Mōrena. Long stories short; here’s my top six things to note in Aotearoa’s political economy around housing, climate and poverty on Tuesday, August 27:

Chris Hipkins says Labour is revisiting its decades-long and bipartisan commitment to Government spending and debt being less than 30% of GDP.

Economists overseas are also challenging the austerity thinking of the last 40 years designed to reduce the size of Government.

In solutions news, electricity gentailers face competition from lines companies.

In the quote of the day, Antonio Guterres tells Simeon Brown that restarting oil and gas drilling was ‘signing away our future.’

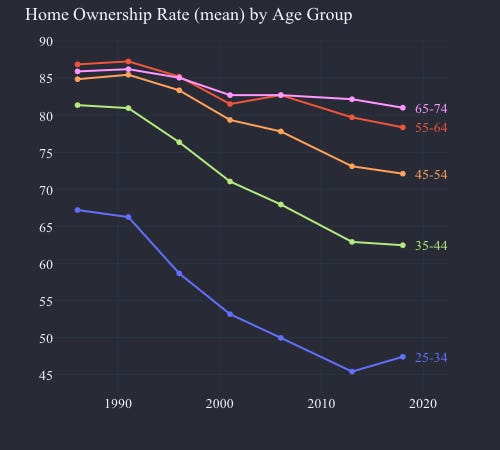

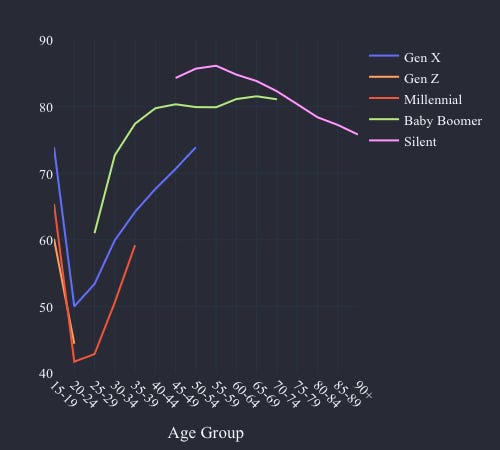

Charts of the day maps out the effects of intergenerational wealth transfer.

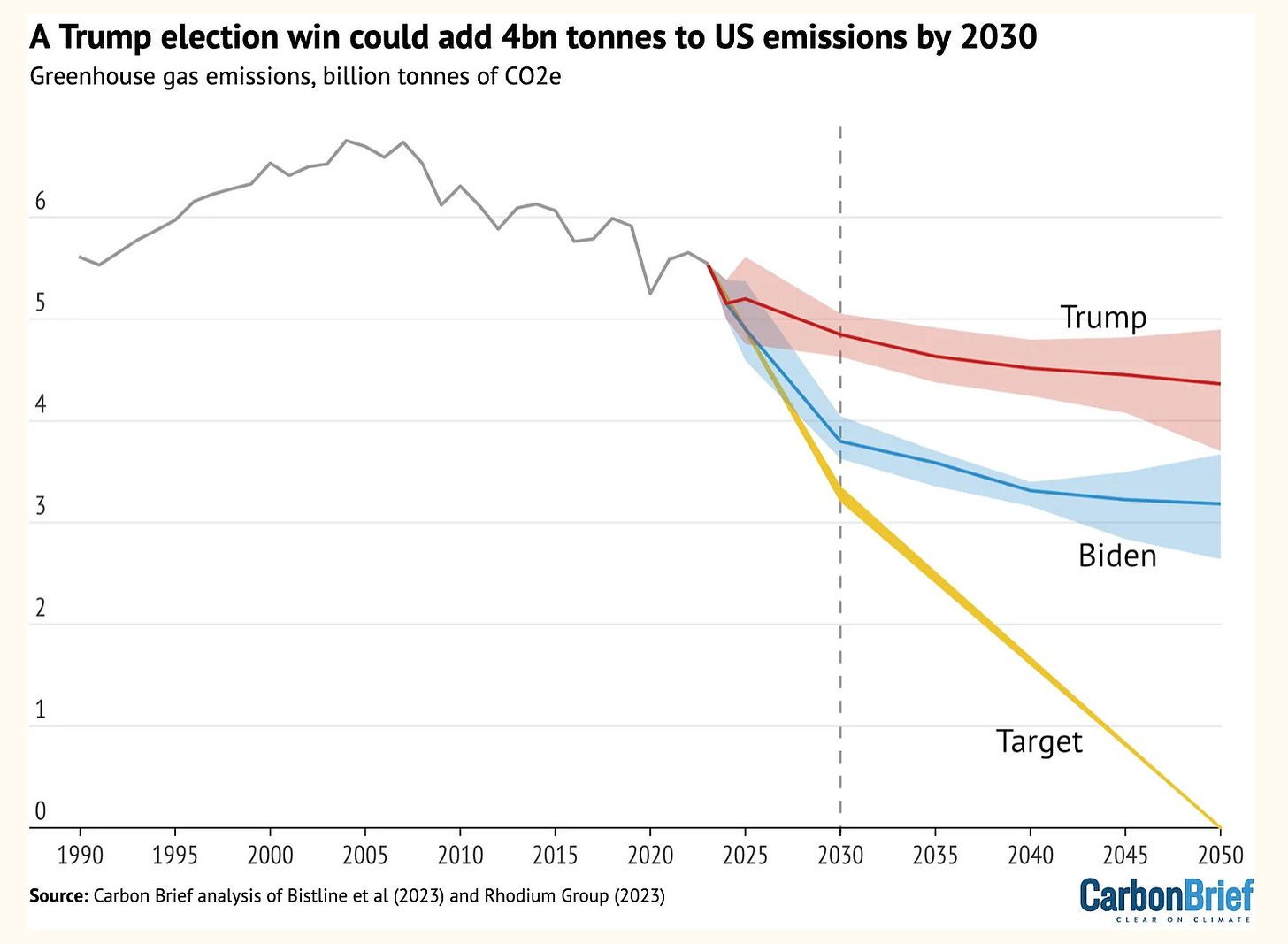

Climate graphic of the day projects from a Trump-led America run along Project 2025 lines might mean for climate emissions.

(There is more detail below the paywall fold and in the podcast above for paying subscribers.)

The Top Six on Tuesday, August 27

1. Another chink of light in the fiscal rules debate

Hipkins suggests releasing 30/30 shackles on Govt’s share of GDP

Regular readers of The Kākā will know I think the effectively bi-partisan approach by National and Labour over the last 30 years to run Budget surpluses and to keep both the size of Government spending each year and public debt below 30% of GDP has been disastrous and is unsustainable.

It has driven an intergenerational transfer of wealth from the young to the old1 through the tax system and housing market, and created a $100 billion infrastructure deficit, thanks in part to unfunded, unplanned and unacknowledged population growth of 1.5% to 2% per annum through migration of mostly temporary workers.

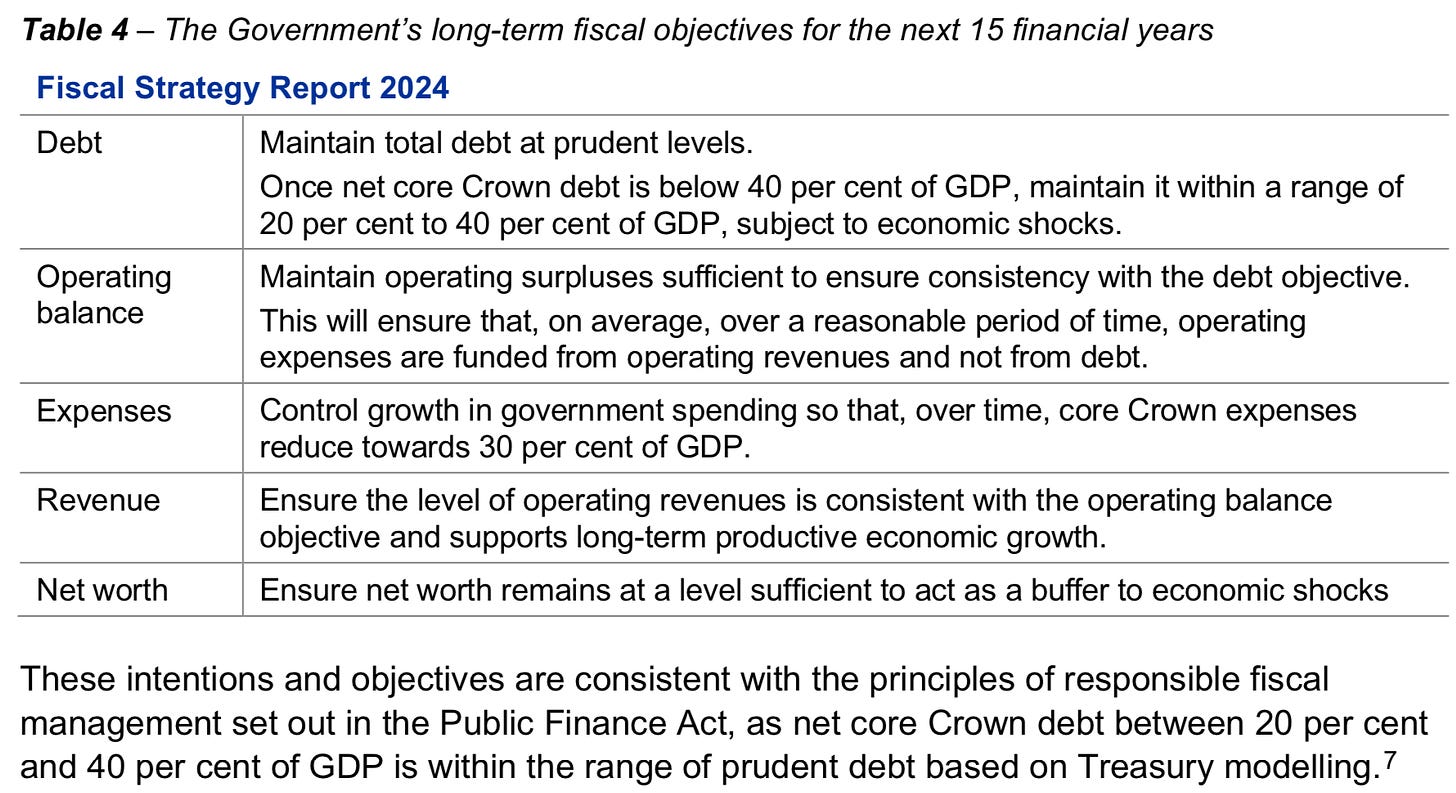

There has been some tweaking at the edges from both in either direction, but essentially that has been their joint approach since 1990. National aimed to run surpluses and get gross debt under 20% of GDP through the 2010s. Labour committed to the same in 2017, although then-Labour Finance Minister Grant Robertson tweaked that to keeping net debt under 30% of GDP, although that included the NZ Superannuation Fund on the assets side of the net debt calculation with about 15% of GDP. National have just committed to getting net core crown debt under 40% of GDP and within a range of 20-40% of GDP, along with getting core Crown expenses under 30% of GDP. Neither have changed much from that 20-30% range for debt and 30% for spending.

I have argued both of those limits are simply not sustainable already for our current social contract with Government around NZ Super and publicly funded health and education, let alone in the longer run with an ageing population. That’s because of structurally faster health and education spending than GDP growth all over the world, and because of past underfunding of investment and maintenance. Other developed countries with proper public services have expenses to GDP shares closer to 40-45% of GDP and debt to GDP of closer to 80% of GDP. We’re currently at 33% for expenses and 45% for net core crown debt, although bizarrely, the current definition doesn’t include the NZ Super Fund so the apples-with-apples comparison with Labour’s 30% cap is around 35%. Basically, they’re the same at 30%.

Up until now both National and Labour have had essentially the same rules and approach, which they and Treasury would argue is driven by the ‘principles of responsible fiscal management’ in the Public Finance Act (1989), which Treasury has interpreted as meaning net debt must stay between 20-40% and budgets must be balanced over time.

Here’s the current Government’s strategy, as detailed in Budget 2024’s Fiscal Strategy section.

Here’s Robertson’s fiscal strategy in Labour’s pre-election pitch last year, summarised as:

“to achieve an OBEGAL surplus across the forecast period and to keep net debt below 30 percent of GDP.”

Robertson also argued last year Labour was projecting the size of Government annually would fall below 30%, implying Labour agreed with National’s approach to the size of Government.

Is there real change in the wind?

It’s very early days, but Labour is turning its mind to whether that 30/30 rule works. Leader Chris Hipkins gave a speech to LGNZ’s conference on Friday that headlined his promise not to force councils to do things without Government funding, but it also included an intriguing suggestion Labour was revisiting the fiscal rules.

Here’s excerpts from his speech (bolding mine):

“We need an honest conversation between central and local government about how we are going to pay to fix up our infrastructure, and central government walking away from that conversation is an abandonment of their responsibilities.

“An honest conversation would force all of us to face up to some inconvenient truths. For four or five decades now we’ve run down our assets and under-invested in growth. Blaming today’s local government leaders for that conveniently ignores the role central government has played in setting the rules of the game.

“Big investments take time to show results. I stand by the investments made and the ones we were yet to make in the future of our country. I wasn’t interested in prioritising investments that I could be guaranteed to cut the ribbon on. We need to think longer term when it comes to investing in our future as a country.” Chris Hipkins speech to LGNZ conference

Hipkins said central Government couldn’t keep loading ever more onto councils.

“We need to make some big calls, and these big calls need to be backed by proper investment. That simply won’t happen if we continue to constrain Government spending to such a narrow percentage of GDP.

“We must have the realistic and adult conversation about borrowing. Borrowing for day-to-day consumption isn’t something we should do, if avoidable. Particularly not for tax cuts. An exception perhaps being a global and deadly pandemic.

“But borrowing to fund investment in infrastructure and assets for the future is something a government shouldn’t be so afraid to do.” Chris Hipkins speech to LGNZ conference

Hipkins said Labour had been working on a sustainable funding model for councils and both parties should work towards that.

2. ‘What if we discarded fiscal rules to invest in health?

That’s the question economist Mariana Mazzucato posed yesterday in this video:

“What if” we abandoned false fiscal constraints, and actually invested in what matters? Listen to the video I did for the WHO report on the Economics of Health for All.” Mariana Mazzucato.

3. Solutions news: Finally, lines companies can compete

One of the things announced yesterday by Energy Minister Simeon Brown and PM Christopher Luxon to improve the electricity market was to allow lines companies to compete properly with the gentailers. The details haven’t been decided, but this would allow businesses that already have capital and some connection to customers to give the gentailers a run for their money.

Currently lines companies can’t own generation of more than 50 MW on their own networks and can’t own more than 250 MW connected to Transpower’s network.

4. Quotes of the day

‘Hey, Simeon. This guy Antonio from the UN wants to have a word…’

“When governments sign new oil and gas licenses, they are signing away our future.” UN Secretary General Antonio Guterres in a speech yesterday to the Pacific Islands Forum meeting in Tonga, where Foreign Minister Winston Peters was in attendance.

PM Christopher Luxon arrives at the Forum today after last night announcing with Energy Minister Simeon Brown the early resumption of issuing permits in a post-Cabinet news conference.

Asked by journalists about New Zealand’s decision to resume issuing permits for offshore exploration and if he had spoken to Luxon about it when he visited New Zealand last week, Guterres said: “The only thing I can tell you is that the oil and gas that will be discovered from now, I am absolutely sure it will never be used.” Via NZ Herald’s Adam Pearse

5. Charts of the day

What intergenerational wealth transfer from the young to old looks like

6. Climate graphic/chart/pic of the day

‘Drill, baby, drill’

The best of the rest

Top Six Scoops and Deep Dives for Tuesday, August 27

What would happen if Methanex left NZ? Eloise Gibson

Goldsmith told fishing lobbyists Foreshore and Seabed law change would reduce claimable amount from 100% to 5%. Te Aniwa Hurihanganui

Te Whatu Ora diverts digital upgrade funding to payroll system Phil Pennington

Lives set to be translated into long-term assets and liabilities Danyl McLauchlan

Hundreds of homes in development not connected to sewerage RNZ Checkpoint

The Kākā’s journal of record for Tuesday, August 27

Climate: Minister for Energy Shane Jones announced the Labour-led Government’s ban on new offshore oil and gas exploration permits would be reversed by the end of 2024. Cabinet has also agreed to remove barriers to importing LNG, to potentially increase access to contingent hydro storage, and to enable electricity lines businesses to own more generation assets.

Climate: RMA Reform Minister Chris Bishop and Energy Minister Simeon Brown announced a series of reforms meant to ease the consenting process for renewable energy projects, including increasing the default consent duration for renewable energy projects to 35 years. A bill would also be introduced to enable an offshore renewable energy regime.

Work & Income: The Court of Appeal ruled in favour of Uber drivers who have been arguing they were misclassified as contractors. The CTU and Labour called on Workplace Relations Minister Brooke van Velden to abandon her plans for contractor reform designed to overrule the court the rulings. RNZ, NZ Herald

Economy: The Auckland Business Chamber's latest business confidence survey found 66% of NZ businesses reported negative confidence and 56% reported under-performance against expectations.

Economy: Inland Revenue announced a new tax Bill’s introduction to the House. The Bill’s proposals include implementing the OECD's crypto-asset reporting framework, setting out tax relief measures for "future emergency events", and allowing people under 16 to enrol in KiwiSaver.

Renewable Energy: The Environmental Protection Authority (EPA) announced an independent panel using Covid fast-track legislation had consented an additional nine three-bladed wind turbines up to 162m tall to be added to Te Rere Hau Wind Farm near Palmerston North. NZ Windfarms and Meridian agreed last year on a 50-50 joint venture costing up to $600 million to add 39 new turbines generating up to 170 MW. The other 30 turbines are already consented.

Finally, some fun things

Cartoon of the day

Timeline-cleansing nature (action) pic

‘Rhubarb, rhubarb, rhubarb…’

Ka kite ano

Bernard

Corrected from an earlier version, which said the reverse. My fault. Thanks to subscribers for pointing it out.

Share this post