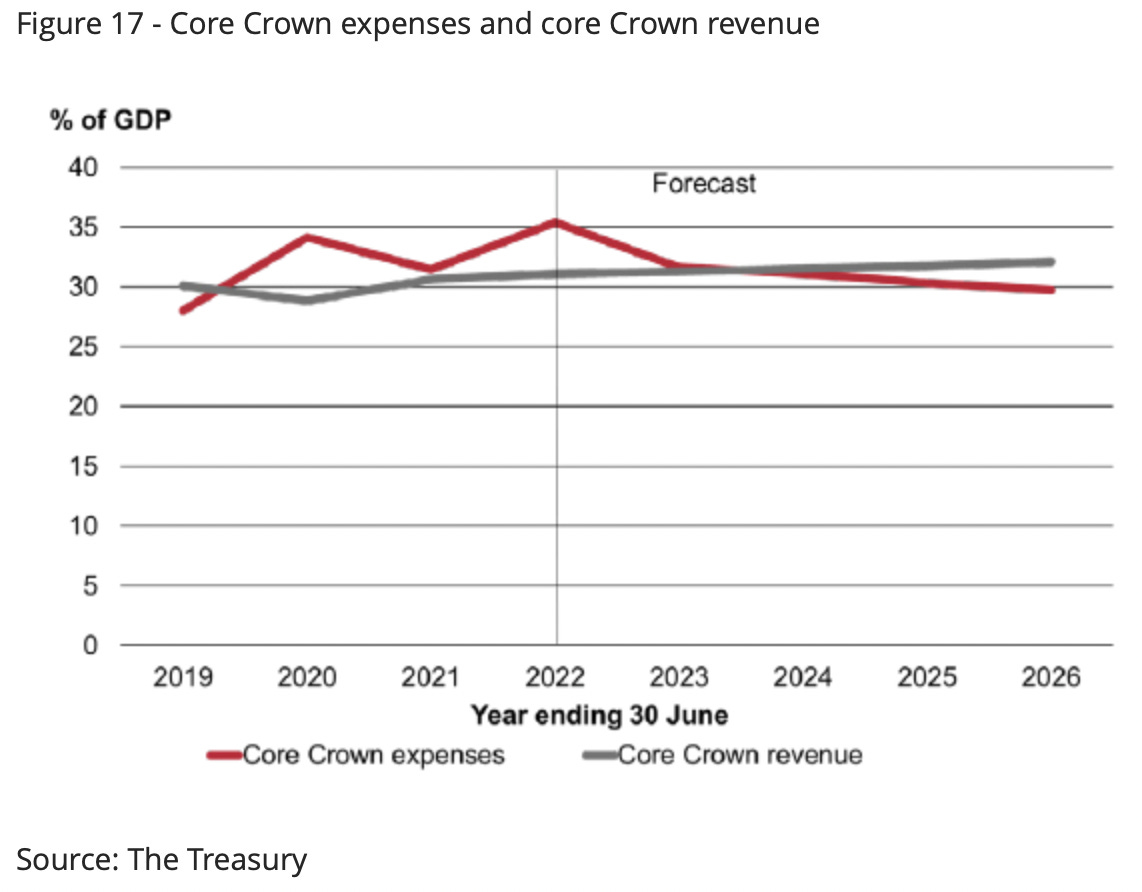

That mantra has never been stated as such out loud, but it governs every aspect and level of Government and our major public services day in and day out. It effectively means that the size of Government should be no larger in the long run than 30% of GDP, and that is enforced by keeping net public debt no larger than 30% of GDP.

Paid subscribers can see more analysis and detail on the mantra and its effects below the paywall fold now, although I’ll open it up after midday for sharing publicly, given the public interest involved. Subscribers can advise in the poll below if they want it earlier, or even immediately.

Elsewhere in the news here and overseas this morning:

Russia turned off all gas supplies to Germany overnight as part of scheduled maintenance on its Nordstream 1 pipeline, but Germany fears the Kremlin will choose in ten days’ time not to turn it back on, forcing rationing for industrial users and a sharp recession through the Northern winter; Reuters

Hundreds of protestors outside bank branches in the central Chinese province of Henan were beaten by Police after they demanded access to US$5.8b of cash frozen after fraud hit the banks, and after some customers were wrongly designated by local officials as Covid cases to stop them protesting; and, BBC

A survey of over 900 women doctors in Aotearoa-NZ found they thought the system was at risk of catastrophic collapse because of many years of under-funding and staff shortages. RNZ Stuff

The 30/30 mantra that’s sucking our future dry

It governs every aspect of our daily lives and all of public life in Aotearoa-New Zealand, but few know about it or have thought it remarkable enough to debate publicly. In many cases, it is just assumed to be such an obvious and good thing that it’s not worth contesting or noting.

The mantra is that no central or local Government will build a public service, set a tax or run deficits that mean the size of central Government or the size of net Government is much more than 30% of GDP in the long run. Effectively, it’s a 30/30 mantra because it means the tax to GDP ratio is set at around 30% of GDP and net Government debt is not allowed out go much above 30% for more than a couple of years. This interdependent rule circumscribes what Government can do, how much it can invest and what politicians are ‘allowed’ to propose to voters.

It has meant that over the last 30 years, our Governments (both local and central) have effectively run the most sinking of lids they could on Government-provided services such as healthcare, education, welfare and public transport. It is the strand of Governmental DNA that runs through everything. It is the unspoken force behind directives from public service leaders to the front lines and in their advice to incoming ministers and councillors. Its legal basis is the 1989 Public Finance Act.

There’s are good examples in plain sight every day and the effects are just as evident in the crises engulfing our health system at the moment and in the crisis emerging in the wider labour force. Covid was the shock that has exposed the weak underpinnings the 30/30 mantra has created for our economy and society. We’re discovering that mantra only works when our population is growing fast because of high levels of temporary guest worker migration and an ongoing-and-forever slide in interest rates that powers house prices higher. Now the migration has stopped and interest rates have risen (at least for now), the weakness of our economy’s underpinnings are clear.

Just this morning, health workers and ambulance staff are warning of a ‘catastrophic collapse’ in services because of staff, infrastructure and equipment shortages built up over many years of straining to keep spending on healthcare and worker wages low. Business groups are pleading with increasing desperation for the Government to properly releases the shackles on temporary worker migration.

When the tide goes out, the naked are exposed. Covid was a social and economic undersea earthquake that happened in 2020. The tide going out is in effect the sea drawing back before the tsunami comes back in.

A simple example

Here’s just one example. This morning the Erin Gourley reports for the Dominion Post that prospective Wellington City Council councillors are being told by the Council’s CEO Barbara McKerrow and CFO Sara Hay in a briefling released later today that they’ll have few choices to talk about with voters other than to consider selling Council assets. Here’s the detail, with the between-the-lines messages spelled out below:

The council – which has a big portfolio of commercial assets including ground leases under many commercial buildings, a 34% shareholding in Wellington Airport, and ownership of the KiwiPoint Quarry – may have to sell some off in order to “recycle the proceeds to other council priorities”.

A pre-election report is presented each year to candidates looking to run for election and summarises key issues for the council, including details of the council’s finances and the challenges ahead for the next council term.

Candidates reading this year’s report, released on Tuesday, should be left under no illusion that the tests awaiting them will be real and demanding – building a city capable of housing up to 80,000 more residents, in an evolving climate, with huge and growing infrastructure needs and declining revenue. Erin Gourley for the Dominion Post

Why is this the only option? Because most of the levers councillors could use to change the trajectories of spending on public services are unable to be used because of the 30/30 mantra. Also, the current situation of creaking-to-breaking-point infrastructure and huge future investment needs are the inevitable result of the 30/30 mantra in tandem with a high population growth strategy. The just-as-inevitable moment of truth we now face is because the safety ‘pressure valves’ of low-wage migration and ever-rising housing prices stopping an implosion and/or implosion have been turned off by the Covid shock.

For example, let’s say councillors wanted to invest much more heavily in water infrastructure and public transport to solve the housing affordability and water quality crises in Wellington. They are told they can’t use borrowing because debt isn’t allowed to be more than 280% of revenues. Why is that? Council debt limits are effectively governed by the Local Government Funding Agency (LGFA), which is a Treasury-run joint bond issuance agency that is carries a Crown guarantee. It means that councils, especially the faster-growing large ones such as Auckland and Wellington, cannot go over that two to three times revenue level because it would cause credit rating downgrades for the councils, and possibly the sovereign rating of the central Government itself.

The constant demand to reverse fiscal creep

That is not allowed because those downgrades would increase borrowing costs and interest rates for everyone, including ratepaying and median-voting home owners, who depend on ever-rising leveraged and tax-free house prices to offset their low wages. Higher debt levels would probably require a higher level of central Government taxation than the current 30% of GDP.

Currently, the ‘fiscal creep’ built into fixed income thresholds for our income tax system are expected to drive revenues to GDP above 30% over the next couple of years, and even more than spending1 (see chart below). That’s what is driving National’s calls for tax cuts and why there is consensus about there not being a need or desire for wealth or capital gains taxes.

The low-tax mantra at every turn

So why don’t councils just increase their own taxes in the form of rates or new fees? Unlike in Australia, where the states do charge property stamp duties and are granted a share of centrally-collected GST, our councils have few revenue-raising tools other than rates, parking fees, building consent fees, library fees and rubbish fees. Some have water charges.

Any attempts to increase rates or council debt to solve these issues are driven back by voters and/or the central Government because taxes aren’t ‘supposed’ to be more than 30% of GDP and public debt isn’t supposed to be more than 30% of GDP.

Hiding in plain sight

It took me an awful long time to understand the underpinnings of this interlocking system that proscribe the options for politicians and voters. It was actually laid out in public by the Labour and Green parties before the 2017 election when, in an attempt to convince voters, the public service (and themselves) that they were on board with the 30/30 mantra and therefore a ‘safe’ pair of hands, they committed to the ‘Budget Responsibility Rules’ that were designed to get net debt as measured then under 20% of GDP and keep Government spending around 30% of GDP. That spending limit can only be achieved with balanced budgets and debt around the 20-30% of GDP mark.

Hence the Labour-led Government’s go-slow on infrastructure and housing investment in its first two to three years as it bore down on capital spending and operating spending to achieve those targets. It’s why KiwiBuild failed and why it refused to agree to its own Welfare Advisory Group recommendations to increase benefits to the levels needed to significantly reduce child poverty. Its also why there is constant pressure downwards on wage growth in the public service. Without it, the ageing population and the naturally higher expenses to GDP of healthcare mean the spending to GDP ratio would inevitably rise and break the mantra. That is only sustainable with rising house prices so homeowners can offset that low wage growth with tax-free and leveraged capital gains.

The crises now rolling through our health system are an inevitable result of a decades-long starvation of operational and capital spending to keep achieving the 30/30 mantra. The drive for low wage growth in the private sector is also a result, indirectly, of the mantra. Without significant public investment in infrastructure and R&D requiring higher debt and taxes, the private sector cannot get the productivity growth needed to justify higher wages. Again, that is only sustainable with low consumer price inflation imported from overseas and ever-rising house prices.

The tide just went out and the failure of our 30/30 mantra to allow enough investment in health and real-wage-growing public infrastructure is there now for all to see. The opening of the borders for those who have choices to leave and the arrival of the winter flu season with Covid have thrown its failure into stark relief.

Chart of the day

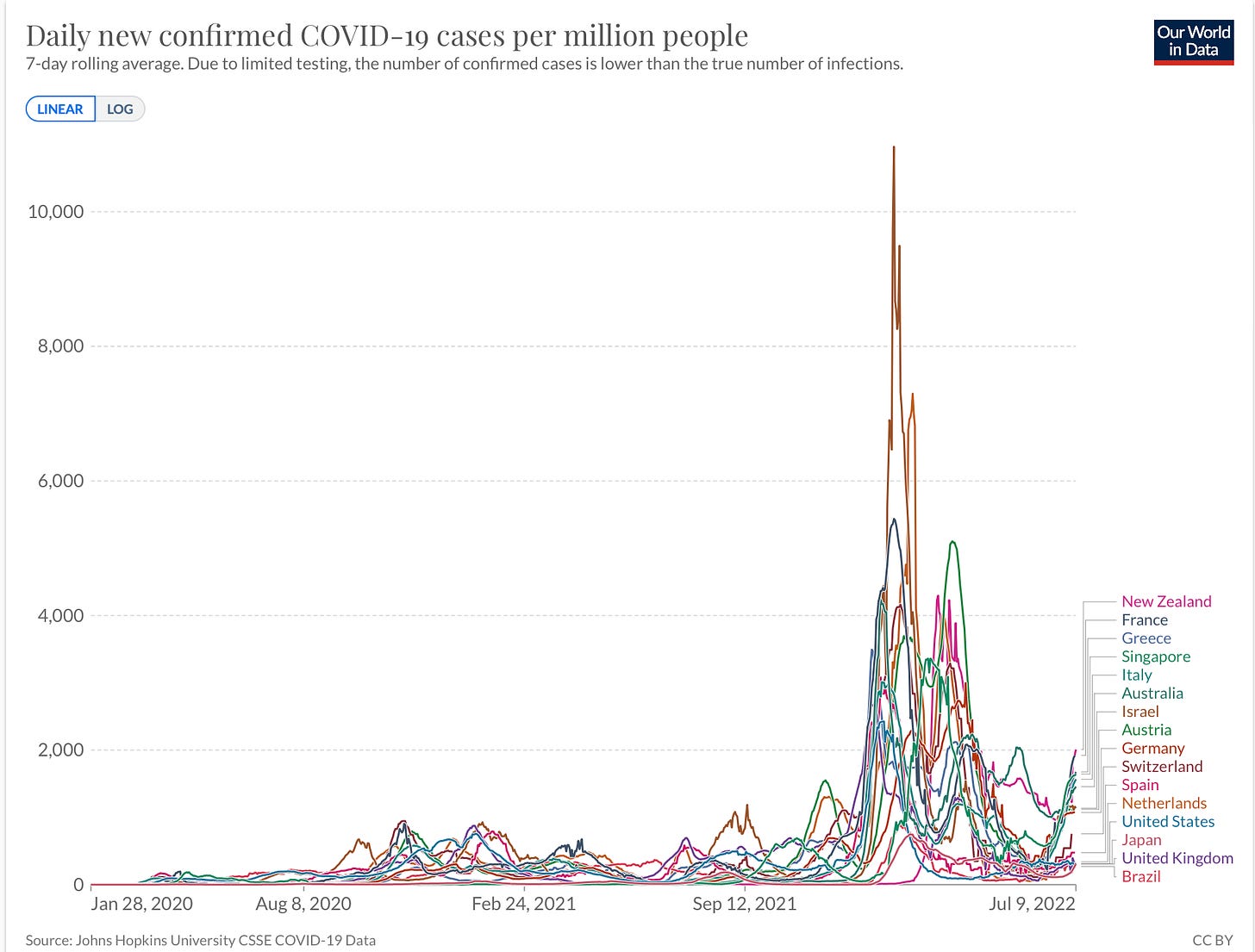

At the wrong end of the rankings

Aotearoa-NZ now has the highest Covid case rate per 100,000 population in the developed world, as pointed out in this chart via Eric Topol’s substack Ground Truths.

Quote of the day

A portrait of sociopathy

“If we have 50,000 riders they won’t and can’t do anything. I think it’s worth it. Violence guarantee[s] success.” Uber’s Travis Kalanick via The Guardian from leaked documents on his response to fears French taxi drivers would assault Uber drivers.

Number of the day

Down 0.3% - Electronic card spending in the core retail industry (excluding vehicle-related industries) fell 0.3% in June from May in seasonally adjusted terms, after experiencing a slight increase (0.9%) in the previous month, Stats NZ reported yesterday. Core retail includes consumables (eg groceries and liquor), durables (eg furniture, hardware, and appliances), and apparel (eg clothing and footwear). In actual terms, total retail spending using electronic cards reached $6.0b in the month of June, up $112m or 1.9% from June 2021. That compares with CPI inflation of around 7% _ i.e. that was a real drop in consumer spending.

Comment of the day on The Kākā

‘A delusional low-wage, high-living-cost country’

“I shook my head when I read about Arden’s work in Australia re immigration. Initially I thought what a stupid thing to do, then I realised if we have to compete with Australia on a level playing field for our workers the we’ll either have to finally improve things here or resign ourselves to being a second class backwater. (If we aren’t already). A low wage high living cost country aspiring to be a first world country is delusional particularly one who’s economy is based on agriculture. Very few first world farmers make money farming, they live off subsidies provided by more profitable industries taxes. Our farming heyday ended in the 70’s and I fear the penny has yet to drop!” CraigB on yesterday’s Dawn Chorus

Indeed. The magical thinking is strong for us all. Who stayed.

Some fun things

Ka kite ano

Bernard

PS: Here’s that poll on whether to open it up early to the public.

And here’s a poll asking whether opening it up to the public will change your willingness to re-subscribe.

A relatively high corporate tax rate and a sharp rise in profitability in recent years has also helped bolster tax revenues from wages and profits (but not capital gains). High inflation is also driving high nominal growth in GST revenues.

Share this post