Kia ora. Long stories short, here’s my top things to note in Aotearoa’s political economy around housing, climate and poverty on Thursday, November 28:

The News: The Reserve Bank cut the OCR 50 bps to 4.25% yesterday and Adrian Orr signalled another 50 bps cut to 3.75% on February 19. He told me he was concerned about administered inflation by the Government, including through bus and train fare hikes and electricity price increases.

Scoop du jour: Lloyd Burr interviews Covid Royal Commission Chair Tony Blakely for Stuff.

Deep-dives du jour: Tim Brown looks in depth at whether Westport can be moved (RNZ).

Solutions news: The Government is investing $82 million into 12 Maori housing providers to build 198 affordable homes. Stuff

Editorial Opinion du jour: Chris Slane nails Casey Costello in this cartoon.

(There is more detail, analysis and links to documents below the paywall fold and in the podcast above for paying subscribers. Normally, if we get over 100 likes we’ll open it up for public reading, listening and sharing, but I’ve decided to open this up from the start due to the public interest involved.)

The News: RBNZ loosening as Govt tightening

RBNZ eyes another 50 bps as fiscal policy bears down on GDP

I was struck yesterday during the Reserve Bank’s monetary policy news conference in Wellington by just how quickly the bank’s forecasts and tone have changed this year, the first under the new Government.

As recently as May, the day before the Budget, the Reserve Bank projected it would not have to cut the OCR to where it is this morning (4.25%) until November of 2026. Mere months later, we’re already there, two years ahead of schedule, with another 50 basis point cut to 3.75% expected on February 19. Back on May 22 of this year, the Reserve Bank forecast the OCR would not get there until early 2027.

So what changed?

The intensity and scale of the Government’s real and per-capita cuts to current and future spending and investment on public housing, hospitals, public health, transport, welfare and education surprised many voters and workers through 2024. Now it’s dawning on many in business and the wider economy just how much the Government’s austerity programme is dragging on consumer spending and employment. The Government is tightening hard in the middle of a recession.

Treasury has warned of the most severe budget tightening in real and per-capita terms in our history if Nicola Willis carries through on her pledge to achieve a surplus in 2027/28 and bend public debt and the size of Government back down towards and then under 30% of GDP respectively, from 34% and over 40% respectively. A cut of 4 percentage points of GDP means real cuts of over $20 billion a year by the end of the forecast period, relative to a steady state.

A quick trip around the rest of the day’s headlines should remind business owners and spenders just how much more cutting of Government jobs and spending is to come, including:

News yesterday of 1,500 job cuts by Te Whatu Ora-Health NZ, albeit including 300 still-vacant roles; RNZ

Waka Kotahi-NZTA telling councils of public transport funding cuts that in Wellington’s case would require fare increases of 70%; RNZ

SolarZero collapsing and sacking 160 workers; and,

WhangāreiWhanganui Council sacking 21 staff as it tries find $2 million of savings, thanks partly to cuts in expected funds from central Government. RNZ

The flood of bad news around job cuts, shop closures and higher public services costs with more to come is weighing on spending and investment, despite apparently stronger business and consumer confidence. There is a growing disconnect between election-related surges in confidence and actual spending and investment.

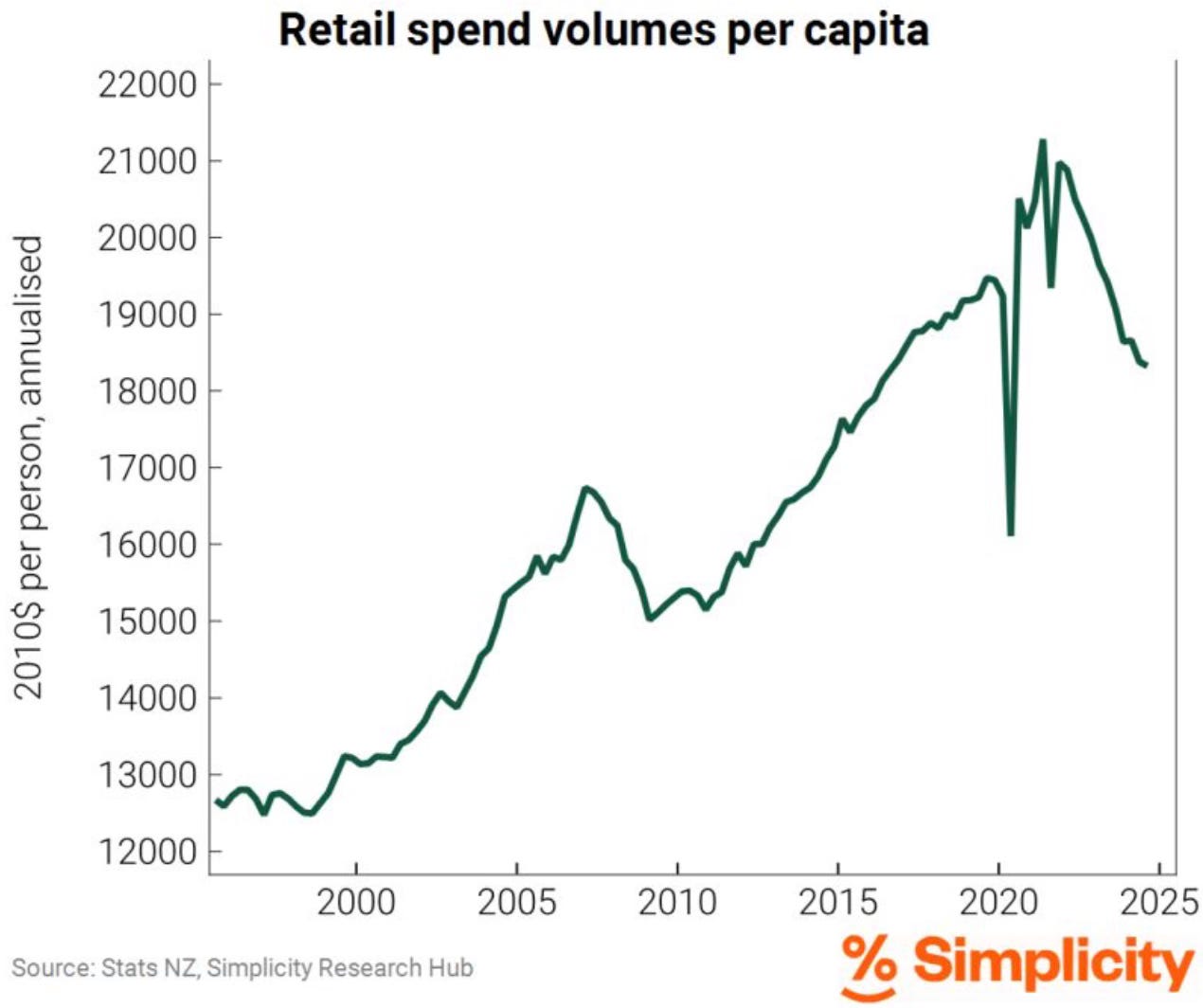

Retail spending per capital has crashed to 2016 levels and is still falling.

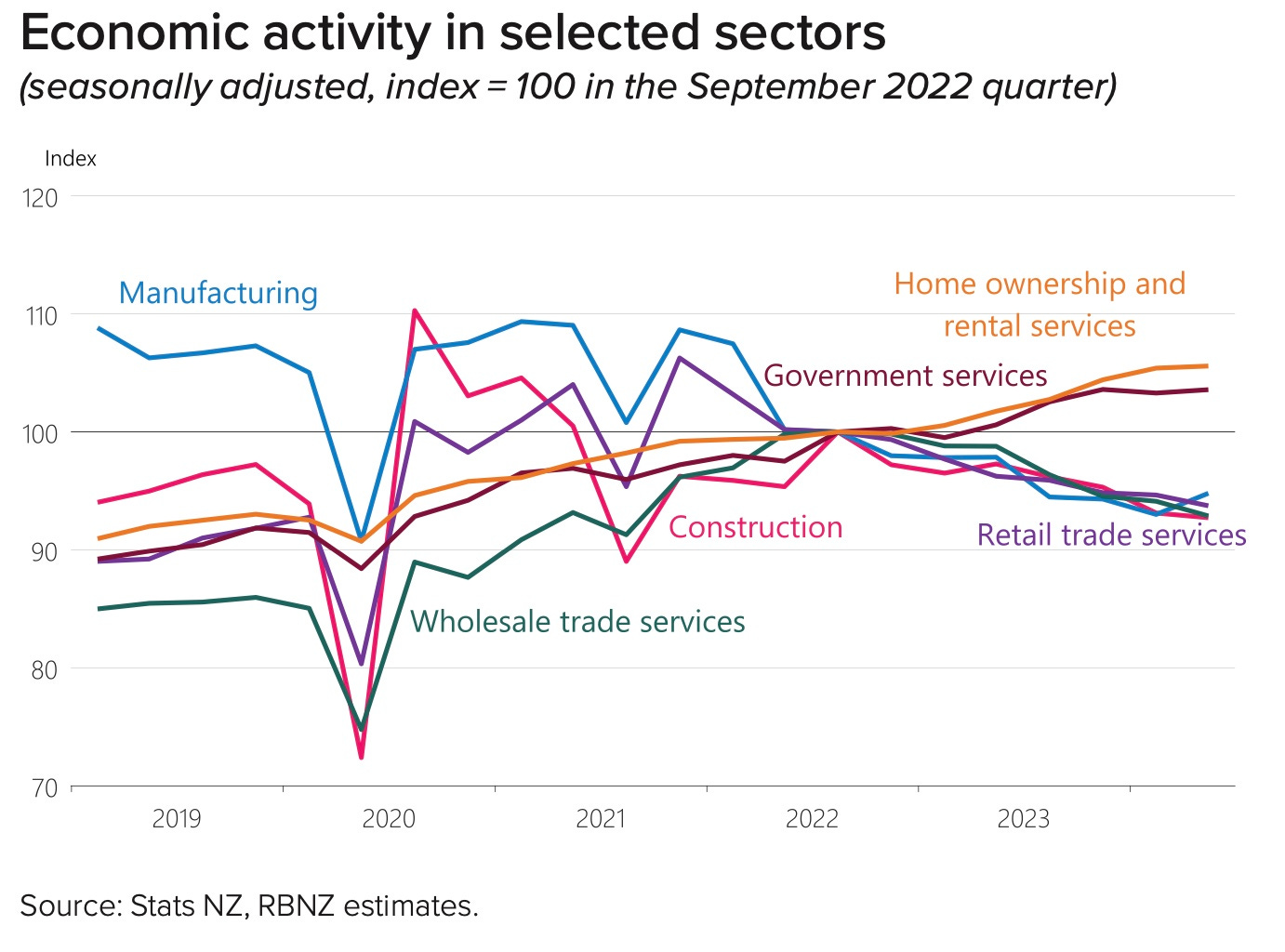

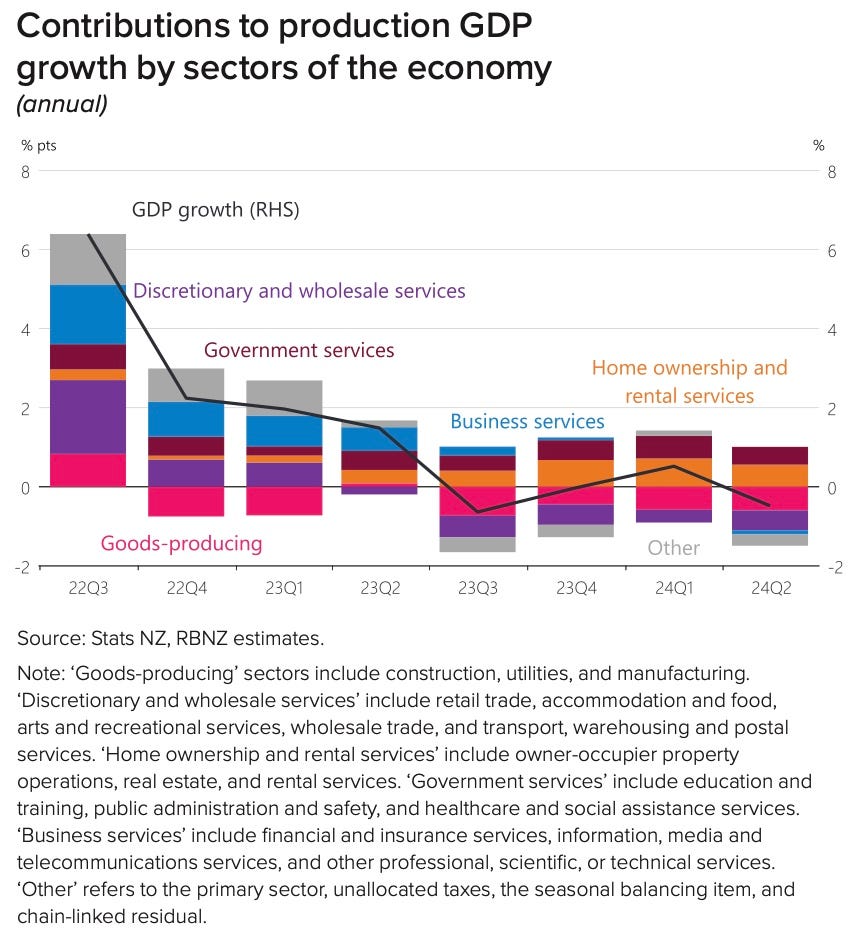

The Reserve Bank itself showed just how lopsided the economy has become towards the housing market and how much of the rest of it is suffering, including these charts showing homeownership and rental services and Government were the only generators of production GDP growth over the first nine months of 2024:

PM Christopher Luxon celebrated the rate cut yesterday and said the economy was on the “right path.” Here’s his comments via RNZ (bolding mine):

"Many Kiwis are already seeing relief with mortgage rates falling, allowing their budgets to stretch a little bit further and giving families an extra dose of confidence heading into Christmas," he said.

"We can't fix all of New Zealand's economic challenges overnight, and we know that many families and many businesses are still doing it tough. The economy is coming out of a very deep and protracted recession that has put immense pressure on household finances and also businesses' bottom lines.

"With inflation now within the target range and another OCR cut welcomed today, the outlook is positive, and we are on the right path. I feel 12 months into this job, more positive about the future for New Zealand than at any point. We have a fantastic future ahead of us." Christopher Luxon yesterday via RNZ

By prioritising mortgage rate reduction and tax cuts over employment and GDP growth, the Government has delivered for home owners and landlords. Its job cuts, administered price increases and public services reductions have hit renters hardest.

A longer recession is a feature of Government policy. Not a bug.

Deep-dives du jour: What infrastructure shortages mean

Housing feature: Why this part of Auckland might get no new houses for seven years. A $500 million project to improve wastewater infrastructure could see the council decline or pause new resource consents. Stuff’s Caroline Williams

Watercare head of wastewater planning Andrew Deutschle said wastewater connections would be paused and Auckland Council asked to decline or put on hold any new building consent applications should the treatment plant reach capacity before the upgrade is completed.

Asked what this would mean for houses unable to connect, Deutschle said a pause on building consents meant there wouldn’t be any newly-built houses sat unoccupied, waiting for a wastewater connection before people can move in.

Nick Rowe, of Nick Rowe Architecture based in Stanmore Bay, said not allowing new connections for seven years could “cripple” the local construction industry.

“In an industry that has already been hit hard by the economic downturn, many local businesses may struggle to survive.”

He questioned why property owners and developers were paying “exorbitant” infrastructure growth charges (IGCs) — fees to cover costs associated with extra demand on the water network — while allowing the network to “get to a point where it can no longer do what it needs to”.

“Subdivisions have been approved and IGCs collected, however at this stage it appears that these new sites may not be able to connect to the network.” Via Stuff

Climate feature: Can an entire town be moved? RNZ’s Tim Brown

Honorable mentions

Urbanisation feature: From graffiti removal to zero waste LDR’s Mary Afemata via RNZ

Covid explainer: NZ's Covid response reviewed: What the Royal Commission has found so farA long-awaited report from the Royal Commission of Inquiry into NZ's Covid-19 pandemic response is being delivered to the Government today. 1News’ Anna Murray

Editorial Opinion du Jour: ‘Lucky she didn’t use Chat-GPT?’

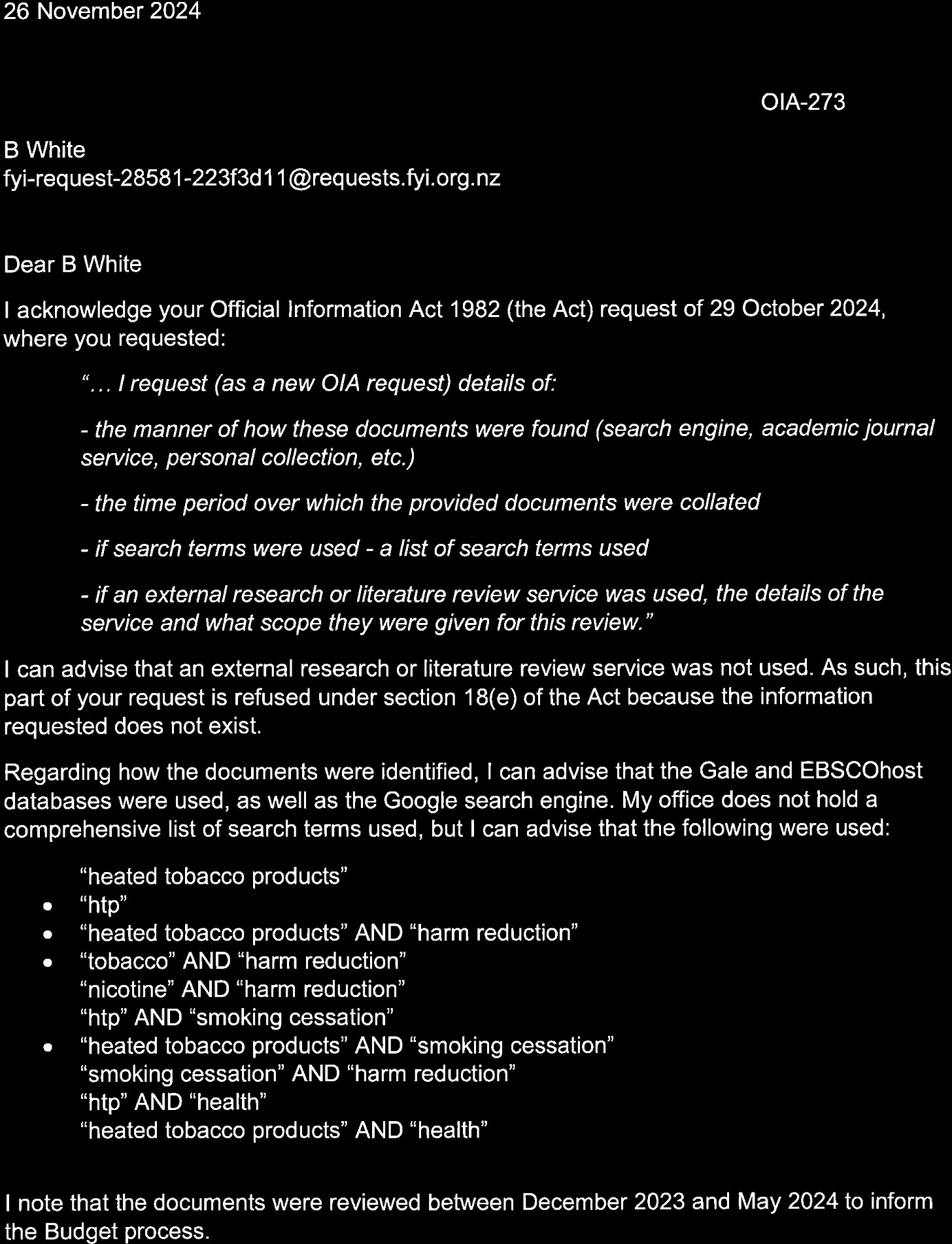

Here’s the document obtained under the OIA referred to above:

The Kākā’s Journal of Record for Thursday, November 28

Economy: The Reserve Bank cut the Official Cash Rate by 50 basis points to 4.25%, and said it would lower the OCR again early next year if economic conditions continue to meet its projections. It said it expects economic growth to recover during 2025, while employment growth is projected to remain weak until mid-2025. RNZ

Housing & poverty: The number of households in emergency housing motels fell from 3,141 in December 2023 to 993 in October 2024, Associate Housing Minister Tama Potaka announced. 786 households moved from emergency housing into social housing via the Priority One pathway introduced in April; Potaka didn't clarify outcomes for the other 1362 households that left emergency housing. RNZ

Housing & poverty: Associate Housing Minister Tama Potaka announced $82 million to fund 12 Māori housing providers to build 198 houses in areas with shortages of quality affordable rental housing. Rent for the houses will be capped at 80% of market rent for their location.

Health & jobs: The Government plans to cut 1500 public health roles, including 47% of roles from Te Whatu Ora's Data & Digital group, which manages outdated IT systems, and 24% of roles from the National Public Health Service, which promotes vaccination, prepares for emergencies, and delivers smoking cessation support. The Public Service Association said the IT cuts will prevent Te Whatu Ora from proceeding with planned upgrades; the Digital Health Association said the cuts could result in “significant disruptions”.

Economy: Stats NZ said its upcoming release of GDP statistics for the September 2024 quarter will be updated to include new data sources and changes to its seasonal adjustment methodology. Stats NZ said the more detailed data will improve its understanding of economic activity over the period.

Transport: Bus and train fares are expected to increase nationwide due to Waka Kotahi NZTA, in accordance with ministerial expectations, asking local councils and transport authorities to increase their private share of public transport expenditure. Greater Wellington Regional Council transport chairperson Thomas Nash said 71% fare increases would be needed next year to meet the new revenue targets.

Timeline-cleansing (?) nature pic of the day:

Ka kite ano

Bernard

Share this post