TLDR & TLDL: PM Jacinda Ardern has rejected the suggestion her Government has given up on meaningfully improving housing affordability for buyers and renters. Yesterday in her opening Parliamentary statement of the Government’s ambitions for the year she again said the Government wanted to improve affordability and was ‘pulling all the levers’ to do that.

But again the PM would not indicate what success would look like, or when the Government could be judged on its progress (or lack of it). I take a deeper look below the paywall fold at the PM’s statements yesterday on housing and which levers aren’t being pulled.

Elsewhere in the news this morning:

Chloe Swarbrick has called for a select committee inquiry into the Govt’s economic response to covid (NZ Herald);

one of NZ’s big three fuel retailers, BP, reported a US$12.1b profit globally last year, and rejected growing calls in Britain for a windfall tax on oil majors (Guardian); and,

Transmission Gully’s road-building JV is tearing up large sections of the 27km motorway from Porirua to the Kapiti Coast and replacing badly laid seal as Waka Kotahi continues to refuse to say when the two-years-overdue road will open. (DomPost)

Later today, I’ll be covering the second Parliamentary day of the year and writing more on the causes of inflation and the real-world effects of anti-vaccine protests on our national economic and health security. I welcome comments and suggestions for questions from paid subscribers below.

(I have now opened up this article to all of the public to read in full and share. I’m able to do this sort of accountability and explanatory journalism on housing, poverty and climate because over 1,400 people have become paid subscribers to The Kākā. I’d love you to join as a full subscriber, which enables you to comment below and gives you access to all my daily emails, and access to my weekly webinars and chat threads. Come and join us and see what’s below the paywall fold.)

Show us what success looks like

The PM issued a series of defences of the Government’s housing policies and progress yesterday in the first full day of political debate for the year. Her comments came in the wake of various reports showing house value inflation accelerating to a fresh record high average of over $1m nationwide, and OECD criticism of the Government’s performance on housing affordability for renters and first home buyers.

Firstly, Ardern appeared on TVNZ’s Breafast show for her first weekly interview of the political year there, and then she issued her opening statement to Parliament on the Government’s plans this year.

Here’s the key exchange on housing (bolding mine):

Asked by host Jenny-May Clarkson about what had happened to the Government’s promise of making housing affordable, Ardern said: “That hasn’t changed. That has absolutely not changed …

“We have made progress. We are not giving up. We continue to do everything that we can, pull every lever we have, whether it’s changes to tax rules, whether its supporting councils with more infrastructure in the ground, creating progressive home ownership, creating transitional housing, supporting our social services … and building more public houses than seen in the last 20 years. We are doing all of that because we need to do everything we can if we’re going to change this market.”

Ardern said the Government had limited the number of rent increases renters experienced in a year, stating it was “making an tangible difference”.

She said under Labour there had also been changes to letting fee rules and that more than 8000 places had been created in public housing, which was a “big jump” on the net decrease which existed.

Ardern said the Government had also tried to even up the playing field in the housing market, bringing in a bright-line test and interest deductibility, which was having a “significant impact”.

“I don’t think either of us would argue that we don’t want a situation where home ownership slips out of the reach of New Zealanders. I see it as something that is core to us. It gives financial stability to people, it gives them anchor to a community. This is absolutely an ambition we have but today’s first home buyers, once they are in the market, we want to ensure we don’t have a housing crash,” she said.

“Everything that we are doing we have to constantly make sure we are reaching those affordability goals for people but that we also don’t see a situation where people’s number one asset loses its value in a crash.”

Ardern concluded: “We will try everything, Jenny-May, to make it easier for whānau to get into homes.” TVNZ Breakfast

There are so many problems with the PM’s stance that it’s worth breaking them down.

Firstly, there is an inherent contradiction in the PM’s desire to never have prices fall much, and to also achieve affordability (whatever the PM thinks it is — she has never told us what she thinks success looks like).

The magical thinking of affordability without a crash

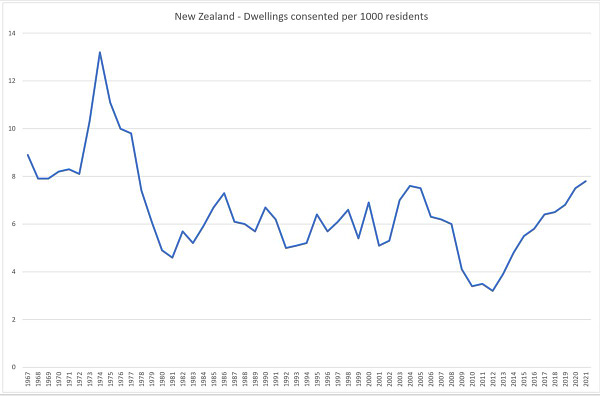

The horse has bolted so far now that it’s actually not possible to achieve any reasonable level of affordability any time in the next decade or two without a housing crash, or even just holding prices stable. The PM’s comments at the end of 2020 that she wanted house price inflation to moderate to around 5% a year from the current 27% a year make that even more impossible.

The simple maths of house prices rising more than 50% since 2019 to a price-to-income multiple of over 11 nation-wide means that prices would have to fall 5% each year for three consecutive years before that multiple returned to the eight seen when Ardern first campaigned for election in 2017 with the argument that prices were already at ‘crisis’ levels and affordability needed to improve. (By the way, John Key also described them at crisis levels in 2007 when they first headed over seven and when most analysts saw four or five as a reasonable level of affordability to target.)

If a multiple of eight in 2017 was a ‘crisis’, what is 11 now? A ‘catastrophe’?

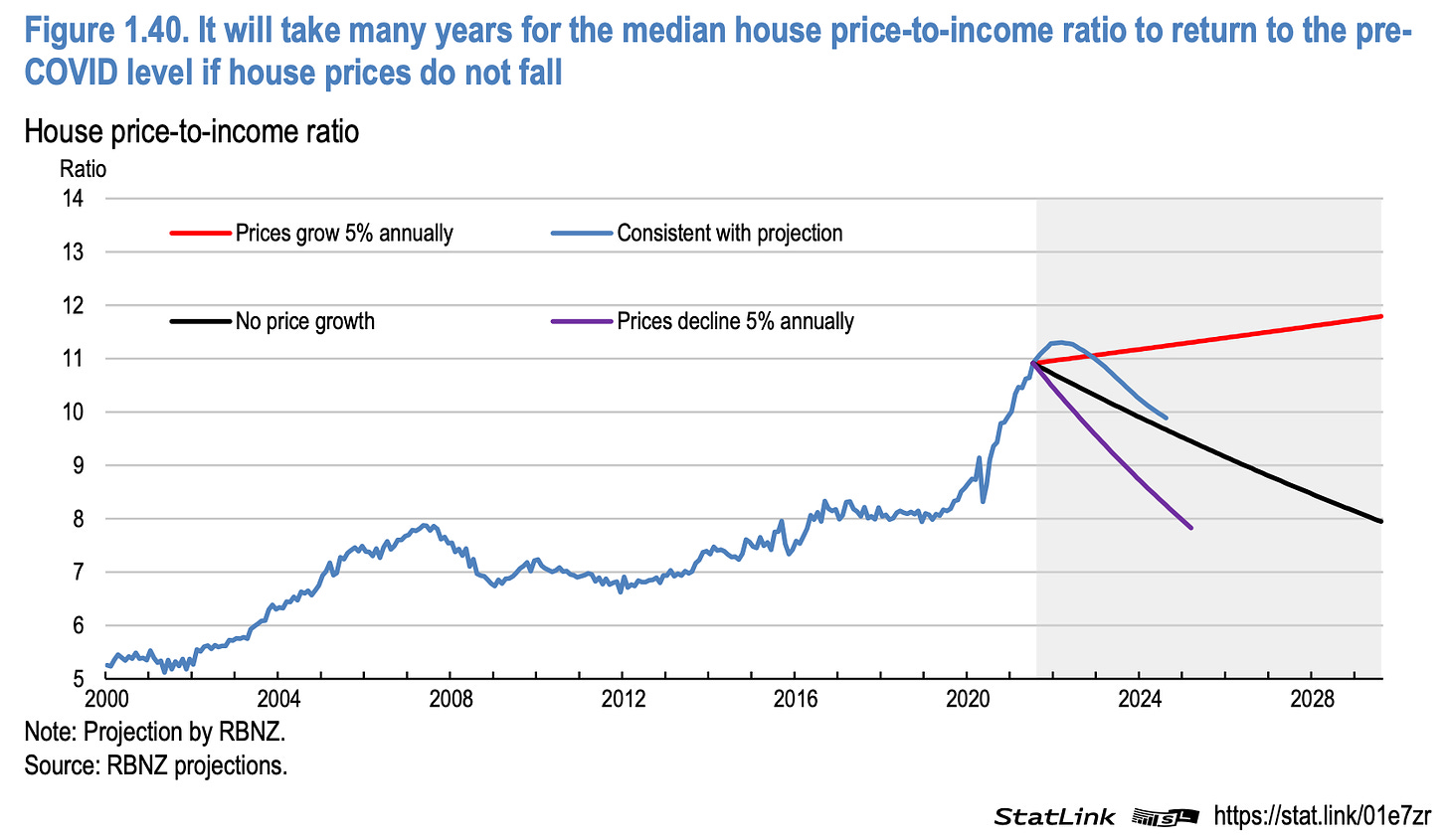

The OECD dismantled the PM’s implied argument (and that of the Opposition) that affordability can be achieved for current generations without a house price crash in its country survey last week with this one chart.

The PM’s stated preference for a five percent annual housing inflation rate makes affordability worse over the coming decade, not better. Even a 15% fall over three years would simply return affordability to ‘crisis’ levels. A fall of 40%-plus would be needed to get affordability down to reasonable levels around five any time in the next decade. (By the way, our banks and economy would handle that fall without much trouble, according to the Reserve Bank’s most recent bank system stress test last year.)'

By pledging to improve affordability while also not having a crash that would hurt the most recent first home buyers, she is essentially saying that she does not understand the maths, or does, but hopes we don’t notice it.

Is 11 affordable? Or 8? Or 5? Or 3?

Secondly, if we are to hold the Government accountable and if the machinery of Government is to have something to aim at, then the PM needs to tell us where she wants affordability to go. Assuming a ‘crisis’ level of eight is too high, then what is it. She has also failed to say what an affordable level of rental affordability is, even though she herself has set targets for child poverty reduction, which are very specific about income levels and items of deprivation.

Despite hundreds of pages of policy statements and Urban Development Plans and various major legislative interventions, this Government has never said what an affordable housing level should be, either for buying or renting. Since dropping its 100,000 KiwiBuild target, the Government has been loathe to set hard numbers on its aims around housing.

The previous Government’s Housing Minister Nick Smith briefly talked about a house price to income multiple of four as something worth targeting. It was even included in instructions to councils when assessing whether to assign the ‘Special Housing Area’ designation (remember those?). The Auckland Council’s (then) Chief Economist Chris Parker proposed targeting of a multiple of five by 2030, arguing that only a level below three could be seen as truly affordable. Parker is now a principal adviser at Treasury.

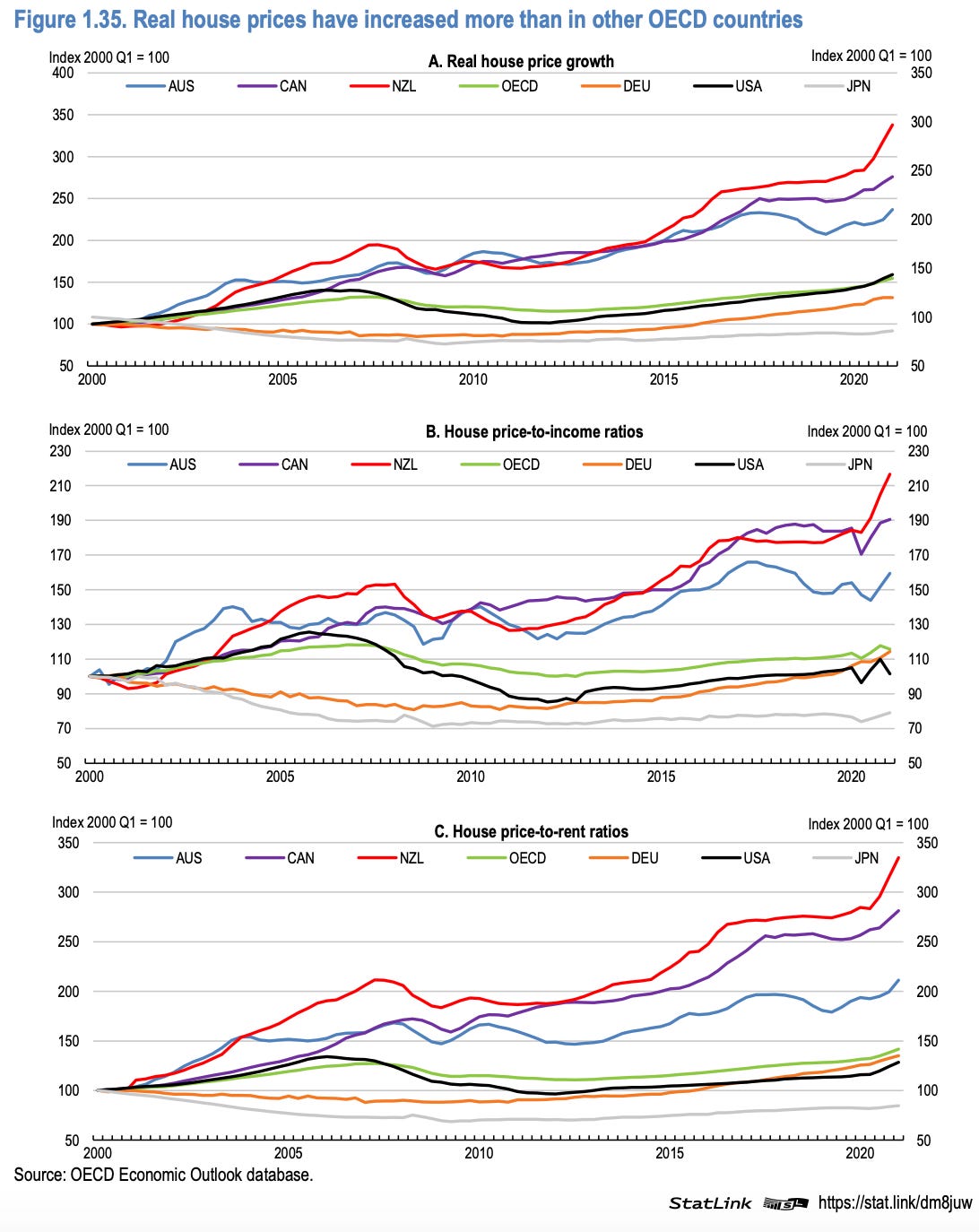

To give everyone an idea of just how out of whack our affordability levels are for both buyers and renters, here’s the OECD’s measures of our affordability vs the rest of the world.

The closest any arm of the Government has come to suggesting a reasonable level of rental affordability was a passing mention by officials in a policy statement on housing and urban development last year that wrote (bolding mine):

“Aotearoa New Zealand households spend the largest proportion of their disposable income on housing costs in the OECD. According to The Better Life Index 2020, our households spend on average 26% of their gross adjusted disposable income on housing, compared to the OECD average of 20%. Our unaffordable housing is resulting in too many people in housing stress or experiencing homelessness. In addition, the homes we do have often are not meeting our needs.”

“Tenants in public housing generally pay an income‐related rent of 25% of their income. This is considered affordable for public housing tenants. In contrast, some double‐income families with a mortgage may be able to support a higher proportion of housing costs relative to income.

“A common benchmark used internationally considers that housing that costs more than 30 per cent of income is unaffordable. However, banks will often lend to borrowers where mortgage servicing costs are greater than 30% of the borrower’s income.” Ministry of Housing and Urban Development officials in this policy.

Repeated questions to the PM and Housing Minister Megan Woods from me and others have failed to get them to either agree with those benchmarks or say the Government would ever target them.

You’re not actually pulling all the levers

Thirdly, the PM continues to repeat that the Government is pulling all the levers, when even her own policy decisions shows it is not. If ‘all the levers’ were being pulled, the Government would be:

taxing wealth or capital gains in some form, as is done in virtually every other comparable country and as she proposed early in the 2017 election campaign, before saying two years later she would never tax capital gains in her political lifetime and ruling out a wealth tax in the 2020 election;

building many, many more than the 10,700 state houses either built or planned to be built between 2017 and 2022, given a shortage of affordable-type homes (not the McMansions, massive townhouses and luxury apartments being delivered via private developers) most see well over 50,000;

funding a lot more transport and housing infrastructure at council level;

giving capital grants to housing providers to unleash much more social housing from the ‘third sector’; and,

seriously considering some form of rent controls.

Ultimately, the Government’s guiding light is its adherence to the Public Finance Act’s indication that net debt must always trend back towards 20% of GDP, which means it cannot use its balance sheet to properly address the massive underinvestment in infrastructure in the last 30 years. That has limited its capital spending plans to less than half the infrastructure deficit estimated by the Infrastructure Commission - and that’s before any further population growth. It has also stopped the Government from providing capital grants to community housing groups.

It has also repeatedly ruled out rent controls and there has not been a single infrastructure funding deal done, despite the Act being passed two years ago. This failure was mentioned by the OECD this week.

In summary, the PM’s insistence that the Government still cares about affordability may be true in an emotional sense, but is not true in any real, believable, accountable or meaningful sense.

A question for subscribers: Do you want this opened to the public so it can be shared? Please like or comment if you do.

Scoops and notable news elsewhere

Useful longer reads

Chart of the day

Spookies, curiousities and profundities

Thread of the day

The Craic

A fun thing

Ka kite ano

Bernard

Share this post