TLDR: Construction cost inflation hit a record high annual rate of 7.7% in the June quarter and is likely to remain intense for the rest of the year, Core Logic reports this morning in its quarterly Cordell Construction Cost Index. It sees the potential for a further rise into double digits because of labour shortages later this year.

Paid subscribers can see more detail and hear more of my analysis in the podcast above.

‘It will get worse before it gets better’

Core Logic published its Cordell Construction Cost Index (CCCI) for the June quarter this morning and warned already-record-high inflation was likely to escalate through the rest of this year because of labour and building material shortages and a long pipeline of unfinished building consents.

The CCCI measures the cost to build a 200 sqm three-bedroom, two-bathroom single storey brick and tile house. The Index rose 2.6% over the quarter, lifting annual growth to 7.7%, which was the largest increase since the CCCI commenced in late 2012.

CoreLogic Chief Property Economist Kelvin Davidson said the industry was under intense cost pressure and an early reprieve was unlikely.

“This is the swiftest rise in the NZ CCCI we’ve seen in a decade, and I don’t expect these price pressures to ease for at least another couple of quarters, given ongoing materials shortages and labour pressures.

“Looking ahead, it wouldn’t be a surprise if cost pressures get worse in the next quarter or two, potentially pushing up towards double-digit indexed growth, before they start to slow later as builders’ workloads potentially ease off in 2023. But we’d also be a bit more confident than in the past that the wider construction industry won’t go from boom to bust.

“After all, the loan-to-value ratio rules and tax system now favour new-build property, both for owner-occupiers and investors. A higher ‘normal’ level of demand for new property than we’ve seen in the past should give developers confidence about future market conditions.” CoreLogic Chief Property Economist Kelvin Davidson

So what? - If you haven’t already listened to my Dawn Chorus yesterday, I’ve gone in depth into the industry’s problems with productivity that are worsening the inflation, which is the major domestic source of inflation in the economy overall.

Elsewhere in the news here and overseas this morning:

UK inflation pain - The Office of National Statistics reported overnight that British consumer prices rose 9.4% in June from a year ago, lifting the annual inflation rate from 9.1% in May. Food and fuel costs drove most of the 0.8% rise in prices in June from May. The Bank of England expects British inflation to rise over 11% later this year and is expected to hike its official cash rate by 50 basis points to 1.75% on August 4.

European gas plea - The European Commission formally asked European Union countries to plan to cut gas consumption 15% this coming winter because of fears Russia would cut off gas supplies completely. Meanwhile, the IMF published an analysis showing how Russian gas cuts would hammer European GDP, including potential 2-3% cuts in German output next year.

Another crypto crash - The Zipmex crypto-currency exchange and lender announced overnight it had suspended withdrawals because of market volatility and the ‘financial difficulties of our key business partners.’ The exchange operates from Thailand and also offers services in Singapore, Indonesia and Australia. Coindesk

Farmers on edge - Biosecurity and Agriculture Minister Damien O’Connor announced last night a stepping up of measures to stop Foot and Mouth Disease from getting into Aotearoa-NZ from Bali, including using disinfecting foot mats for passengers arriving from Indonesia. We no longer have direct flights from Bali or Indonesia since Covid. An audit of the supply chain for PKE from Indonesian palm plantations would also be carried out.

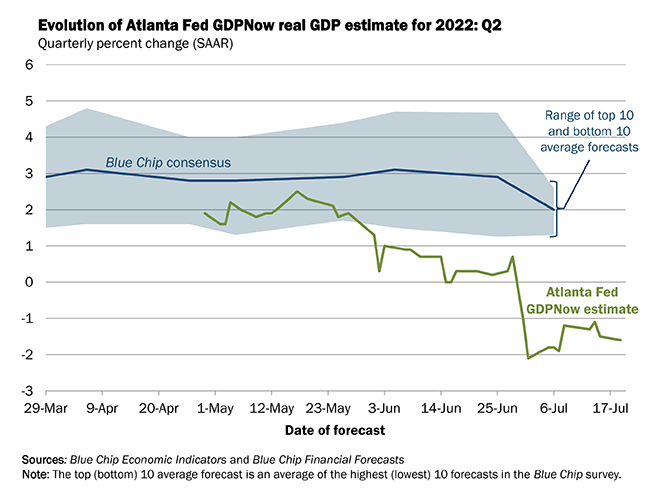

Chart of the day

US already in recession?

The Federal Reserve Bank of Atlanta produces a weekly ‘flash’ estimate of ‘GDPNow’ that estimates GDP growth given a bunch of real time leading indicators. Its latest weekly estimate is that the US economy is already in recession with June quarter GDP down 1.6%.

Number of the day

If only

US$416,000 - The US National Association of Realtors published June sales data overnight showing the median price of existing homes sold in June was a record-high US$416,000, up 13.4% from a year ago. That’s NZ$668,000 at the current exchange rate of 62.2 USc. REINZ reported last week the median existing home price in June was NZ$816,000 or US$507,000, which equates to 13.7 times the World Bank’s measure of Aotearoa’s net national income per capita of US$33,692. The US median price is 7.8 times US net national income per capita.

So what? - Our houses are almost twice as expensive relative to income than those in the United States.

Quote of the day

The PM on Three Waters

“There is common ground, one area where we absolutely all agree except potentially bar the opposition, is that the status quo is untenable. The vast majority of local government accepts that, and it then becomes a debate of what you do about it.” PM Jacinda Ardern speaking after delivering a speech to Local Government New Zealand’s annual conference yesterday in Palmerston North, via RNZ.

So what? - The PM has again focused on the aspiration, rather than the balance sheet structure and a social license to go with it that is needed to achieve the improved water quality. Three Waters is in effect a political fudge to try to solve the real need for local and central Government to use their balance sheets to invest much more heavily in water and other infrastructure, but without specifically asking voters to raise taxes in the form of water charges and public debt in the form of water authority bonds. I’ll go into more depth on this in a deep dive later today.

Some fun things

Ka kite ano

Bernard

Share this post