TL;DR: The failure of yet another pre-fabricated house builder1 and a legal threat2 against our biggest council to force more greenfields development are two more signs, if we needed them, that our economy and society are now just a residential land market with bits tacked on.

These two latest events again demonstrate the massive skew in our tax settings in favour of housing land ownership has so changed the DNA of our political economy that nothing really changes without the removal of that skew. They also show the election debate we’re having has yet again failed to address the three elephants in our societal room:

residential land will have to be taxed and business investment incentivised to change the land-seeking, inequality-widening and low-capital-investment biases now embedded throughout our economy, politics and society;

our infrastructure financing and taxation systems are totally broken and inadequate at both central and governmental level, yet no politicians want to have honest conversations with each other or voters about how to fix it by increasing taxes and/or user-pays charges; and,

the bipartisan and accidentally-on-purpose Government policy settings enabling and encouraging population growth of 1.5-2% per annum through migration of guest workers dominates our economic and societal outlook, and remains undebated and unacknowledged.

Elsewhere in the news this morning:

Christopher Luxon overtook Chris Hipkins as preferred PM in a 1News-Verian poll, which also confirmed National will need Winston Peters’ support to govern;

The Reserve Bank played a very straight political bat in leaving the Official Cash Rate on hold at 5.5%, albeit with a slightly less hawkish bias around hiking rates again; and,

Global temperatures in September averaged 1.8 degrees above pre-industrial levels and were a full half a degree celcius above the previous record high for a September (see chart of the day below), which climate scientist Zeke Hausfather described on X as “absolutely gobsmackingly bananas.”

Paying subscribers can see more detail below the paywall fold and hear more of my analysis in the podcast above. I’m happy to open it up for public listening, reading and sharing once there are 50 ‘likes’ and plenty of comments from paying subscribers saying it’s ok.

How NZ Inc works & why it won’t change until land is taxed

The dominant way that house builders, land owners, land bankers and households make outsized profits and capital gains in Aotearoa-NZ is to buy more land, preferably with a big mortgage, and wait. They don’t need to build a house efficiently, or any house at all. They don’t need to build a profitable business or invest in shares in someone else’s business. It’s always, always about the business of driving up land values and using mortgage debt to increase the leveraged returns, which aren’t available from other investments.

Home owners and land bankers just need that land zoned residential, and can then wait for the leverage, time and the failure of central and local Government to build the infrastructure to cope with regular 1.5-2% population growth to deliver the rents and untaxed capital gains to make the owner far richer than they ever be from saving wages or profits.

Working in a job or profession or investing in a business or managed fund is a mug’s game, compared to the leveraged, spectacular, government-guaranteed, ongoing and tax-free capital gains on residential land. The differences in incentives between investing equity in leveraged-up land and investing equity in unable to be leveraged stocks or business investments are so vast. In other countries, capital gains on land and other asset value increases are taxed, while savings in funds that invest in businesses receive tax incentives, either on the way into the fund or in the fund itself. Savings in our investment funds are taxed throughout.

This royally skewed set of incentives is why our housing market is worth NZ$1.6 trillion, which is four times our GDP (NZ$400 billion), 10 times the value of our listed companies (NZX total market value of $160 billion), eight times larger than our total managed funds sector ($200 billion including NZ Super Fund and ACC) and 16 times larger than our only-very-marginally-incentivised household pension funds (Kiwisaver at $100 billion). For comparison, Australia’s housing market is worth the same four times GDP, but is worth four times stocks, three times and funds under management. In the United States, its housing market is worth twice GDP, once the stock market, twice funds under management and 7.5 times its comparable ‘subsidised’ household pensions market, which is known as 401k in America, rather than KiwiSaver.

This dark heart of our political economy shows up regularly in all sorts of ways, in particular the focus of investors, developers, politicians and equity-rich home owners on greenfields development of clearly-titled and mortgageable plots of land. An actual occupied house on the land is a bonus, but not necessary to be exposed to these gains.

The spectacular gains on land values mean they are the main driver of profit for developers and builders selling sections and/or house and land packages. The developer and/or builder does not need to create an efficient or large-scale system for building homes. They can happily exist on the tax-free gains from rising land values.

These financial incentives are the reason why our house-building sector largely remains a collection of small-scale family-run operations that can afford to bumble along because they can access equity in family homes or land to get them through the ups and downs of markets. Corporates are also unable to access the tax advantages and easy and cheap mortgages that owner-occupiers and rental property investors can get. It means we don’t have an efficient, large-scale house-building industry that uses pre-fabrication to lower costs and improve quality. Why invest in improving your business when you’re better off using the money to buy more land?

And that’s just the start of the perverse outcomes

The other unintended but economically and societally devastating consequences of this tax and leverage incentive imbalance include:

New Zealand homes being built of cheaper materials and not being built to last over 100 years to reduce long-term running costs because the cost of land is so high that there is proportionally less cash available to spend on the building;

cheaper and faster-to-decay building materials increase health, education and lost productivity costs, but are externalised to the value of the building because the costs are picked up by the taxpayer at large;

The capital value of the building deteriorates over time, rather than increases, while the land value continually appreciates, which incentivises buyers and investors to leverage much more on the land than the building and to spend the least on making the building last and be as healthy as possible;

Banks are much more focused on mortgage lending than business banking because the risk adjusted returns on mortgages are much higher in a market that generates vast tax-free gains for property owners;

the focus on using surpluses from work and business profits for deposits for residential land acts to starve businesses of capital for growth and productivity;

the focus on having a salary or wage to obtain bank approval for a mortgage reduces the willingness of younger workers to start or invest in their own businesses;

the need for home owners to maximise their disposable regular income and the need to have mortgage rates as low as possible to service the maximum amount of debt creates a political incentive to always push for tax cuts and tax credits that increase disposable income available for servicing debt on multiple properties;

the need for increased demand for rental properties and the desire to reduce competition for that rental property creates extra demand in the political economy for population growth from temporary migrants without the necessary infrastructure investment to enable more house building;

the demand for tax cuts and to limit rates increases by councils creates a further perverse feedback loop that is a win-win for land owners – lower taxes and rates revolts further limit the ability of the Government and councils to pay for the underlying infrastructure needed to build more homes;

the preference by banks for clearly delineated, freehold plots of lands to support mortgages pushes homebuyers and investors to buy stand-alone house and land packages, rather than to buy apartments, where land title is divided, possibly uncertain and a smaller portion of the value of the overall house-and-land cost;

the immense scale of the tax-free capital gains made mean there is a lot more for the winners to lose if the incentive structures are changed, and it means those ‘on the ladder’ realise they need ever larger and more-leveraged gains to ensure they can help their own children get deposits;

the sheer scale of the deposits now needed to ‘get on the ladder’ has created a political incentive to lobby for the use of pension funds (KiwiSaver) to bolster deposits; and,

the preference for stand-alone and uncomplicated plots of land creates the political incentive for more greenfields land development, rather than brownfields land development, which tends to see more apartment developers, which are in turn less attractive to investors because of their relatively low exposure to land price appreciation.

Which in turn turbocharge the following feedback loops

The end results of these mismatched and imbalanced tax incentives, feedback loops and perverse outcomes include New Zealand;

having the most expensive rents in the world relative to incomes and the highest proportion of poor renters in the highest amount of rental stress;

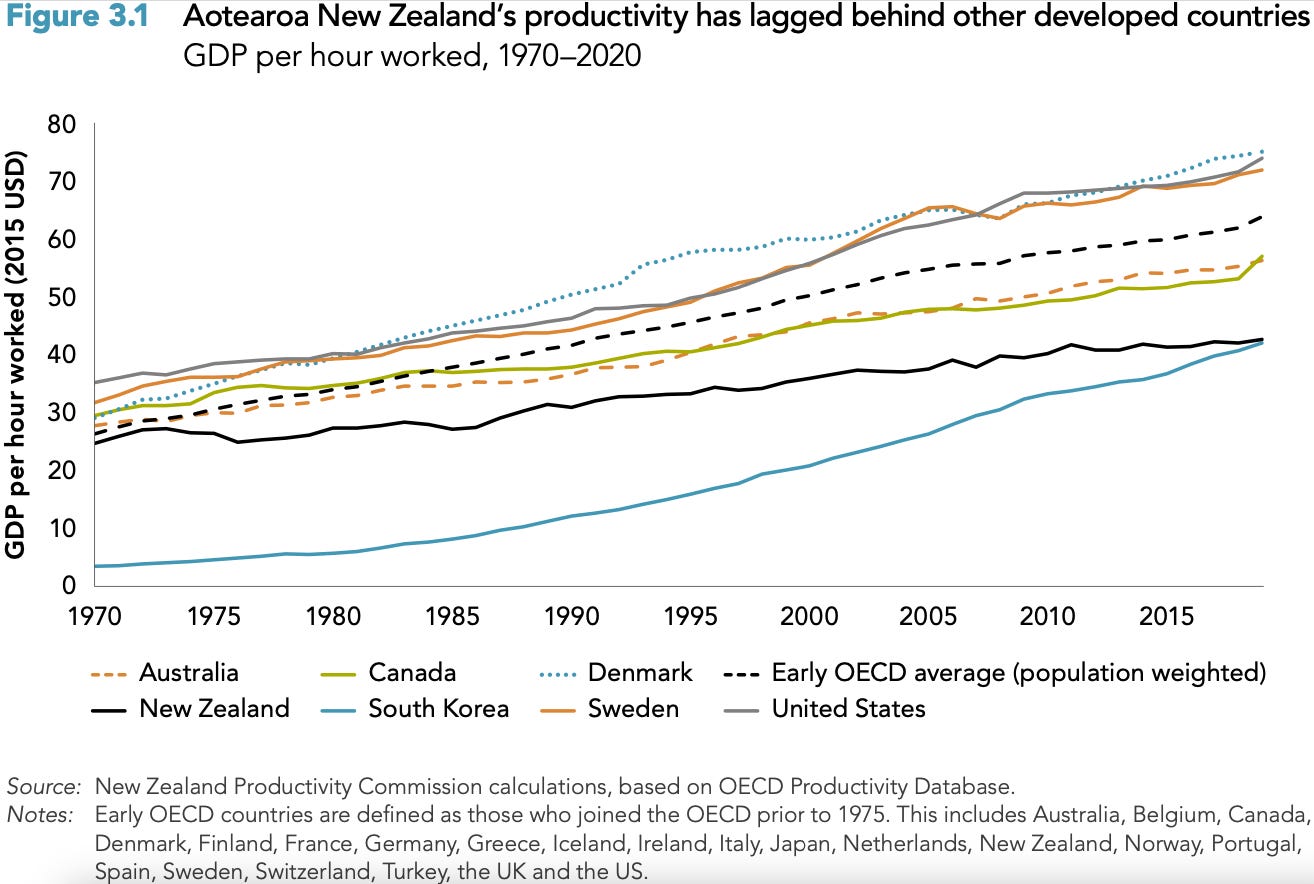

having one of the lowest public infrastructure and business investment rates in the OECD because of the need for low taxes and to put surpluses from wages and profits into residential land, which starves the economy of investment in roads, transport, machinery, business innovation and intellectual property that would increase productivity and real wages;

having one of the lowest number of total houses per 1,000 head of population in the world, along with the lowest number of new builds in the world, relative to population growth; and,

having record-high amounts of skin infections, chest infections and diseases of poverty in the developed world because of over-crowding, poor housing quality and rent stress.

The charts that tell the story

Low housing stock and high population growth…

Plus ever-growing demands for tax cuts and low public debt…

Plus the resulting lower-than-forecast and falling infrastructure investment…

Equals slower-than-needed growth in housing supply…

On top of the resulting poor business investment…

Leads to poor productivity growth and lower real wages…

Also, increased rent stress and higher deposits drives longer work hours…

You get the picture. Rinse and repeat.

Until that fundamental incentive changes, the various attempts to tweak our way to a solution are just more fudges, nudges, kluges, deflections, dissemblings and distractions.

Chart of the day

‘In my professional opinion, this is absolutely gobsmackingly bananas’

Ka kite ano

Bernard

BusinessDesk-$$$’s Denise McNabb reported this morning that TLC Modular, which is providing pre-fabricated pods made in Vietnam for two six-level apartment blocks being built by Kāinga Ora, faces liquidation because of a $550,000 debt owed to civil works contractor Yakka TDC.

BusinessDesk-$$$’s Oliver Lewis reported this morning that the Russell Property Group, which wants to develop 250ha of greenfields land around the Formosa Golf Course at Beachlands on the eastern fringes of Auckland, has threatened legal action to launch a judicial review of an impending Auckland Council adoption of its Future Development Strategy (FDS). The FDS reduces the amount of greenfield land available for future suburban development to 8,600ha from 9,600ha. It cites the financial cost of infrastructure and the climate costs of sprawal. “Growth in rural areas will be minimal to retain the rural environment and rural productivity,” the FDS states.

Share this post