TLDR: Evidence emerged this morning that the IRD was asked to look at delivering $100 helicopter payments to each and every Aucklander during the city’s extended lockdowns last year. It said it couldn’t do it easily.

Those logistics issues are now being confirmed with IRD struggling to find the bank accounts for 170,000 people eligible for Budget 2022’s $350 cost of living payment to non-beneficiaries earning less than $70,000 per year.

Paid subscribers can see more detail and my analysis below the paywall fold, plus an idea I put forward for a better, fairer, faster and simpler way to make helicopter money payments.

Elsewhere in the news here and overseas:

CoreLogic published its latest update of its Mapping The Market tool this morning that showed 51% of Aotearoa-NZ’s suburbs had fallen in price in the last three months;

Infometrics published a new analysis of housing affordability this morning that showed affordability at its worst level since 1957;

The Human Rights Measurement Initiative’s annual report for Aotearoa New Zealand was published last night, showing tangata whenua were the most likely to suffer human rights violations in education, healthcare, housing and justice;

US Federal Reserve Chairman Jerome Powell told Congress this morning a ‘soft landing’ for the world’s largest economy was now a ‘very challenging’ prospect and that a recession was now a ‘possibility,’ which nudged global stock and bond prices higher on hopes Powell’s comments meant much, much higher interest rates wouldn’t be needed to bludgeon inflation lower;

Britain’s annual inflation rate rose in May to a 40-year high of 9.1%, the Office of National Statistics reported, which was above April’s rate of 9.0%, but in line with economists’ forecasts; and,

US President Joe Biden called on Congress overnight to suspend federal ‘gas’ taxes of 18 USc per gallon on petrol (7.6 NZc/litre) and 24 USc per gallon of diesel (9.9 NZc/litre) for three months1. CNBC

Govt eyed helicopter payments for Aucklanders

This morning we awake to news that the IRD has struggled to find the bank accounts of all the 2.1m people eligible for the $350 ‘cost of living’ payments for non-beneficiaries earning less than $70,000 per year that was announced in the Budget in May.

Also, we’ve discovered IRD argued it would not be able to easily make a ‘helicopter money’ payment of $100 per person to Aucklanders, as was suggested (and then rejected) internally by the Government late last year during extended Covid lockdowns in Auckland and the Waikato.

Jenee Tibshraeny reports for the NZ Herald-$$$’s front page story this morning that IRD initially didn’t have bank account numbers for 170,000 of the 2.1m when the $350 payment was announced in May, and has now found 130,000 of them. It thinks it will be able to get all but 11,000 of them. Jenee reported the IRD’s acting commissioner and CEO Cath Atkins told a select committee yesterday IRD had taken on 300 contractors to administer the payments over five months and expected to need as many as 750 IRD staff to handle inquiries at peak payment times.

Meanwhile, Marc Daalder reports this morning for Newsroom that the Government considered making ‘helicopter cash’ payments of $100 per Aucklander during the extended Covid lockdowns late last year, but that they decided against it after IRD warned it would struggle to roll out such a payment to all New Zealanders, let alone anything more targeted.

Citing OIA documents, Marc quotes IRD officials writing in a November 3 briefing about a suggested one-off payment to all New Zealanders that:

"Designing, implementing and administering this payment would require a significant reprioritisation of Inland Revenue's work programme. Our experience is that it would be very challenging to design and stand up an untargeted one-off payment before the end of the year.

"We need further confirmation and details on the parameters to design the payment, and to assess whether it is feasible, cost effective, and establish a timeline if Inland Revenue is asked to deliver the payment."

A week later, Marc reports ministers asked about narrowing the payment to Aucklanders only, which elicited this IRD response on November 10:

"The level of operational support required to accurately deliver a $100 payment to Aucklanders prior to Christmas would be significant and beyond Inland Revenue's current capacity.

"Given the Government's and public expectations around these [Regional Support Payment] measures, we consider there would be significant reputational fallout if progressing the one-off payment resulted in Inland Revenue failing to meet these expectations.”

Marc reports Revenue Minister David Parker saying the Government decided against the payments after the November 10 briefing. Parker is quoted as saying:

"Ministers focused on support for businesses and the CBD, which was why in the end they went with other measures including vouchers.” David Parker quoted from an email via Newsroom.

The case for a helicopter payment system instead

This highlights the issues around why the Government did not make ‘helicopter money’ cash payments to all residents during the lockdowns of 2020 and 2021. Instead, the Reserve Bank printed $55b to buy Government bonds in financial markets from banks and fund managers. The Government, in turn, used $20b of that money to pay cash directly as few-questions-asked grants to employers as wage subsidies and resurgence payments.

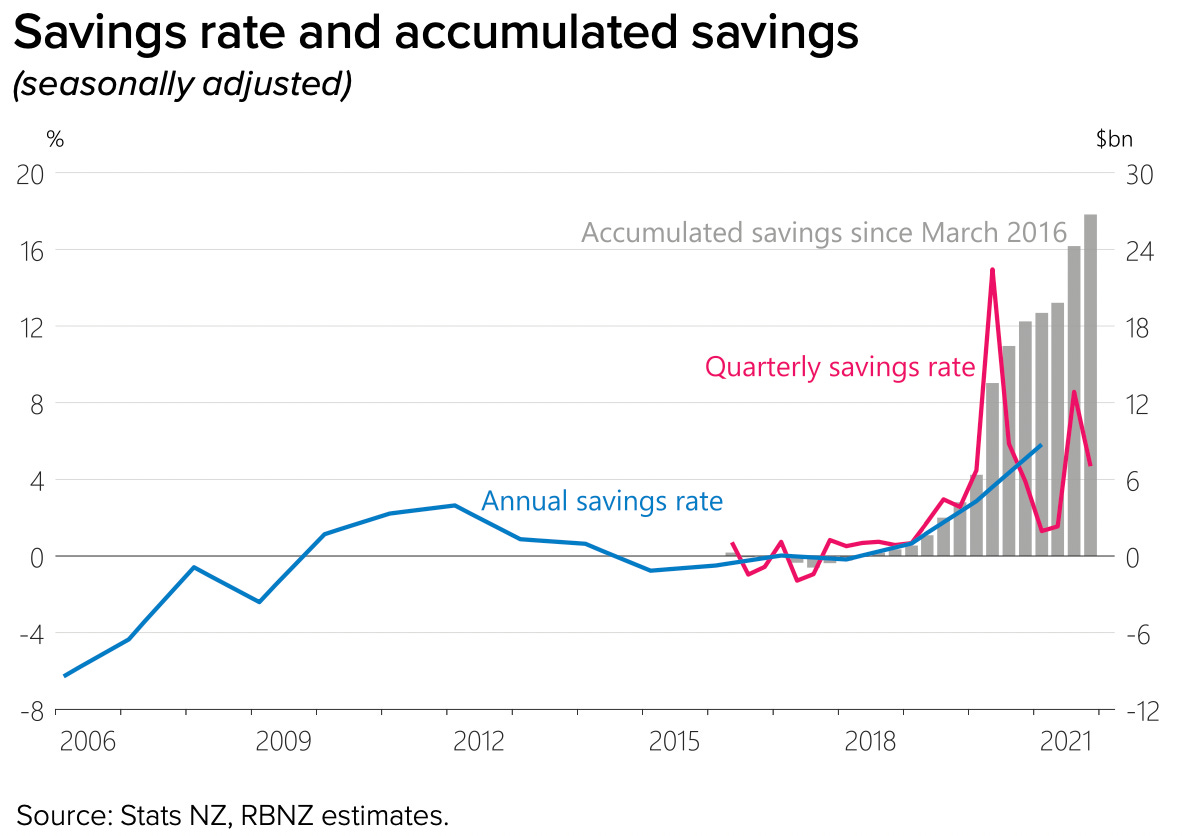

That money was crucial in the initial weeks of lockdowns in reassuring employers about cash flows and avoiding mass sackings. But it was soon evident the money was not needed and it has ended up as increased cash balances in the bank accounts of households with assets (ie home owners) and non-financial businesses, as the chart shows. It was an indirect transfer of wealth from taxpayers in general, including renters, PAYE wage earners and GST payers, to asset owners in the form of home owners and business owners. Less than $1b has been repaid and many companies, including NZME and Fletcher Building, have chosen to keep the cash and pay it out to shareholders as dividends and share buy-backs.

Why not pay it direct to everyone, not just the richest?

The Government could have instead paid that $20b in cash directly and equally to all residents, including children, to support the economy in the event of feared collapse due to lockdowns. This sort of payment was made in other countries during lockdowns, but the Labour Government chose to focus the cash grants on businesses.

One argument against such helicopter payments, as detailed above by IRD, was the logistical challenges involved in identifying residents and being able to make payments quickly into their bank accounts. Another argument is that ‘helicopter money’ funded directly by the Reserve Bank printing money and handing it directly to the Government would be seen as inflationary, reckless and unfair. That’s one reason why the Government chose the roundabout route of the Reserve Bank buying bonds on the financial markets after the Government had issued the bonds to banks and fund managers.2

One result of that was the banks and fund managers capturing a margin on the way through on the money roundabout. Also, interestingly, the Government never actually spent all of the $55b in freshly printed money it received in that roundabout way. There is still $33.4b sitting in the Crown Settlement Account with the Reserve Bank, the Reserve Bank’s data shows. The difference of $22b almost exactly matches the $23b in extra household and business savings seen in the above chart.

So how could the helicopter money have been done?

My suggestion? One way to ensure immediate, fair, direct and controllable payments to all residents would be for the Reserve Bank to create accounts for every resident of Aotearoa-NZ as soon as they were born, that could be accessed by an app or debit card connected to the EFTPOS payment system.

The Reserve Bank is considering whether (and how) to develop a central bank digital currency that would effectively be able to generate New Zealand dollars independently of the banking system.3 These Reserve Bank-created ‘e-dollars’ would be exchangeable one-for-one with regular private bank dollars. So far, the Reserve Bank has focused on creating wholesale facilities or accounts for these e-dollars, but it could just as easily create retail accounts for each New Zealander on birth.

This could be done by creating an app and a Reserve Bank account for every individual ahead of a crisis. The bank would have to identify someone as a resident of Aotearoa-NZ and ensure that resident had a way of using that account to buy things, through an app linked to the account and/or some form of debit card linked to the EFTPOS system. If a Government was worried about how the money might be spent, it could be limited so the e-dollars could not be used to buy alcohol or for gambling, for example. Australia has issued a similar type of debit card payment system for some beneficiaries.

When the crisis hits, the Reserve Bank could then be directed to inject the fresh e-dollars equally in a one-off way to every resident to spend or convert into a ‘regular’ NZ dollar in a regular bank account. Given the e-dollars could be endowed with smart contract qualities, they could be time-limited and even given a special interest rate, which could even be negative. That would encourage people to spend it quicker, if the rate was negative and highly-enough negative.

Open Matariki accounts for all that use e-tāras

I’d propose every baby born here and everyone classified as a permanent resident be given such a ‘citizen’s dividend’ account. The ‘citizen’s dividend’ idea has been proposed overseas as a way of making universal basic income payments, or setting up endowments for children that can be used for college education.

I’d suggest the accounts be called Matariki accounts and the currency be called the e-tāra. Every child born here could be granted a starting payment of, say, $10,000, which would be linked to the parents’ or guardians’ Matariki account. That could be used to help families in those tough early years, but also create a base of usage that meant people and shops were familiar with the Matariki cards, the Matariki app and the e-tāras. In time, the accounts could be used for benefit payments and, if people chose, as their main transaction account that employers, the IRD, Government departments, ACC and others would use. Anyone being granted residency would be given a Matariki account.

Such an account would solve many of the online identity issues currently handicapping many Government and small business attempts to build the online economy. It would also provide a competitive element for private banks to keep their fees low.

Just a thought. I welcome your comments and suggestions for improvement below.

Quote of the day

GIB and other shortages are pushing builders to the brink of failure

"In one subdivision alone, I counted 19 houses waiting for either bricks, windows, or Gib board. And they've all been sitting at this stage for a number of weeks. So there will be cashflow issues." Building Supplies Cooperative chairperson Carl Taylor talking to Sam Olley on RNZ’s Checkpoint last night.

Number of the day

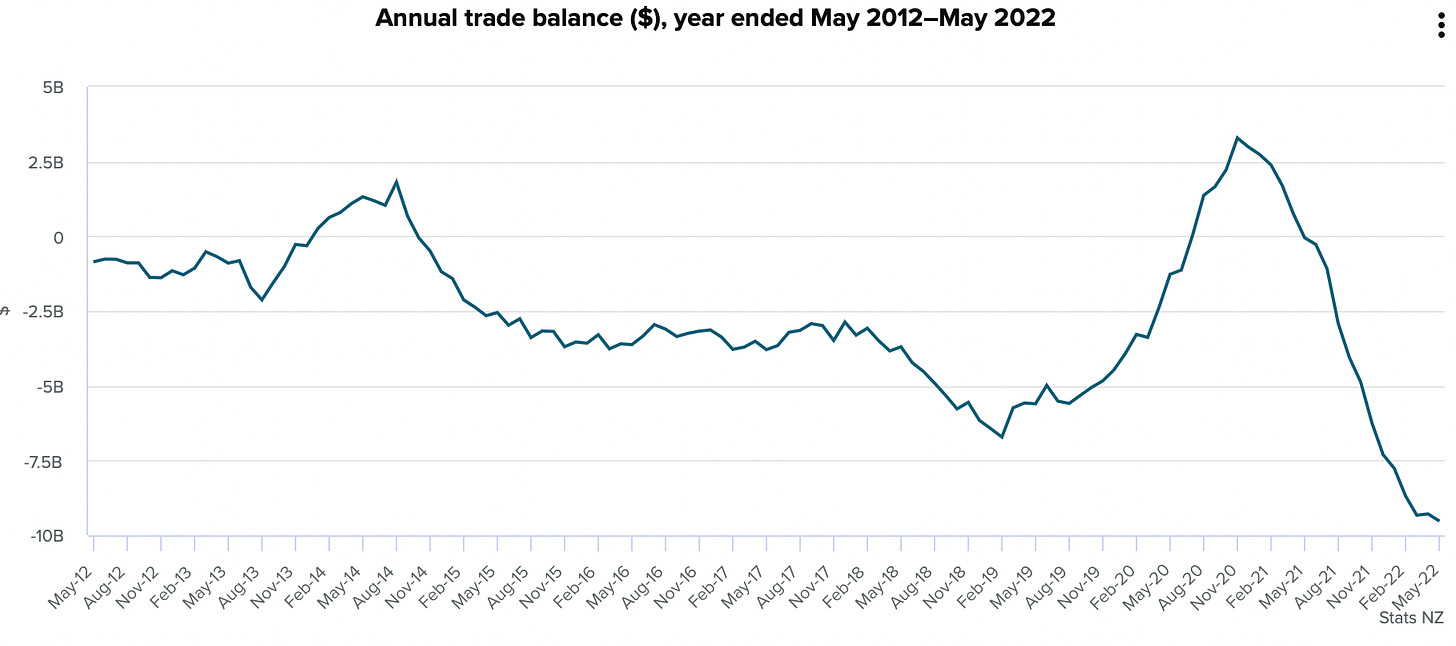

Goods imports galore now

$9.5b - Stats NZ reported yesterday Aotearoa-NZ’s annual merchandise (goods) trade deficit was $9.5b in the year to the end of May 2022, vs a deficit of $49m the previous year. Goods exports were valued at $67.2b for the year, up $7.7b from the previous year. Annual goods imports were valued at $76.7b, up $17.1b from the previous year.

Chart of the day

A goods deficit, which won’t have many services exports to offset it

Comment of the day in The Kākā community

Fixing the flaws in consumer confidence measures

Hi Bernard, could you dive into how fit for purpose the consumer confidence index even is? It feels incredibly flawed on a number of levels. Firstly, as you pointed out, due to the fact the statistics do not reconcile with the survey, which reflects the power of certain stories being told and held, regardless of the reality. Secondly, (and perhaps more importantly) the fact we are still seeking to assess people's engagement and understanding of the economy based on their intended consumption, in a midst of global converging crises, where "consuming" our way out of global warming and biodiversity loss isn't physically possible and in fact perpetuating the crisis. I wonder if it was replaced with a citizen confidence index (informing on engagement on policy and strategy in governments and organisations big and small - per Jon Alexander's suggestion), or removed entirely as a distraction would be more helpful? Georgia in yesterday’s Chorus

Some fun things

Fun fact: The US Federal tax on petrol has been unchanged at 18.4c/gallon since 1993 and represents less than 4% of the current total price of around US$5/gallon, which is the equivalent of NZ$2.07 per litre. That 18.4c/gallon is the equivalent of 7.6 NZc per litre and compares with the NZ$1.35/litre of taxes being charged for regular at the moment, which includes road user levies of 95.4 NZc/litre and GST of 39.9 NZc/litre. This is down from the usual NZ$1.64/litre because of the current 29 NZc/litre levy cut that is due to expire on August 14.

Interestingly, the Reserve Bank was less worried about the implications of ‘going direct’ when reversing the bond buying. It is planning to sell the bonds directly to Treasury at market determined prices over the next five years, along with letting some of the shorter maturity bonds ‘roll off’ or mature, whereby the Government pays cash directly to the Reserve Bank as the bonds mature.

Currently, New Zealand dollars are ‘created’ by banks when they issue a loan out of ‘thin air’, which is matched by deposits in either their own accounts or another bank’s accounts, depending on how the customer chooses to spend the money. The only limit to how much money the banks can ‘create’ is the Reserve Bank’s requirement that each new loan must be backed by a certain percentage of the bank’s own equity capital. Effectively, the banks can only create new money as fast as the extra profits regenerated into equity capital they are able to report. One reason the Australian-owned banks are sometimes unable to grow lending super fast is they have to pay the cash generated from profits back to their parent shareholders in Australia. That’s one reason why the Reserve Bank ordered all banks (including the Australian-owned ones) not to pay dividends as soon as Covid hit was to ensure they had enough capital to deal with losses and to grow lending to support the economy.

Share this post