TLDR: Reports are emerging of an 80-90% slump in inquiries for new house builds because of rising interest rates and concerns about falling house prices. Fear is growing of a repeat of the boom-bust cycle that has killed past attempts to improve the construction industry’s structure, technology and training to improve productivity.

Paid subscribers can see more detail and analysis below the paywall fold and in the podcast above.

Tragically, here comes the bust after the boom

For years it has dominated the cadence of our economy and stopped our splintered, sub-scale and high-cost house-building sector from investing in the new technology, scale-building consolidation and training needed to improve productivity, and, ultimately, improve housing affordability.

The boom-bust cycle in housing is acknowledged as the main reason why so many builders and tradespeople prefer not to make permanent hires, prefer not to bring on apprentices and prefer not to invest in scale, technology and systems that would allow them to build many more homes faster and cheaper. After all, why invest in expensive capital and training when there’s a high risk you’ll be stuck high and dry with equipment mothballed and highly-trained staff leaving to work in Australia as soon as the bust comes.

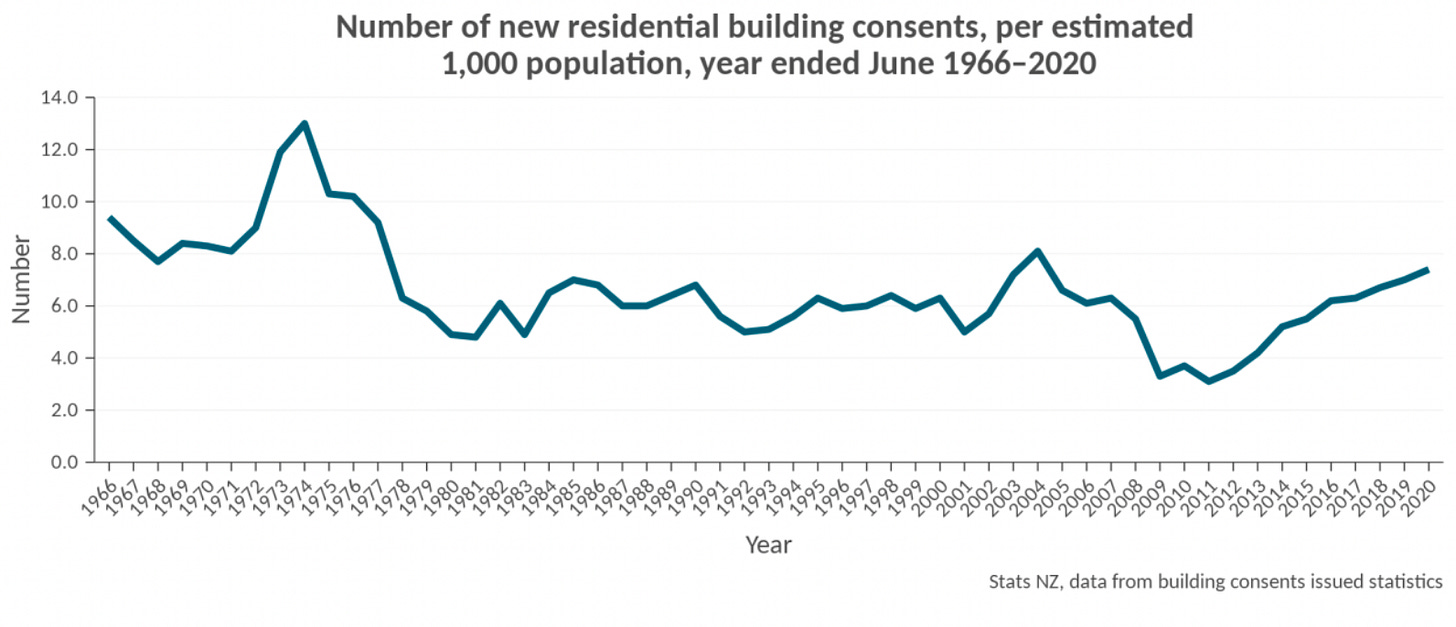

That’s what happened in 2009/10 after the systemic collapses of retail-funded property finance companies and the Global Financial Crisis. Building consents collapsed to lower levels per capita than during World War Two and the Great Depression and an entire generation of just-trained apprentices and subbies jumped on planes to work in construction and the mines in a booming Australian economy through 2010 to 2012 (thanks to China’s massive buying of iron ore and coal to fuel its own infrastructure surge unleashed to combat the GFC)

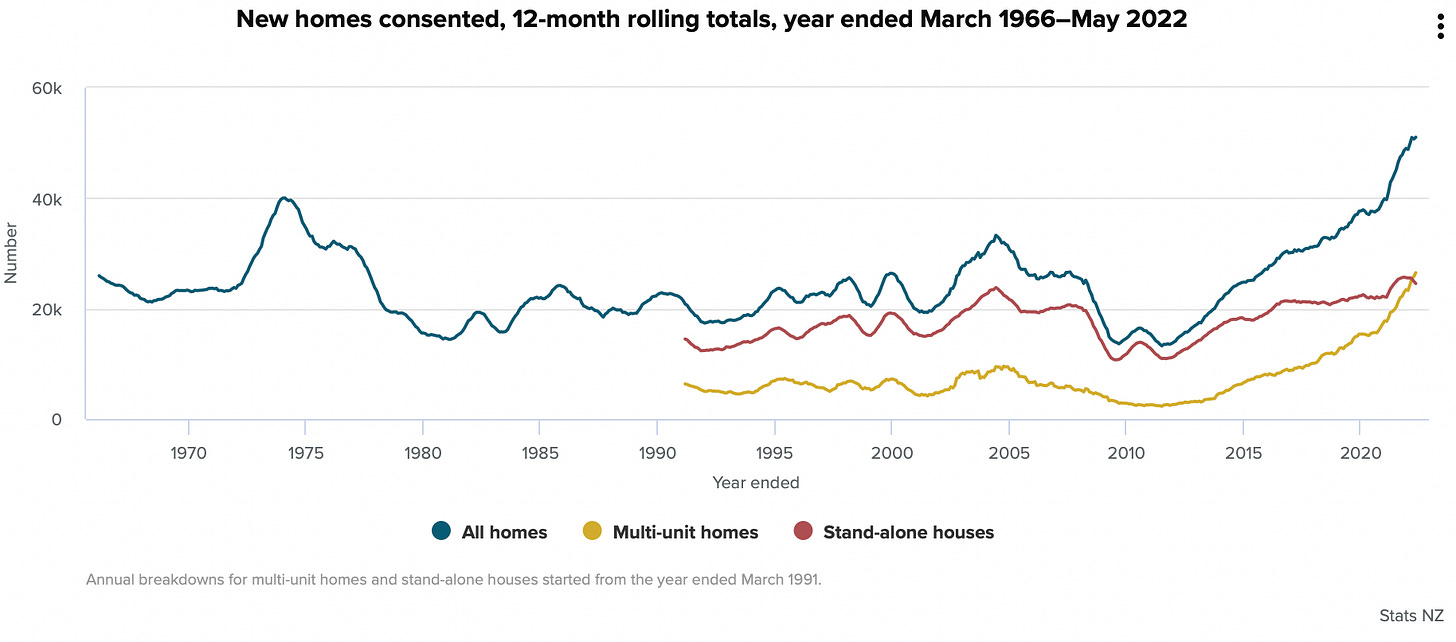

That knowledge and capacity just went. The hope in the 2010-20 decade just completed was that a rebound in the housing sector could be sustained, in part by the Government providing a strong baseline of building demand through Kainga Ora and Kiwibuild, and as bigger firms able to build more complex higher-density projects built up their balance sheets and were able to ‘build through’ the ups and the downs safe in the knowledge they could handle the buffeting.

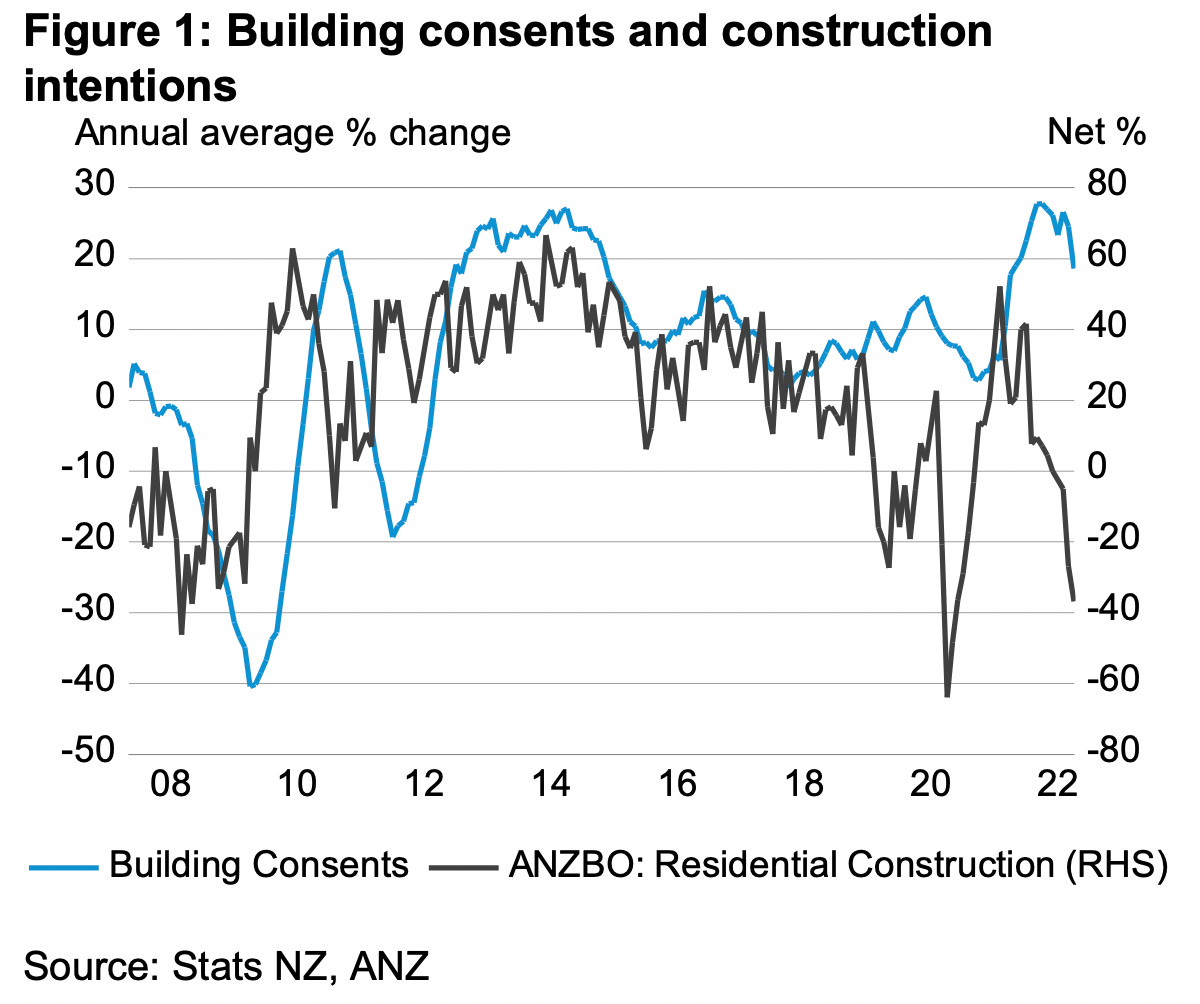

The bust is coming

We’ve already seen a collapse in residential building intentions in the NZIER QSBO and ANZ business confidence surveys earlier this year as the easy and cheap credit dried up from November onwards, which in turned dragged down house prices from the peaks and reduced some of the incentives to buy off the plan and flick them on for capital gains, tax-free or otherwise.

However, this morning Carmen Hall reports for the NZ Herald-$$$ from interviews with builders large and small that inquiries for new builds have crashed 70-80% in recent months.

"We know from nationwide sales data across a lot of our members, that there's been a decline in interest and a decline in demand of between 70 and 80 per cent over the past six months. Those numbers are eye-watering. This is going to wreak havoc." Master Builders Association national vice-president Johnny Calley via NZ Herald-$$$

Classic Group director Peter Cooney was quoted as saying sales were back down to levels last seen in 2008 because of tighter credit and uncertainty about interest rates. He has been through four boom-bust cycles.

"Workloads are still strong from last year's sales but going forward in six months it will be a whole different ball game. There is going to be some real hurt coming in the construction industry.

"This one has been a lot more sudden than we expected. I would anticipate that it will last until such time as interest rates begin to decline again which will be when inflation is under control." Classic Group director Peter Cooney

Interest rate rises and still-very-high house prices were also blamed by others.

"The biggest uncertainty will be how long the cycle takes to turn around. The biggest challenge will be how to bring new housing back to an affordable level." Venture Developments director Mark Fraser-Jones

New Zealand Certified Builders CEO Malcolm Fleming was quoted as saying his members had 12-24 months of work lined up.

Housing Minister Megan Wood was quoted as saying the Government was aware of the issue.

"We have been engaging with the sector on this issue through forums such as the Construction Sector Accord, which has played a vital role in maintaining a viable construction sector over the past year." Megan Woods.

A dream dying at birth

Meanwhile, there have been reports via BusinessDesk-$$$ in recent weeks from leaked internal documents showing Kāinga Ora has frozen new hiring and building plans because of concerns about cost blowouts now and the long term debt outlook with the new higher interest rates.

The long-held dream of lifting the base of house-building demand to a dependable and relatively high drumbeat to encourage the creation of larger-scale builders of more complex medium density homes may well have just died at birth.

‘Engaging with the sector’ is a long way from saying the Government guarantees to buy 15,000 affordable medium density homes per year. At present, those numbers are in the low-single-digit thousands, and remain subject to the whims of individual ministers and Governments.

Again, the 30/30 maxim is holding the Government back from providing that assured multi-election-cycle demand that the scale builders will want to see before they commit to the scale, technology and skills development needed to make those investments pay through the cycles.

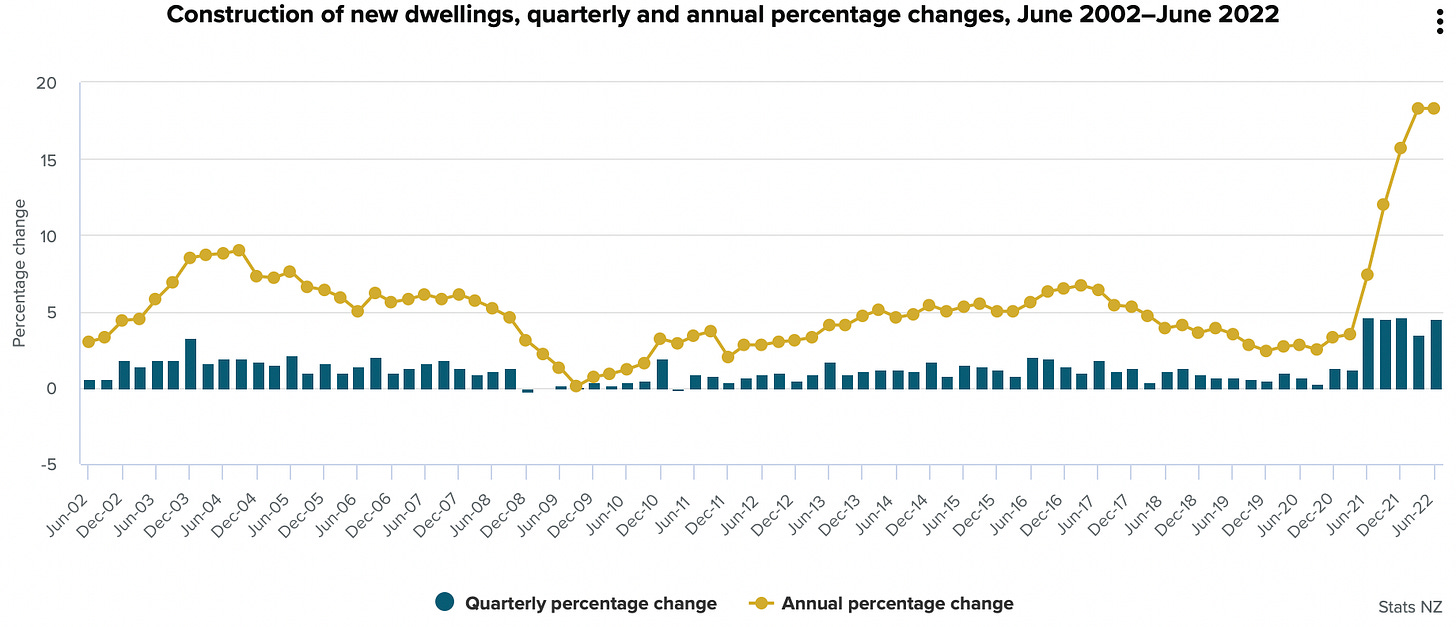

And, of course, the failure to improve productivity much has helped drive the latest burst higher in construction costs (chart below of housing cost inflation in Monday’s CPI data) because of a surge in demand without the capacity to respond.

Twas ever thus.

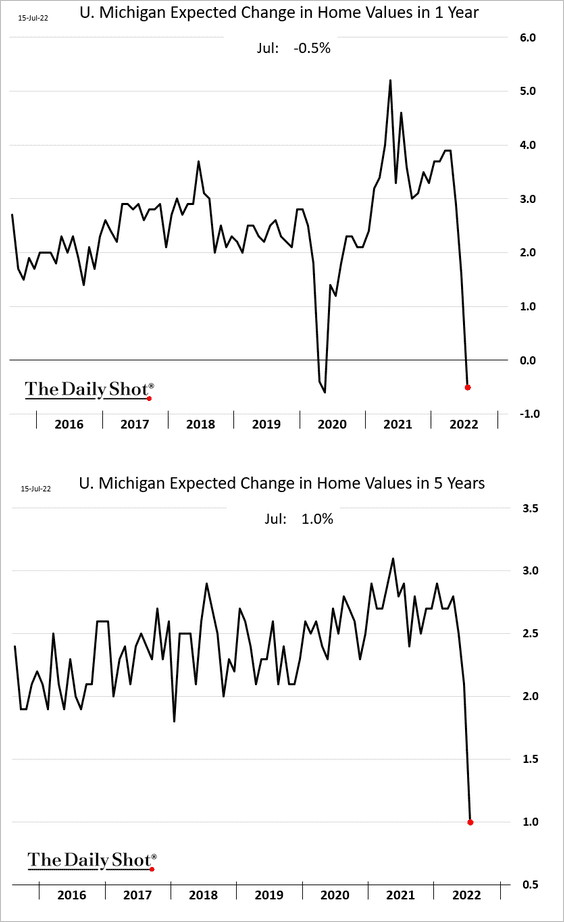

Chart of the day

US homeowners just got very pessimistic

Elsewhere in the news here and overseas this morning:

‘0% here we we come’ - The European Central Bank will consider a full 50 basis point hike in its main deposit rate from minus 0.5% to 0% (!) on Thursday night NZ Time in an effort to catch up with finflation running at nearly 9%. A full half point hike would be bigger than the 25 basis points financial market expectations. Reports citing unnamed central banking sources in the FT-$$$, Reuters and Bloomberg overnight previewed the shift to a more aggressive stance, which boosted the euro. The Bank of England’s Governor Andrew Bailey also gave a speech overnight signalling a 50 basis point hike, the biggest since 1994, to 1.75% early next month.

London’s burning - Britain experienced its hottest day ever overnight, with daytime temperatures hitting 40.3 degrees celcius in places (up from the previous record high of 38.7C in 2019) and night time temperatures now at 25C (up from previous a previous high of 23.9C in 1990). Fires broke out in parks and commons near homes in and around London, railways buckled and Luton Airport’s runway melted. Wildfires raced through southern parts of France and over 1,000 people died in Portugal from the heat. (See numbers of the day below). BBC

Gas back on? - Reuters reported overnight from two anonymous sources that Russia was likely to turn Europe’s gas supplies back on through the Nordstream 1 pipeline later on Thursday after a 10-day outage for scheduled maintenance, which would ease fears of imminent rationing of gas to industrial users and electricity generators, and reduce some of the risks of a Eurozone recession later this year.

Housing not starting - Data released overnight showed US housing starts fell 2% to 1.559m in June from May, which was less than the consensus forecast by economists for a rise of about 1.4%. US 30 year mortgage rates have almost doubled this year to nearly 6% as US longer-term interest rates have risen sharply in anticipation of more aggressive tightening by the world’s biggest central bank, the US Federal Reserve. It is expected to hike its main rate 75 basis points to a range of 2.25-2.5% next Thursday morning NZ Time. AP

Rising profits cheer - US stocks rallied 2-3% this morning despite the signs of strong inflation and slowing economic growth, partly because early profit season results show companies have been able to increase their profits despite the sharp rises in costs as they exercised market power to increase prices faster than those costs. About 9% of S&P 500 firms have reported June quarter earnings, with two-thirds beating analysts’ expectations for profits so far. Some investors are betting the market has bottomed out. CNBC

RBA review details - Australia’s Treasurer Jim Chalmers formally announced an independent review of the Reserve Bank of Australia this morning, including whether the bank’s current inflation-targeting framework is appropriate and how it performed during Covid. The review will be led by the Bank of England’s financial policy committee external member Professor Carolyn Wilkins, macroeconomist Professor Renee Fry-McKibbin, and secretary for public sector reform Dr Gordon de Brouwer. AAP

Quote of the day

‘Just do it’

"Mask-wearing should be like wearing a seatbelt.” Ashley Bloomfield in a Newshub article where PM Jacinda Ardern was criticised for not wearing a mask at a gathering of youth Parliamentarians in the Beehive yesterday.

The photo below is from the PM’s Instagram.

"What we mean when we recommend mask-use is that you should do it." Covid 19 Minister Dr Ayesha Verrall said when asked about her boss’ photo.

Some fun things

Ka kite ano

Bernard

Share this post