TLDR and TLDL: This week I start with my weekly audio chat about the week’s big global news, News Zealand over the Horizon, with Peter Bale. I then include my summary of the key news this week, including the 'anti' Mother of All Budgets, Bitcoin being blindsided, talk Britain could remove its tariffs on meat imports from Australia and NZ, Ford’s launch of its electric F150 double-cab ‘truck’, my charts of the week, a few longer weekend reads and a few fun things.

The anti-MOAB Budget

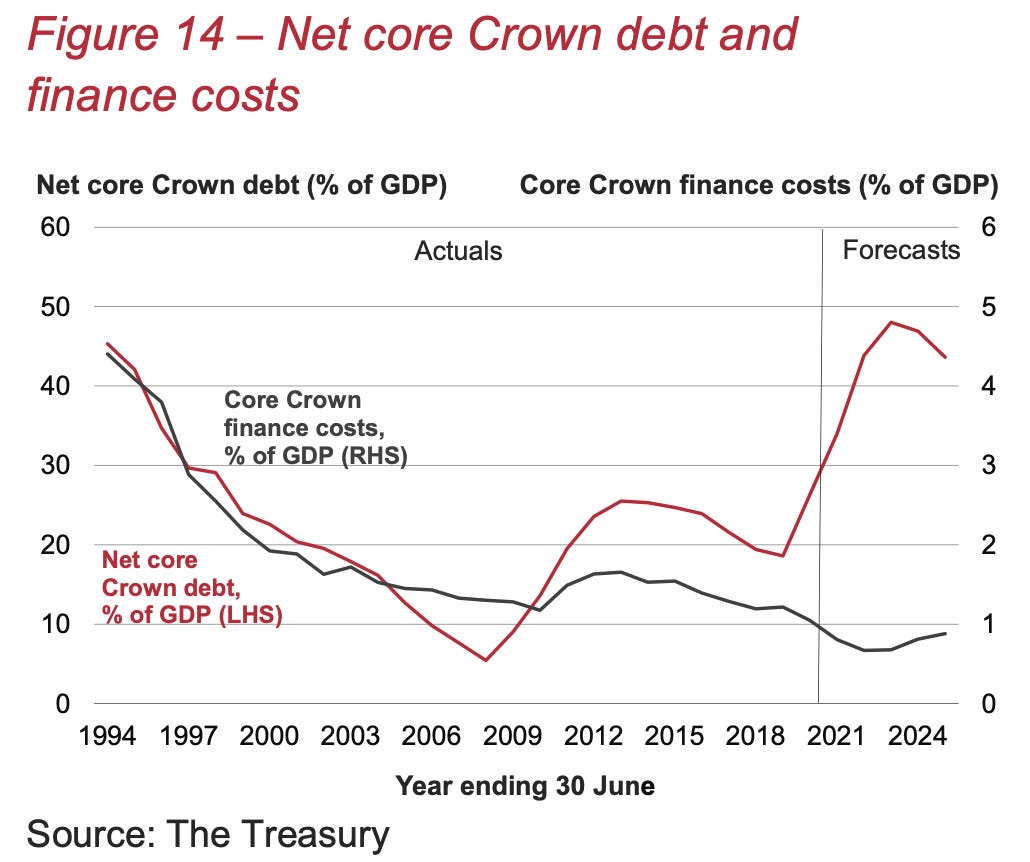

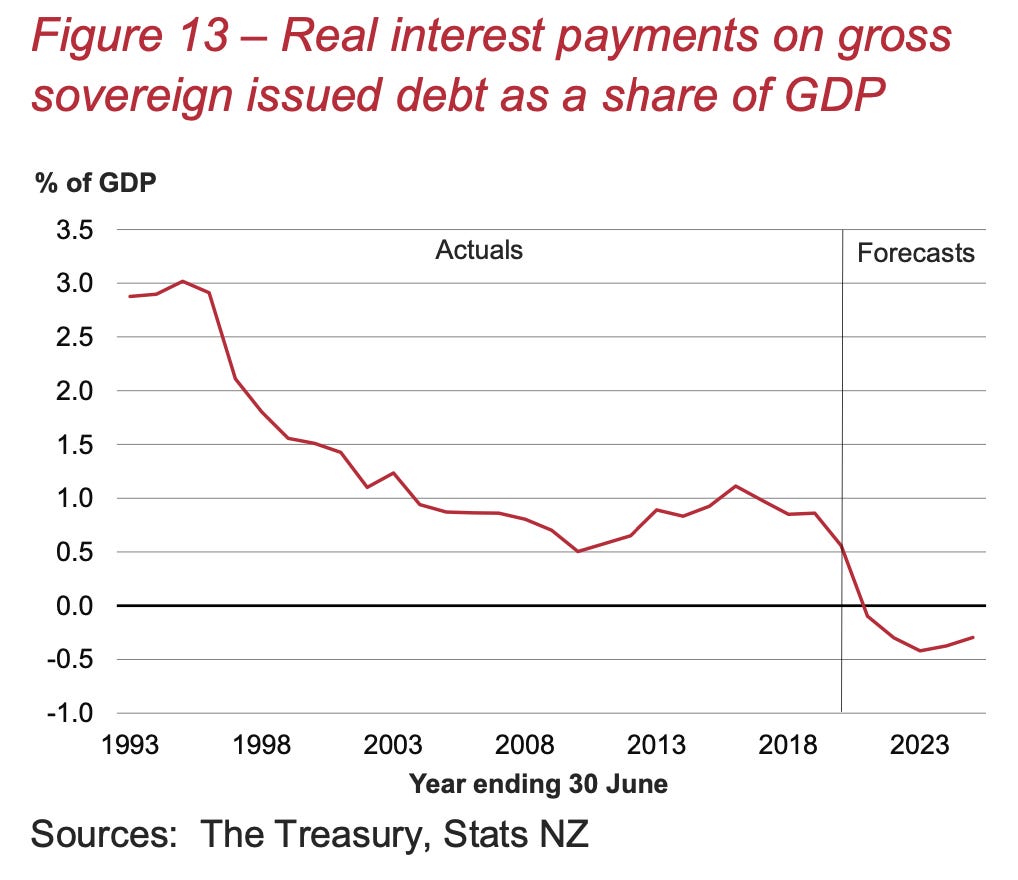

Grant Robertson pitched this Budget, his first of three before the 2023 election, as ‘righting the wrongs’ of Ruth Richardson’s 1991 ‘Mother of All Budgets’ benefit cuts and ‘striking a balance’ between getting back into surplus withing three or four years and reducing child poverty.

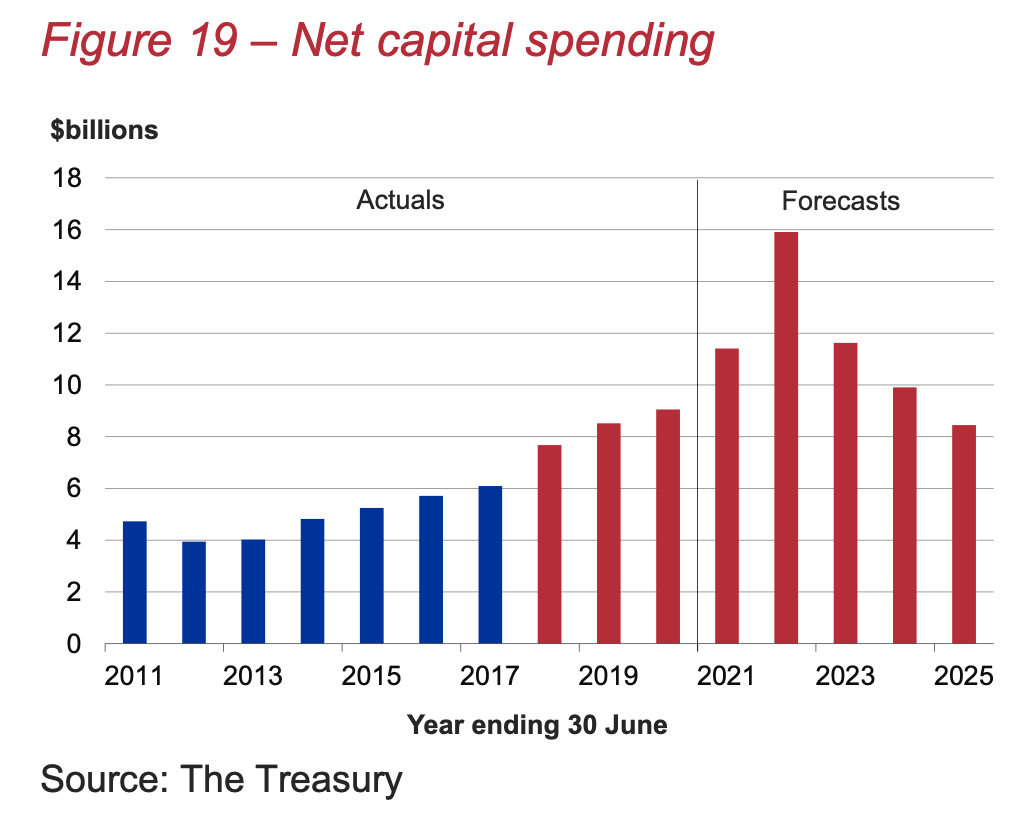

The balance struck was the Government used about half of the $20b improvement in the revenue outlook since the election to spend on benefit cuts and used the rest to reduce planned borrowing. It still has plenty to do to reduce child poverty and its forecast of falling infrastructure spending in the out years shows it prioritised lower debt over filling the huge infrastructure deficits.

That’s disappointing, and I think a poor economic and social decision when real interest rates for Government borrowing are negative. The charts below tell the story. Borrowing costs below 1% of GDP, real borrowing costs negative, yet infrastructure spending falls in the out years.

Elon and Xi blindside Bitcoin

Bitcoin had a wild ride this week after China threatened to regulate cryptocurrencies and Elon Musk tweeted he was worried about the carbon emissions produced to mine bitcoin and that Tesla would no longer accept bitcoin as payment. Slow learner…

The market capitalisation of all crypto currencies fell by US$1t to US$1.5t this week. Easy come, easy go…

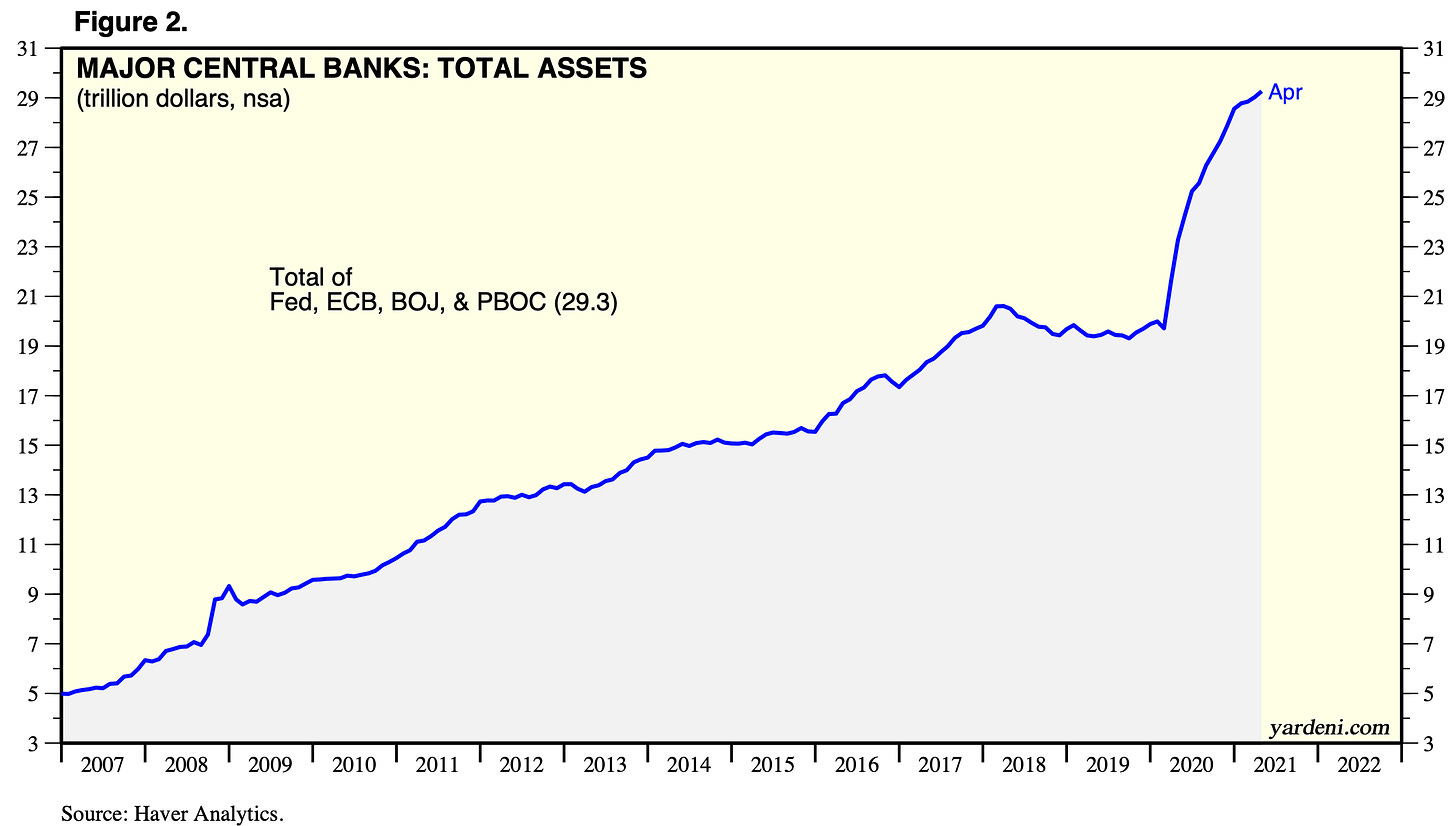

Remember that all these crazy asset prices are because investors know that central banks have spent about US$10t in the last year buying bonds for cash. A lot has been stashed back in bank accounts, but some is looking for a home in something that is not a fiat currency, including rental properties in Mangere.

Finally, a realistically priced electric double-cab ute

Ford launched its all-electric F150 Lightning this week in America with a base price of under US$40,000. That’s not far off the base price in America of about US$30,000 for a petrol powered F150, which is (of course) the best selling ‘light’ vehicle in America and has been the best-selling ute there for 40 years.

The base-level Lightning can do 370 kms on a charge and has some brilliant features to make it worthwhile for your average tradie, including a boot where the engine was. It also has 10 120-volt power outlets and one 240-volt outlet for running power tools. Ford says it can power the tools on a job site for three days while still having power left over for a 80 miles of driving. It can also also power a home during a blackout with battery pumping power back into the house. Now we’re getting somewhere.

Here’s my current favourite US car reviewer Doug Demuro with his take.

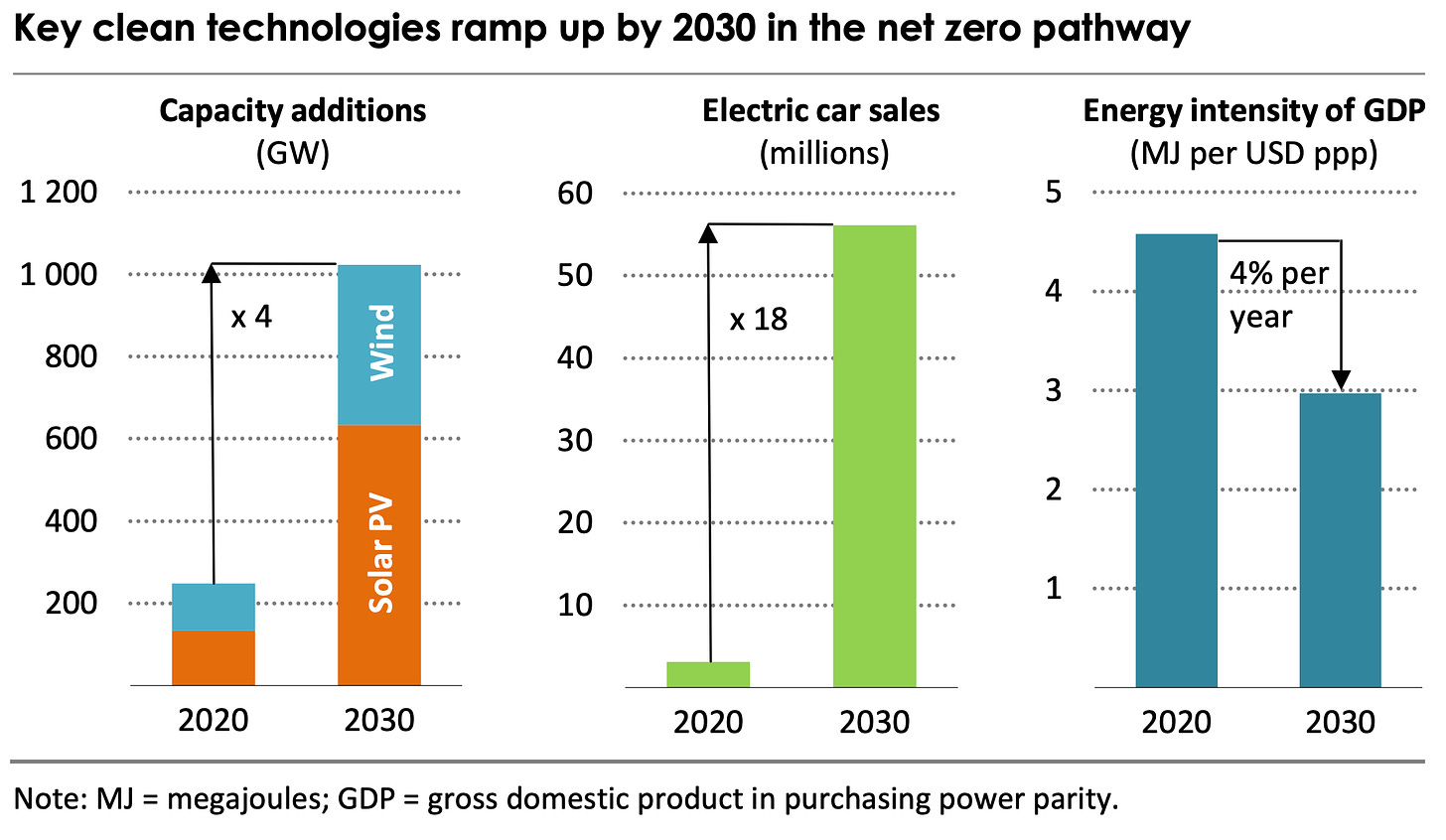

The IEA called for no new oil and gas fields

This just has to be included in a summary of the world’s big events this week, and again shows how far behind the curve our Government, public and body politic are on climate change.

The International Energy Agency, which is a sort of UN for the world’s oil and gas producing countries, said this week in a major report about how to get to carbon emissions to keep climate change to 1.5 degrees above the pre-Industrial age average that the world must stop developing new oil and gas fields immediately. It also called for the end to sale of fossil fuel cars by 2035.

“If governments are serious about the climate crisis, there can be no new investments in oil, gas and coal, from now – from this year.” Fatih Birol: The IEA’s Executive Director.

Also, G7 nations agreed to phase out fossil fuel subsidies and stop financing international coal projects. (BBC)

New Zealand has yet to give an end date for the sale of fossil fuel cars, has done little to arrange a just transition to net zero by 2050 and is still increasing emissions. The Climate Commission is due to give its final advice to the Government at the end of this coming week about how to get there. The rubber better hit the road soon.

Britain may remove all tariffs on Australasia’s meat imports?

Everyone’s focus this week was understandably on the Budget, but a real ruckus blew up in Britain about the possibility it could actually remove all tariffs on meat imports from Australia and New Zealand in a desperate attempt to get new Free Trade deals fast.

That would be amazingly good for our lamb exports in particular, but it’s hard to believe Britain would really drop its pants completely.

Here’s a useful fresh summary of the British farming outrage.

Also on the trade deal front, just quietly, China has started technical talks with Australia and New Zealand about joining the CPTPPA. (Bloomberg) The whole point of the original TPP was to lock China out of a wider trade deal that included America and the rest. Trump pulled America out so China wants to join now.

That’s a great incentive for Biden to look at rejoining to keep China out. If Britain was to do proper trade deals with Australia and NZ, it could then join as well to create quite a whopping free trade area that included Britain and America. Happy Days.

Charts of the week

My longer weekend reads

Share this post