TL;DR: National has released its infrastructure policy for the election, opting for a tweaked version of a bipartisan and 30-year-long low-infrastructure-investment and low-public-debt strategy that created our housing and climate crises and has dug a $200 billion infrastructure hole for future generations to live with or fill.

Elsewhere, there’s news in our political economy on climate, housing and poverty, as:

Chris Hipkins revealed Michael Wood was asked to sell his Auckland Airport shares 12 times, prompting the opposition to call for his sacking;

Auckland City councillors will decide today on the fate of $2 billion worth of Auckland Airport shares owned by the council, even though three councillors have also declared their interest in Airport shares; and,

The Christchurch City Council voted 10-6 last night to retain the Park Terrace cycleway in a victory for local cycling supporters against a backlash from pro-car councillors.

Usually, I put in a paywall for paying subscribers at this point in the email newsletter and lock off the podcast above from free subscribers. But I want to experiment until the end of June with publishing everything to everyone immediately to see what happens with subscription rates, revenues and email opening rates. I want to thank paying subscribers in advance, who are still the only ones able to comment and get access to our very active chat section and webinars. Join our community by subscribing in full to support my journalism in the public interest about housing (un)affordability, climate change (in)action and poverty (not enough) reduction.

The holes (still) in National's infrastructure policy

The magic remains strong in the thinking of our mainstream political, economic and infrastructure strategists, despite 30 years of failure. Somehow, voters and other decision-makers keep believing in the magic too, if the policy options and debate are anything to go by.

Somehow, the magicians say, we can have strong population growth, affordable housing, achievable emissions reductions, good public services, low tax, low public debt and no tax on capital gains, inheritance and wealth — all at once.

All it requires is someone else’s balance sheet or wages to pay for it, rather than taxpayers and ratepayers through higher public debt, taxes and rates. Those other private balance sheets of pension funds, overseas investors and developers haven’t yet stumped up their own billions, but the magicians keep pleading: ‘one day they just might pay…one day…with a few more tweaks…voters should believe in the magic….again.’

But the results of 30 years of this magical thinking is far from magical in the housing, climate and poverty crises that are now threatening to overwhelm Aotearoa’s hospital, justice and education systems, let alone the Crown’s balance sheet, if those long-term liabilities were properly costed. Aotearoa now has:

the highest housing costs in the world and the most stressed renters in the world relative to incomes;

a climate emissions liability in the current Paris Agreement expiring that Treasury has estimated at up to $24 billion within six years;

diabetes, obesity and mental health crises that are grinding their way into billions of dollars per year in health and justice system costs, none of which ae costed in the Crown’s future liabilities; and,

endemically stagnating productivity growth and real-per-hour-wage growth because of a lack of infrastructure, research and development and business investment, along with the corrosive effects of the housing, health and climate crises cited above.

Aotearoa’s political economy now appears trapped in its own special definition of insanity, where it does the same thing over and over again, expecting a different result.

NIMBYs + NOMBY = endemic and growing infrastructure deficits

National’s new infrastructure policy for Election 2023 released yesterday certainly sits within that definition of insanity in our political economy. It still leans heavily on the NOMBY (Not On My Balance sheet Yet) principle that has dominated Governments run by both sides of politics for 30 years. The key is in the ‘yet’. The only reason the results of this failure are not crystallised on the national balance sheet is Treasury is failing to do the actuarial analysis its own ‘Living Standards Framework’ says it should do to assess the Crown’s long-term liabilities.

It is another warmed up version of a policy of trying to shift all the new infrastructure costs and debt to Public Private Partnerships , developers and new home buyers has failed so spectacularly to invest enough to house a fast-growing population and lower emissions enough to avoid a massive climate liability.

National is not alone. Labour has also used the NOMBY approach to mesh nicely with the NIMBY approach at local government level, all in the service of keeping Government debt low to keep mortgage rates low and to keep inflating land values, which is how to win the median voters who only know how to get rich through leveraged and tax-free gains on land values. The only reason it has been politically sustainable for so long is the constant promises of ‘just one more time with feeling and tweaks’ from the ‘grown-ups’ in Treasury and the big consulting firms and banks who promote PPPs and off-balance-sheet vehicles.

At some point someone has to call bullshit on the NOMBY + NIMBYs = MAGIC thinking. How many more times will the young renters eyeing up higher-paying jobs with relocation expenses paid in Australia believe that more of the same will change their own disposable income and housing affordability equations.

So what’s in National’s policy? And what isn’t?

National released its infrastructure policy1 for Election 2023 yesterday, including dumping its Election 2020 policy of creating a publicly-owned Infrastructure Bank and replacing it with a ramped-up version of the existing Crown Infrastructure Partners (CIP). It would 'provide advice and expertise to the Crown on new financing models for infrastructure, including public-private partnerships, tolls, and value capture instruments.'

National said it would bring in long-term city and regional partnerships with councils to plan and manage infrastructure.

But the plan doesn't suggest how much of the Crown's balance sheet would be used to borrow or invest in the plan, or say how much of the $100 billion current infrastructure deficit would be filled, or the further $100 billion needed to cope with 0.5% population growth over the next 30 years2.

Although National would make the Infrastructure Commission responsible for a 30-year infrastructure plan, again without any indication of likely population growth. The word 'climate' is not mentioned in the document.

What we’re debating on Chat today

Here’s the most popular Chat thread in The Kākā’s community so far this morning. I put up sneak peeks of this Dawn Chorus to paying subscribers from 6 am onwards.

Quotes of the day

Watch this exchange to see political discomfort

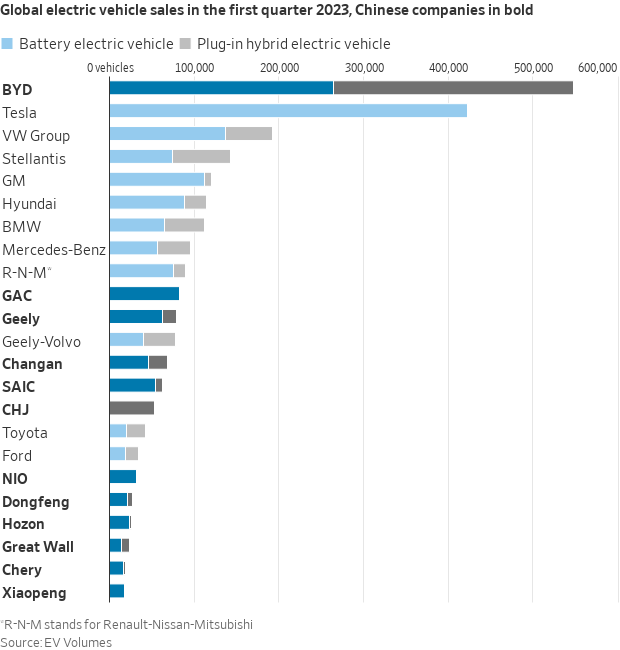

Chart of the day

How China is winning the EV sales racen’s

Cartoon of the day

Ka kite ano

Bernard

Here’s the full PDF of National’s Infrastructure Policy for the true policy wonks. You’re welcome.

Remember of course that our actual population growth has been 1.5%-2.0% for the last 20 years and is currently running at over 2.0% because of a stunning bounce-back in net migration of temporary visa workers, backpackers and students.

The holes (still) in National's (not so) new infrastructure policy