TLDR & TLDL: This week we covered a shift in the outlook for interest rates and house prices, and tried to work out what Russia’s invasion of Ukraine would mean for Aotearoa-NZ. The podcast above includes our discussion of the week that was, including another guest appearace from the University of Otago’s Robert Patman.

In summary this week:

The Reserve Bank hiked again and warned even higher interest rates would be needed to flatten inflation;

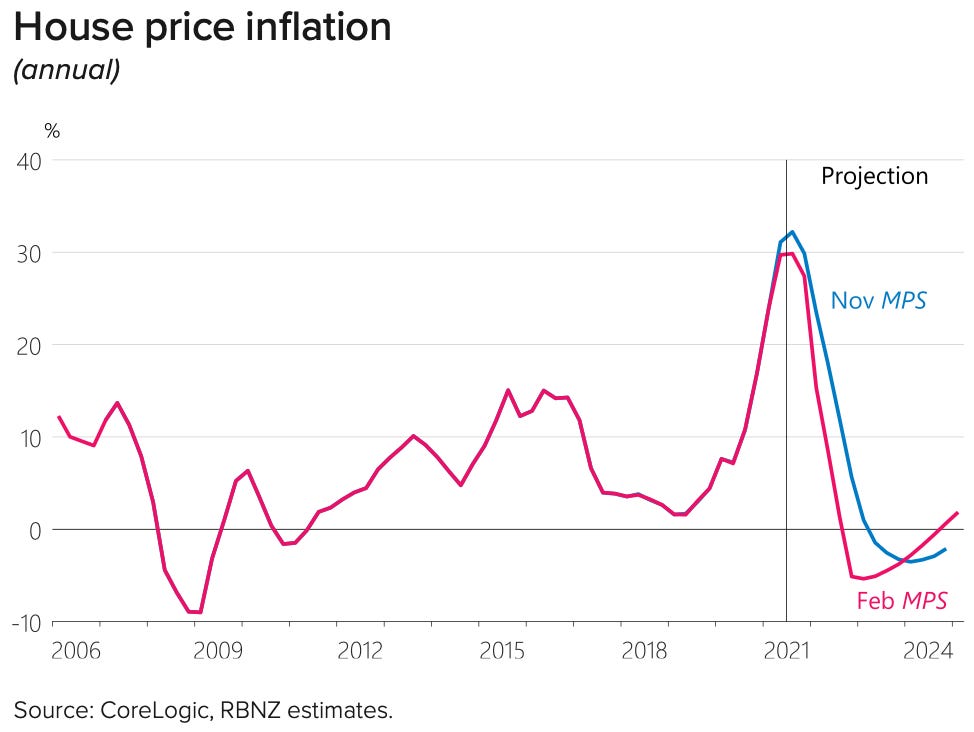

The Reserve Bank forecast house prices would fall 9% in the next couple of years from a peak in the December quarter of last year;

Core Logic reported home owners who sold their homes in that December quarter made a total of $7.5b in mostly untaxed capital gains;

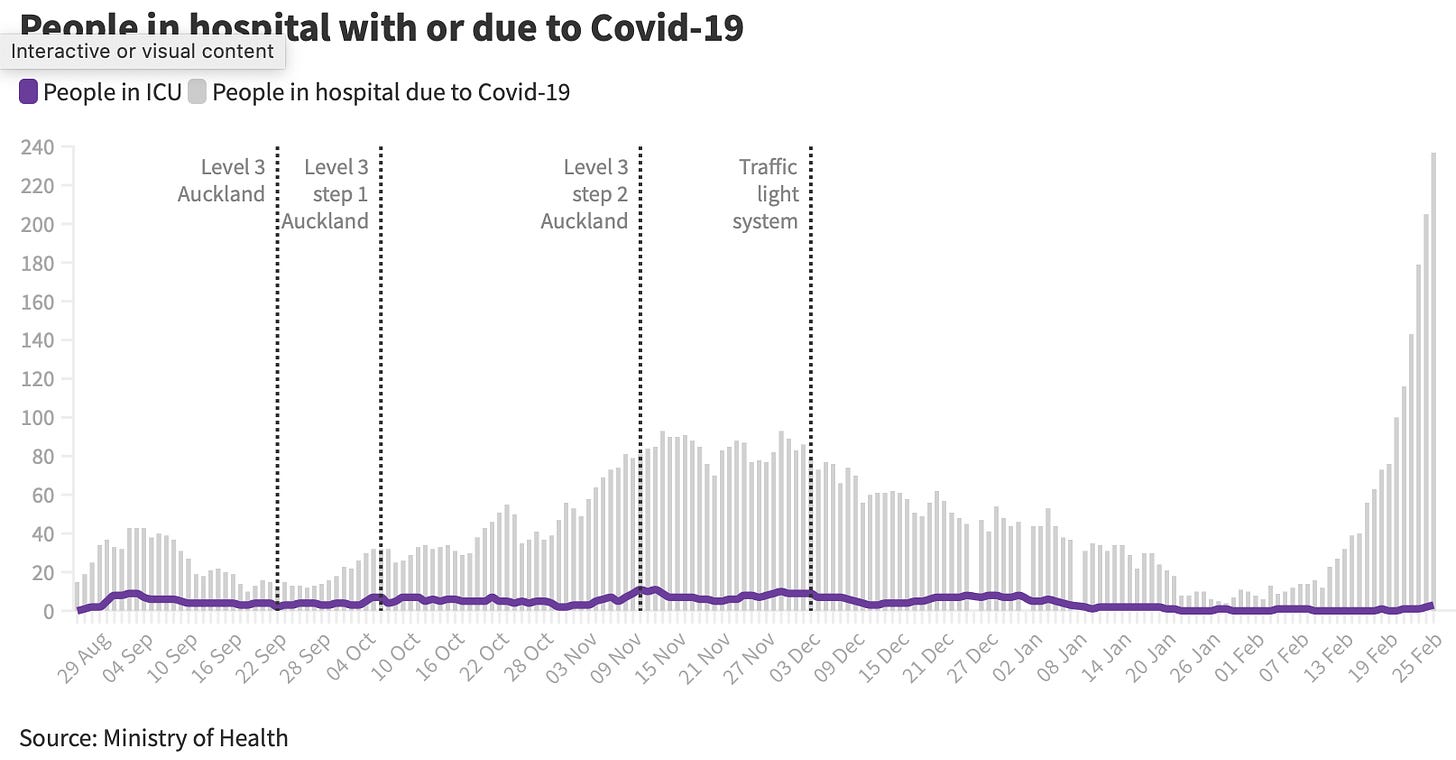

Our covid case numbers went vertical and our contact tracers were finally overwhelmed after two years; and,

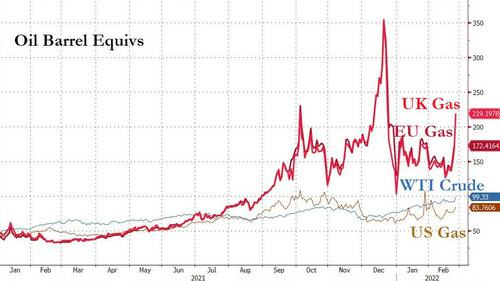

Russia started Europe’s biggest war since 1945 and unleashed new surges in global energy and food inflation.

This is our weekly sampler email for all free and paid subscribers. We welcome new paid subscribers, who can join our community to comment and be part of the conversation via the ‘hoon’ webinars and my weekly Ask Me Anything comment thread. Paid subscribers get full access to all the daily emails and podcasts, and support the sort of explanatory, accountability and solutions journalism we do about housing unaffordability, climate change inaction and child poverty reduction.

Five things to note

1. Interest rates are rising again

This week the Reserve Bank made its first interest rates decision for 2022 and issued new economic forecasts for the first time in three months. It hiked the Official Cash Rate 25 basis points and lifted its forecast track for the OCR by around 70 basis points to a peak of 3.35% by the end of next year because it was more worried about inflation becoming bedded in above its 1-3% forecast range.

I asked Governor Adrian Orr a few questions about those changes and wrote this analysis of the decision in my daily email the next day. Paid subscribers can hear those exchanges and the analysis in the podcast that went out with the email.

2. House prices will fall a bit more

The Reserve Bank also extended and deepened its forecast for house price falls to a total of 8.9% from a peak hit in the December quarter to a trough in the March quarter of 2024. They have already fallen 2.7% since November.

I wrote an analysis of why the Reserve Bank’s rate hikes are unlikely to crash the housing market by 30-40% in my daily email and podcast on Wednesday, which paid subscribers received in full.

3. But the December quarter was a doozy (for asset owners)

CoreLogic reported that the final quarter of the house price boom post-covid was spectacular for mostly tax-free capital gains. It calculated the combined capital gains for home owners who sold in the December quarter was a total of $7.5b, with the median capital gains recorded per home almost doubling in the last two years to $420,000. Homeowners had held their homes for a median 7.1 years before selling.

Just 0.7% of the sales reported in the quarter involved the owner making a loss. Just imagine any other asset class where 99.3% of the trades were profitable and the average percentage of profitable trades has been over 90% for five consecutive years.

I wrote this analysis of CoreLogic’s figures yesterday when they came out for paid subscribers, along with a look at what Russia’s full invasion of Ukraine was doing for oil, gas, aluminium and dairy prices.

4. Russia invaded Ukraine and oil rose over US$100/barrel

This week Russia first invaded the eastern breakaway regions of Ukraine, and then raced on through to a full invasion of the former Soviet republic that is physically bigger than the size of France. European natural gas prices rose more than 40% this week to the equivalent of over US$200/barrel. Actual brent crude futures prices rose around US$10/barrel to US$105/barrel this week. (See chart below)

Peter Bale and I did a special half-hour popup ‘hoon’ with Robert Patman on Thursday to explain what happened, why and what might happen next. Here’s the resulting podcast and email that I opened up for both free and paid subscribers.

5. Our Covid case numbers went ballistic

This week our covid outbreak finally overwhelmed our contact tracers after two years. The Ministry of Health stopped publishing locations of interest and the Government’s response moved to phase III, which means only household contacts of positive cases have to isolate. Hospitalisations more than doubled this week to 237, but numbers in ICU still remain very low, as these RNZ charts show. Now we will see if our hospital wards can cope, given we are still a month or so away from the peak of hospitalisations.

Scoops and news of note this morning

Useful longer reads and listens for the weekend

Profundities, curiosities, spookies and feel-good news

Fun things

Have a great weekend

Ka kite ano

Bernard

Share this post