TLDR: Global markets are in meltdown mode this morning as renewed fears about hotter-than-expected US inflation and central bank rate hikes slammed stock and bond prices in China, Europe and the United States. Bitcoin crashed 18% overnight after crypto lender Celsius blocked withdrawals and Binance had an outage.

Elsewhere in the news this morning:

UN Human Rights Commissioner Michelle Bachelet, 70, announced overnight she would not seek a second term from August, creating the sort of opening that a Helen Clark or Jacinda Ardern could go for if they were that way inclined;

Economists surveyed by the FT-$$$ see a near-70% chance of a US recession next year; and,

Fletcher Building faces a grilling from major shareholder Simplicity later this week over its Gib supply crisis, while new Building and Construction Minister Megan Woods (replacing Poto Williams in yesterday’s Cabinet reshuffle) will also address the crisis.

I have decided to put this one out to all publicly, partly as a reminder the Dawn Chorus is here for paid subscribers, and because of the magnitude of the shifts overnight and yesterday. Many thanks to paid subscribers, who support my ability to do this work.

In geo-politics, the global economy, business and markets

Concerted selloff - Chinese, European and US stocks and bonds cratered overnight on growing investor concern that faster-than-expected US and European inflation figures could force the world’s two biggest central banks to rapidly hike their official interest rates much-more-rapidly than previously assumed in coming weeks. As of 6.30 am NZT, the S&P 500 was down 3.7%, the Nasdaq was down 4.5% and the US 10 year Treasury bond yield had jumped 25 basis points to 3.40%, which is its highest level since 2011. The fall in stocks puts the US market into bear market territory, which is down 20% from a peak. Earlier European stocks closed down 2.4% and Hong Kong stocks closed down 3.3%. CNBC

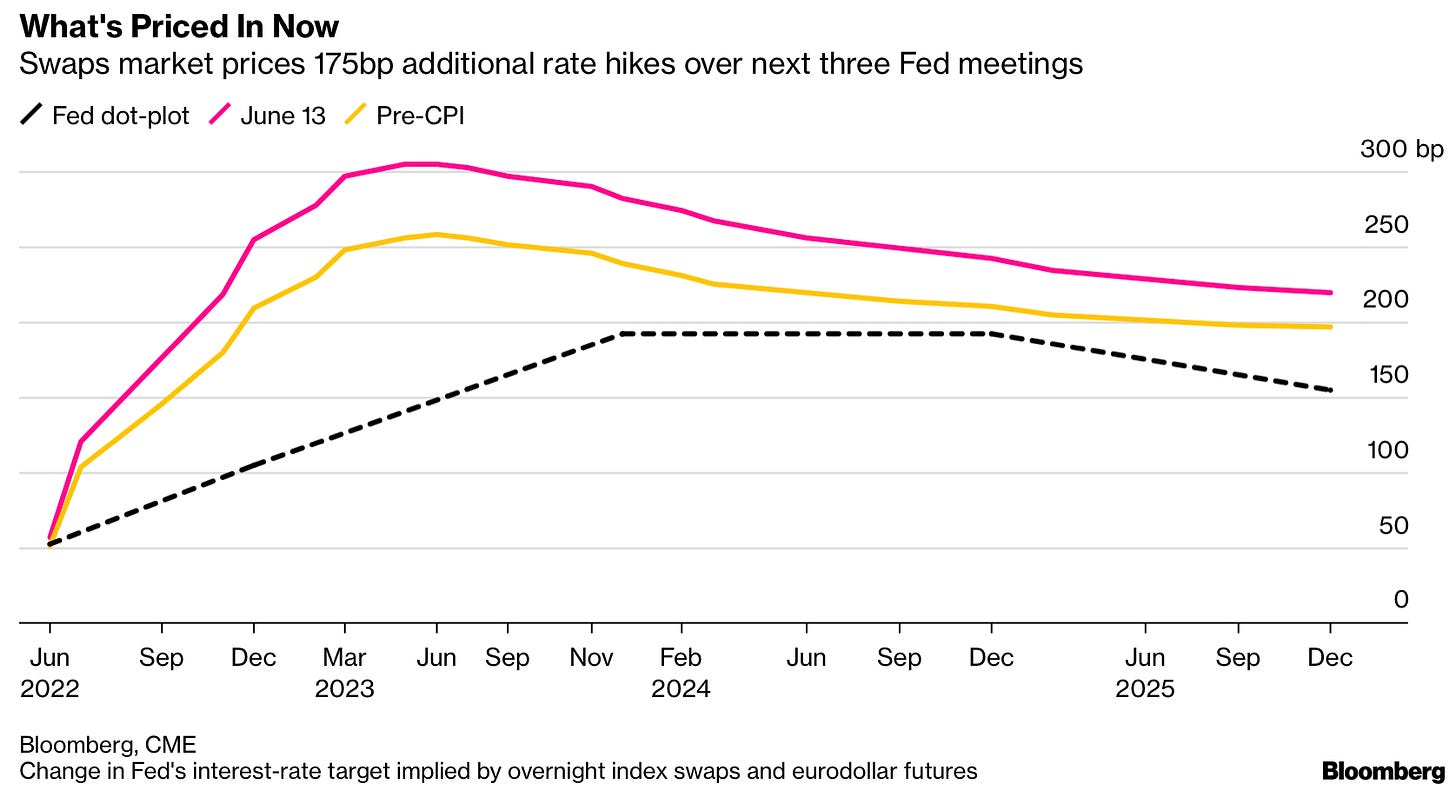

100 bps Fed hike? - Financial markets are now pricing in the chance the US Federal Reserve could decide on Wednesday night to put up its Federal Funds Rate by 75 basis points to a range of 1.5% to 1.75%. Previously, the consensus was that only a 50 basis point hike was necessary. One or two outliers are even suggesting a 100 basis point mega-hike is possible when the Fed’s decision is announced on Thursday morning NZ Time. Reuters

Crypto meltdown - Bitcoin’s price crashed as much as 20% this morning to under US$24,000 for the first time since December after, a crypto-currency lender, blocked withdrawals and Binance, the world’s biggest crypto-currency exchange, suffered a ‘stuck transaction’ outage for several hours. The total market value of crypto-currencies fell below US$1t and is now US$2.2t below its November 2021 peak. Reuters

So what? - Markets are going into meltdown mode now over the fear that higher inflation will stop the usual central bank response to a downturn or market slump of lowering interest rates. The crypto-currency world is in even worse shape, with an effective run on crypto banks now a regular thing. Last night’s collapse of Celcius does not bode well. There is a growing risk now of some sort of GFC version 2.0 that is driven by collapses in the crypto sector, emerging market crashes and severe stress on Europe’s banking system as investors dump their Italian, Greek and Spanish bonds.

Buckle up. This matters here because a big markets meltdown and bigger chances of a global recession may force the Reserve Bank to pause its own rate hikes, which would see mortgage rate hikes slowing down or stopping. See more in quote and chart of the day below.

Briefly elsewhere this morning

Ukraine suffers big losses as Russia advances in the east - BBC

China scrambling to contain Beijing super spreader event - Reuters

EU eyes legal action after UK scraps Brexit clauses over Northern Ireland - Reuters

New South Wales set to swap land tax for (existing) stamp duties - The Guardian

Scoops and news of note here in Aotearoa-NZ

Fletcher faces grillings - Major shareholder Simplicity is set to grill Fletcher Building’s board on Friday over the Gib supply crisis, which has crippled building projects and forced dozens of smaller builders and developers into receivership. PM Jacinda Ardern also said yesterday new Building and Constructions Minister Megan Woods, who is replacing Poto Williams, would also be able to more actively address the issue, given Woods is also Housing Minister and ultimately responsible for Kāinga Ora’s massive build programme, and is therefore a major Gib buyer.

Defensive stance - Fletcher Building CEO Ross Taylor (no not the cricketer) went out to do a round of interviews yesterday to defend Fletcher’s position. He told NZ Herald-$$$’s Anne Gibson that Gib stockpiling was partly to blame and Fletcher had been surprised by the surge in consents to 50,000 last year from 30,000, as had others. Taylor also spoke to Lisa Owen on RNZ’s Checkpoint about the Gib crisis, saying there was no bias in the industry towards plasterboard. The Australian-$$$’s Bridget Carter also spoke to Taylor, who is from Australia, about Fletcher’s bullish profit outlook and its Australian growth plans.

So what? - This is a perfect storm for Fletcher Building’s social license to operate. Amid an ongoing building materials market study, the political temperature is rising over Fletcher’s 95% dominance of the plasterboard market and how shortages are crippling large swathes of the building sector, causing collapses and delays that will stifle the overall economy’s momentum and threatens to unravel growth in what has been the economy’s most robust sector. Ross Taylor should have a chat with Foodstuffs CEO Chris Quin to see what it’s like to lose that social license.

Briefly elsewhere this morning

West Coast blames Govt for seawall funding shortfall - The Press

House asking prices drop 2% on Trade Me in May, biggest drop ever - Stuff

Commissioners dump plan to put houses on Tauranga Racecourse - Stuff

For the record yesterday

A major-minor reshuffle - PM Jacinda Ardern announced what her office described yesterday as a minor reshuffle that saw:

Poto Williams stripped of the Police and Building and Construction, but somehow remaining in Cabinet with her 10 ranking intact (she was given the Conservation and Disability Ministries);

Kris Faafoi leaving Cabinet and Parliament altogether to spend more time with his family;

Kiri Allan

promoted into Cabinet and given Faafoi’s Justice portfolio (already in cabinet);Chris Hipkins given Police and relinquishing Covid 19 (to Ayesha Verrall) and parts of his Education portfolio (to Jan Tinetti);

Michael Wood given Immigration and Willie Jackson given Broadcasting;

Kiri AllanandPriyanca Radhakrishnan promoted into Cabinet from being ministersoutside Cabinet;Kieran McAnulty given Emergency Management and Racing ministries outside cabinet, while also becoming Associate Local Government minister; and,

Trevor Mallard is leaving as Speaker to become an ambassador in Europe (thought to be Ireland) and will be replaced by Deputy Speaker Adrian Rurawhe.

So what? Ardern realised the Government is in deep trouble over perceptions of being soft on crime and not being in control of gang violence and drive-by shootings. She also acknowledged the Gib crisis and that heavy-hitter Megan Woods needs to grab the issue off Williams.

The reshuffle, which was not minor, but also not major, has strengthened the roles of the ‘kitchen Cabinet’ around Ardern and Grant Robertson, with Woods and Wood being given the troublesome and potentially dangerous ministries of Building and Immigration respectively. Chris Hipkins’ reputation as a ‘Mr Fixit’ of Cabinet is concreted in with his assumption of the Police portfolio.

But the biggest news may be Ardern’s comment that she plans a bigger reshuffle early next year. The biggest wildcard (and I know nothing specific to back up this possibility) would be the removal of herself in the same way (and similar timing) in which John Key handed over to Bill English before the 2017 election. There is a plumb UN job up for grabs. Just saying…

That would give Grant Robertson a clear run to the election with the flexibility to propose a wealth tax, which he has not ruled out for himself, even if the PM has. This is purely speculative on my part, but stranger things have happened.

Useful longer reads

Todd Niall has a good piece in Stuff this morning explaining how political disunity in Auckland is hurting its climate change efforts.

Quote of the day

This reveals a lot about investor thinking

“There is very little chance of the Fed pivoting to support financial markets until there is a trend of very meaningful economic disappointments.” Seema Shah, chief strategist at Principal Global Investors, via FT-$$$

Number of the day

Russia making more now from oil than before the war

€93b - Russia earned €93b from fossil fuel exports in the first 100 days of the war, the Center for Research on Energy and Clean Air reported overnight. Just over 60% of the revenues came from the European Union.

Chart of the day

How market expectations of Fed hikes have changed

Comment of the day on The Kākā

A truly radical idea for a money-printing followup

“If the RBNZ lends to commercial banks via FLP, what stops the RBNZ having an offshoot that provides retail banking services?.” Neil on Monday’s Dawn Chorus.

Spookies, profundities, curiousities and feel-goods

Fun things

Ka kite ano

Bernard

PS: I have corrected that Kiri Allan was promoted into cabinet. She was already there. My apologies and thanks to readers for pointing this out. I’ve also clarified that New South Wales is looking at swapping its existing stamp duties for a land tax, not the other way around, as the original headline could be read to me.

Tuesday’s Chorus: Global market meltdown