TLDR: Te Pūtea Matua (Reserve Bank) Governor Adrian Orr has just demonstrated his inflation-fighting resolve and political independence with a volley of monetary policy tightening and tough talk that will shock parts of the economy to a standstill.

If Orr had put on a Grinch costume and told everyone to give up on Christmas it would fit perfectly with the bank’s actions, forecasts and comments yesterday.

In the process, the Reserve Bank has put a huge dampener on the economy leading up to the festive and shopping season. It will blow away any consumer and housing market enthusiasm that might have been building for the summer. The tourists and the sun will come, but they’ll find a bunch of grumpy locals, especially the real estate, and mortgage brokers. There’ll be some moody Labour politicians too.

The Reserve Bank’s decision to engineer a recession should also put a full stop on any suggestion the Governor was too close to the Government and his Finance Minister boss Grant Robertson. The central bank just made it massively more difficult for the Labour Government to win a third term, which was already in serious doubt.

National Finance Spokesperson Nicola Willis and aspiring Finance Minister David Seymour may not want to keep Adrian Orr if they win next year’s election, but they should be quietly sending him thank you notes in their Christmas cards this year. He may well have just put them in the Beehive.

So what just actually happened?

In summary, the Reserve Bank:

tightened the Official Cash Rate as expected by 75 basis points to 4.25%, which was the biggest rate hike since the OCR began being used in 1999 and to the highest point since just before its biggest ever rate cut in January 2009;

said it even considered raising the OCR by a full 100 basis points to 4.5%;

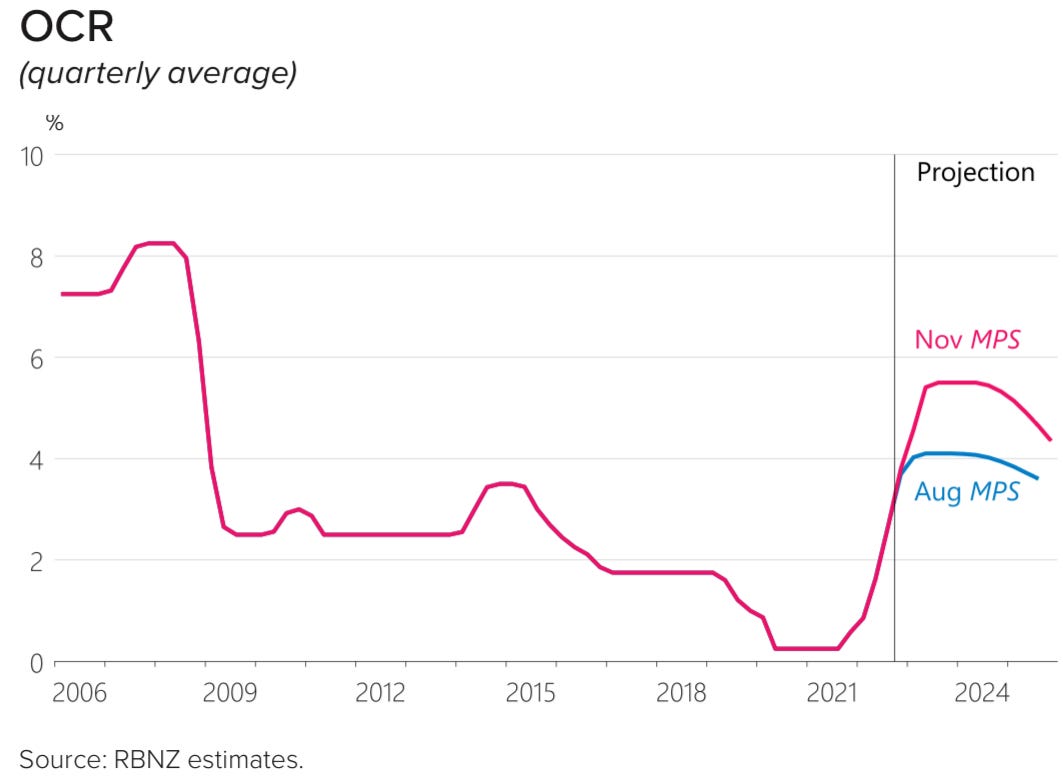

lifted its forecast track for the OCR to a peak of 5.5% by midway through next year from a peak of 4.1% in its August MPS, which would imply fixed mortgage rates at or over 7% by the election in the fourth quarter of 2023;

surprised financial markets by its hawkishness because its forecast OCR peak was around 25 basis points above the peak forecast in financial markets just before the release of the statement yesterday,

forced up wholesale interest rates by around 25 basis points, including lifting the two-year swap rate that mortgage rates are supposed to be based by 27 basis points to 5.28%;

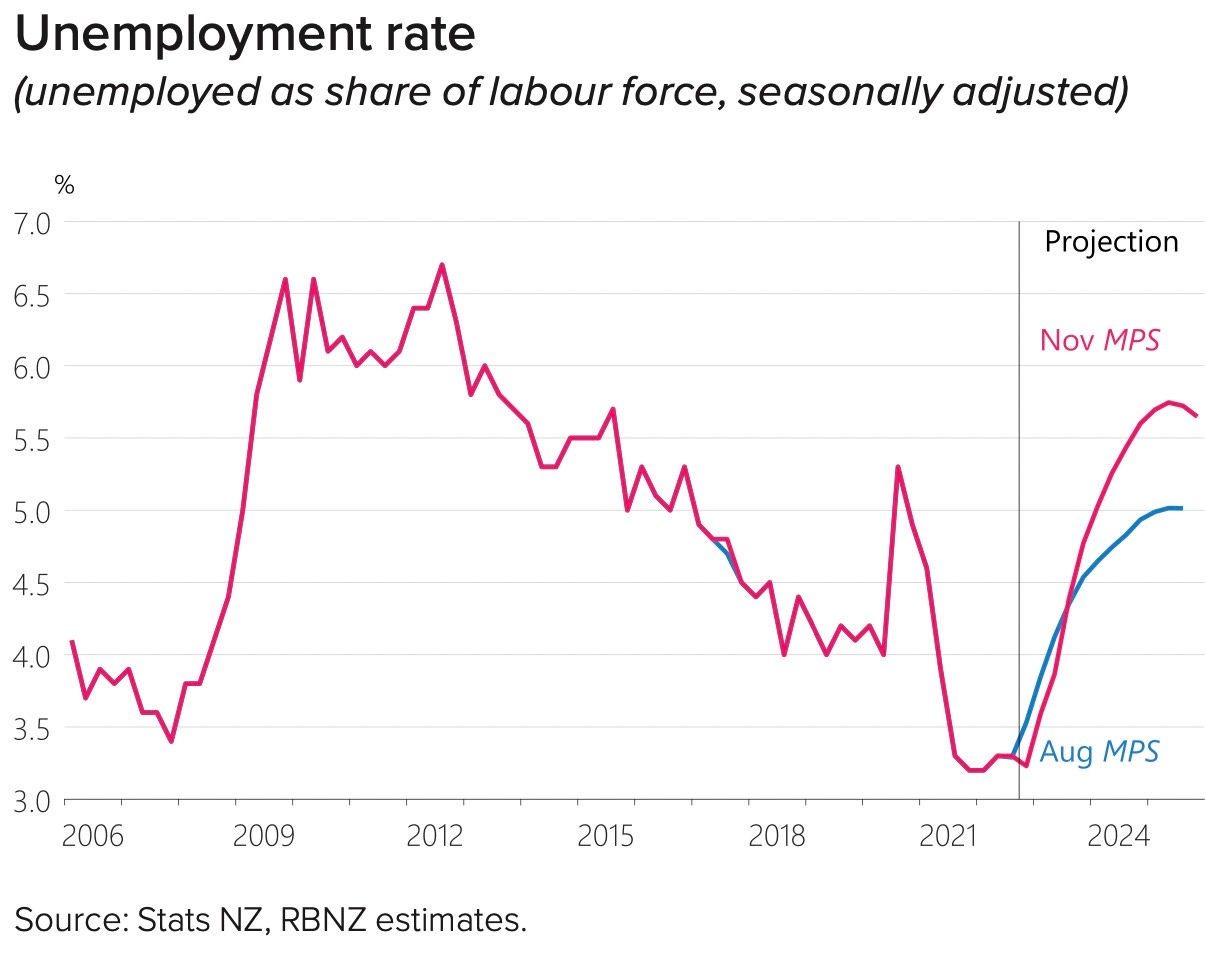

forecast a four-quarter-long recession totalling 1.0% of GDP that would lift the unemployment rate to 5.0% by the beginning of 2024 and a high of 5.7% a year later;

forecast inflation would still be over 6% by next year’s election and would not go below the 3.0% upper-end of the target band until late 2024, with an end point of 2.0% by the end of 2025, which was the first time in the bank’s history it had ever forecast would not go below the 2.0%-midpoint of its target bank;

noted banks had not passed on all of the recent rises in wholesale interest rates into retail interest rates, which it expected to happen in coming months; and,

deepened its forecast for the peak-to-trough fall in the CoreLogic/RBNZ House Price Index to around 20% from 15% in August, although the bank also forecast at its Financial Stability Report earlier this month it saw a 20% fall.

What the Reserve Bank Governor said

Orr was in particularly hawkish form through the news conference, actively calling on consumers and wage and price setters to tighten their belts and brace for a recession that was necessary to contain inflation.

Here’s a selection: (bolding mine)

‘Cool your jets people’

“Think harder about your spending. Think about saving rather than consuming. Just cool the jets.” Adrian Orr in the November MPS news conference.

‘We need to reduce spending levels’

“What we're highlighting here is that inflation is no one's friend. And in order to rid the country of inflation, we need to reduce spending levels. That means that we will have a a period of negative GDP growth, we think to the tune of around 1% of GDP.” Orr.

‘We need to reset expectations’

“The sooner inflation expectations, the sooner wage expectations decline back to being consistent with our target, then the less work there is for monetary policy to have to do, otherwise it has to come through a drag on spending, which we are imposing through higher interest rates. And the longer that it takes to feed through to inflation, the more costly it is, so it's all about expectations.” Orr

On the debate about a 100 basis point hike

“On the 50, 75, 100, I think it would be fair to say the committee spent more time on 75 versus 100, than they did with 50 versus 75.” Orr

On the risks looser fiscal policy makes the bank’s job harder

“All things all other things unchanged, which they never are, higher government spending means higher demand in the economy, which means upward pressure on inflation for us, and vice versa. So that's a nice simple one.

But then it becomes far more complex because how did they raise their revenue? Was it through increased taxes? Was it through increased funding of spending? And what is the nature of the spending that they're doing? Is it long term infrastructure productive capacity? Or is it more short term welfare spending or whatever?

“So it's always a complex picture. Over recent times, it's been broadly neutral if not, if not slightly negative fiscal impulse. Looking forward we see a risk to the upside. Because of the cyclical place we're in at the moment.” Orr

‘We started below neutral and have a ways to catch up’

“We started from a position of well below any sense of neutral so you had to go a long way just to get to the start line. And we'll be going a long way quickly. What we have been finding is new shocks keep arriving. The world just doesn't stop and let us catch up and the new shocks that have been arriving: Russia, Ukraine, the food, the energy, the weather price shocks, and now the incredible labor shortages. So we have to keep adjusting, adapting, but we are well down the path of the tightening cycle.” Orr

‘We want to tighten fast and then wait’

“We are very eager to to get to a position where we can watch, worry and wait and we can feel confident that inflation will be worn down. Inflation is no one's friend. And so we want to get there sooner. That's why you're seeing quite a steep forward path for the official cash rate.” Orr

Here’s the full video of the news conference for the true tragics.

The key charts from the MPS

The centre of attention: the 140 basis point rise in the OCR track

The lower track for house prices than August

Inflation at 6% come election time

Unemployment 4.8% and rising by election

So what was the reaction?

The tone of the reaction from economists was of shock, although the initial market reactions yesterday afternoon were relatively sanguine, with the 25 basis point rise on wholesale interest rate markets and only a small rise in the NZ dollar. However, the NZ dollar rose a full cent overnight to 62.3 USc.

Here’s a few quotes from economists to give you a flavour (bolding mine), along with audio above in the podcast of my ‘hoon’ with David McLeish from Fisher Funds and Jarrod Kerr from Kiwibank.

‘The most hawkish I’ve ever seen’

“The RBNZ is deliberately engineering a recession to bring the forces of supply and demand back into balance, and to break the back of the inflation cycle.

“Over the past 35 years we have read thousands of central bank releases and policy statements and it was hard to recall ever reading one that was as outright hawkish as that which the RBNZ published today.” Sean Keane of Triple T Consulting for Credit Suisse

How it ties in with the political outlook

“Our expectation is that by the end of 2023 New Zealand will have a new government with a very different view on immigration, and that the unemployment rate will be higher against the backdrop of a slowing economy, a stronger currency and a reversal in the forces or supply and demand.

“By that time also a large number of fixed mortgages will have been reset to higher levels and the reality of a higher funding rate will be much more real as people make their individual spending decisions.” Sean Keane of Triple T Consulting for Credit Suisse

An OCR with a 6 in front of it?

“Infometrics now expects a peak OCR of 5.75% by mid-2023, with a 75bp rise in February, a 50bp lift in April, and a 25bp increase in May. However, we believe that the balance of risks still lies to the upside, and a 6.0% OCR is easy to envisage.

“We can also contemplate a lower OCR peak if inflation, the labour market, and the economy all soften faster than expected, but we regard this outlook as unlikely.” Brad Olsen from Infometrics.

‘There’s a risk of tightening too much’

“We acknowledge the scale of the challenge that the RBNZ faces in breaking the cycle of rising prices and wages. But for the first time in a while, we’re also thinking about the risk that the RBNZ could end up overcooking it on the inflation front. We now expect OCR cuts to begin in early 2024, six months earlier than we did previously. Those rate cuts are both earlier and faster than what the RBNZ is projecting.”

“Make no mistake, the RBNZ is not just signalling a recession, it’s forecasting a downturn on a similar scale to the Global Financial Crisis – different causes, but similar consequences. On the RBNZ’s forecasts, economic activity continues to fall below its potential long after the recession has ‘officially’ ended.” Westpac Economist Michael Gordon

An economist talks about the only thing that matters in the end

“The Bank has almost halved its assumptions on productivity growth – essentially dropping the economy’s perceived speed limit.” BNZ Economist Craig Ebert

‘It’s a welcome big call’

“Hope is not a strategy. The RBNZ Monetary Policy Committee gets that, and deserves a pat on the back for facing the challenges head-on. If the facts change, they’ll change their minds. But right now, the fact is that high inflation is looking increasingly entrenched, and dithering would only make the problem worse.

“This inflation problem is unlikely to be beaten until retail interest rates have spent a decent amount of time sitting considerably higher than CPI inflation.” ANZ Economist Sharon Zollner

‘Better for the old than the young’

“If you’ve recently purchased a home or you’re about to come off a very low fixed-term rate on your mortgage you are about to feel it. If you have debt that has a variable interest rate of any sort you’re about to feel it.

“Younger people tended to have more debt. Older people with more assets or money in the bank might actually benefit from the higher interest rates.” CTU Economist Craig Renney

What do I think?

I agree with those that fear the Reserve Bank is over-reacting and may drive the economy unnecessarily into a brick wall. I think it will increase the chances of a change of Government by the end of next year.

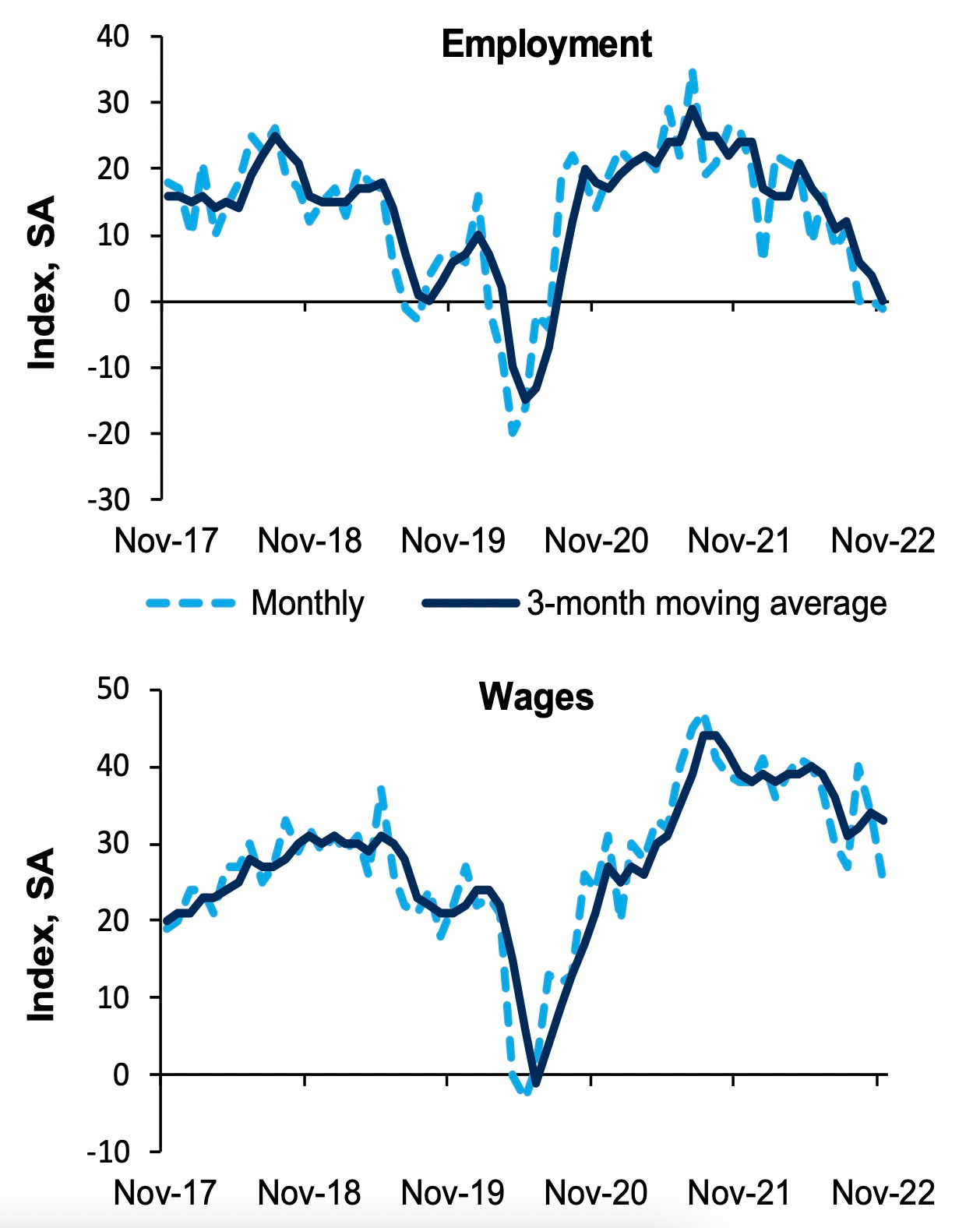

Charts of the day

Richmond Fed factory survey shows US inflation pressure easing

Substack of the day

Ka kite ano

Bernard

Share this post