TL;DR: Prime Minister Christopher Luxon said yesterday tenants should be grateful for the reinstatement of interest deductibility because landlords would pass on their lower tax costs in the form of lower rents.

That would be true if landlords were regulated monopolies such as Transpower or Auckland Airport1, but they’re not, and the history of interest rates halving from 2009 to 2021 while rents doubled also shows that’s wrong.

‘I think if you're a renter, you're very grateful for the fact that actually costs that have been passed on to landlords are not being passed on to you.’ Christopher Luxon

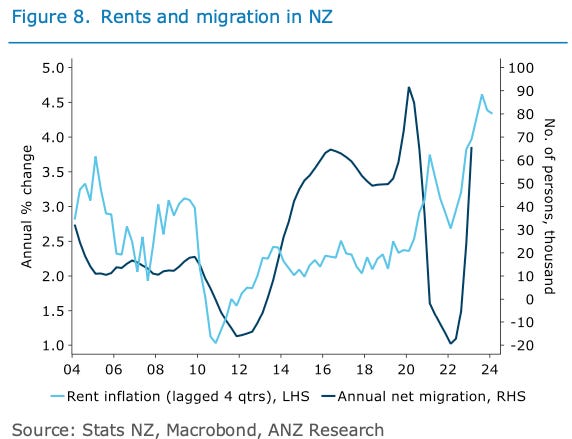

But don’t take my word for it. Treasury, the Reserve Bank of New Zealand and the Housing and Urban Development Department published a detailed study last year (in PDF form below) showing rents are connected to household incomes, housing supply and population, rather than landlord costs or taxes. Mortgage costs have only a minor effect, they found.

…over the past 20 years, nominal wage inflation and the relative supply and demand of dwellings are the two key drivers of rent inflation…Treasury, RBNZ and HUD paper

(Paying subscribers can see more detail and analysis below the paywall fold and in the podcast above immediately. I’ll open it up for full public reading, listening and sharing if paying subscribers want me to by liking this article more than 100 times.)

Elsewhere in Aotearoa-NZ’s political economy at 9 am:

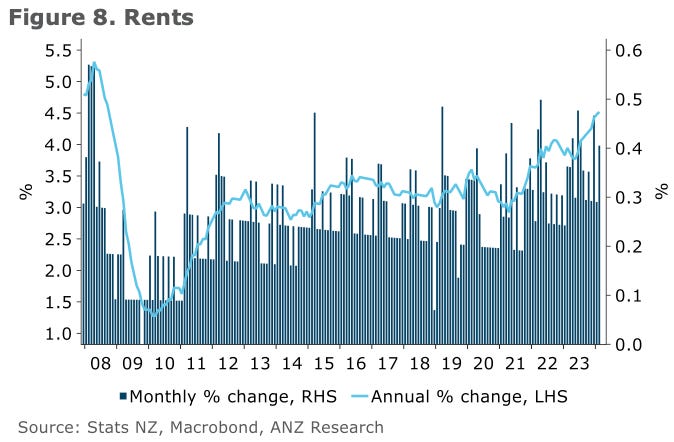

Rent inflation rose to a 15-year high of almost 6.0%2 nationally in February from a year ago, while domestic airfares rose 7.7% from a year ago, keeping upward pressure on domestic services inflation and adding to arguments for the RBNZ to either hike again or hold interest rates high for even longer. Stats NZ

The Government announced it would provide $10 million to ensure the 2024 ski season can go ahead on the Whakapapa and Turoa ski fields, but has told the recipients this will be the last time. The previous Government said the same when taxpayer support to continue was given last season and ACT said before the election no more ‘corporate welfare’ should be granted.

Overseas, overnight in geo-politics and the global economy:

Oil prices jumped 2% overnight to almost US$84/barrel after Ukrainian drones hit two more oil refineries inside Russia’s borders, including one less than 200km from Moscow.

A bill to ban Tik-Tok in the United States passed the US House of Representatives 352-65 overnight, although it has yet to pass the Senate or be ratified by US President Joe Biden, and a potential sale to a US owner by its ultimate Chinese parent, Bytedance, is seen as another more likely option. Bloomberg-newsletter Reuters

Japan’s Honda, Nippon Steel and ANA Holdings last night granted workers pay rises of more than 4% yesterday, which was up from 3.6% last year and the fastest wage growth in Japan since 1992. The wage growth is seen increasing the chances the Bank of Japan will finally end its decades-long experiment of negative interest rates by increasing its key policy rate by 10 basis points to 0.0%, possibly as soon as next Monday, or next month. Reuters

PM expects landlords to use tax benefits to lower rents & build new homes. But the research and evidence shows that isn’t happening and won’t happen.

Prime Minister Christopher Luxon has often referred to his business and economic experience as a virtue for the new National-ACT-NZ First Government, but his views on how the billions of dollars in tax benefits he’s delivering for landlords flow through to tenants is completely at odds with official research and decades of evidence.

Luxon talked up the likelihood that landlords would pass on the benefits of reversing interest deductibility changes from April 1 in multiple interviews and two news conferences over the last 72 hours. (See videos below) At various points he has said renters should be grateful landlords would pass on the benefits of the tax deductibility changes and that he expected the changes to increase the supply of rental housing, both from new homes and empty homes coming back into the market.

He told a news conference yesterday National had campaigned on reintroducing interest deductibility because it cared about renters.

"What has been utterly unacceptable is that there's been a $170 per week increase in rents under the previous government, and they just kept going up and up and up.

"A big reason for why they go up is because landlords have been hit with costs associated with the removal of interest deductibility, and also the extension of the brightline test. Those costs have just been passed straight through to renters with higher levels of rent.

"We care about renters. I think if you're a renter, you're very grateful for the fact that actually costs that have been passed on to landlords are not being passed on to you.” Christopher Luxon in a news conference (from 11:15) yesterday.

He saw the move increasing the number of rental properties built and offered for private rental. He added he had received advice the policy would create “downward pressure” on rents.

"So actually increasing the supply of rental properties by making sure landlords aren't actually removing their properties from the rental market, that they aren't adding those costs of interest deductibility and brightline implications onto the rents, is actually a very good thing."

Luxon made similar claims in Monday’s post-cabinet news conference, and in an interview on 1News Breakfast on Tuesday.

“We looked at our economic conditions, looked at what we can afford, and what we're delivering is relief to landlords. So they can put downward pressure on rents.” Luxon on Breakfast.

‘This is all about improving life for renters’

He went on at greater length in his post Cabinet news conference on Monday.

“This is all about improving life for renters. One of our major challenges, as you well know, is that average rents have gone up $170 a week under the previous government. A big part of that was the costs that were loaded onto landlords for interest deductibility and also through some of the effects of the Brightline test.

“We want to make sure that there's a supply of rental property. It's really important. We have a high functioning rental market in New Zealand. We have supply challenges in the ownership market. We have supply challenges in the rental market, supply challenges in the social housing market. All of those things are linked. So they were important decisions for us to make.

“I’m more interested in the outcome, frankly; I know it may be intriguing to you, but actually what matters most is actually, for renters in New Zealand, they get downward pressure on their rents.

“If you are thinking about the renters of New Zealand, which is where I’d hope you might be thinking, they will be very grateful for the fact we are doing everything we can to increase the supply of rental properties across New Zealand.” Luxon in his post-Cabinet news conference. (Transcript)

He was then specifically challenged on whether rents would go down, and what he would do with rents on his four rental properties. He has previously said he did not have mortgages on them so changes in deductibility of interest would have no impact.

Media: Will rents go down?

PM: Well, we hope that puts downward pressure on rents, and certainly we’ll see a stabilising of rents.Media: Not downward pressure—will rents go down?

PM: Well, we’ll see some stabilising of rents. We won’t see $170 per week being added to average rents in New Zealand.

Media: Will you drop your rents?

PM: That’s a decision for me and my personal finances, to work that through. Luxon in his post-Cabinet news conference. (Transcript)

So what do the deepest studies and evidence show?

Treasury, the Reserve Bank of New Zealand and the Housing and Urban Development Department published a detailed study last year (in PDF form below) showing rents are connected to household incomes, housing supply and population, rather than landlord costs or taxes. Mortgage costs have only a minor effect, they found.

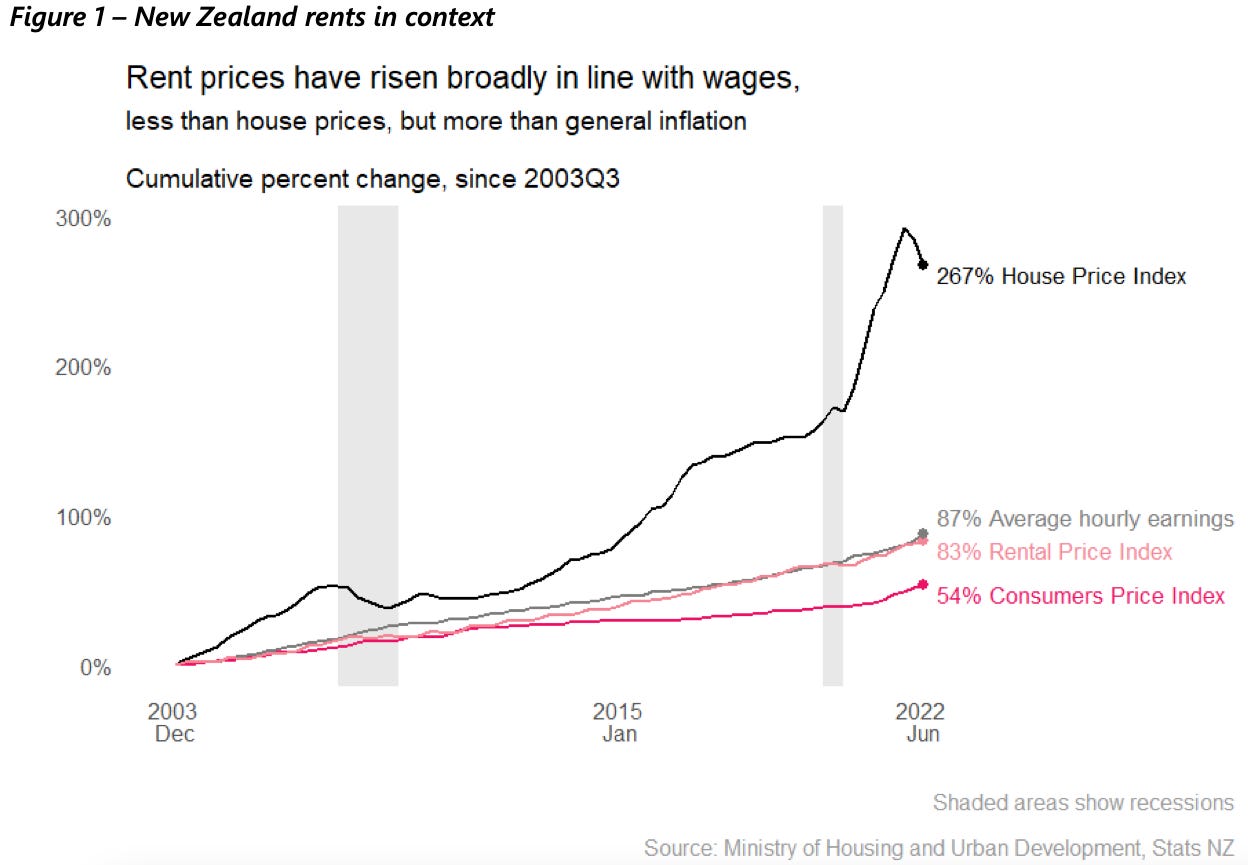

The 24-page study, What Drives Rents in New Zealand? National and Regional Analysis, published this chart showing what actually drove rents.

This is the money quote from the study.

“We find that, over the past 20 years, nominal wage inflation and the relative supply and demand of dwellings are the two key drivers of rent inflation at both the national and regional level, through impacting tenants’ ability and willingness to pay, and the availability of rental properties respectively. When the effect of other factors is excluded, a 1 percent increase in nominal wages leads directly to a 1 percent increase in new tenancy rents. A 1 percent increase in people per dwelling, leads to a 1.5 percent increase in rents at the national level.” Treasury, RBNZ and HUD in the August 2023 paper: What Drives Rents in New Zealand? National and Regional Analysis.

Mortgage rates and costs have much less of an impact, they found.

“We also find that rent inflation at the national level is affected by mortgage rates (increasing mortgage rates increase rents) and the unemployment rate (increasing unemployment decreases rents). However, their contributions are smaller and less significant than wages and the physical supply and demand of dwellings.” Treasury, RBNZ and HUD in the August 2023 paper: What Drives Rents in New Zealand? National and Regional Analysis.

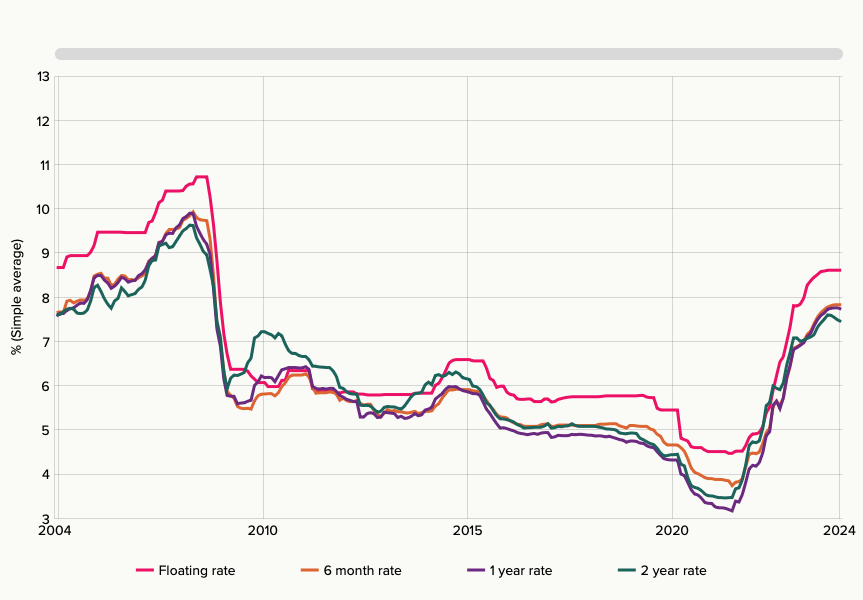

So what happened when mortgage rates fell sharply?

Luxon’s comments about taxation costs being passed on would also apply to landlords passing on mortgage cost reductions as interest rates fell. Here’s what actually happened to mortgage rates and rents.

So rents rose faster than disposable income, leading to tenants paying a higher share of their income in rent.

Rent share of income

It turns out housing supply and population growth are quite important.

Treasury, the RBNZ and HUD are not the only ones saying landlords don’t just pass on higher or lower costs. Here’s independent economist Tony Alexander via OneRoof and CoreLogic Chief Economist Kelvin Davidson via CoreLogic.

“Will they pass on the restoration of their after tax income to what it was a few years ago into lower rents? No they won’t. Why?

“Because it is hard to find evidence that progressive removal of this deduction ability caused much extra upward pressure on rents. In the five years before investors started to progressively lose their deduction ability, average nationwide new rents in the dataset gathered up and reported by Statistics NZ rose on average 3.3% a year. Since then rent growth has averaged just over 4%. The increase is small. So, if there is any giving back it will also be small.” Tony Alexander via OneRoof

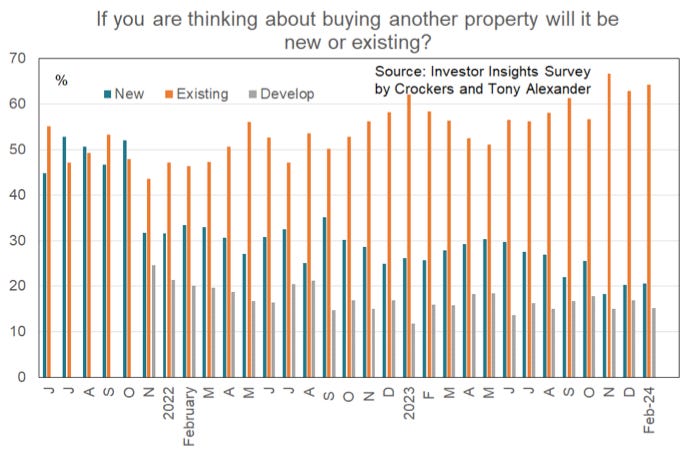

And will landlords use the tax change to decide to build new houses?

If Luxon is right and the change in Government and the well-known change in interest deductibility rules will cause a surge of landlord interest in building new homes, it’s not evident in either building consent or surveys of landlord appetites to build.

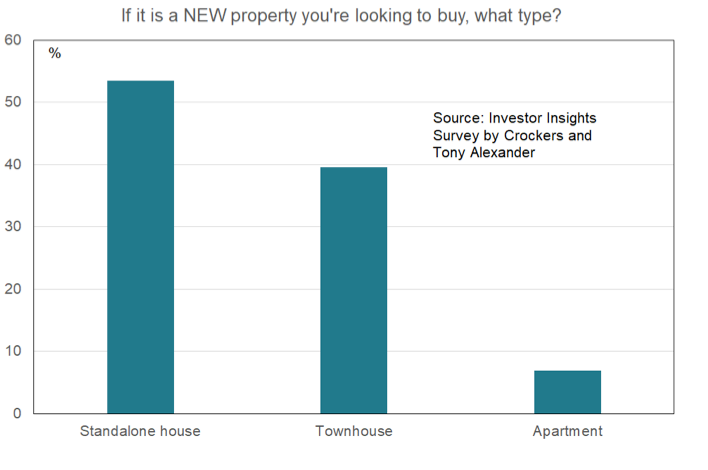

Luxon’s view that landlords want to build new homes for renters, which are largely apartments and townhouses, is not borne out by what landlords say they want.

It’s also at odds with the fact that new builds were already exempt from the deductibility rules, although it could be argued more profitable existing homes would make it easier for landlords to expand their portfolios with new builds. The trouble is, they’re actually reducing their appetite for new builds as rentals. Some of the new-build demand for new standalone homes is from landlords building a big new home to live in themselves.

With their higher profits from owning rental properties.

So what do landlords want? They want to buy existing homes and or land to receive the leveraged capital gains on land values tax free. The change in deductibility rules are more likely to translate straight into higher prices of existing homes and land than new homes.

Timeline-cleansing nature pic

As opposed to unregulated monopolies such as Air New Zealand, which the PM is familiar with…

This is the ‘flow’ measure of rents that uses the rents recorded for rental agreements with bonds lodged in the month. The ‘stock’ measure showed annual inflation of 4.5% and monthly inflation of 0.4% from January. The flow measure fell 2.0% in February from January.

Share this post