Kia ora. Long stories short, here’s my top six things to note in Aotearoa’s political economy around housing, climate and poverty on Wednesday, October 2:

PM Christopher Luxon was able to escape having to pay ‘brightline’ capital gains taxes of up to $70,200 on the sale of his Kate Sheppard apartment in Wellington because the sale was delayed until after his Government changed the rule by the PM’s requirements for the refurbishment of Premier House, as reported last night by NZ Herald’s Thomas Coughlan and The Post-$$$’s Thomas Manch.

In the scoop of the day, Health NZ is looking at privatisation ownership and operation of hospitals.

In the deep-dive of the day, Māori are twice as likely to die or be hospitalised from accidental poisonings and overdoses.

In solutions news, Germany has installed 550,000 solar panel arrays on balconies in a year to generate 200 MegaWatts of solar.

In quote of the day, Luxon reassures listeners on NewstalkZB he’s not worried about his personal finances being discussed publicly because ‘it’s ok, I’m sorted.’

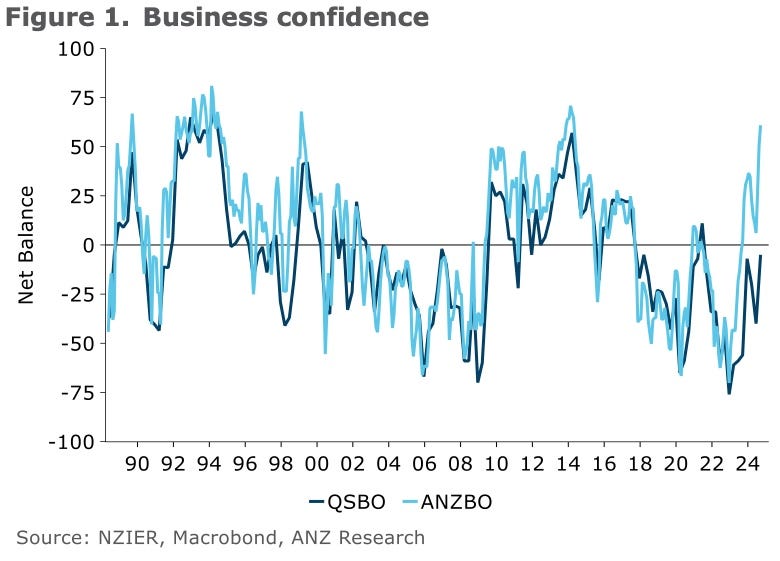

In charts of the day, the gap in business confidence in September between future and existing conditions was starker in NZIER’s survey released yesterday than in ANZ’s survey released on Tuesday.

(There is more detail, analysis and links to documents below the paywall fold and in the podcast above for paying subscribers. If we get over 100 likes we’ll open it up for public reading, listening and sharing.)

1. Luxon escapes paying capital gains tax by a few months

Apartment sale gains would have been caught by test if done before July

Timing matters in politics, and in tax.

It was reported last night by The NZ Herald’s Thomas Coughlan and The Post-$$$’s Thomas Manch that PM Christopher Luxon managed to escape having to pay up to $70,000 in capital gains tax under the five-year brightline test for capital gains in place before July 1 this year because his Government changed the rule back to the two years originally set by National, and because the sale of the Wellington apartment in question was delayed from earlier in the year by Luxon’s requirements for a refurbishment of Premier House. The sale of his Onehunga rental property earlier this year would not have been subject to any of the bright line rules because it was bought in November 2016 when only a two-year rule applied.

Here’s the detail (bolding mine):

According to online property data, the sale was made on September 9. Luxon paid $795,000 for the apartment in 2020. According to documents seen by 1News, the apartment was sold for $975,000, making a $180,000 capital gain. The sale has yet to be settled.

The Herald has verified the figure. Luxon’s office would not confirm nor deny the price, which was $15,000 below the apartment’s RV and well above most digital price estimates. OneRoof estimates the property is worth $745,000.

Luxon bought the apartment when investment transactions were subject to a five-year bright-line test. The bright-line test is a kind of capital gains tax that taxes the gain someone makes on a property, excluding the family home, at the owner’s marginal tax rate if it is sold within a certain time period.

The test was brought in by the Key Government in 2015 and set at two years. In 2018, Labour extended the test to five years and in 2021 it extended it to 10 years. Main homes, defined by the Inland Revenue Department as the home to which you have the “greatest connection”, are excluded from the bright-line test –but Luxon’s main home is in Auckland, meaning the apartment would have been caught by the tax.

Because Luxon bought and sold the apartment within five years of purchase and he bought the apartment after the introduction of the five-year test, he would have been required to pay tax under that test at a rate of 39% – equating to a maximum tax of $70,200.

However, on coming into office, Luxon’s Government scrapped both of Labour’s extensions of the bright-line test, shifting it back to two years as of July 1, 2024. That means Luxon avoided being caught by the five-year test by just over two months and saved himself up to $70,200. If he had sold the apartment in February, when he declared he would move into Premier House, he would likely have been required to pay the tax. The NZ Herald’s Thomas Coughlan

However, the liability may have been reduced because of renovations to the apartment, both The NZ Herald and Post reported. A spokesman for Luxon also suggested the delay in selling was due to the apartment being renovated, rather than Premier House.

A spokesman for the Prime Minister said, “the management of the Luxons’ properties are private matters which are unrelated to Mr Luxon’s capacity as Prime Minister”.

The timing of Luxon’s move into Premier House is due to the fact it was recently renovated and not because by selling the apartment now, Luxon has avoided the bright-line test. The NZ Herald’s Thomas Coughlan

The Post-$$$’s Thomas Manch also reported the sale price and that the sequence of events meant he did not have to pay the capital gains tax.

Luxon bought the Wellington apartment for $795,000 in September 2020 when entering Parliament, according to property records. Sales data not yet publicly available shows he sold the property, with the settlement still pending, for $975,000 on September 8, being $180,000 more than he bought it for almost four years earlier.

Under the prior brightline test rules, changed by the Government in July, this sale would have attracted property sales tax on any capital gain, as it was bought between 2018 and 2021, and sold within five years.

But the Government changed the brightline test on July 1, lowering the threshold to two years after purchase. That meant the sale of Luxon’s apartment no longer attracted a property sales tax on capital gain.

Luxon also sold one of three Onehunga, Auckland rentals he owned on September 5. The two-bed, one-bathroom house was bought by Luxon in 2015 for $650,000, and was sold for $930,000, equating to $280,000 more than he purchased it for.

This property would not have attracted a capital gains tax under the former or current brightline test. The Post-$$$’s Thomas Manch

2. Scoop of the day: Hospital privatisation suggested

Jessica Roden reported for 1News last night that Te Whatu Ora-Health NZ is now looking at privatising ownership and maintenance of hospital buildings through Public Private Partnerships (PPPs) to avoid the Government having to use its own capital, even though that is much, much cheaper.

Earlier this year, Health New Zealand told ministers given the scale of investment required, "a range of options for different financing and commercial arrangements may be needed".

Build and leaseback arrangements, where private companies own the buildings, would help free up funds.

They also floated "Public Private Partnerships", and said they are widely used overseas.

Health NZ chief infrastructure and investment officer Jeremy Holman said PPPs are "a whole spectrum of how the private sector could work with the private sector from that side of it so there are many different options in there".

On the suggestion, Minister of Health Shane Reti said: "I won't reiterate all the advantages and disadvantages. The most obvious is the freeing up of capital that the Crown can then deploy elsewhere." As reported by Jessica Roden for 1News

3. Deep Dive: ‘Twice the rate of deaths’

1News looked in depth at the issue of drug overdoses in a piece published online last night and based on the The Drug Foundation’s Drug Overdoses in Aotearoa 2024 report. It turns out Māori are twice as likely to die from an accidental drug overdose than non-Maori and are twice as likely to end up in hospital with drug poisoning.

Here’s the detail (bolding mine):

Otago University research fellow and Māori health researcher Dr Michaela Pettie (Ngāti Pūkenga) says the data is “disheartening” and “deeply worrying”, but it aligns with what they already know – how accidental drug overdoses disproportionately harm Māori.

Michaela says she backs the Drug Foundation’s recommendations to build a national overdose surveillance system, as it can give more information about drug poisoning and accidental overdoses.

The Drug Foundation’s Overdose Prevention Plan says a national overdose surveillance system could provide timely data on drug supply changes, and fatal and non-fatal overdose patterns, which is crucial for an effective overdose response. Currently, there isn’t a national system in place.

“From that information, we can make more informed decisions about how we can support Māori communities,” Michaela says.

She says there needs to be improved access to education, employment, and housing – all of which play into why people would use drugs. 1News Explainer.

4. Solutions news: Embracing ‘balkonkraftwerk’

This is an inspiring story via Grist about how Germany put half a million solar panels on apartment balconies in a year. They call it ‘balkonkraftwerk’ or balcony solar.

Unlike rooftop photovoltaics, the technology doesn’t require users to own their home, and anyone capable of plugging in an appliance can set it up. Most people buy the simple hardware online or at the supermarket for about $550 (500 euros.)

The ease of installation and a potent mix of government policies to encourage adoption has made the wee arrays hugely popular. More than 550,000 of them dot cities and towns nationwide, half of which were installed in 2023. During the first half of this year, Germany added 200 megawatts of balcony solar. Regulations limit each system to just 800 watts, enough to power a small fridge or charge a laptop, but the cumulative effect is nudging the country toward its clean energy goals while giving apartment dwellers, who make up more than half of the population, an easy way to save money and address the climate crisis. Grist

5. Quote of the day: ‘Don’t worry about me. I’m ok.’

"If we're going to criticise people for being successful, and, you know, let's be clear, you know, I'm wealthy, I'm, you know, sorted.” PM Christopher Luxon on NewstalkZB yesterday when asked by Heather du Plessis Allan how he felt about his personal finances being reported the previous evening on 1News.

6. Charts of the day: Hope before revenues

The Kākā’s Journal of Record for Wednesday, October 2

Competition: The Commerce Commission declined clearance for Foodstuffs North Island and South Island's proposed merger, saying it would make it easier for Foodstuffs to push down supplier prices and for Foodstuffs and Woolworths to co-ordinate prices. Foodstuffs North Island said it was disappointed, citing a streamlining of back-end support functions. NZ Herald, The Post

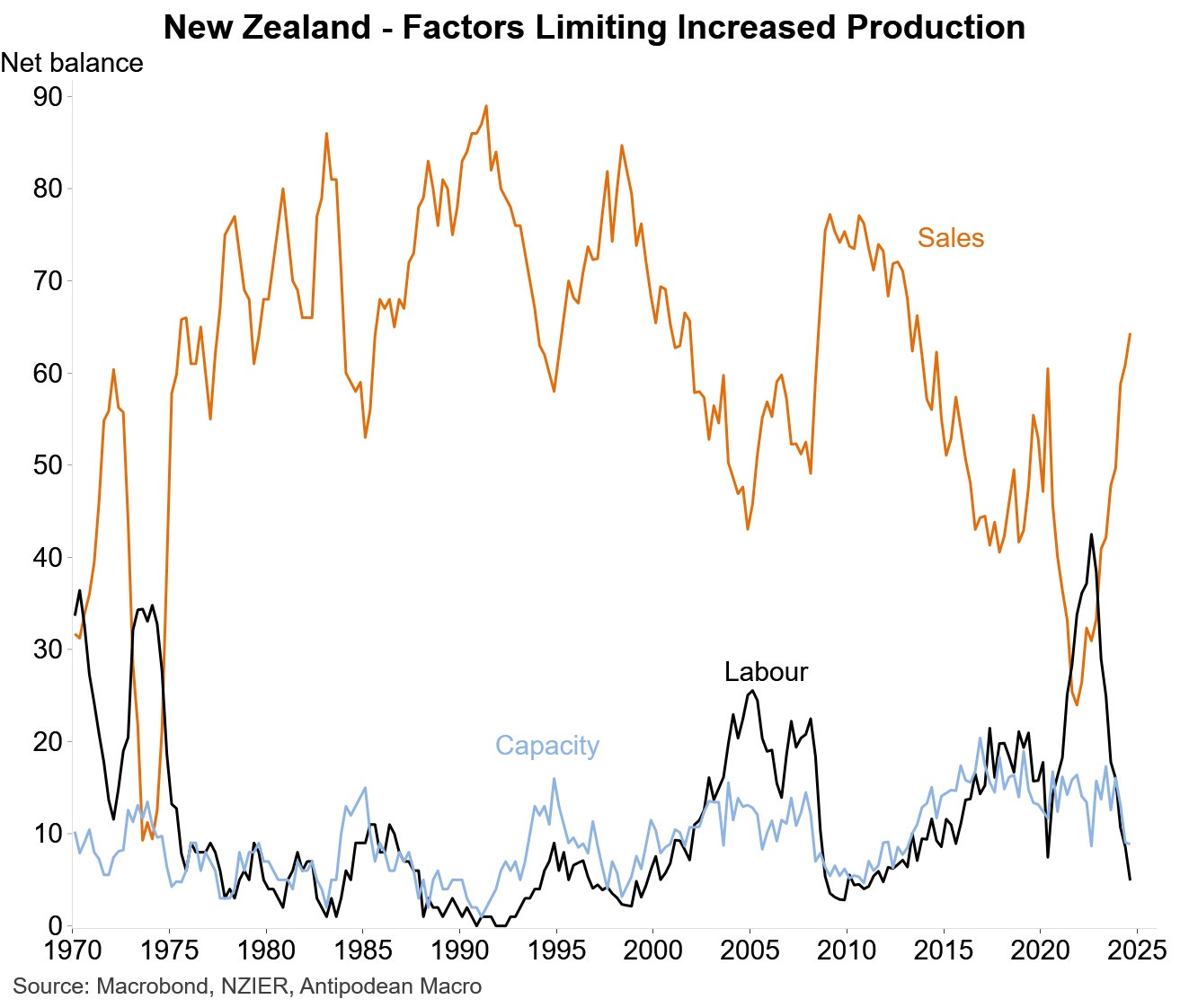

Economy: The New Zealand Institute of Economic Research’s (NZIER) September quarter survey found a net 5% of firms expected general economic deterioration ahead, as compared to net 40% last quarter. ANZ, commenting on the survey, said indicators of capacity stretch and pricing pressures suggest the improvement in business confidence won't get in the way of reducing CPI inflation to the RBNZ's target. BNZ changed its view for next week’s RBNZ decision to a 50 basis point cut from 25 basis points.

Environment: The Finance and Expenditure Committee's inquiry into climate adaptation recommended the Government implement a national adaptation framework geared towards ensuring "adequate housing", not "preserving people's wealth". The Environmental Defence Society said the report echoes many of its own recommendations; the Green Party said its own adaptation approach would focus on support & “clear guidance” for local governments. NZ Herald, The Post

Economy: Stats NZ reported a 20% drop in the number of new homes consented in the year to August, with a 39% drop in Wellington. Construction and property statistics manager Michael Heslop said the number of apartments consented in the year ending August was "the lowest in 10 years."

Housing: Building and Construction Minister Chris Penk announced that, under changes to the Building Act, builders could make small changes to plans, such as substituting like-for-like building products, without having to apply for a building consent amendment.

Kākās: The Department of Conservation said Wellingtonians should check eaves and attics for mated pairs of kākās looking for sheltered, enclosed spaces to nest. Kākās often nest in hollow trees, but in an attic can "sound a lot like rats or mice."

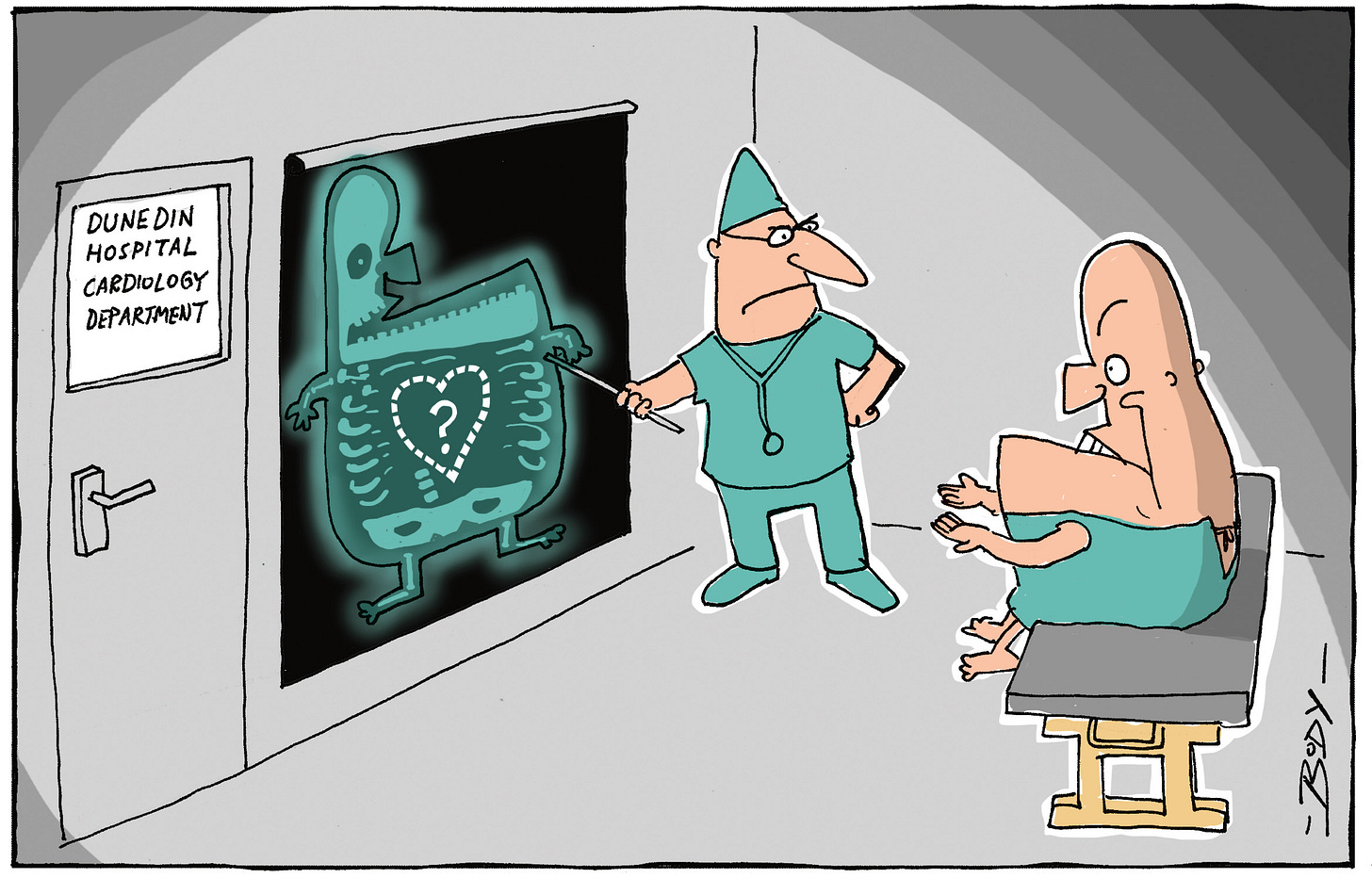

Cartoon of the day

‘It should be here’

Timeline cleansing nature pic of the day

Sunny days in a quiet place

Ka kite ano

Bernard

Share this post