Kia ora. Long stories short, here’s my top six things to note in Aotearoa’s political economy around housing, climate and poverty on Tuesday, October 1:

PM Christopher Luxon has made $460,000 in tax-free income this year from capital gains on the sale of two of his rental properties, almost as much as the $484,200 gross income from his actual job, which he, like other earners of wages, has to pay tax on. Asked about not paying tax on the income from capital gains, he said he didn’t see the point of questions about a capital gains tax as it removed the incentive for wealth creators. 1News

In the scoop of the day, Guyon Espiner reported for RNZ yesterday that officials advised NZ First Minister Casey Costello that most of the benefits of the Gov $216 million tax cut for heated tobacco products would go to Phillip Morris.

In the deep-dive of the day, Public Housing Futures has produced a map of stalled and empty Kāinga Ora sites throughout the motu, showing thousands of half-finished or bare land where work has stopped, despite close to 100,000 people being registered as homeless. See more in an interview below, done the day after Luxon moved into Premier House, now the drapes and carpets and paint are up to his preferred standards.

In solutions news, the world’s largest battery maker, CATL, has announced it is moving long-life vehicle batteries to production that will last 15 years or 1.6 million kilometres, with a ten-year guarantee.

In quote of the day, Clutha Mayor Bryan Cadogan says he is livid the Government has chosen $14 billion in tax cuts over a proper hospital for the lower half of the South Island.

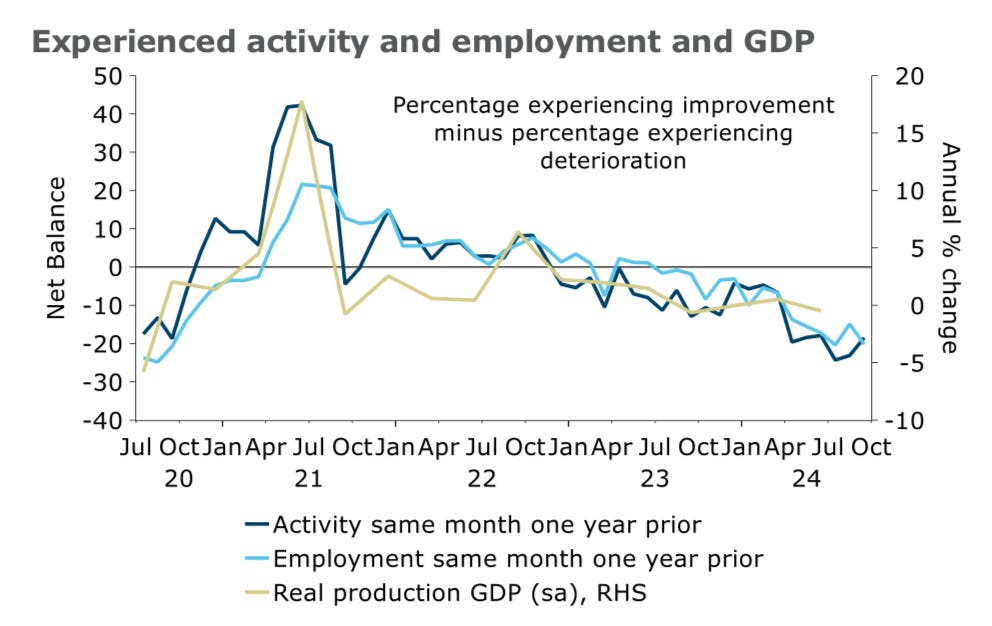

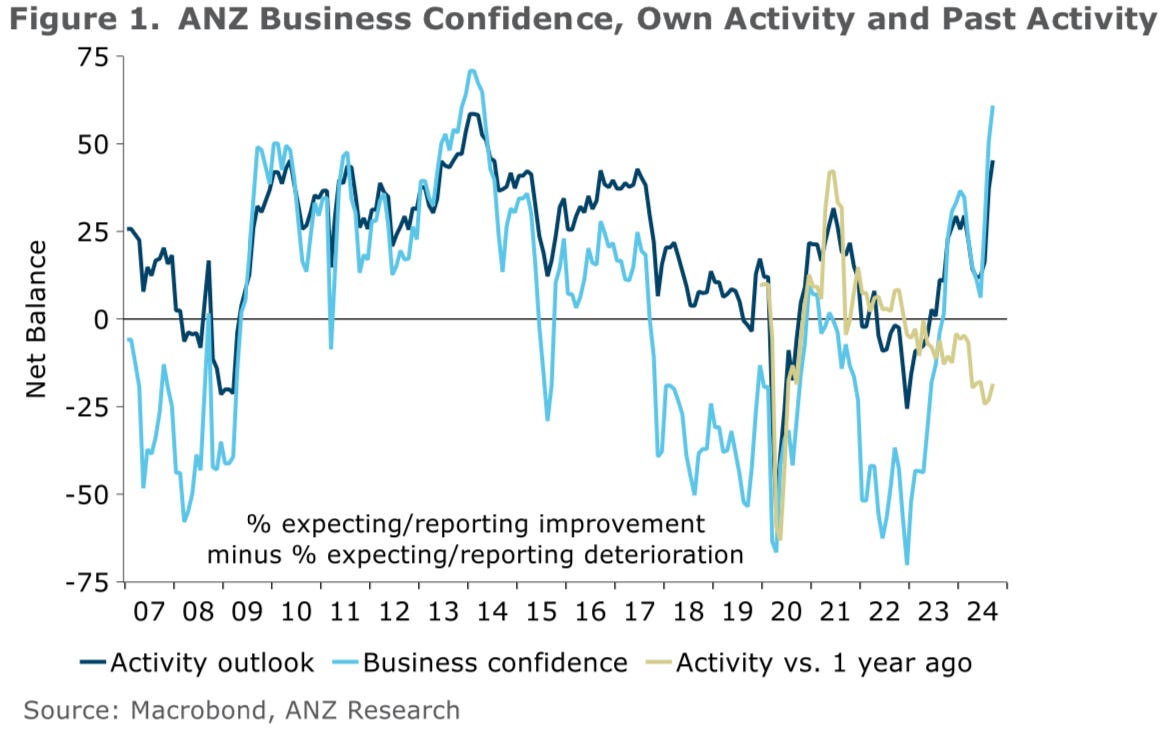

In charts of the day, business confidence about the future economy and firms’ own futures improved markedly in September, but actual experienced conditions remain in recession territory.

(There is more detail, analysis and links to documents below the paywall fold and in the podcast above for paying subscribers. If we get over 100 likes we’ll open it up for public reading, listening and sharing.)

1. Luxon says wealth generators need tax incentive

Luxon makes more in tax-free income from capital gains than PM’s salary

PM Christopher Luxon was questioned yesterday about the $460,000 in tax-free income from capital gains he is reported to have made this year from the sale of two rental properties, including his apartment in Wellington now that he has moved into Premier House. His gross annual salary as PM from July 1 was $484,200, which IRD’s calculator shows would require he pay $168,260 in income tax, if that was his only taxable income.

He was first asked if he should pay tax on the capital gains income.

“No, we don't have capital gains tax in New Zealand. We think it would be bad for New Zealand because you don't tax your way out of recession."

Asked if he made good money off the sale, Luxon said the "sale is still progressing".

"I don't know what the point of the questioning is.” Luxon via 1News’ Maiki Sherman last night. (From 4:52 on in the video below)

Luxon went on to say wealth generators needed the incentive of not paying tax on income from capital gains.

"We don't believe in a capital gains tax or a wealth tax. We think, for people who actually generate wealth in this country, it's a massive disincentive and as I've said along the way this is a Labour government that took the keys to our economy, put the car in the ditch.

“We're getting it out of the ditch and they want to put it back in there again by increasing taxes, by increasing spending and borrowing more." Luxon.

2. Scoop of the day:

Guyon Espiner reported for RNZ yesterday that officials advised NZ First Minister Casey Costello that most of the benefits of the Gov $216 million tax cut for heated tobacco products would go to Phillip Morris.

Honorable mentions

Health: The 3 key documents about Dunedin Hospital yet to be released RNZ

Auckland: Auckland mayor seeks to scrap city’s economic development agency. Tātaki Auckland Unlimited has been criticised and its budget slashed ‒ and it now faces being disestablished completely The Post-$$$’s Dita De Boni

Councils: Govt's lack of faith in Hawke's Bay Regional Council revealed in letters. Minister for Local Government Simeon Brown told the council he didn’t believe it could deal with situation without a Crown Manager appointed. Stuff’s Marty Sharpe

Health: Man waited at ED for more than an hour as blood poured from his mutilated fingers. He was made to stand in a queue after a workplace accident. Stuff’s Shilpy Aurora.

3. Deep Dive: Mapping less homes and morehomelessness

Housing activist group Public Housing Futures has produced a map of stalled and empty Kāinga Ora sites throughout the motu, showing thousands of half-finished or bare land where work has stopped, despite close to 100,000 people being registered as homeless. I spoke below with Public Housing Futures’ Vanessa Cole about the map and the data

Honorable mention

Climate: No new gas likely for 10 years despite Govt exploration plans. Repealing an oil and gas exploration ban is unlikely to significantly bolster gas supplies in the short term, according to government modelling. RNZ’s Eloise Gibson

4. Solutions news: A battery for buses lasting 1.6m kms

Contemporary Amperex Technology (CATL) is the world’s largest battery maker and has just announced it will start producing a low-density and long-life battery for buses that will last 15 years and 1.5 million kilometres. CATL is even providing a 10-year 1 million km guarantee. BatteryIndustry.tech

5. Quote of the day: Clutha’s mayor rips into Govt

"We're livid. Definitely the messaging that we received was at a tangent to what ministers Reti and Bishop gave last week."

“People will die here if the health facility is not up to scratch now, it won't be fit for purpose purpose in the future, and a building like this that's not fit for purpose ultimately correlates to deaths.

"So they're putting lives of the South on the line to save some money. You can't give $14b in tax relief and then turn around and say 'Oh, I can't make the books balance, I'll build half a hospital' ... If you get one chance to build a hospital, don't build half a hospital." Clutha Mayor Bryan Cadogan speaking with Lisa Owen on RNZ’s Checkpoint last night after 35,000 marched in Dunedin on Saturday after the changes.

6. Charts of the day: Hope before revenues

Business confidece is surging, but activity remains very weak

Experienced activity suggests NZ is still in a recession

Still on track for a recession into 2025

The Kākā’s Journal of Record for Tuesday, October 1

Climate: Greenpeace Aotearoa sued Fonterra, alleging it misled customers by labeling its Anchor butter as 100% grass-fed. Greenpeace claimed up to 20% of a Fonterra dairy cow's diet could be fodder crops, including imported palm kernel feed linked to deforestation in Southeast Asia. RNZ

Economy: ANZ's NZ Business Outlook reported that business confidence was up 10 points in September, and that residential construction intentions were at their "highest since mid-2021". NZ Herald

Environment: The Environmental Defence Society said the Resource Management (Freshwater & Other Matters) Amendment Bill will enable “a full-blown assault" on freshwater and biodiversity, including by establishing a consenting pathway for new coal mines near significant natural areas.

Investment: Ethical investment nonprofit Mindful Money found that socially or environmentally harmful Kiwisaver investments fell significantly over the past six years. Tobacco and alcohol investments dropped 74% and 33% respectively, and nuclear weapons-related investment fell from $100 million in 2019 to $13 million.

Environment: Research from Kantar and the Sustainable Business Council found only 22% of respondents believed NZ businesses were taking significant action to address community and social issues.

Climate: The Environmental Law Initiative launched High Court action against Environment Southland, arguing it breached its duty to use the Resource Manage Act to monitor & protect Southland wetlands. The ELI said drainage of wetlands for dairy farming required a resource consent, but that no resource consents were found for 61 wetland losses investigated in a 2020 report.

Cartoon of the day

To the doghouse?

Timeline cleansing nature pic of the day

Not really a spider about to be scuttled off

Ka kite ano

Bernard