TLDR & TLDL: This week the Government started to fray over how (and whether) to open up for the summer as it became clearer the ‘fringe’ DHBs won’t reach the 90% double-vaxxed threshold before February. Elsewhere, our Reserve Bank denied responsibility for the latest housing boom and the US Federal Reserve announced it would start tapering its money printing, but cautiously to avoid a ‘taper tantrum.’

In this week’s Friday afternoon zoom webinar ‘hoon’ with Peter Bale at 4pm for paid subscribers (listen to the podcast above), we also discussed Aotearoa-NZ’s commitment to cut climate emissions 50% by 2030 (albeit with two thirds of the work being done offshore, and China’s plans to quadruple its nuclear arsenal.

(This is the weekly ‘sampler’ email and podcast for both free and paid subscribers. The links to this week’s articles go to the paywalled versions. But I’d love the free subscribers reading the detail and analysis below to subscribe fully to make my version of accountability and explanatory journalism about affordable housing, climate change policies and child poverty financially viable)

Five things that mattered this week

1. Fraying at the edges

The Government’s kitchen cabinet stumbled through a week of mixed messages over whether Aucklanders would be able to leave the city for Christmas and summer holiday. PM Jacinda Ardern told a music radio station Aucklanders would need to be certified as doubled-vaxxed and have a negative test before they could fly or drive somewhere else.

Covid Minister Chris Hipkins suggested Aucklanders might need to book time slots to avoid motorway queues on the way out, but Deputy PM Grant Robertson ruled out the idea as impractical. He agreed another way to keep the virus out of Tairawhiti, Northland and Whanganui might be to cordon off those areas instead.

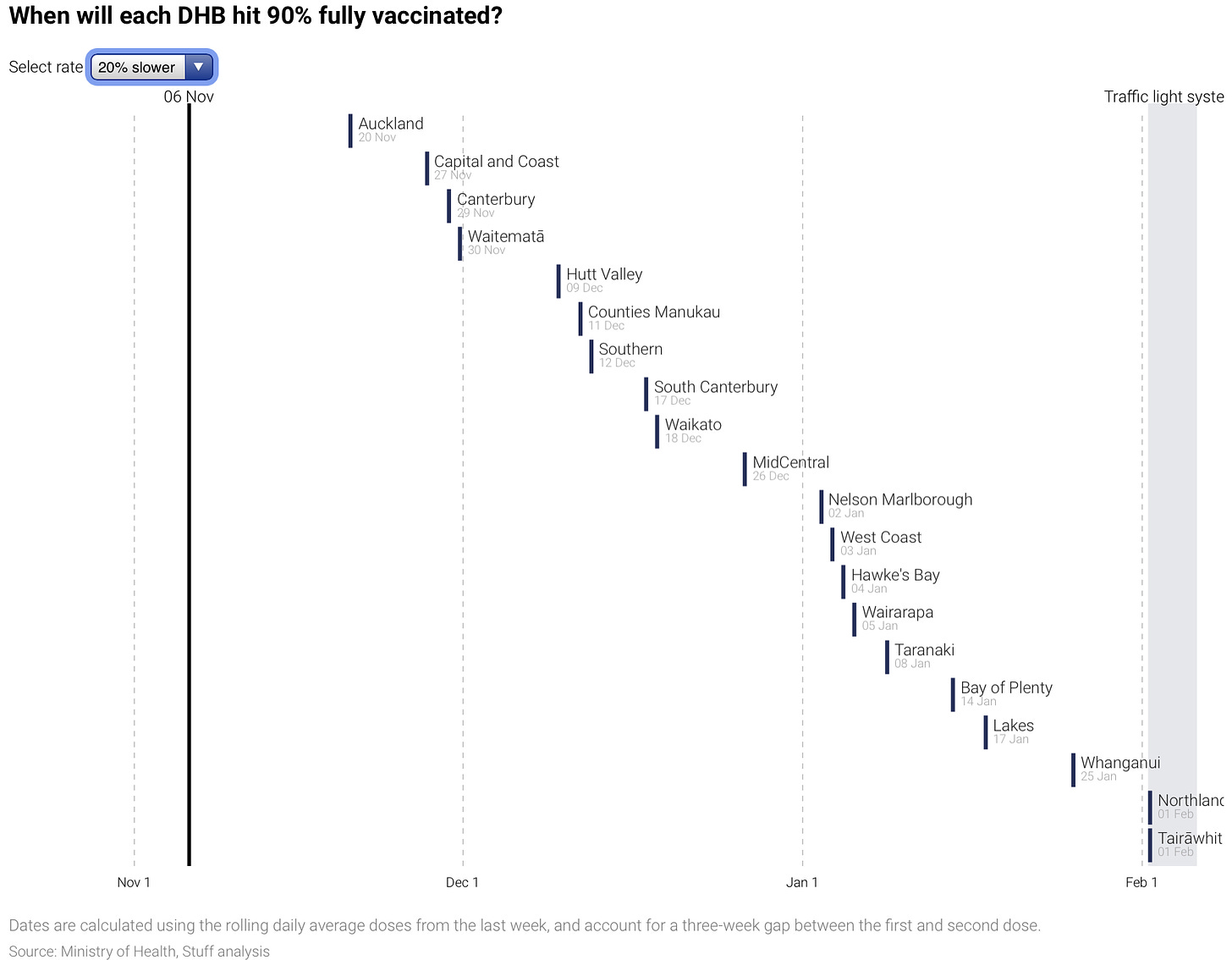

It’s now clear from the vaccination rate trajectories (see Stuff chart below and interactive analysis) that Tairawhiti, Northland, Lakes, Bay of Plenty and Whanganui are unlikely to get to 90% double-vaccinated before February, if ever. In theory, that would stop the rest of the country easing their restrictions and stop Aucklanders leaving for the summer. But the PM has promised the nation a ‘classic Kiwi summer’, forcing the Govt to look for a fudge, or to break its promises to either the regions or Aucklanders. The Nov 29 cabinet decision is looming. At current rates, Counties Manukau is unlikely to hit the 90% target by then.

What they said (bolding mine):

“We do still want Aucklanders to move around though particularly over summer and Christmas so what we are looking at for now is how do we keep in that hard border, but some checks around it so more people can move but we might say use testing or vaccinating status to help people move around a bit more.” Jacinda Ardern

“It might be that people get allocated a time in which they can travel. We haven't made that decision yet. It's an option. We're just working through what the practical options are to ensure that we don't end up with people spending days sitting in their cars.” Chris Hipkins.

"I don't think it's particularly likely that there would be the kind of scheme where you were allocated a day. I can't see that - it wouldn't be very practical. But we do have to find a way through in the event that we still have a boundary there." Grant Robertson on the idea for time slots.

The key chart: Are we there yet?

The key number: 54,361 - The number of second dose vaccinations still to be given to the eligible population in Counties Manukau to get to 90% double-vaxxed. In theory, Auckland cannot relax its restrictions inside its boundaries until Counties Manukau reduces that number to zero. At current vaccination rates, that is not until mid-Dec.

2. No taper tantrum. Yet.

The US Federal Reserve announced it would start tapering its money printing and bond buying programme later this month and finish by mid-2022, citing elevated inflation pressures that were “largely reflecting factors that are expected to be transitory.” This is slightly tougher language than its previous comment that inflation was transitory, but the mid-2022 end to the taper was in line with market expectations.

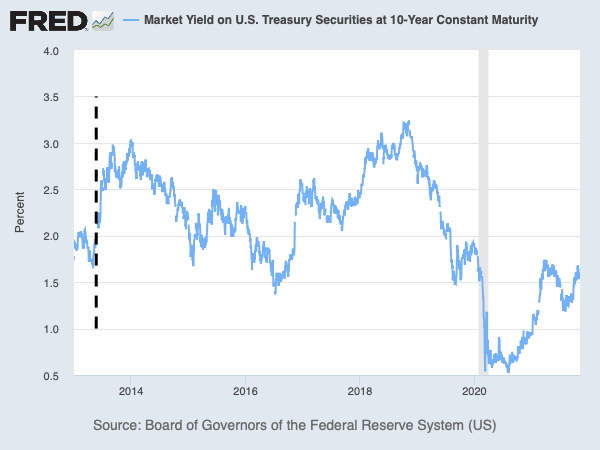

Global stocks rose to fresh record highs on the news meeting expectations, and because company profits keep surging and companies keep handing record amounts of (freshly printed) cash back to shareholders to recycle into a bank or a Govt bond. Those fearing (or hoping for) another ‘taper tantrum’ like the one seen in late 2013 (see dotted line below showing where the Fed signalled its post-GFC printing taper) did not see one. The 2013 bond market meltdown saw the US 10 Year Treasury yield jump from 1.7% to 3.0%, which forced the Fed to resume money printing to avoid a financial meltdown and boost GDP growth again by pushing up asset prices.

Fed Chair Jerome Powell hosed down expectations on Wednesday that the Fed needed to react more urgently to the recent inflation spike, which also helped dampen longer term interest rates on Thursday and Friday.

What he said:

“We think we can be patient. We don’t think it is a good time to raise interest rates because we want to see the labor market heal further.” Jerome Powell in a news conference.

The key chart: 2013 was a tantrum - 2021 is not. So far.

The key number: 30 basis points. The reaction of bond markets since the Fed started signalling a taper in July has been much milder than in 2013, when the yield rose 130 basis points. The 10 year yield is up from only 1.2% to under 1.5% this morning.

3. ‘Blame someone else’

The Reserve Bank rejected accusations it was responsible for the 34% explosion in house prices over the last 18 months, saying it was only a ‘bit player’ in a market bedevilled by supply side problems and tax advantages it was not responsible for fixing.

But I argued this view downplays the central bank’s enthusiastic adoption of unconventional monetary policy (money printing to buy bonds) at Fed-like levels, and ignores its now-reversed decision to completely remove restrictions on riskier mortgage lending. It denies responsibility, but the Reserve Bank actually made a political decision with the agreement of the Finance Minister to increase the wealth of the wealthiest to stimulate the economy.

It worked to cushion the worst economic shock in our history, but it also permanently widened wealth inequality massively. They were advised of the effects and there were alternatives, but went ahead anyway and are now trying to shift the blame to others. That’s a pity. They’re not fooling many, and there will be an eventual political reckoning when the generation locked out of their futures work it out.

What he said (bolding mine):

“The role of the Reserve Bank is a ‘bit part’. We are one cause of demand changes as we alter interest rates to meet our monetary policy Remit.

“The extent to which New Zealand house prices have reacted to changes in housing demand is mostly related to the inability of housing supply to respond. Houses have been scarce at a time that demand was strong. The reverse is now evolving – with housing building at record levels at a time that population growth is static.” Adrian Orr in a speech.

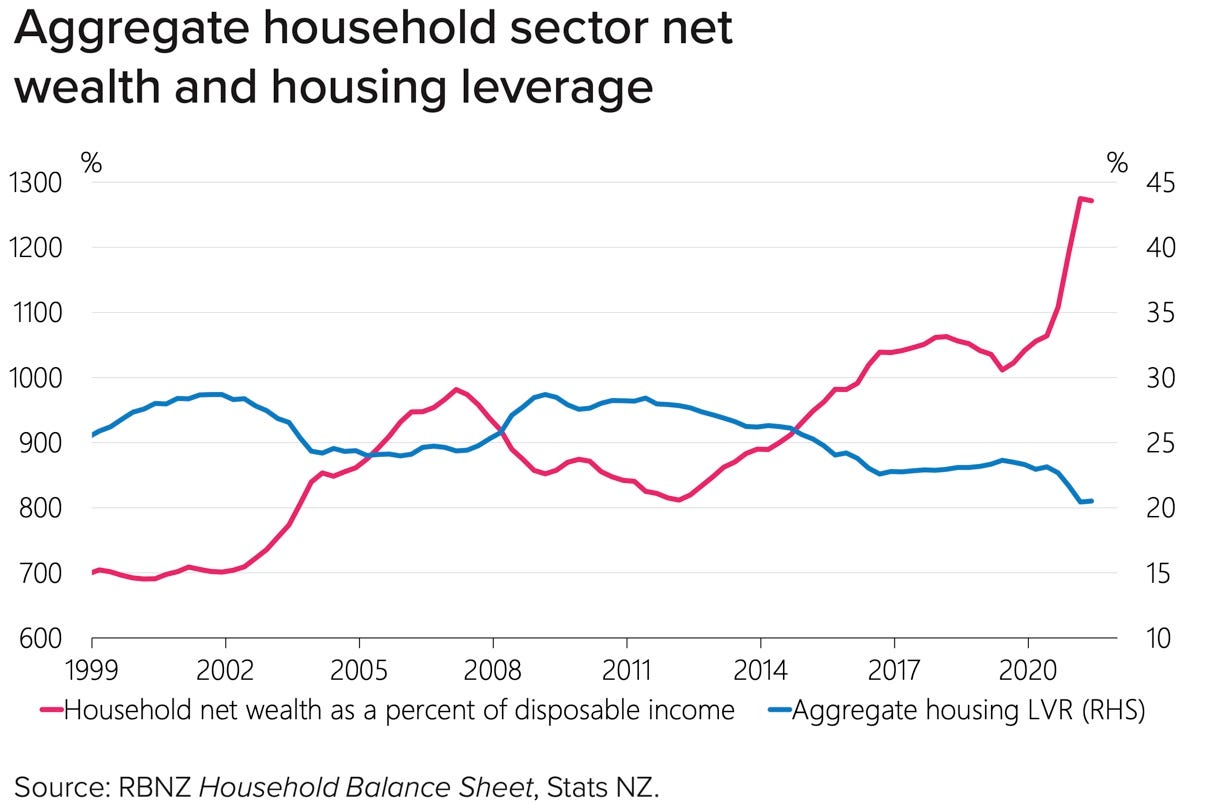

The key chart: The Wealth Effect

The key numbers: The Govt’s stimulus spending of at least $18b in cash grants, plus the Reserve Bank’s $57.6 of money printing to buy Government bonds, generated an extra $549b in wealth for property owners, an extra $45b in business and household deposits in banks, and an extra $2.3b in consumer spending. The bank knew the wealth effect was a blunt instrument with diminishing returns.

The bank’s own research from 2019 shows that every $1 rise in household wealth generates three extra cents in spending. So far, that would mean the $549b extra in household wealth from housing would have generated an extra $16.5b in retail spending. It’s unknowable what retail spending would have been without the money printing and bond buying, but the Reserve Bank appears to have gotten poor stimulative value for its money, while also dramatically worsening wealth inequality.

4. The NIMBYs lash back

The backlash has begun to the Government’s ‘Townhouse Nation’ accord with National to allow three three-storey dwellings on each suburban section without notification or the need for a resource consent. Councillors on the Auckland Council debated the new Medium Density Residential Standard (MDRS) on Thursday and it got real ugly real fast.

Those thinking councils have nowhere to turn and no tools to stop it should think again. The discussions centred around launching a public campaign to reverse the policy and looking at how to use development contributions to stop intensification. It unleashed extreme comments from former National minister Christine Fletcher and others about how the Govt was riding roughshod over residents and ‘urban slums’ were not needed. The council’s planner John Duguid said there was plenty of land zoned for housing and intensification was not needed.

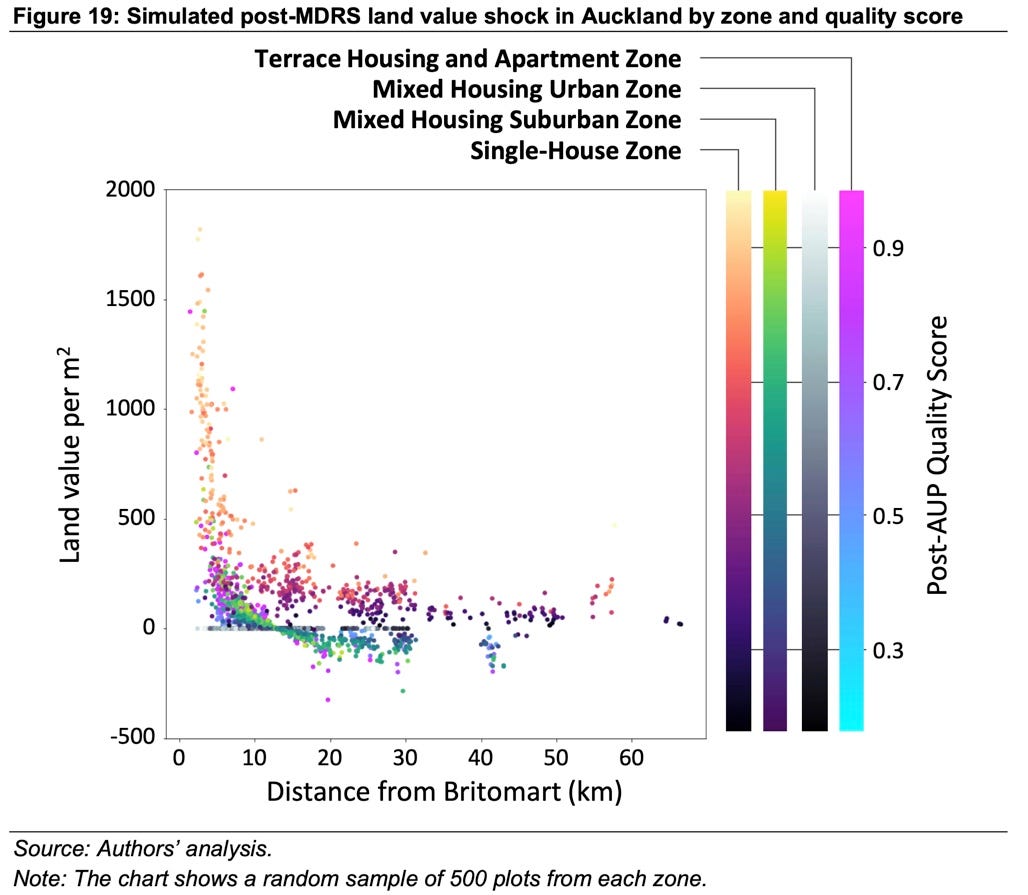

The key chart: The land price impact

This chart from the PwC-Sense Partners report (page 49) on the MDRS’ impact on land prices shows how land close to the centre of Auckland will rise in value, but land 10-20km from Britomart will reduce in value as the policy ramps up intensification. Good.

They said it:

“This is a scorched earth policy to build Soviet-style blocks. We don't want to be the council that oversaw the uglification of the city." Orakei Local Board chairman Scott Milne.

“I see it as tantamount to the rape of Auckland. I can't believe a piece of legislation with significance such as this is going to be rushed in such a way. I have no intention of withdrawing, and furthermore I'd say it's gang rape because it's by both Labour and National, and I'm appalled.” Christine Fletcher

The key numbers: No wonder they’re fighting hard

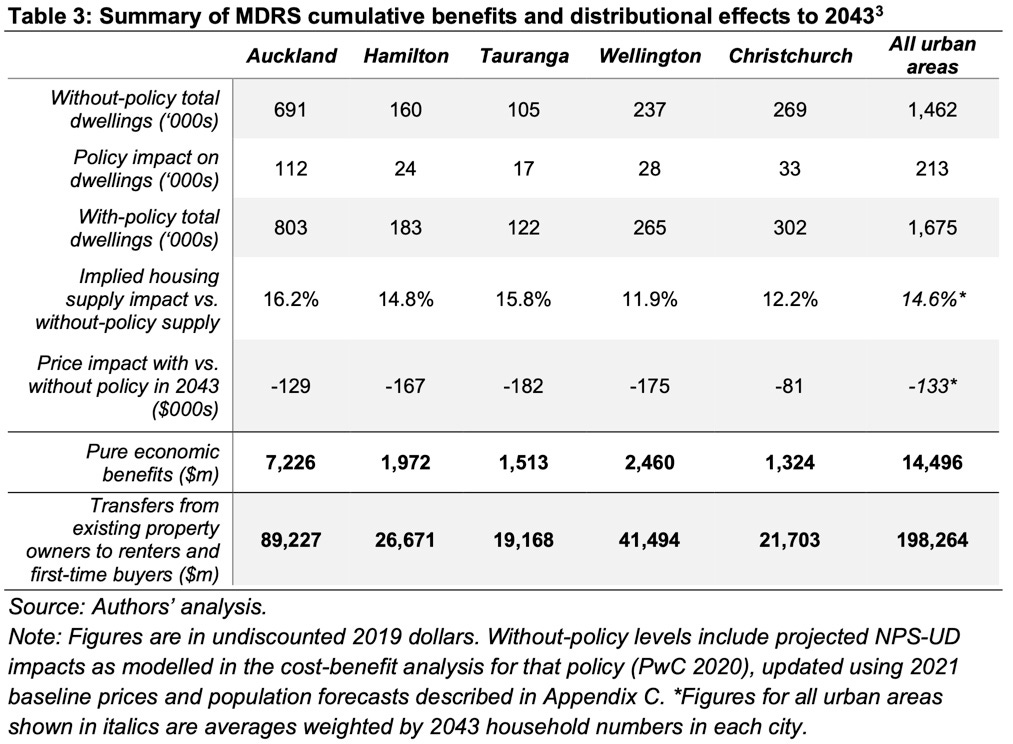

$198.264b - The PwC-Sense Partners estimate (page 15) of the combined value transfer from existing owners to renters and first home buyers because of MDRS over the next 22 years in 2019 dollars. They also estimate lower house price inflation worth $133,000 on average across New Zealand. Table below.

5. Don’t believe it’s over yet

Former PM John Key has warned the housing boom is over because rising interest rates will hit very-heavily-indebted home owners hard, land supply is opening up and high migration has finished. He also wants tighter Govt spending and lower public debt.

I argued in this email for subscribers and in my podcast above it’s premature to say house prices won’t keep rising, that home owners will be stressed and that migration has finished. Actually, extra land supply is not a given, mortgage stress is low and there’s plenty of political and economic reasons why high net migration will fire up again in the coming years. Public debt is also nowhere near being a problem

What he said (bolding mine):

“I personally think house prices won't collapse. I think that's a good thing because I don't think you actually want to leave a whole lot of New Zealanders with negative equity. But I think that the rise and the rapid rise in house prices is not sustainable, and it can't and will not continue.” John Key

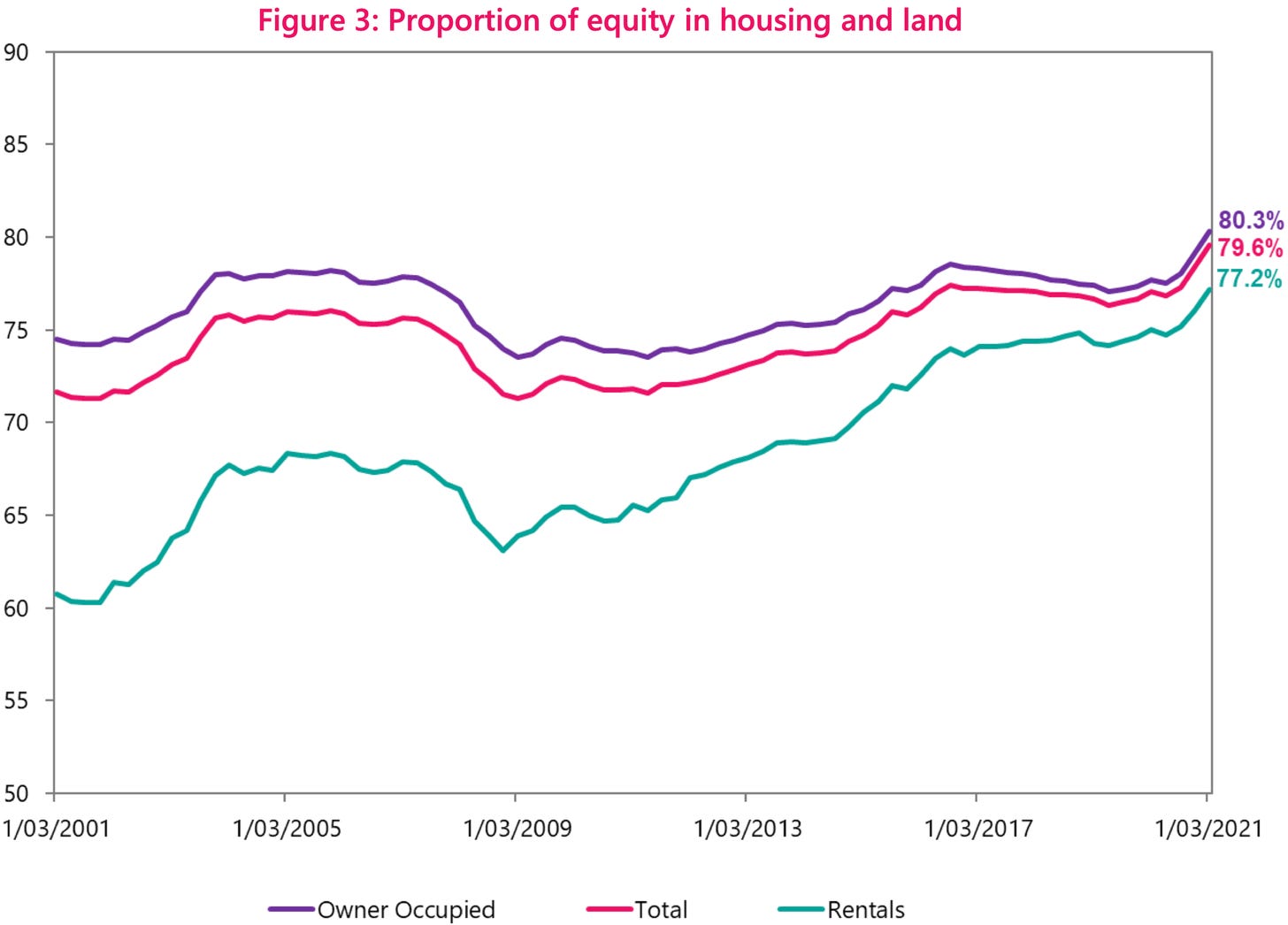

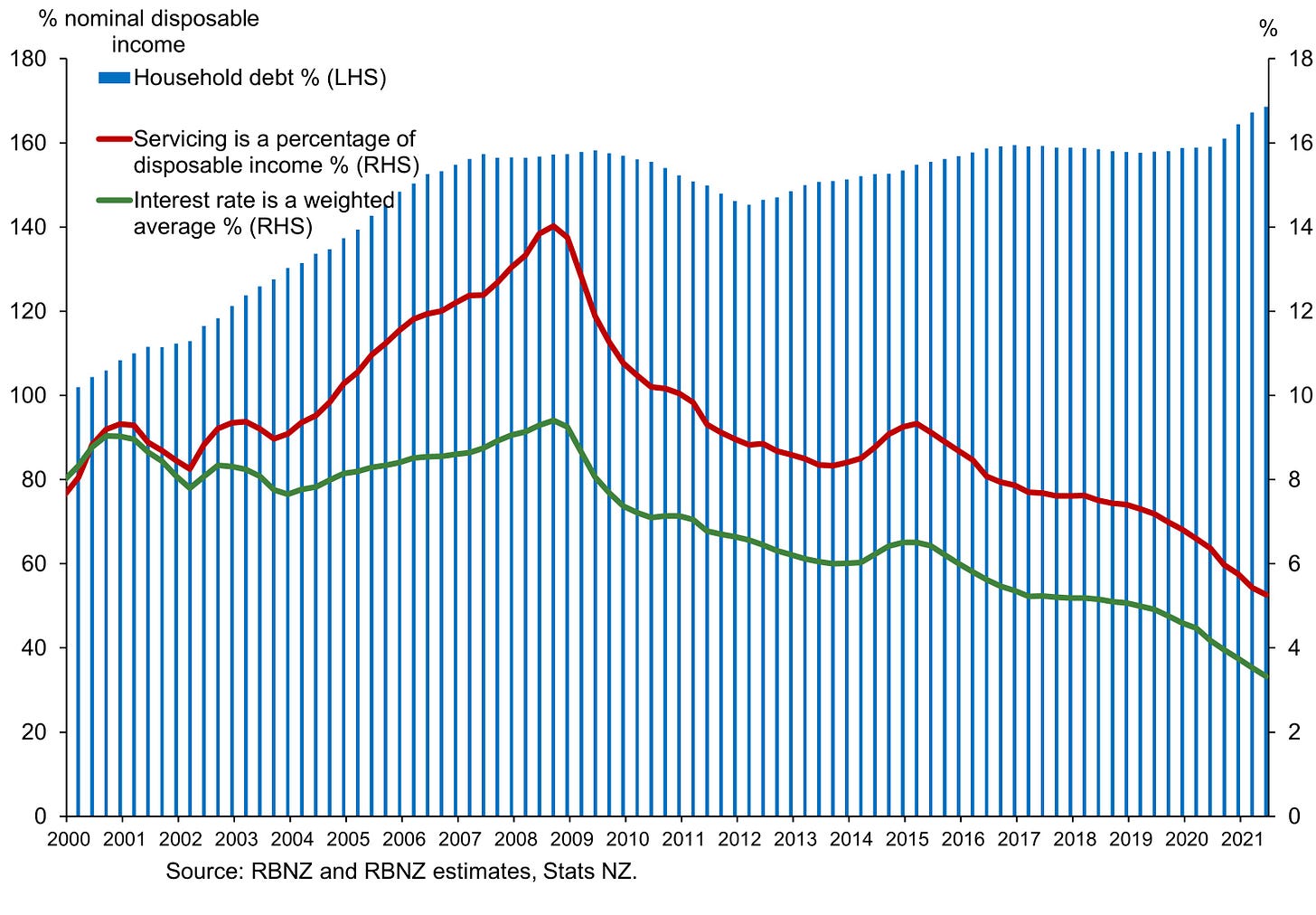

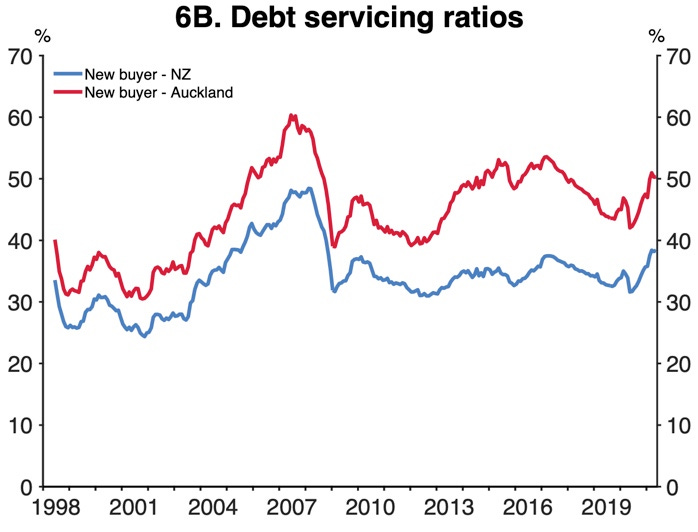

The key charts: Mountains of equity, low servicing costs (even for new buyers)

Key’s basic argument is home owners are very indebted and face negative equity if house prices fall, and that interest costs rising will put them under pressure. However, there is actually mountains of equity in the housing market and mortgage stress is at record lows right now.

The key numbers: Everyone is well above the water

The debt servicing load is currently close to 5% of disposable income for home owners overall. It would have to triple to get to the pain levels seen in 2008. No one is expecting a 9% mortgage rate any time soon. The highest likely mortgage rate is expected to be around 6%.

Also, households have $1.3t in equity in a market worth $1.7t. Only those who got into the market in the last couple of months would be anywhere near being in negative equity, and even then would have to see a 30% fall overnight to be in that position.

Some fun things

Have a great weekend.

And if you’ve got this far and you’d like to support my work, please subscribe.

PS: I have a special offer now of 50% off for students using their .ac.nz email addresses.

Share this post