TLDR: In a big week for our political economy:

Te Putea Matua (the Reserve Bank) decided to force the economy into a recession around next year’s election to bludgeon inflation down from 7% to 2%;

Governor Adrian Orr expressed regret in a statement to a Parliamentary Committee about the economic shocks and the higher-than-target inflation and admitted the bank’s actions had contributed to it;

National Leader Christopher Luxon withdrew his promise to repeal the 39c income tax rate, saying the economic conditions had changed; RNZ

The MakeIt16 campaign to lower the voting age won its Supreme Court appeal against the voting age of 18 being consistent with the Bill of Rights outlawing discrimination on the basis of age, prompting Labour to promise a Parliamentary vote on the issue, although National and ACT said they’d block it getting the required 75% majority; and,

China’s covid outbreaks widened in several major cities, forcing fresh lockdowns and riots around the mega-factory that makes iPhones, while a deadly fire in a (literally) locked down apartment building sparked riots in Xinjiang and Beijing. Reuters

So what?

The RBNZ’s much-harsher-than-expected approach means it has decided to engineer a recession to beat inflationary expectations lower. It also demonstrated its political independence with an exclamation mark because if the plan works, the Labour Government will be trying to get re-elected late next year, while:

the economy is in recession;

unemployment is headed for 5%;

house prices will have fallen almost 20% from their peaks;

new fixed mortgage rates will be over 7%; and,

inflation will still be more than double the RBNZ’s 1-3% target range.

In effect, Labour’s already difficult job of getting re-elected for a third term, just became a lot harder. Aspiring Finance Ministers Nicola Willis and David Seymour should quietly be sending Adrian ‘the Grinch’ Orr thank you notes with their Christmas Cards, although probably not enough to say they’re looking forward to working with him as his boss/es.

But is the tightening justified?

A strict reading of the Reserve Bank Act gives the bank every right to tighten as much as it projects it needs to in order to get inflation down to around 1-3% within the next couple of years. Inflation at over 7% is certainly well outside the band and there seems to have been some semi-permanent supply shocks in the global economy and here that would require a response.

Reserve Bank Chief Economist Paul Conway, in our interview on Thursday, pointed to labour shortages here due to covid sickness and lower migration, along with labour shortages in China due to its falling working-age population and end of its big internal migration of poorer farmers in central China to the east and southern coastal factory regions. He also thinks a long-warned-about ageing of developed world populations has also worsened the labour shortages.

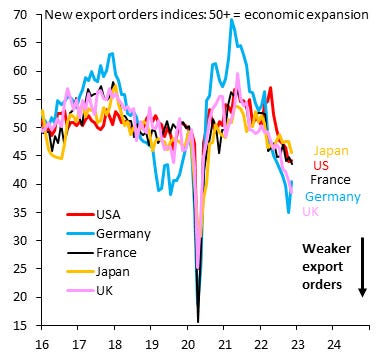

There’s also the geo-political shifts that are frustrating more globalisation as some companies ‘onshore’ and ‘friend-shore’ their supply chains back into the American-led or European-led blocs to reduce their exposure to China’s military-and-security-industrial complex. For example, just yesterday, the United States banned sales of ZTE and Huawei equipment sales because of concerns about how China’s Government could use the gear to gather information remotely. Reuters

But some of the inflation will be temporary. Oil prices are back down below their pre-war levels again and the covid effects on work forces will eventually subside. The permanence of the de-globalisation and ageing populations issues is also a matter for debate. There is actually not much of a reversal of offshoring or a drop in trade volumes happening, but certainly the growth of the integration of the global economy has stalled. I think there’s still plenty of globalisation to happen in the services sectors via global cloud computing, but that’s also unproven. I also think it’s way too soon to think that all the migrant labour flows that have been growing for decades have somehow stopped or been blunted permanently because of covid.

The big questions to ask

The first big question to ask is whether we (and the Reserve Bank) can rely on its own forecasting. It was wrong in the 10 years before covid by over-forecasting inflationary pressures and under-forecasting the ability of the labour market to grow via extra participation and migration. It was wrong during covid by not forecasting the labour market effects of covid or the war in Ukraine. It should be forgiven for both of those errors because everyone else was wrong and it was slightly less wrong than most others. In the end, we all have to rely on the bank’s forecasting and its models and hope they keep updating them fast enough and well enough to take account of these changes as they happen.

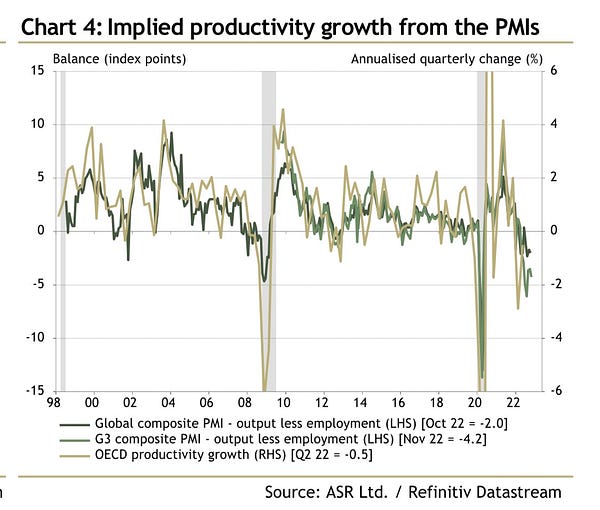

The second big question to ask is whether the bank should have to get inflation back down to around 2% within a quick couple of years, or whether it should cut itself some slack to allow longer and be more tolerant of inflation that is a bit higher in the long run at around 3-4%, especially if its because of labour shortages. There are quite a few serious economists saying the number to target should be 4% rather than 2%, and that a little bit of inflation is not a bad thing in the long run, especially if it reverses a decades-long shift in income from workers to shareholders.

But that different approach would take a change in the Reserve Bank’s legislation and a debate about the role of inflation targeting in wealth and income distribution. I don’t think we’ve thought or researched enough into how the decades-long obsession with getting inflation and keeping it there generated an economic framework that worried too much about wage-price spirals and not enough about inflation caused by companies using their market power to increase prices and their profit margins. The end result was using the levers of monetary policy to always ensure there was a surplus of labour, which gave companies more power to engineer higher profit margins and higher income shares for capital.

Have a listen to this to see how little the Reserve Bank has thought about it, or sees it as a problem.

Quotes of the week

Christopher Luxon changing his mind after the RBNZ rate shock

“Let's get really sobering about the reality of this. Interest rates are going to continue to rise because inflation is stubbornly high, and we are now heading to a recession.”

“We would like to offer people tax relief, but when I look at things ... if I think about the 39% tax rate in particular, that's something that I really want to think about. The situation has changed big time.

“We've been crystal-clear to say that the economic conditions will determine what we can achieve in our first term in government and so we will take stock of where we sit today and we will revisit where we are." Christopher Luxon

Robertson renewed his attack on Luxon after that

"I just don't think you can trust National on tax. There's been so many U-turns over the few weeks on policy, it's hard to keep up. We don't need people whose first reaction is to panic.” Grant Robertson after Luxon’s comments.

Adrian Orr finally has a regret on the RBNZ’s ‘least regrets’ policy

“On behalf of the Monetary Policy Committee, we are sorry that New Zealanders are being buffeted by significant shocks and inflation is above target.” Adrian Orr to the Finance and Expenditure Select Committee this week.

Scoops of the week

Chart of the week

Useful longer reads

Soberings, spookies, curiosities and feel-goods

The Craic

Ka kite ano

Bernard

Share this post