TLDR: This week inflation hit a 30-year high of 6.9%, Auckland Council prioritised protecting villas over allowing extra houses, global interest rates kept rising, Grant Robertson was accused of not helping Adrian Orr enough to fight inflation and I gave an update on The Kaka’s growth plans.

The podcast above is a recording of our weekly ‘hoon’ webinar from Friday afternoon. Unfortunately, Peter Bale was not available so it’s a simple one of me talking about the week’s events and answering questions from paid subscribers. It was a bit longer than the usual hour because I received lots of questions about housing, politics and electric double cab utes.

I also aired in depth for the first time my first draft of a big new idea how we could build half a million affordable homes and slash net transport and housing emissions in a way that turns a tiny fraction of the last 30 years’ unearned tax-free capital gains into housing and climate investments that ‘pay it forward’ for today’s under 30s and future generations. I’ll write about this in more depth over the long weekend.

Five things to note this week

Inflation hit a 30-year high

I wrote in depth on Friday morning about this week’s 6.9% annual inflation figure and why its causes are painfully familiar.

Labour challenged to help Reserve Bank more on inflation

On Tuesday an interview Reserve Bank Governor Adrian Orr had with the IMF was released that prompted accusations from the Opposition that Finance Minister Grant Robertson was not being enough of a monetary policy mate for Orr.

Here’s my analysis of those claims and defences.

Auckland Council’s reluctant and partial up-zoning

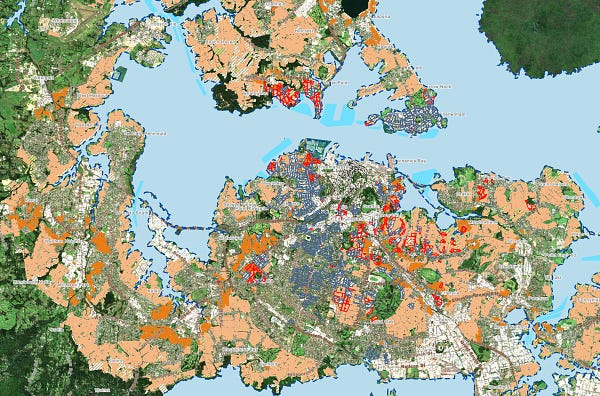

The Auckland Council released its updated maps showing how it wants to tweak its Unitary Plan in response to the Government’s legislative attempts to upzone around urban centres through the National Policy Statement on Urban Development (NPS-UD), which allows six storey high apartments within walkable distance of CBDs and the Medium Density Residential Standards (MDRS), which allow three three-storey townhouses on pretty much any section.

The Council’s response was to carve 16,000 houses out of the MDRS by designating them special character, including this one on Dominion Rd. It said it was “all about special character.”

Have a look inside it. And the careful way the agent doesn’t say what development potential it has.

Only 5,000 homes lost that protection.

It would be nice if Auckland Council was all about affordable housing and carbon zero.

Here’s a good explanation with detail from Matt Lowry via Greater Auckland.

And this thread is useful.

The Solomon Islands signed a security deal with China

The Solomon Islands confirmed it had signed a security deal with China that Australia, the United States and Aotearoa-New Zealand fear could China’s warship stationed in a position able to block Australasia’s trade routes and significantly ramp up the militarisation of the Pacific.

Here’s Anne-Marie Brady’s deeper analysis of the deal.

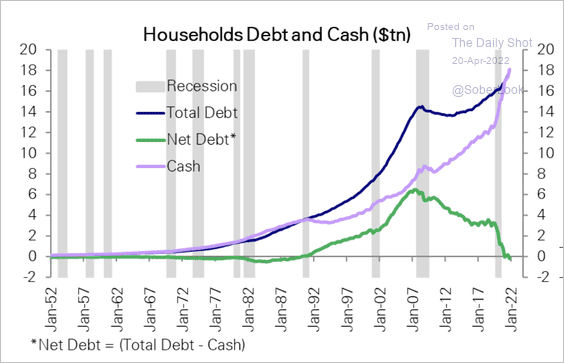

The US 10 year bond yield hit a three-year high

The US 10 year Treasury bond yield, which I’d argue is the one market interest rate to watch globally if you want to see what might happen next, jumped from just over 2.8% to a three-year intra-day high on Friday of 2.97%.

That made US stock markets very nervous on Friday. Remember, the higher bond yields go, the more attractive they are relatively instead of stocks. Many fear the Federal Reserve’s apparently more aggressive approach to taming inflation could push up interest rates quite high and cause a recession, which would also be bad for corporate profits and therefore share values.

The S&P 500 fell 2.8% on Friday night in what appears to be the beginning of another market conniption over rising interest rates.

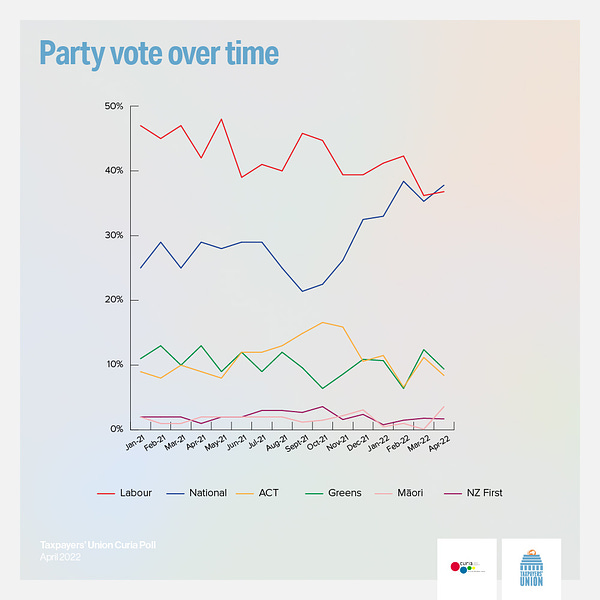

Charts of the week

Spookies, profundities, curiosities and feel-goods

Some fun things

Ka kite ano

Bernard

Share this post