Long stories short in Aotearoa’s political economy around housing, poverty and climate on Tuesday, January 21:

PM Christopher Luxon presented his new Cabinet this week as refreshed and refocused on hustling for economic growth, but again did so without any new strategies or policies beyond doubling down on extracting and selling resources and assets to prop up a housing market with bits tacked on;

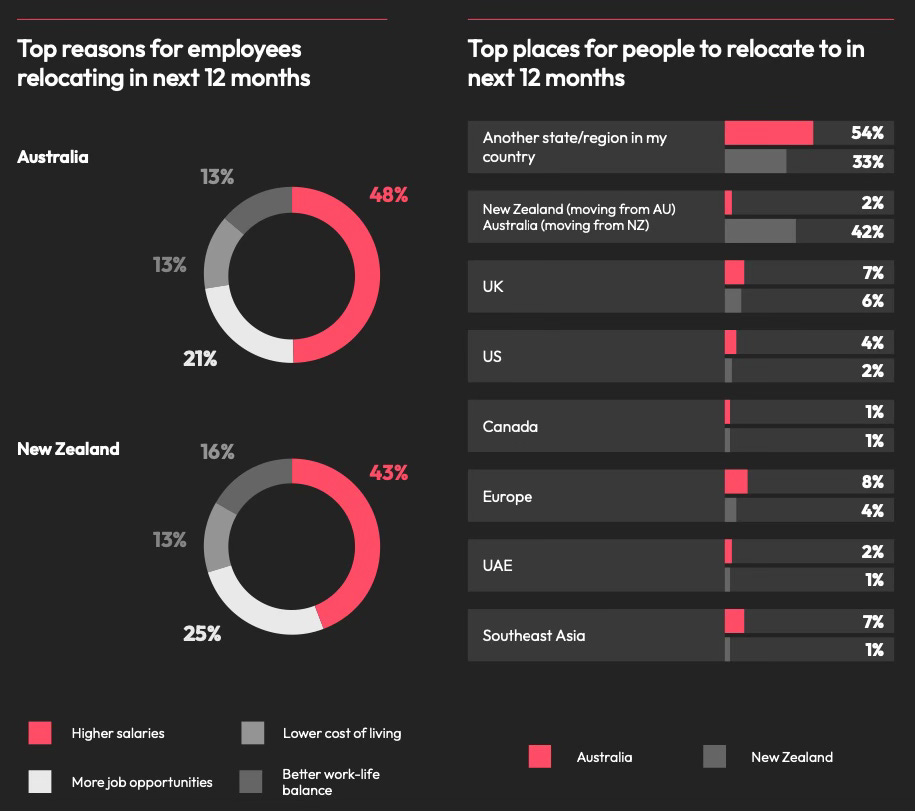

However, nearly half all professionals and managers surveyed for recruiter Robert Walters’ 2025 salary guide don’t buy it, and are either throwing in the towel and planning to migrate themselves to Australia in the next year (42% of the 3,000 New Zealanders surveyed), or expect their employees to leave in 2025 (40% of managers surveyed);

The economy also isn’t cooperating with the Government’s bet that lower interest rates will solve everything, with most metrics indicating per-capita GDP is still contracting faster and further than at any time since the National-alone Government of 1990-96 unleashed a series of crash-or-crash-through government spending and welfare cuts;

The interest rate cuts being relied on by the Government to restart the housing market are also not working, as QV’s report today of flat prices and activity in December showed, with QV Operations Manager James Wilson saying: “It looks as though the economy is still in a dark place right now, and debt to income ratios should still keep a lid on things in the year ahead.”;

The abrupt Government fee increases, funding cuts, capital freezes, spending reviews and repeals that have crashed back and forth across departmental budgets and the Cabinet in the last year have both undermined confidence in the civil construction and housebuilding sectors, and angered traditional National’s provincial supporters, let alone shocked council planners and consenters into a nationwide freeze; and,

The most awful example of the desperation and frustration many feel about the funding cuts and limbo-like budgets is in disability funding, where parents of severely disabled children face yet more years without respite, as shown in this deeply reported feature yesterday by former DHB member Colleen Brown at The Listener (gift link)

(There is more detail, analysis and links to documents below the paywall fold and in the Dawn Chorus podcast above for paying subscribers. If we get over 100 likes from paying subscribers we’ll open it up for public reading, listening and sharing.)

‘I don’t buy all the hustle talk. I’m out of here’

Professionals and managers are voting with their passports against the Government’s hustle-harder strategy for economic growth. A survey by recruiter Robert Walters of 7,700 professionals across Australia and New Zealand (3,020 in NZ, including 97% describing themselves as managers or professionals) for its 2025 salary review found 42% of those surveyed had already decided to migrate to Australia or planned to in the next year. It found 40% of employers in New Zealand reported team members were leaving (27%) or expected them to (13%).

Gap between business confidence & activity widest ever

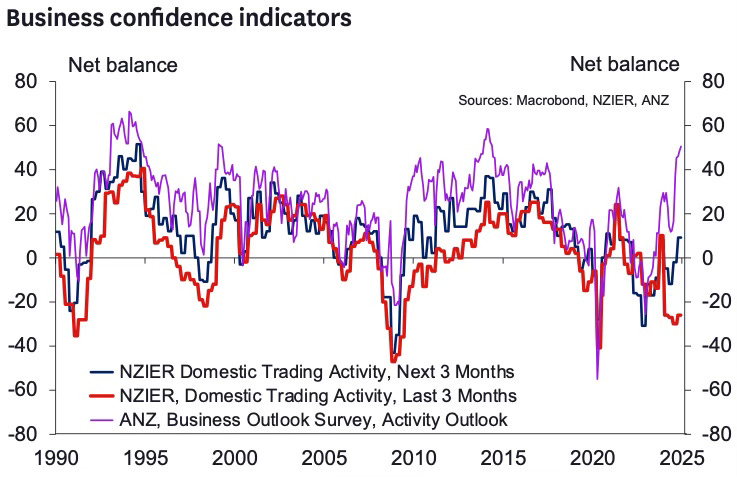

On the eve of Luxon’s State of the Nation address to the Auckland Chamber of Commerce tomorrow, business leaders are increasingly agitated about the lack of growth they had been told to expect last year as the Reserve Bank cut the Official Cash Rate by 125 basis points.

Westpac NZ pointed out yesterday in a note that the gap between stated confidence about the wider economy (ANZ survey with purple line in chart below) and actual activity in past three months (NZIER survey with red line) was the biggest seen since the surveys began in 1990.

“While businesses are very hopeful about the impact of lower interest rates, very few are seeing any benefit from them yet.” Westpac NZ economist in note.

Housing market also frozen & listless, despite rate cuts

The frozen-in-place nature of the economy was evident too in QV’s report today on values in the housing market in December. QV’s House Price Index fell another 0.3% in December from November and remains 15% below its 2021 peak.

QV Operations Manager James reported he was seeing little growth and pointed to the RBNZ’s Debt To Income multiple controls in July last year as a factor holding market back in the face of lower interest rates. Here’s his comments (bolding mine):

“It’s been ‘steady as she goes’ throughout much of last year, and it looks like it’s going to stay that way for a while yet. It’s a new year, but the same restraining factors are still very much at play – including sustained weakness in the labour market, a high cost of living, credit constraints, and a surplus of properties for sale on the market today.

“The marked uplift in demand for housing that has come as a direct a result of falling interest rates hasn’t yet converted into any significant price pressure, so we’re only seeing very small pockets of growth.

“In the longer term, I expect we will see more growth this year than last, but with rising unemployment and such a high level of economic uncertainty, there are currently no indications that house prices are suddenly going to go from flat to flat-out in the immediate future.

“We can expect to see more investors return to the market throughout 2025, especially if interest rates drop markedly further. That will put a bit of price pressure on first-home buyers, who have picked up a larger share of the market in recent times. But it looks as though the economy is still in a dark place right now, and debt to income ratios should still keep a lid on things in the year ahead.”

The standoff was also evident in Barfoot & Thompson figures for Auckland released on January 7, which showed sales volumes fell 2.7% in December from a year ago, while new listings rose 16% and total stock rose 17%.

‘The cruelty is immense’

This deeply-reported Listener (gift link) feature by Colleen Brown on the effects of a freeze on disability funding is a sobering example of just how frustrated and angry many are with the unnecessary fiscal medicine and mean approach of the Government.

Here’s a few examples in the article:

Finding answers on how to care for her daughter has meant Hoskins has been grilled by health professionals about her parenting skills. She has trialled new treatments and had to manage relationships between her family and myriad different agencies to help Hineraumati live as well as possible.

Former minister Simmonds’ claims of carers spending public money on items like pedicures and massages deeply affected Hoskins. She felt stigmatised.

“This job of looking after Hineraumati is relentless. I can’t just hand her over to someone else,” she says. “I’ve had people question us about the funding we get for Hineraumati – I feel judged.

“The minister cast us all into one category – frittering our money away on painting our nails. Those comments play into all kinds of negative stereotypes.”

An email on November 22 from Claudia’s NASC stated that the current government “pause” for residential care would remain in place beyond June 2025 except in extreme cases that the family will never meet. “We have had one holiday in 26 years without Claudia,” McKenzie says. “I have no hope left. Louise Upston has put a full stop on hope in our family. It feels like a sentence. The same system that tells us to get on with it has abandoned us.

“This slams the door on our future freedom, our identity away from our daughter and happiness. The cruelty, the toll it has taken, is immense.”

A lack of trust in government, feelings of despair, and grief are spoken about constantly by the disability community, particularly on social media. The families spoken to by the Listener are typical of hundreds across New Zealand.

Cartoon of the day

Timeline-cleansing nature pic

Ka kite anō

Bernard

Share this post