TLDR: I interviewed Reserve Bank Chief Economist Paul Conway soon after the central bank announced it had decided to go ahead with a 50 basis point hike in the Official Cash Rate to 4.75%, as expected, but also after some had called for a pause to assess the damage from Gabrielle. The full interview is available for all in the podcast above.

Conway detailed the Reserve Bank’s initial forecasts that Gabrielle would increase CPI inflation by 0.3% in each of the next two quarters and increase GDP by around 1% in the coming years.

We talked about:

the nature of one-off shocks that the Reserve Bank can look through, including Gabrielle’s short term effects;

whether there is just as much of a risk of profit-price spirals in Aotearoa as there is of wage-price spirals (spoiler alert: the data on profits isn’t good enough to say…yet);

how the wages are negotiated now vs the last time inflation was signficantly above 2% for an extended period in the 1970s and 1980s (spoiler alert: unions had more power to agree big and fast pay increases back then); and,

how the way the Government funds its Gabrielle spending will work with (or against) the Reserve Bank’s efforts to slow inflationary pressures in the economy.

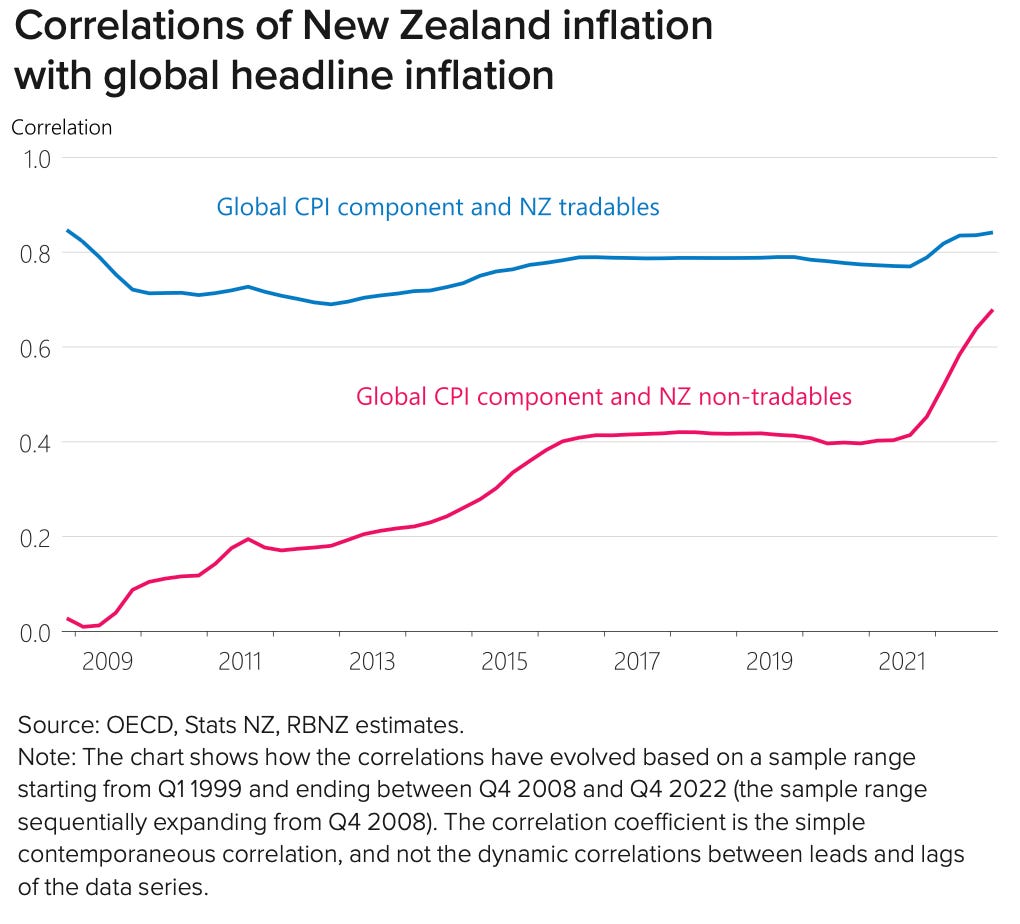

We also talked about the special topics in the Monetary Policy Statement (pages 28-34), which showed how non-tradables inflation is becoming increasingly connected to international inflation, and just what is happening with wage inflation in different sectors.

This was the most interesting chart in the MPS in my view.

It begs the question about just how much the Reserve Bank can change the course of inflation here when both the tradables and non-tradables inflation is at least correlated with international inflation pressures.

Ka kite ano

Bernard

Share this post