TLDR & TLDL: This week omicron started spreading in the community, our border controls were effectively tightened, we learned house prices started falling in December, wholesale interest rates surged again globally on inflation fears, and the Government is looking at tweaking regulations to ease the CCCFA credit crunch.

In particular:

omicron ‘super-spreader’ wedding events attended by a Covid-positive Nelson family last weekend in Auckland forced all of Aotearoa-NZ back into the ‘red’ setting of the Covid traffic light restrictions from 11:59 tonight;

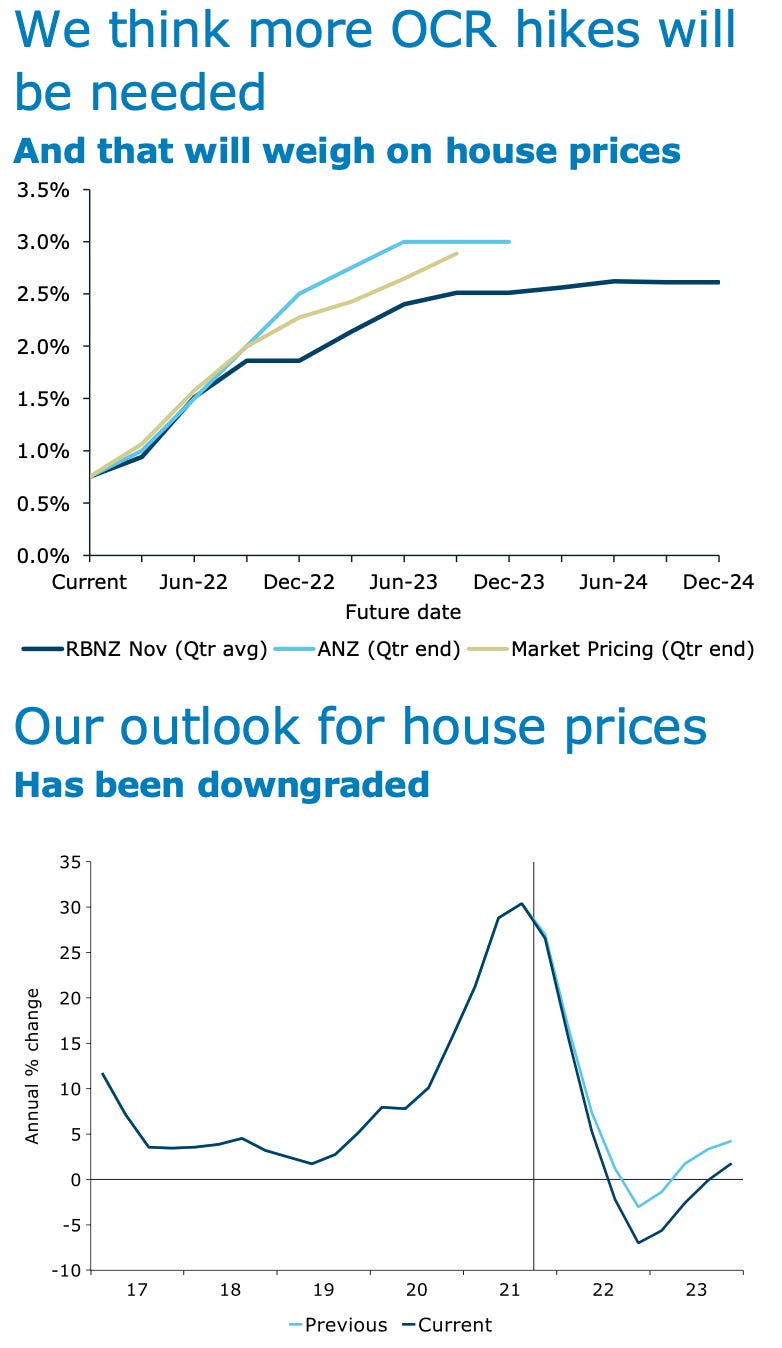

we learned house prices fell 1.0% nationwide in December and more than 3% in Auckland City, with ANZ predicting a fall of as much as 7.0% later this year;

wholesale interest rates rose again on inflation fears here and overseas, with ANZ forecasting our Reserve Bank will have to hike the official cash rate to 3.0% by early next year, implying 6.0% fixed rate mortgages later this year;

MBIE stopped releasing new MIQ slots for March and April, effectively closing the border to anyone who hasn’t already booked a regular MIQ slot until further notice; and,

ministers indicated they may tweak regulations, rather than legislation, to ease the CCCFA credit crunch that meant 20-35% more mortgage applications being denied in December than usual.

Next week we’ll find out if:

households and small businesses will be able to get hold of and use Rapid Antigen Tests (RATs) themselves from home any time soon (Wednesday);

inflation hit 6.0% in Aotearoa-NZ in the December quarter (Thursday at 10.45 am);

what the Fed is likely to do with global interest rates this year (Thursday 8 am our time); and,

whether Russia might invade some or all of Ukraine, which would shunt interest rates, oil, gas prices, and share prices all over the place.

Peter Bale and I talked about all these developments (except for today’s omicron red alert announcement) and more in our Friday afternoon ‘hoon’ webinar for paid subscribers, which we recorded above in podcast form for all to listen to. It was recorded at 4pm on Friday before today’s omicron announcement.

This is The Kākā’s one guaranteed free and full weekly summary article for all subscribers. I’d love ‘free’ subscribers to become paid subscribers and join us as full members of the The Kākā community. Full subscribers receive all of my journalism in The Kākā’s daily emails and podcasts and get invites to ‘Ask Me Anything’ and ‘Weekly Hoon’ zoom webinar sessions on Fridays at midday and 4pm. They can also comment below.

Paid subscribers support the accountability, explanatory and solutions journalism I do on the housing unaffordability, climate inaction and child poverty crises. Join us now.

1. Omicron starts spreading

PM Jacinda Ardern and Ministry of Health Director Ashley Bloomfield announced today in a late morning news conference in the Beehive Theatrette that a Motueka-based family of nine had tested positive for the omicron variant of Covid, and that they attended a wedding in Auckland and other events with more than 100 people last weekend that were likely to be super-spreader events. One person infected was an Air NZ attendant, who had then gone on to work on four flights between Auckland, Nelson and New Plymouth on Sunday, Wednesday and Thursday.

Ardern said this meant omicron was likely to have been spreading in the community in the Auckland and Nelson regions in the last week, which meant Aotearoa-NZ would have to all move back to the ‘red’ setting of the traffic light system of restrictions from 11.59 pm tonight for “some weeks” so as to slow an expected surge of omicron cases. This means no events with more than 100 people can be held, and that indoor events and hospitality venues must seat guests more than a metre apart.

The key details from the news conference included:

case numbers are expected to rise to at least 1,000 a day within the first phase of the outbreak over the next 14 days, during which the current approach would not change for PCR and Rapid Antigen Tests (RATs), contact tracing and two weeks of isolation for positive cases and close contacts;

that means RATs would only be available at official PCR (polymerase chain reaction nasal swab) testing sites and pharmacies, or through those employers who had successfully applied to the Ministry of Health to import their own;

tactics would adjust during an unspecified transitional second stage to focus on those with more risk of developing serious illness, and less about self-isolation of everyone with a positive test or who was a close contact;

the final third stage would be once case numbers reached thousands per day and would have different definitions and rules for self-isolation, which contacts need to isolate and how much contact tracing will be done;

Ardern said RATs were only 80% efficient and would only be used once the current 40,000 per day capacity for PCR tests and current contact tracing systems were overwhelmed, would would be in second and third phases;

she said Bloomfield and Associate Health Minister Ayesha Verrell would give more details on Wednesday about how the rules and definitions for self-isolation, contact tracing and RATs availability would change in the three-phase system;

Ardern said over 4.5 million RATs were in the country and another 1 million were expected in the coming week;

Ardern reitrated there were no plans for lockdowns or regional boundaries;

Bloomfield said the Ministry of Health was reconsidering its advice on mask usage, the four week gap between first and second does for kids and the four month gap before booster shots;

Ardern and (later) Deputy PM Grant Robertson said scenarios ranged from having thousands of cases a day to 50,000 cases a day and that the health system had contingency plans in place for those numbers;

Robertson said the mid-point scenario of 25,000 cases per day would see up to 350,000 workers or 12% of the workforce self-isolating at home and that the Government was working with the private sector to limit the effects on supply chains;

Treasury estimated that 25,000 cases a day would cost around $50m per week in leave support payments of $600/week for fulltime workers and $359/week for part-timers;

Robertson said the Government was looking at further sectoral support options, but had no plans for more widespread wage subsidy or resurgence payments, but that there was currently enough left in the Covid Response Relief Fund ($4b) to pay for the omicron response;

He said the Government had enough fiscal headroom to handle omicron without the need to borrow more than currently planned because stronger-than-expected economic growth had improved PAYE, corporate profit and GST income receipts; and,

Ardern said businesses should plan to be in ‘red’ for some weeks and she reiterated Cabinet had made no decisions about whether to extend the current end-Feb date for the start of MIQ-free travellers for residents returning from Australia.

Quote of the day:

“Such is life.” Jacinda Ardern when asked what she thought about having to put off her wedding planned for later in the summer.

Here’s the full news conference if you want more and have just over an hour to spare...

The key unanswered questions

I went to Labour’s annual Caucus retreat at a coastal wedding venue just south of New Plymouth on Thursday to hear the first full comments of 2022 from Ardern, Covid-19 response minister Chris Hipkins and Robertson on the omicron and economic outlooks. I asked a bunch of questions around border settings, RATs availability and plans and the likely economic and fiscal effets of omicron.

These are the four unanswered questions as I see it:

When can people start testing themselves at home with RATs?

Currently, the Ministry of Health will only allow a limited number of large businesses to import and use a limited variety of RATs. It has worried their relatively high false negative rate would mean Covid carriers would keep spreading the virus and break its elimination and ‘stamp it out’ strategy of tracing and isolating every single close contact.

Its current plans are for people to have to go to pharmacies or PCR testing sites to have trained testers conduct the RATs under supervised conditions. It has wanted to avoid the chaos seen in Britain, Australia and elsewhere where people who bought RATs off the shelves in pharmacies used a variety of tests in a variety of less-reliable-than-PCR ways that could not then be integrated into national reporting and tracking systems.

But it’s clear to everyone that once testers and tracers are overwhelmed, RATs will have to be used at home and in many more workplaces to avoid infectious people being unable to test themselves and therefore keep spreading it, and non-infectious close contacts being unable to quickly clear themselves to keep working. The absence of RATs once testers and tracers are overwhelmed massively increases the risks of a steeper rise in case numbers and self-isolation numbers that then overwhelm hospitals and cause supply chain chaos like that seen in Australia, where empty supermarket shelves and essential service closures have unnerved many.

Do we have enough RATs to cope once our testers and tracers are overwhelmed?

Ardern said on Thursday we had just over 4.5m RATs in the country and said today there was another 1m coming in this coming week. Millions more were on order, she said. But it’s possible we’ll need those many more millions within a couple of weeks. This is all as governments everywhere are desperately trying to get their hands on RATs to send them out to households and workplaces in their millions.

The Government’s long-held reluctance to let the public get their hands on RATs because it conflicted with the elimination strategy looks like it is coming back to haunt us with a vengeance.

Should essential workers and all their close contacts have to isolate for the full 14 days if they’ve been in close contact with a positive case or been at a location of interest?

The risk is that the outbreak grows so quickly that our testers and tracers are overwhelmed before we have enough RATs to avoid positive cases spreading it without knowing, or non-positive cases having to self-isolate unnecessarily. Both situations combine into a nasty feedback loop that both worsens the surge and peak of the cases, and takes out workers needed to keep supply chains working and cope with extreme pressure on the health system.

We’ll find out a lot more about the plans for RATs and for rules about self-isolation periods and thresholds on Wednesday. There are obviously tradeoffs around shortening self-isolation periods and raising thresholds for close contacts from locations of interest having to self-isolate. A lot will depend on how many RATs we can get our hands on and how quickly.

Here’s more from my report sent to paid subscribers on Friday from the Labour Caucus retreat.

By the way, one of the flights from Auckland to New Plymouth was on the Wednesday night (7.50 pm) and may well have included junior Labour MPs travelling to the caucus retreat. Most MPs and all of Cabinet were already in New Plymouth by then.

2. Will the border really reopen on March 1?

MBIE announced via Twitter on Monday night that it had indefinitely postponed a release of new MIQ slots for March and April because MIQ was increasingly full with omicron cases and the rooms may be needed for domestic omicron cases. Effectively, it meant there would be no new MIQ slots issued for the foreseeable future. Currently, the plan is for residents to be able to return from Australia without having to go through MIQ from March 1. That deadline for arrivals to be able to self-isolate was extended from mid-January just before Christmas.

The PM said on Thursday Cabinet had made no decisions about either allowing arrivals to self-isolate from March 1, or extending the deadline again. However, she said the border controls were a major tool in the Government’s arsenal to slow the arrival and spread of omicron, and would continue to be.

She said again today:

“We are still taking very seriously the role of using the border to slow down cases.” Jacinda Ardern.

My reading of that is the PM remains very conservative about reopening the border and adding (even marginally) to the pressure on the current outbreak. My reading of comments from others, including Hipkins, is they think an opening is preferable sooner rather than later, especially if the peak of the omicron wave has passed by the end of February. They want to avoid a peak coinciding with flu admissions in winter.

However, omicron will be far from over by the end of February, and certainly not soon enough for the airlines to schedule services for those that want to come. My reading of the current situation is that the country will remain closed to people who don’t already have MIQ vouchers until at least the second half of this year. It took at least two months for omicron to peak in the UK and Australia. I think it’s very unlikely the PM would allow new MIQ slots to be released or non-MIQ travel to resume until it is clear we’re past the peak and our hospital system has coped. The goldilocks moment for the omicron peak, if there ever could be such a thing, would be March, which would allow MIQ-free travel from June or July and avoid further over-loading the health system in winter.

However, given omicron has only just started spreading in the community and the official policy is to squash and extend the curve, it’s possible the omicron surge could keep going well into April. That would leave little time to open MIQ slots and/or schedule flights for self-isolation before the second half of this year.

By the way, anyone running or planning an event with more than 100 people in one place should not expect any relief or real certainty until well into the second half of this year, in my view. And that’s without another variant coming along.

Councils who have just spent millions upgrading their airports and building convention centres will be particularly frustrated, especially after two years of depressed events venue rents and parking ticket revenues over 2020 and 2021.

I welcome your questions for further inquiry below.

3. House prices are falling

The Real Estate Institute reported this week its national house price index fell 1.0% in December from January, and that sales volumes fell 29.4% in December from the same month a year ago. The index for Auckland City fell 3.1%, while Porirua and Lower Hutt fell 2.9% and 2.6% respectively.

Quote of the day:

“We are noting signs of deceleration in annual price growth compared to previous months. While the market remains confident, the impact of rising interest rates, tighter lending criteria and changes to investor taxation restrictions are starting to shift dynamics. In particular, the amendment to the Credit Contract and Consumer Finance Act (CCCFA) on 1 December 2021 — which requires stricter scrutiny of borrowers’ financial health — seems to have had an immediate effect. Feedback from several regions notes a falloff in buyer numbers — particularly first-time buyers — as a result.” REINZ CEO Jen Baird

Here’s the email I sent to paid subscribers on Wednesday:

ANZ’s economists then forecast a fall in house prices of as much as 7% in 2022 after it also increased its OCR forecast to 3.0% by early 2023, arguing the Reserve Bank needed to act more aggressively to control inflation expectations as annual CPI inflation hits 6.0% in the December quarter (data due Thursday). ANZ had previously forecast an OCR peak of 2.0% and house price falls of 3.0%.

Quote of the day:

“We’d still call this a soft landing, given the starting point. It would likely take a significant household income shock (forcing the sale of properties) for house prices to experience a very severe contraction. That said, anecdote regarding the impacts of the CCCFA have certainly made our ears prick up, and the 0.5% m/m contraction in December suggests this may be biting hard. It’s entirely possible this is the straw that breaks the housing market’s back, contributing to a sharper fall in prices than we assume.” ANZ’s economists.

4. Interest rates are rising

US inflation data showing an annual rate of 7.0% in December and the prospect for a 6.0% inflation rate in New Zealand in the December quarter (data due this Thursday) helped drive up wholesale interest rates in the last week.

The main focus is on the world’s biggest central bank, the US Federal Reserve, which is due to release its next interest rate decision on Thursday morning at 8am our time. No one is expecting it to hike this month, but everyone now expects the first of four 25 basis point hikes this year to start in March.

Chart of the week:

The red line shows the CME FedWatch market expectations for a 25 basis point rate hike in the fed funds rate from the current 0.0-0.25% at the Fed’s March 16 meeting.

What the Fed does is important because it sets the base for interest rates globally and the Fed’s decision since October to stop printing more money and putting up interest rates is challenging the valuations of stocks built up over more than a decade of falling interest rates. Rising interest rates would put downward pressure on asset prices, both for stocks and property. Some fear it could pop a bubble.

This week famed fund manager Jeremy Grantham wrote in a note to clients titled ‘Let the wild rumpus being’ that US stocks and other assets were in a ‘superbubble’ that was about to burst. Asset values could fall by US$35t he wrote. That’s ‘t’ for trillion.

“The most important and hardest to define quality of a late-stage bubble is in the touchy-feely characteristic of crazy investor behavior. But in the last two and a half years there can surely be no doubt that we have seen crazy investor behavior in spades – more even than in 2000 – especially in meme stocks and in EV-related stocks, in cryptocurrencies, and in NFTs. This checklist for a superbubble running through its phases is now complete and the wild rumpus can begin at any time.

“What is new this time, and only comparable to Japan in the 1980s, is the extraordinary danger of adding several bubbles together, as we see today with three and a half major asset classes bubbling simultaneously for the first time in history. When pessimism returns to markets, we face the largest potential markdown of perceived wealth in U.S. history.” Jeremy Grantham in a note to investors on Thursday.

This time is different?

All of these warnings about higher interest rates and bubbles popping (quickly or slowly) are based on that idea that central banks and governments don’t intervene to protest the wealthiest.

However, that implies that this time is different and that central bank governors and finance ministers finally decide to let the chips fall where they may, even if it is severely damaging to the banks they regulate and the individuals that donate or vote the most to support their re-elections.

The masters of the universe running central banks and treasuries have intervened repeatedly to bail out banks and big companies and print money in the last 15 years, without any opposition from politicians and voters. What makes the current harbingers of doom think that anything is different this time?

I wrote more about this with reference to ANZ’s forecast for an OCR of 3.0% in an email to paid subscribers on Thursday:

5. Don’t worry. The re-leveraging cavalry is on its way

Despite warnings from the banks last year, the application of the CCCFA (Credit Contracts and Consumer Finance Act) from December 1 has unleashed a rash of reports of both equity-rich landlords and income-rich first home buyers being rejected for new mortgages by bank loan officers (and their managers) who are apparently freaked out that they’ll be held personally responsible for lending to someone who can’t afford a loan.

The CCCFA was designed to make life difficult for loan sharks trying to load up high-interest rate debt on car and personal loans. Instead, banks decided (or are saying) it was aimed at stopping them lending for investors to buy more rentals and first home buyers stretching to get onto the ladder.

Reports have abounded over the last months of applicants being asked to justify takeaways, holidays and clothes spending. Some have been asked of their plans for children. Centrix reported 20-35% more mortgage applications being denied in December than usual.

However, the timing of the introduction of the CCCFA also coincided with the tightening of LVR rules by the Reserve Bank and questions from bank boards themselves about whether they need to tighten credit standards to avoid risks of bad loans. The Government may be the most obvious party for the lending officer or mortgage broker to point their fingers of blame when the blame could be spread more widely.

Commerce Minister David Clark announced over the last week the Council of Financial Regulators (Treasury, the Reserve Bank, the Financial Markets Authority and the Commerce Commission) would bring forward their already-scheduled review of how the CCCFA was being implemented to address the complaints.

I asked Grant Robertson on Thursday if the issue could be resolved with regulatory tweaks than a rewrite of the legislation. He agreed that was possible.

“I think if we put all of those things together, get the right people in the room, we can resolve that. You wouldn't necessarily have to do a law change. It could be a regulatory change. I just think it's really important here that we get on the same page around what the purpose of the legislation was, and whether or not it's a question of interpretation and implementation, or if it's a question to do with the law itself.” Grant Robertson.

As I wrote in an email for subscribers on Monday, the pressure for rate hikes to stop and for the Government to enable a resumption to the leveraging up of asset prices, or at least stop them falling, will be intense by the end of the year.

It’s hard to believe that the Reserve Bank will keep punishing asset owners to change their inflation expectations because of a global supply shock and that the Government will allow house prices to fall more than 10% or so going into an election year.

A fun thing

Ka kite ano

Bernard

Share this post