TLDR: This week the US Federal Reserve hiked its key interest rate by a super-sized 75 basis points to fight inflation running at 8.6%. That unleashed fresh mayhem on global markets, including another slump in shares into bear market territory and the collapse of crypto-lender Celcius. Bitcoin fell more than a third.

Meanwhile, house prices in Aotearoa-NZ fell again, including Auckland City’s median price falling $360,000 or 23% in six months, the chances of a recession here rose and the Gib crisis morphed into shareholder complaints to Fletcher Building’s CEO. PM Jacinda Ardern replaced Building and Construction Minister Poto Williams with Housing Minister Megan Woods to deal with the crisis. Williams was also replaced by Chris Hipkins as Police Minister.

In this week’s live hoon webinar for paid subscribers, which is in recorded form above, Peter Bale and I talk with special guests independent economist Rodney Jones and Easy Crypto CEO Janine Grainger.

This is my weekly summary and sampler of the big news of the week I’ve covered on The Kaka for both free and paid subscribers. The public interest journalism I do daily on housing unaffordability, climate change inaction and poverty reduction is possible with the support of paid subscribers. Come and join our community by subscribing in full. Our full subscribers have allowed us to make The Kākā fully free for students, teachers and those working for advocacy groups and political parties in these areas. Anyone in these groups should just sign up to the free tier with their work, school, university, polytechnic or advocacy group emails and we’ll convert you to the full paid tier behind the scenes.

A reminder to free subscribers reading here that we have a special $30 a year deal for under 30s and anyone on a benefit. We also have a new special $65 a year deal for over 65s who are renting and reliant on NZ Superannuation.

The five things that changed this week

The Fed’s super-sized rate hike

The US Federal Reserve announced a 75 basis point rise in its official cash rate1 to a range of 1.50% to 1.75%, which was its biggest official interest rate hike since 1994. Global stocks fell sharply before and after the hike, which only a week earlier economists had expected to be a 50 basis point hike. The difference was surprisingly hot inflation data last Friday night showing US CPI inflation of 8.6% in the year to May.

Now we’ll find out how much pain the US economy and global markets can take before the Fed and other central banks have to stop the tightening, or even resume the money printing, as they have done repeatedly over the last decade whenever they tried to force investors to go ‘cold turkey’ on the easy and cheap money.

The Federal Reserve appears determined to squash inflation rather than rescue investors again, but the European Central Bank showed on Wednesday it doesn’t have the same resolve. Having only just signalled last week it would stop printing this month and would hike from below 0% next month, the ECB held an emergency meeting and pledged to keep printing to buy Italian and Greek Government bonds to stamp on a threatened return of the repeated European debt crises seen from 2009 to 2012.

We talked with Rodney Jones about the dramas through the week on global markets, and also looked again the Reserve Bank’s decision to keep lending at cheap rates to banks here, and to slowly unwind its money printing from 2020 and 2021.

Crypto-currency lender Celsius collapsed and Bitcoin fell almost a third

Celsius, an unregulated bank of sorts that lent crypto-currencies to crypto startups at double-digit interest rates2, collapsed after a classic run on the bank. It froze withdrawals and is now trying to work out where the collateral for its loans is and whether it can pay back the crypto-currencies it has lent. Fellow crypto lender Babel Financial also blocked withdrawals and crypo-investing hedge fund Three Arrows Financial collapsed.

The collapses comes after the implosion of the Terra-Luna stable coin complex a month ago and coincided with near 30% fall in Bitcoin to a key support level at US$20,000 on Friday. We talked late on Friday with Easy Crypto CEO Janine Grainger on the hoon about the events in global crypto markets and how it had affected traders in Aotearoa-NZ.

Bitcoin fell another 15% to US$17,616 on Sunday morning.

House prices kept falling in Aotearoa-NZ

The Real Estate Institute released sales volumes and prices data for May showing prices nationwide down 6.0% from the peak in November to where they were in June 21. Prices, as measured by the REINZ’s House Price Index, were down 13.3% in Auckland City to where they were in October 2020. Prices were down 15.8% in Wellington City to where they were in October 2020.

In median price terms, Auckland City’s median price has fallen by $360,000 or 23% from a peak of $1.54m in November to $1.18m in May. The median price isn’t as representative a measure as the House Price Index because a change in the type of properties sold can skew the figures. For example, a surge in the sale of apartments relative to larger houses would skew the numbers lower. But still, that’s a loss of $60,000 a month or $2,000 a day.

In Wellington City, the median price fell 14.6% to $988,000 in May from a peak of $1.157m in October.

The Gib crisis moves to Fletcher Building’s board room

After last week’s loudly-announced decision by Simplicity Living to dump Fletcher Building as its plasterboard supplier, Fletcher Building’s Wallstone Wallboards announced it would import one million square metres of plasterboard that would be available from July. The imports by the maker of Gib, which has a 94% market share, represents an increase of about 7-8% of annual supply.

By Thursday, MBIE and Auckland Council were reassuring ministers and the public that the largest consenter was approving non-Gib plasterboard. By Friday, the Shareholders Association and Simplicity, which owns 0.8% of Fletcher Building worth $35m, met in person with Fletcher CEO Ross Taylor. It didn’t go well from the shareholders’ point of view.

A recession in Aotearoa-NZ by the end of 2022?

Stats NZ reported this GDP fell 0.2% in the March quarter and was up 1.2% in Q1 from the same quarter a year ago. GDP in the year to the end of the March quarter was up 5.1%. The result was below market expectations that ranged from no growth to as high as 0.7% growth by the Reserve Bank in its April Monetary Policy Statement. Covid illness and the after-affects of the lockdowns in the second half of 2021 were blamed.

Economists said the result hadn’t changed their views on what the Reserve Bank would do with the Official Cash Rate on July 13 because the labour market and inflation pressures remained very tight. They still see another 50 basis point hike to 2.5%, although markets have been flirting with the prospects of a 75 basis point hike in recent days.

Most see GDP rebounding around 1.0% in the June quarter to avoid the technical definition of a recession, which is two quarters of lower GDP in row. However, BNZ Economist Stephen Toplis said on Thursday a mild recession was possible later this year.

Other places I’ve been this week

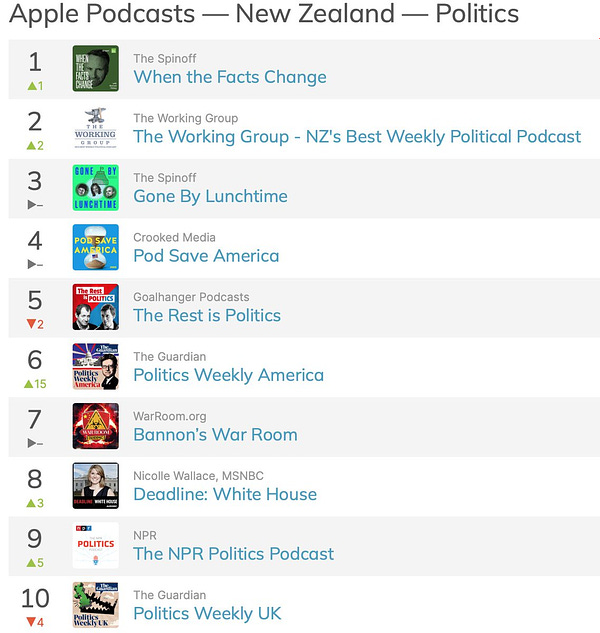

Part of the deal I have with paid subscribers is that I’ll spread my analysis and reporting on the economy, housing, climate and poverty as widely as I can through interviews and panel appearances on publicly available media, such as Newshub’s The Nation, Waatea News, my When the Facts Change podcast via The Spinoff and The Working Group.

Ka kite ano

Bernard

The Federal Funds Rate

Yeah, it looks awful when you say it like this

The hoon around the week to June 19