TL;DR: The Ministry for the Environment (MfE) is looking at a ‘carbon dividend’ scheme that would recycle cash from the Emissions Trading Scheme (ETS) back into the pockets of consumers. That would be popular at a time when many are struggling with living costs, especially if it was done with a simple equal cash payout to residents.

But such a policy would also be inflationary and work against the emissions reductions aims of the ETS, given many consumers would buy more emissions-creating goods and services with the cash.

In my view, a much better alternative would be to recycle up-front an equal emissions rebate to residents as emissions-reducing vouchers or spending that effectively ‘buys’ even more emissions reductions through, for example, bigger discounts on public transport, electric bike discounts, solar panel installation vouchers and discounted energy-efficient appliances and lights. It would also be much better than spending up to $23.7 billion or $4,740 per resident on emissions credits overseas over the next six years, which is the current plan to meet our international agreements (See more detail and analysis on this below the fold)

Elsewhere in the news today (See more below the fold)

most expect the RBNZ to hike 25 basis points to 5.5% at 2 pm;

the RBNZ won’t say whether it paid a ransom to hackers;

Chris Hipkins says Labour may move tax brackets once inflation has cooled;

National is using AI to create images of nurses and robbers for its attack ads;

Transpower has warned of possible blackouts this winter, despite full hydro lakes; and,

climate scientists estimate 2 billion people live in areas of the world that will be uninhabitable by 2100 with the currently-expected 2.7 degrees celcius of global warming.

Usually, I put in a paywall for paying subscribers at this point in the email newsletter and lock off the podcast above from free subscribers. But I want to experiment until the end of June with publishing everything to everyone immediately to see what happens with subscription rates and email opening rates. I want to thank paying subscribers in advance, who are still the only ones able to comment and get access to our exclusive chat section and webinars. Join our community by subscribing in full to support my journalism in the public interest about housing unaffordability, climate change action and poverty reduction.

Recylce ETS cash into emissions cuts here vs overseas

I get it. The idea of getting a cash ‘refund’ in the hand feels good and even fair in a ‘cost of living crisis’, especially if it was an equal cash return that effectively saw richer petrol and diesel buyers subsidising the payouts to poorer drivers who haven’t bought so much petrol. ACT and the Greens have both supported so-called carbon dividends in different forms at different times.

It’s also advocated by those who advocate for a hard-line form of the ETS1 that includes all emissions and simply squeezes prices higher until we hit our targets. Canada has a carbon dividend where up to 17% of revenues from a carbon tax are paid back as an annual cash dividend of C$193.50 (NZ$230) per adult and C$56.50 (NZ$67) per child.

Yesterday, Ian Llewellyn and Oliver Lewis reported for BusinessDesk-$$$ and via FarmersWeekly an MfE spokeswoman saying the government was ‘exploring a range of tools to address the distributional impacts of climate change and climate change policies’.

“One of the tools being explored includes the possibility of a mechanism such as a carbon dividend,” she said.

“However, analysis is still in the early stages and no government commitments have been made.” Ian Llewellyn and Oliver Lewis reported for BusinessDesk-$$$ and via FarmersWeekly

So how much could any cash handout be?

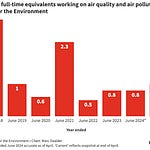

The Government set up its Climate Emergency Response Fund (CERF) in 2021 to spend all the proceeds from the ETS, which at that point were estimated to be $4.5 billion from 2022/23 to 2025/26, on measures to reduce emissions and adapt to the effects of climate change. However, the failure of an ETS auction this year because of Government changes that undermined confidence in the market has cut expected proceeds by $2.7 billion. It is being topped up with $1.7 billion of borrowing and received $605.8 million in savings back from past allocations, which means it is about $400 million smaller.

Currently, after $1.9 billion of spending in Budget 2023, the fund has about $1.4 billion left for spending in Budget 2024, along with any revision to ETS forecasts due at the Half Yearly Update due in December. There may also be an update at the the Pre Election Fiscal Update (PREFU) some time between September 18 and September 29. Assuming no change to the ETS revenues, that would leave about $280 cash per person next year, if that’s the way the Government or Opposition wanted to play it at this election.

But what about over the longer run?

More broadly, a big climate liability is building up for Aotearoa to pay because we are behind the trajectory needed to meet our Paris agreement commitments to reduce emissions by 30% from 2005 levels by 2030. It’s getting close now.

Treasury has already estimated2 the Crown may have to spend between $3.3 billion ($660 per person) and $23.7 billion ($4,740 per resident) on emissions credits overseas for Aotearoa to meet our Paris committments by 2030, depending on the carbon prices at the time, which Treasury estimated at between $44/tonne to $224/tonne.

The task would seem simple: work out what is the cheapest way in costs per tonne to ‘buy’ emissions reductions domestically in the next six years and just keep buying until our emissions reductions needs are met, or they can actually be bought cheaper overseas. There are currently no viable, liquid, internationally approved markets for such credits that we could access.

At the moment, we’re just punting that something turns up in the next six years, or that we can somehow buy approved credits for forest planting in Vanuatu and the likes. Although we’re also competing against the likes of Switzerland, which has been doing this sort of climate diplomacy for over a decade and we have just a handful of such diplomats.Treasury has estimated3 our emissions deficit could be between 88 million tonnes and 114.1 million tonnes by 2030. Just to be clear: the current Government and Treasury position is that voters won’t tolerate much, much higher petrol prices or regulatory interventions to squeeze down emissions. It’s a political view. It doesn’t seem to give the public much credit for debating and deciding the issue. Although it does make life easier for politicians who don’t like arguing in favour of painful things, or more importantly, trying to get elected in the face of opponents screaming that the other lot wants to hurt you, the hard-working-kiwi-bloke-family-taxpayer-double-cab-ute-driver-with-a-boat-in-the-driveway.

The base assumption is we’ll have to go overseas. That’s because we’ve done it before. The Government and various companies bought 90 million tonnes of emissions credits linked to Ukraine and Russia from 2013 to 2015 for as low as 20c per tonne to meet our Kyoto committments, which was the agreement before the Paris Agreement. It turns out the credits were essentially fraudulent and over NZ$200 million went straight to interests thought to be connected to the Russian mafia. This was exposed in a report by Geoff Simmons and Paul Young for the Morgan Foundation in April 2016. The EU stopped using the credits in 2012, but New Zealand kept buying and eventually became the world’s biggest purchaser.

So this assumption is at best a hail Mary and at worst illegal and unethical. We would be much better off either using the ETS to squeeze emissions down through the crude incentive of price, or we could simply begin ‘buying’ emissions reductions at home with a variety of policies and incentives that just keep buying at prices up to and including $100/tonne until we hit our targets.

So how big could ‘vouchers’ be? And what could they be spent on?

In theory, if the ETS was used solely to squeeze our emissions down, there would be a much, much higher carbon price domestically, which would mean a bigger ‘carbon dividend’, up to as high as $4,740 per person, if ETS revenues were squeezed up to the equivalent we were willing to pay to buy credits overseas.

A much better idea would be to use the amounts ranging up to $23.7 billion to reduce emissions domestically, rather than scrambling to compete against Switzerland to buy credits from Vanuatu that don’t exist yet and haven’t been approved yet. In the next seven years.

Thinking about the problem from the point of view of ‘buying’ emissions reductions here creates the tantalising prospect of actually saying to individuals, families, companies, councils and government departments that they should work out how to reduce emissions, work out what the cost would be, and then offer those tonnes up to the Government for cash. That would imply a quite extensive process of proving a particular action or technology would reduce a certain number of tonnes of emissions, and then proving it had been done.

Show us the list. You’ve built a list right?

A better, faster and more believable way would be for the Government to work out what actions or purchases produce the most emissions reductions the fastest, and for the cheapest amount of money. Some of those interventions would require some Government investment, say for example in reconfiguring roads to walkways and cycleways from roadways. Some would be costless in a financial sense in that they did not involve a specific investment, but created a non-financial cost for some, such as lengthening commuting times.

There should be a long list built up within and outside Government that ranks the scale of the emissions reductions, the speed and the cost of obtaining them. We can get a sense of how this is being done up and down the country by looking at the weekend announcement from the Government it would ‘buy’ 800,000 tonnes of reductions per year from NZ Steel for $130 million or an effective cost of $16.20 per tonne. That seems a fair price given we have been looking at spending up to $224/tonne overseas.

We also know the Government decided not to go ahead with the ‘cash-for-clunkers’ scheme earlier this year, partly because the $569 million cost to get dungers off the road would have only generated up to 4,500 fewer tonnes of emissions, meaning the ‘cost’ of the reductions worked out at around $126,444 per tonne. That’s a bit too high.

So what is in between? How many tonnes would I save by cycling everywhere instead of using a car? How many tonnes are saved per electric bus operating in a schedule in, for example, Auckland. I’ve yet to see a list from within Government, but it’s about time we all built these lists. The Government would then be in a position to save money in the long run by spending less on reducing emissions here to meet our Paris targets, than the cost of up to $23.7 billion buying credits offshore.

If for example, the Government can ‘buy’ tonnes of forgone emissions from NZ Steel at $16.20/tonne, why can’t it ‘buy’ my forgone emissions from commuting. I’ve worked out I’ll save about 3.3 tonnes a year of emissions by not commuting by car or flying around the country for work. In theory, I could ‘sell’ that change in my behaviour to the Government for the next six years to 2030 for $320 for my forgone 19.8 tonnes, assuming a $16.20 price. That’s probably too low a price, given carbon prices here got up to almost $90 a tonne late last year, before crashing to $53 now. At $90 a tonne, I’d be getting $1,782 for my six years of behaviour. That’s becoming meaningful.

Rather than checking on me every year to prove I’m not driving and flying, another way is to simply give me a voucher for $1,782 to reduce the cost of buying an electric bike. Or swapping an electric bike for an old dunger of a car I know is worth less than $1,782, which most of them are.

It’s amazing what we’ll do for a ‘deal’

This is where these sorts of vouchers become useful and fair. They can be used to ‘buy’ a reliable amount of emissions reductions that don’t have to be verified after the fact, and the money can’t be used to just go out and buy a bigger car with a bigger engine, or a holiday that adds tonnes of emissions.

The purists would say the ETS price or a carbon tax would do this much more simply and cheaply. My incentives would be to stop driving and flying to save money because the ETS or carbon tax component of the cost reached a threshold that forced me to change. Fair enough. The trouble is that means those who can least afford to pay and can’t change suddenly have to pay much more. It also increases inflation and does nothing to create a just transition that spreads the costs from poor to rich and from old to young.

Sometimes we also like to collect a voucher to save money. There’s something about the quest for discounts that harnesses some behavioural economics juju. E-bike vouchers and public transport discounts have been effective overseas. But it’s surprising to me that we all haven’t tried to work out the costs and benefits of reducing our emissions, collectively and personally, in a way that reduces the long-run cost by reducing the long run liability.

Where’s the list? Perhaps we should start building one here to suggest the Government gets on with using to pick off the cheapest, biggest and fastest emissions reductions to at least slash our emissions and close our Paris deficit by the required 100 million tonnes over the next six years.

News elsewhere today

Te Pūtea Matea (The Reserve Bank) is refusing to say whether it paid a ransom to hackers to get back information stolen from it during a hack, Tom Pullar Strecker reports this morning for The Post-$$$. We’ll get a chance to ask Governor Adrian Orr more at a news conference I’m attending in Wellington at 3pm today.

Most economists expect the central bank to hike the OCR 25 basis points to 5.5% at 2pm, although three of 18 surveyed by Bloomberg see a 50 basis point hike as possible, which would focus attention on whether Budget 2023 forced a bigger move

PM Chris Hipkins said late yesterday a re-elected Labour Government would look at re-setting tax brackets, but only after inflation had cooled (Stuff). Meanwhile, CTU Economist Craig Renney has estimated National’s planned move to reverse tax bracket creep could cost over $8 billion over four years. That would be inflationary.

Jenna Lynch reported last night for Newshub the National Party has admitted using artificial intelligence (AI) to create fake photos for its political attack ads including nurses, robbers, and crime victims, and leader Christopher Luxon didn’t know about it. Luxon initially said he wasn’t sure and then tried to brush it off with a joke about Vin Diesel, who he said he modelled himself on. A National spokesman defended the use of the technology as innovative and said the party would use it responsibly.

Transpower warned yesterday of the potential for blackouts this winter despite hydro lakes being nearly 100% full, pointing to sharp rises in demand at peak times in the morning and evening and the reluctance of gentailers to fire up their gas and coal generators at short notice when wholesale prices are lower.

Somehow, the Electricity Authority judged the current market as working fine for consumers in a report last week. The Government is also at least a decade away from starting to build a hydro-battery at Lake Onslow for a dry year. And this is a wet year.

A paper published in Nature overnight calculated that up to 39% of the world’s population or well over 2 billion people could be living on land that would currently be considered uninhabitable because of heat and humidity by 2100, if as currently expected, climate change increases temperatures by around 2.7 degrees above pre-industrial levels. They’re about 1.1 degrees above those levels and could touch 1.5 degrees higher some time in the next five years.

Ka kite ano

Bernard

Proponents of a hard-line ETS and little other climate policy include the NZ Initiative, as detailed here, although it has been less-than-clear about whether big industrial emitters, farmers and others who get free credits because they compete internationally, should be fully included in the scheme.

Recycle the ETS cash++ into emissions cuts here