TLDR: US stocks cratered 3-5% this morning in a belated realisation that a fast rise in US interest rates is probably bad for US economic growth, corporate profits and relative demand for global stocks. Yesterday they had rallied 3% after the hike on apparent relief future hikes may not be as high as they feared earlier in the week.

Elsewhere in the news overnight and this morning:

The Bank of England hiked its cash rate and warned of both a recession in Britain later this year and double-digit inflation;

Opec+ decided overnight to hold its production unchanged despite the EU’s proposal this week to cut itself off from Russian oil this year, which pushed Brent crude futures prices up 1% over US$110/barrel;

Reserve Bank Governor Adrian Orr told MPs he had no regrets about the policy easing of 2020, which he described as ‘courageous’, told them to ‘take a breath’ and his deputy said house prices were 5-20% above their sustainable level; and,

Countdown announced it would freeze the prices of some staples over the winter to help customers cope with inflation, although it also said it would ‘work with suppliers’ to ensure they shared some of the profit pain of rising costs.

Later today, I’ll invite paid subscribers to my weekly Ask Me Anything thread at midday and our weekly ‘hoon’ live webinar with Peter Bale and guests at the new time of 5pm for an hour (while Peter is in the UK). Paid subscribers can see the invite link below the paywall fold.

In geo-politics, the global economy, business and markets

What? Rate hikes are bad? Really? - Having bounced 3% on Thursday immediately after the Federal Reserve’s biggest rate hike in 22 years, US stock markets slumped this morning on fears a fast series of big hikes might actually slow economic growth, corporate profits and make other assets such as bonds relatively more attractive. Who would have thunk it… CNBC

Selling off everywhere - The Dow, S&P 500 and Nasdaq closed down 3%, 3.5% and 5% respectively this morning. Bond markets sold off broadly as well. The key 10 year Treasury bond yield (yes the one I’m always nagging you about) rose a decisive 19 basis points to a fresh three-year of 3.10%, before closing at 3.03%.

Britain’s stagflationary future - The Bank of England hiked its official cash rate by 25 basis points to a 13-year high of 1.0% overnight, but that wasn’t the main news. It also warned in its May report of a 0.25% contraction in GDP in 2022 and a rise in the annual inflation rate from 7% currently to over 10%. It forecast its rate hikes to control inflation would cause 600,000 job losses.

Hot, hot, really hot - The Reserve Bank of India also hiked its main interest rate yesterday, which was sooner than expected. The 40 basis point rise in its main ‘repo’ rate to 4.4% surprised markets and comes as India is having to ramp up coal production to feed into its power plants to keep the air conditioners going through the hottest heatwave in years. Rolling blackouts are hitting the hottest parts of the country with as many as 18 coal-fired power plants offline because of coal shortages and a jump in coal prices.

An oily profit - Shell reported a near tripling of its quarterly profit to US$9b overnight because of higher oil prices, beating market expectations even after a US$3.9b asset writedown due to its decision to exit Russia in the wake of its invasion of Ukraine.’

Scoops and news of note here this morning

‘Take a breath’ - Reserve Bank Governor Adrian Orr told MPs at a select committee hearing yesterday to “step back and just breathe and think about what we have gone through,” when challenged by National MP Nicola Willis and others about the central bank’s record on inflation and house prices. Full video Stuff NZ Herald-$$$ Bloomberg-$$$

‘Sustainable is 5-20% away’ - Under questioning from Labour MP Duncan Webb and Green MP Chloe Swarbrick, Reserve Bank Deputy Governor Christian Hawkesby told the committee current house prices were "in the order of 5 to 20%,” away from sustainable and prices would need to fall 5% to enter the “range of sustainability.” They’ve already fallen 6%.

Huge news? Or not? - Swarbrick said this was “huge news.” Orr said in response it was “not really news” but the Reserve Bank would publish more detail on house price sustainability in the coming months. See much more in the quotes of the day below.

Price freeze - Countdown (owned by Woolworths Australia) announced last night it had frozen the prices of over 500 essential items from May 9 for an unspecified number of months over winter, including the prices of diced tomatoes, butter, cheese, sugar, flour, shaved ham, hot roast chicken, carrots and pumpkin. MD Spencer Sonn said Countdown had received almost 1,000 cost increase requests from suppliers over the last 10 months, more than double those in the same period a year ago. The average increase of just over 9% was as a result of suppliers’ own costs of raw products, fuel, fertiliser, grains and import costs rising, he said.

Suppliers will ‘help’ - Countdown’s packaged goods director Steve Mills told Lisa Owen on RNZ’s Checkpoint last night he was working with suppliers to try to ‘absorb’ the cost increases. Mills said Countdown’s profit margin was 2.4%, although he wasn’t specific as to whether it was an EBIT or Net Profit profit margin as a share of gross revenues. The Commerce Commission estimated in its market study report (page 63) this year that Woolworths NZ’s EBIT/sales margins had been around 2.7% in 2018, which was above an overseas representative sample of around 2.0%. See more in the quotes of the day below.

Toxic voices - An investigation into the New Zealand Broadcasting School in Christchurch found a toxic culture of bullying, sexual harassment and harmful behaviour among students and staff, Alison Mau reported for Stuff last night.

Some hope for Kim - Immigration Minister Kris Faafoi has offered some relief and hope for murder suspect Kyung Yup Kim that he may not now be extradited to China to face charges. A High Court ruled last month it trusted China not to execute Kim over the 2009 murder, but the final decision is with Faafoi. Advocates for Kim have said China cannot be trusted and have appealed to Faafoi to block the extradition.

‘It’s sensitive’ - The issue of Kim’s extradition is a sensitive one as part of Aotearoa-NZ’s wider relations with China. The minister had yet to comment on the court ruling, but the Dominion Post’s court reporters reported this morning Faafoi was considering Kim’s health. The newspaper reported via Stuff the 47-year old man has been in custody for five years, was suicidal, had a small brain tumour, and liver disease.

11 years later - China has accused Kim of murdering Pei Yun Chen, 20, in her Shanghai apartment in 2009. Kim has denied knowing her, although he was in Shanghai at the time. He was living in Auckland in 2011 with his two children when China applied to New Zealand’s courts to extradite him. Aotearoa-NZ does not have an extradition treaty with China because of its capital punishment policy and fears about state-directed torture and unfair trials. Kim’s advocates are also applying to the United Nations to block the extradition. The case is being watched closely for any legal precedents in Britain BBC , Australia and Canada, who share Westminister-style legal systems and also don’t have extradition treaties with China.

ESG hits DGL - KiwiWealth and Simplicity put NZX-listed chemicals company DGL Group on their banned lists overnight after its CEO, founder and major shareholder Simon Henry, was reported in the NBR-$$$ this week as deriding My Food Bag founder Nadia Lim as ‘Eurasian fluff’. He had said ugly boards produced better IPOs than attractive ones. See the full quote below. Sorry. It is painful to read, but it’s having real world effects.

Lim speaks out - Lim gave an extensive interview to Kim Knight of the NZ Herald-$$$ that was published this morning, in which explained why she was speaking out and why she wanted to have a cup of tea and a chat with Henry. See her quotes below.

Cycling wins this time - Auckland Council voted late yesterday 13-3 in favour of a plan to spend $306m on cycleways in and around central Auckland over the next 10 years. The issue had become of a lightening rod for debate between mayoral and council candidates for council elections in October. See more in the quotes of the day below. There were seven abstentions in the vote. Here’s Simon Wilson’s report in the NZ Herald last night and Phil Pennington’s report on RNZ last night.

Willis Bond buy Z station sites? - Property Developer Willis Bond is in advanced talks to buy about 50 of Z Energy’s petrol station sites in New Zealand from Ampol for about NZ$140m in a sale-and-lease back deal, Bridget Carter reports this morning for The Australian-$$$. Ampol bought Z Energy earlier this year. Some of Z’s inner city or main road sites would be excellent locations for medium to high density residential and/or commercial development.

Towers auctions heating up - Sale and lease back deals are all the rage at the moment, especially for Aotearoa-NZ’s mobile phone towers. Morrison & Co and Brookfield are selling Vodafone NZ’s towers in a similar sale-and-leaseback deal, as is Spark. Overnight, the AFR-$$$’s Street Talk column reported KKR-owned infrastructure investor John Laing has joined the NZ$1b auction for Vodafone’s towers, along with Canadian investor Northleaf Capital, paired with London’s InfraRed Capital Partners.

NZ Super in the mix too - Australia’s Infrastructure Capital Group is also bidding, alongside the Ontario Teachers’ Pension Plan and its partner the NZ Super Fund. Street Talk reported the list also included DigitalBridge Group. Street Talk said Spark was preparing to launch its own sale of a smaller tower portfolio in the coming weeks.

Film-TV industry in uproar - Duncan Greive had the scoop via The Spinoff on Wednesday about conflict of interest concerns expressed around Film Commission CEO David Strong. Strong has been put on special leave and the Commission is now conducting a review into concerns about funding for a film script Strong wrote in 2008. It got an NZ on Air grant to be made into a TV series by Great Southern Television a month after his appointment in June last year. Blair Ensor also reported for Stuff late on Wednesday about the review and about Ensor being on special leave. A letter from Commission Chair Kerry Prendergast to the Screen Production and Development Association (SPADA) in March noting the conflict of interest sparked the outrage.

‘More accountability please’ - The Auditor-General, John Ryan, released a letter to The Treasury yesterday calling for more accountability over the $74.1b granted under the Covid Response and Recovery Fund (CRRF). Watch this space.

Quotes of the day

‘Just chillax dudes’

“We’re not playing catchup, we’re just doing monetary policy as usual. We’ve got this.

“We were one of the first countries in the world to stop quantitative easing and to start raising our interest rates. As much as we like to think we are a big important country, going alone on monetary policy in a global shock takes enormous courage. I congratulate our monetary policy committee members and our staff for doing that.” Reserve Bank Governor Adrian Orr responding at a Finance and Expenditure Select Committee hearing to questions from MPs about the bank’s inflation record. Full video here

‘Je ne regrette rien. Rien de rien.’

“No regrets, and I will continue to have no regrets. You have to play the cards that are in front of you at the time.

“I regret not buying Apple shares in 2000.” Orr in the same hearing when asked if he had regrets about the bank’s actions in the last two years.

‘They’re actually tightening’

"The unusual part, that we've come through. That has passed - that was the unusual period. That macro, one-off support has gone, and we're back to the more targeted approach.

"Fiscal policy - the Government's impulse was last year and the year before - is actually a drag now.” Orr when asked by Willis whether the Government’s fiscal policy was being enough of a ‘mate’ to monetary policy. Orr described fiscal policy as now operating at ‘business as usual’ levels. NZ Herald-$$$

A ‘slay the dragon’ moment

“It’s like when we all take medication, it’s got to build up in your system and these Fed-fund rises always have a lag time. Meanwhile the market pricing in so much more is a tightening of financial conditions that have a knock on effect on the real estate market, mortgages.

“That’s getting some of the Fed’s job done until that medication builds up enough that it really becomes the decisive ‘slay the dragon moment.’ Tim Horan, co-chief investment officer of fixed income at Chilton Trust, quoted in WSJ-$$$ this morning. (And no it’s the former Fed economist Tim Horan, not the former Australian rugby great Tim Horan)

‘Ugly boards are better’

“I can tell you, and you can quote me, when you’ve got Nadia Lim, when you’ve got a little bit of Eurasian fluff in the middle of your prospectus with a blouse unbuttoned showing some cleavage, and that’s what it takes to sell your scrip, then you know you’re in trouble.

“Go back to that prospectus and find that photo. You know you’re in trouble. I mean, you know, when you got a TV celebrity showing off her sensuality to hock script, then you know you’re in trouble. The uglier the board, the more successful the share. So, I sort of don't get it; you come to market telling everyone it’s a great company. And, by the way, we’re selling it and running.

“I don’t get it. I mean, I’m a simple man. I don’t get it. If it’s so good, why are you selling it?” DGL founder, CEO, director and major shareholder Simon Henry, quoted in an NBR-$$$ article about board quality and IPOs.

‘Let’s have a cup of tea and a chat Simon’

"I just kept thinking about it the whole way. What if it was your daughter? I realised it's not about me. I'm lucky, I've had years of support and opportunities to build up a thick skin and resilience, but there are obviously so many people who aren't in that position, who are vulnerable, and who would have seen a reflection of themselves in those comments. Those are the people I feel sad and disappointed for. I'm not speaking out for me - it's for them.

"I would be more than happy to make him a cup of tea and sit him down and have a korero with him - and I think he'd very quickly discover I'm not a little bit of Euro-asian fluff.” Nadia Lim in an interview with Kim Knight published in the NZ Herald-$$$ this morning

A preview of the culture war we’re going to get in October

“All the evidence in the world is if there's any one thing you can do as a city, is you get people biking. And we can be a Copenhagen in the South Pacific, we can be an Amsterdam." Auckland Councillor and Planning Committee chair Chris Darby in yesterday’s debate on a $306m plan to invest in cycling infrastructure. RNZ

"It's farting against thunder." Auckland Councillor Daniel Newman, who opposed plan and questioned whether spending $2b overall to reduce emissions by 30,000 tonnes was value for money. He also rejected giving up any road space to cyclists. NZ Herald

“Only 1.2% of Aucklanders bike to work and yet Auckland Transport is proposing to waste an insane amount of money, during a cost of living crisis, on compulsory bike training in schools while stripping teachers and parents of their parking.

“Auckland Transport must end its war on the long suffering 80% of ratepayers who use private motor vehicles for essential services.” Auckland Mayoral candidate Leo Molloy in a statement on the plan.

‘Making profit is not a bad thing’

“We are working very closely with our suppliers and they are being very proactive about how we can both try and absorb cost, price increases and mitigate those where we can. So we try to pass on the least amount of increase as we possibly can to our customers.

"Sixty-three cents in the dollar of the price we're getting from suppliers is made up of raw materials, packaging, freight costs. We're at 2.4% profit in our business. Yes, we are high volume, but we're a very low margin business.

"Making profit is not a bad thing. We're investing $1b over the next couple of years in infrastructure.” Countdown’s packaged goods director Steve Mills said when asked about the Commerce Commission’s estimate in its Market Study final report that the Countdown-Foodstuffs supermarket duopoly was making excess profits of $430m/year, as of 2018.

Numbers of the day

14.9m - The World Health Organisation published its latest estimate overnight of the number of excess deaths globally from Covid January 1, 2020 to December 31, 2021. It saw a range of range 13.3 million to 16.6 million, centred around a total of 14.9m, which was almost three times the the 5.4m official death toll via World In Data.

Minus 2,677 - The WHO’s mean cumulative estimate of Aotearoa-NZ’s excess deaths during those first two years of Covid, according to its data pack. Britain had an estimated 149,000 excess deaths over the two years Covid. If New Zealand had dealt with Covid in the same way as Britain, we would have had 36,300 more deaths than we did.

70% - I rounded up. Turkey’s annual inflation rate hit a two-decade high of 69.97% in April because of the halving of its currency over the last year and higher oil and commodity prices due to the war in Ukraine. The monthly inflation rate of 7.5% was above economists’ consensus forecast for 6%. The Turkish lira is in a feedback loop with higher inflation and a lack of faith in Turkey’s politically-controlled central bank, which was forced by President Tayyip Erdogan to cut its cash rate 500 basis points in September. CNN

1% - Standard Chartered has estimated Chinese oil consumption fell in April by as much as 1.1m barrels a day or 1% of global demand because of Covid lockdowns, although it sees this recovering by July.

Chart of the day

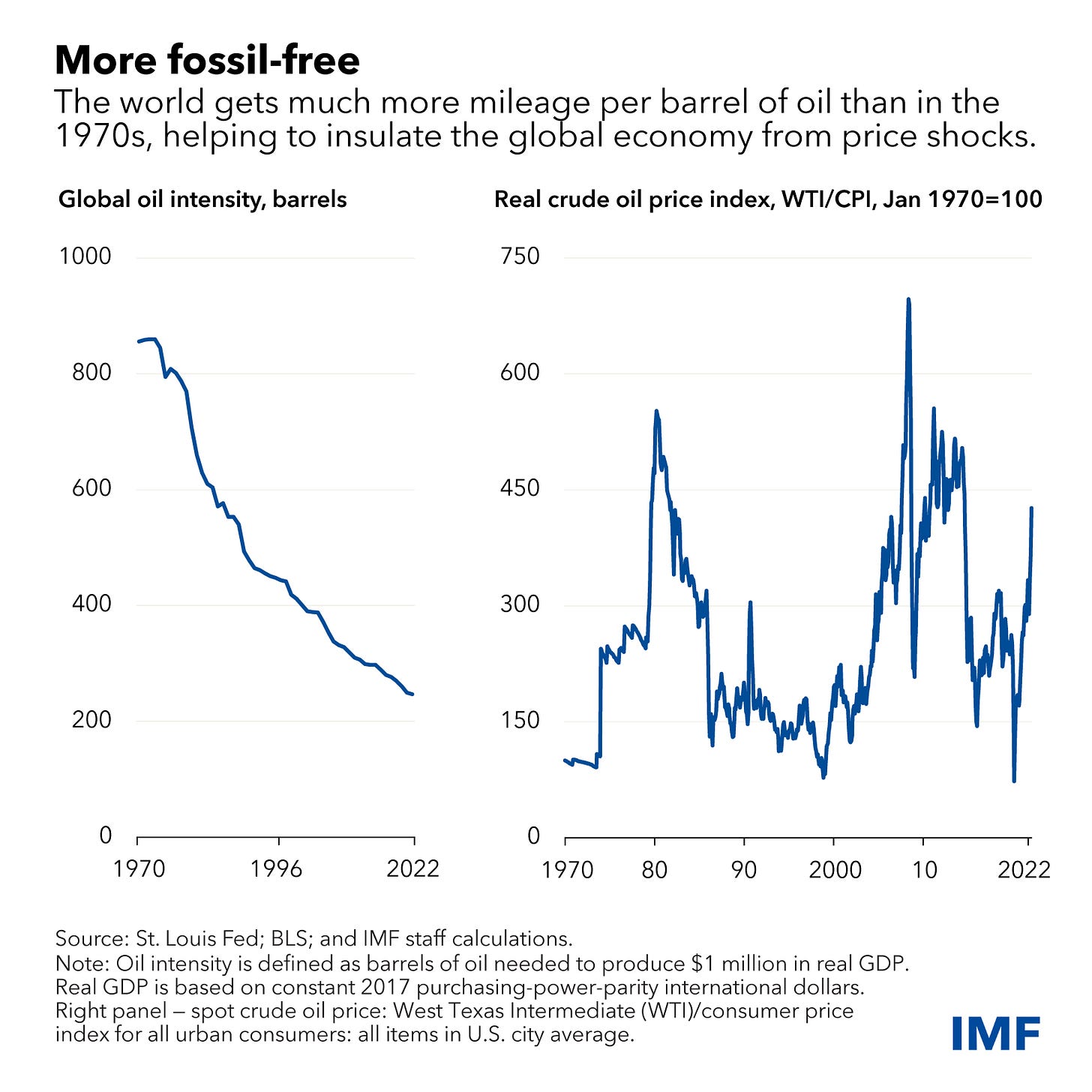

Global economy not as oil-reliant as it used to be

This IMF chart gives some hope the oil shock of the last year won’t be quite as painful as the ones in 1973 and 1979 due to the Israel-Egypt Yom Kippur war and the Iraq/Iran war respectively.

Cartoons of the day

Here’s the link for paid subscribers to join our live webinar hoon at 5pm (repeat 5pm NZ Time) for an hour. We’ve shifted it back an hour while Peter is in the UK. He needs a bit more sleep and we appreciated the extra time suggested by subscribers last week.

Ka Kite ano

Bernard

The Chorus for Friday May 6