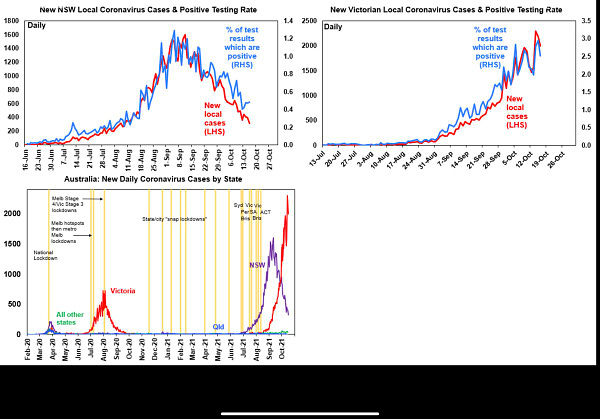

TLDR & TLDL: This week the Government gave up any remaining hope of ‘stamping out’ Auckland’s Covid outbreaks and is now racing to vaccinate the most hesitant and hard to reach parts of the population before delta reaches them.

It effectively told the nation to brace for a doubling of cases in the next couple of weeks and laid out how it hoped the hospital system will cope in the coming months. ‘Coping’ will probably mean thousands of delayed elective surgeries, cancer screenings and other tests, as DHB’s reshuffle staff to jury-rig a near-doubling of ICU and high dependency unit beds.

Also: our Government put out a half-baked discussion paper on its climate emission reductions plans that could embarrass Aotearoa-NZ on the global stage of a key conference at Glasgow in two weeks time. There’s now a risk our trading partners will punish us for being an Australian-style climate laggard by putting climate import tarriffs on our meat and dairy exports.

Meanwhile, energy prices exploded in Europe and raised fears higher inflation will become embedded enough to force the world’s biggest central banks, the Fed and ECB, to stop printing money and start hiking rates sooner-than-expected next year.

Look out below the fold for my five things to know this week, my five numbers of the week, my five charts of the week, my five must-reads elsewhere for the weekend, and, some fun things. I’ve spread links to the emails sent this week to paying subscribers as a taster for those yet to subscribe in full.

Also, have a listen to my ‘hoon’ with Peter Bale in podcast form above from last night. It’s a Zoom webinar opened up for paid subscribers and happens every Friday at 4pm for an hour. It’s like a Zoom drinkies session for members of The Kākā community.

(This is the weekly summary for all subscribers to my email newsletters and podcasts on The Kākā , including both the paid and free subscribers. Becoming a paid subscriber helps me continue my accountability and explanatory journalism on housing, climate, transport, welfare and the economy.)

Our ‘hoon’ around the week’s events in geo-politics and the political economy in and around Aotearoa-NZ covered the following topics, and answered questions from paying subscribers on the webinar:

The end of the Covid elimination strategy and what it means,

The likely doubling of Covid cases over the next fortnight and whether our hospital system can cope;

The widening energy crisis in Europe and China, and whether Russia is helping or hurting;

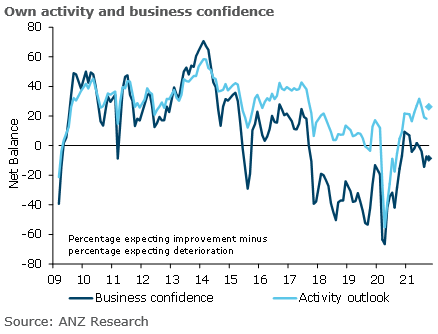

Whether higher inflation is bedding in globally and will force the Fed and RBA to hike soon;

The death of Pakistan’s father of the bomb, AQ Khan, from Covid-related complications at the age of 85;

The floating oil bomb just off Yemen that threatens millions; and

How an Australian real estate agent was tripped up by poor apostrophe practice.

Peter produces an excellent free weekly email on global affairs via The Spin-off I’d recommend signing up to here.

Five things worth knowing this week

1. Pivot! Pivot! - The government finally pivoted hard to preparing for Covid to become endemic among Auckland’s unvaccinated communities. It signalled most of those who test positive for Covid and don’t need hospital care will be able to self-isolate at home to leave space in MIQ for the riskiest spreaders and returning ex-pats.

It’s possible MIQ stays could become shorter earlier than the end of the March quarter of next year, now the imperative to avoid incursions is sliding away.

2. Intergenerational pain - The Government revealed a much-healthier-than-forecast set of Crown Accounts for the year to June 30, including a deficit before gains and losses of just 1.3% of GDP, less than a third of what was forecast in the May Budget just five months.

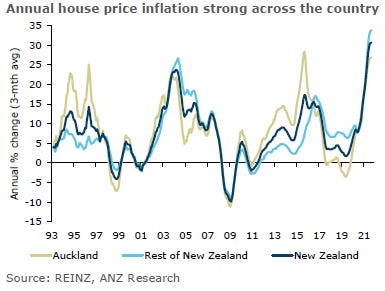

That’s because of the economy’s strong rebound after last year’s lockdowns. But it also showed how inadequate our Public Finance Act rules from 1989 as a way to ensure we invest in future climate and housing infrastructure, let alone catch up on 30 years of under-investing.

3. Covid ate my homework - The Government unveiled a discussion paper with a few ideas on how to reduce climate emissions, more than two years after the passing of the Zero Carbon Act and almost a year after declaring a climate emergency. The ideas fell short of achieving the Climate Commission’s carbon budgets in the early years and were widely ridiculed by climate experts.

Climate Change Minister James Shaw can only hope he gets something more substantial to take with him to Glasgow in less than a fortnight in a form of a Nationally Determined Contribution that avoids Aotearoa-NZ being labelled a laggard to be targeted by carbon tariffs.

4. Are we there yet? - PM Jacinda Ardern refused again this week to specify when Auckland, Northland and the Waikato would be released from its level three restrictions, let alone the rest of the country stuck in level two. In particular, she wouldn’t say what the vaccination threshold the Government is targeting, other than wafting ‘over 90%’ over the motu.

That could mean 90% double dosed of the most vulnerable communities in South Auckland, Northland and the East and West Coasts, or it could mean 90% single dose of the Auckland-wide over-15 population. As of Saturday morning, those most vulnerable communities remain below 25% double-dosed, while Auckland’s adult first-dose rate is at 87%.

5. Will it stick? - Energy prices across Europe and Asia jumped to record highs this week, raising fears consumer price inflation spikes over 4% in many countries could become embedded. Emissions reductions policies, including the closure of coal mines and power plants, are finally hitting prices in a dramatic way. These shortages and price spikes are also slowing global economic growth and worsening supply chain snarl ups ahead of the Christmas shopping season.

The bigger question for asset prices and the global economy will be whether the US Federal Reserve and the European Central Bank become worried enough that they are forced to admit the inflation surge is not transitory. The could see them end their money printing (US$120b and €80b a month respectively) early and start hiking interest rates next year. The jury is still out, but some see the verdict coming next month.

Five numbers of the week

60 - Last Sunday’s Covid case numbers, which ended any remaining debate about the possibility of ‘stamping it out’ in Tamaki Makaurau. Cabinet extended lockdowns in Auckland, Northland and Waikato.

0.9% - The rise in retail sales in September from August, as measured by spending through debit and credit cards. This was weaker than the 10% bounce some economists had expected because of the easing of restrictions to level three in Auckland and level two elsewhere during September.

US$125b - The amount of tax expected to be paid by big tech firms in markets they operate in, but aren’t based in. The OECD agreed a deal over the weekend to set a global minimum corporate tax rate of 15% for large businesses, which will see of tax redistributed from the home countries of global tech and other firms to those countries where they operate.

5.4% - The annual consumer price inflation rate in the United States in the 12 months to September. Annual inflation in the 12 months to August was 5.3%. Energy, food and rent inflation drove most of the increase and heightened fears the Covid-era inflation would become embedded in a way that forced interest rates higher.

170 - The number of daily Covid cases that Public Health Director Caroline McElnay said this week would start to prove difficult for tracking and tracing teams to keep up with. She said it was likely numbers would double by next month with the R value over 1.

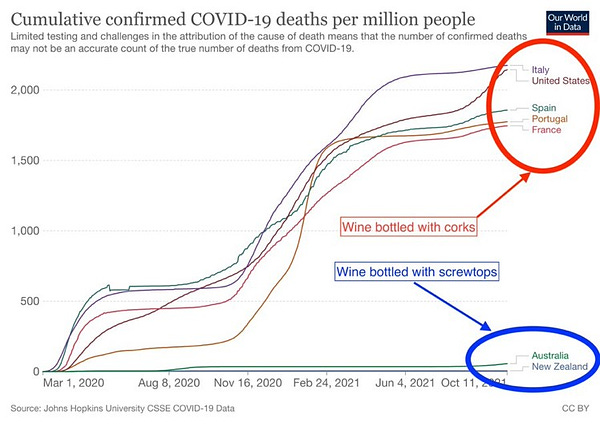

Five charts of the week

A fun thing

Have a great weekend

Bernard

Share this post