Kia ora. Long stories short, here’s my top things to note in Aotearoa’s political economy around housing, climate and poverty on Tuesday, November 26:

The News: Non-profit lender Community Finance has launched a Community Housing Funding Agency to connect pension fund investors with Community Housing Providers (CHiPs) and accelerate non-state social home building. Launched last night with a private guarantee backed by philanthropists such as Stephen Tindall, Brendan Lindsay and Rowan Simpson, the new agency has called on the Government to provide a targeted guarantee to ‘supercharge’ lending to CHiPs to build thousands of homes, similar to that used by LGFA for councils and used overseas for non-Government social housing.

Scoop du jour: More than 70 vacant flats in Auckland Council's pensioner villages will be refurbished and rented out after sitting empty for years, some almost in ruin, Amy Williams reports this morning for RNZ.

Deep-dive du jour: Rachel Thomas has written a first anniversary analysis of the health system’s crisis because of the Government’s focus on debt reduction in The Post.

Solutions news: Miriam Bell also writes about the launch of an LGFA for CHiPs via The Post.

Editorial Opinion du jour: Diana Crossan & Malcolm Rands have written an Op-Ed in The Post about why a Capital Gains Tax won’t be enough.

(There is more detail, analysis and links to documents below the paywall fold and in the podcast above for paying subscribers. Normally, if we get over 100 likes we’ll open it up for public reading, listening and sharing, but I’ve decided to open this up from the start due to the public interest involved.)

The News: ‘Guarantee us to build thousands of homes’

CHiPs funder calls on Govt to guarantee billions to build social homes

Non-profit Community Finance has launched a Community Housing Funding Agency (CHFA) to connect the $300 billion managed by New Zealand pension fund investors with Community Housing Providers (CHiPs) in order to accelerate non-state social home building.

Launched last night in Wellington with a private guarantee backed by philanthropists such as Stephen Tindall, Brendan Lindsay and Rowan Simpson, the new agency has also called on the Government to provide a targeted Crown guarantee to ‘supercharge’ lending to CHiPs to build thousands of social homes. Similar guarantees are provided in the UK, Ireland, the United States and Australia to enable the building of significantly higher proportions of affordable homes.

Community Finance CEO James Palmer called on an audience that included Finance Minister Nicola Willis, Tindall, former PM Bill English and Labour housing spokesperson Kieran McAnulty for the Government to get involved to create a type of Local Government Funding Agency (LGFA) for CHiPs. LGFA borrows on behalf of councils with a Crown guarantee to dramatically lower borrowing costs and make it easier for fund managers to buy council bonds. The idea would be for the Government to provide a guarantee for the bonds issued by the CHFA, enabling much bigger bond issues to pension funds that require large lines of tradeable bonds with high credit ratings.

“While this is a big step, it is in line with Community Finance’s purpose and commitment as a social enterprise and will make it easier for a targeted public guarantee to follow in the future, as proven in Australia,” Palmer said.

“If we genuinely want to supercharge community housing in our country, this can be a defining moment in our history, when we truly bring together the best of philanthropy, impact investors, fund managers, charities and Government,” he said.

Community Finance has already arranged $165 million worth of borrowing for CHiPs, including the Salvation Army, connecting investments from the likes of Simplicity KiwiSaver, Westpac KiwiSaver and Harbour Asset Management in bonds used to build affordable homes.

Palmer pointed to the example of Housing Australia, which was launched in mid-2018 and has since lent over A$4.1 billion to Australian CHiPs to build 18,800 new homes and save A$740 million in interest costs.

He explained how the Crown guarantee could work:

A Government guarantee of the CHFA bonds would be a remote, contingent liability. While it would be noted in the Government’s budget, it would not have to carry a direct cost, as it would be improbable that it would be called upon. This makes sense when there have been no failures in this sector in New Zealand (as expected with the long-term Government funding) and reflects how they are treated by many other countries.

The Australian research which highlighted this approach to public finance accounting standards further noted, “Justification for the use of guarantees is often framed in terms of cost savings to government, as the provision of direct funds decline. Notable is the near zero default rate amongst the European social housing guarantees reviewed, and their minimal impact on government accounts.”

Palmer released a paper describing the model here:

Infrastructure and Housing Minister Chris Bishop is scheduled to talk to the Community Housing Association’s conference in Auckland later today.

Scoops du jour:

Housing: Half of Auckland council's pensioner flats vacant for years RNZ’s Amy Williams

Housing: ASB closes door to many preapprovals from mortgage advisers for rest of year RNZ’s Susan Edmunds

Health: Some referred to hospital 'five or six times' before being accepted, patient says RNZ’s Ruth Hill

Deep-dive du jour:

Analysis: Health hurts in a Government obsessed with debt. No toast, but more tobacco are the hallmarks of a chaotic year in health and a Government hamstrung by austerity and the coalition it’s in bed with. The Post’s Rachel Thomas

Solutions news

Housing: Impact investors hope to unlock as much as $500m for social housing. A new private sector social housing funding agency has been set up to better tackle New Zealand’s dire shortage of affordable housing. The Post’s Miriam Bell

Editorial Opinion du jour:

Diana Crossan & Malcolm Rands Op-Ed in The Post: The case for tax reform, and why a capital gains tax won’t be enough. Our current tax policies have accompanied a poorly performing economy with overpriced housing. Why would we keep doing more of the same?

The Kākā’s Journal of Record for Tuesday, November 26

Economy: Stats NZ's retail trade data for the September 2024 quarter showed core retail sales were down 1.7% compared with the September 2023 quarter, and total retail sales were down 2.8%. Retail NZ CEO Carolyn Young said the data matches its recent survey's finding that 70% of respondents failed to meet sales targets for the quarter.

Crime & poverty: A new 24/7 police station would be established in central Auckland as part of the Government's broader move to increase the "funding, power, and tools" of frontline police, Minister of Police Mark Mitchell and Minister of Justice Paul Goldsmith announced. The Federal Street station would open to the public in mid-2025. RNZ

Construction & environment: A report by waste and resource recovery peak body WasteMINZ argued that expanded polystyrene (EPS) should be classified as a contaminant under the Resource Management Act. The authors argued EPS is detrimental to both human health and marine and freshwater ecosystems, and could be replaced with safer alternatives.

Climate: University of Colorado and NIWA research found microbes in wetlands, landfills, and livestock digestive tracts were responsible for large spikes in methane emissions since 2020. NIWA scientist Peter Sperlich said particularly high methane emissions coincided with the 2020-23 La Niña event, which led to wetter conditions in methane source regions.

Poverty & health: A report by the Helen Clark Foundation found obesity now surpasses smoking as NZ's leading death & disability risk factor, and argued that the majority of NZers support stricter regulation on unhealthy food and restrictions on advertising. It recommended introducing a sugar tax, removing sugary drinks in schools, and ensuring healthy meals in hospitals.

Climate: The Conversation presented COP29 with a report on a Pacific climate adaptation study arguing that the World Bank and IMF, in their role as key climate finance institutions, are loading Pacific countries with unsustainable levels of sovereign debt, with private contractors the "real beneficiaries." The report found 72% of funds for adaptation and mitigation was in the form of loans.

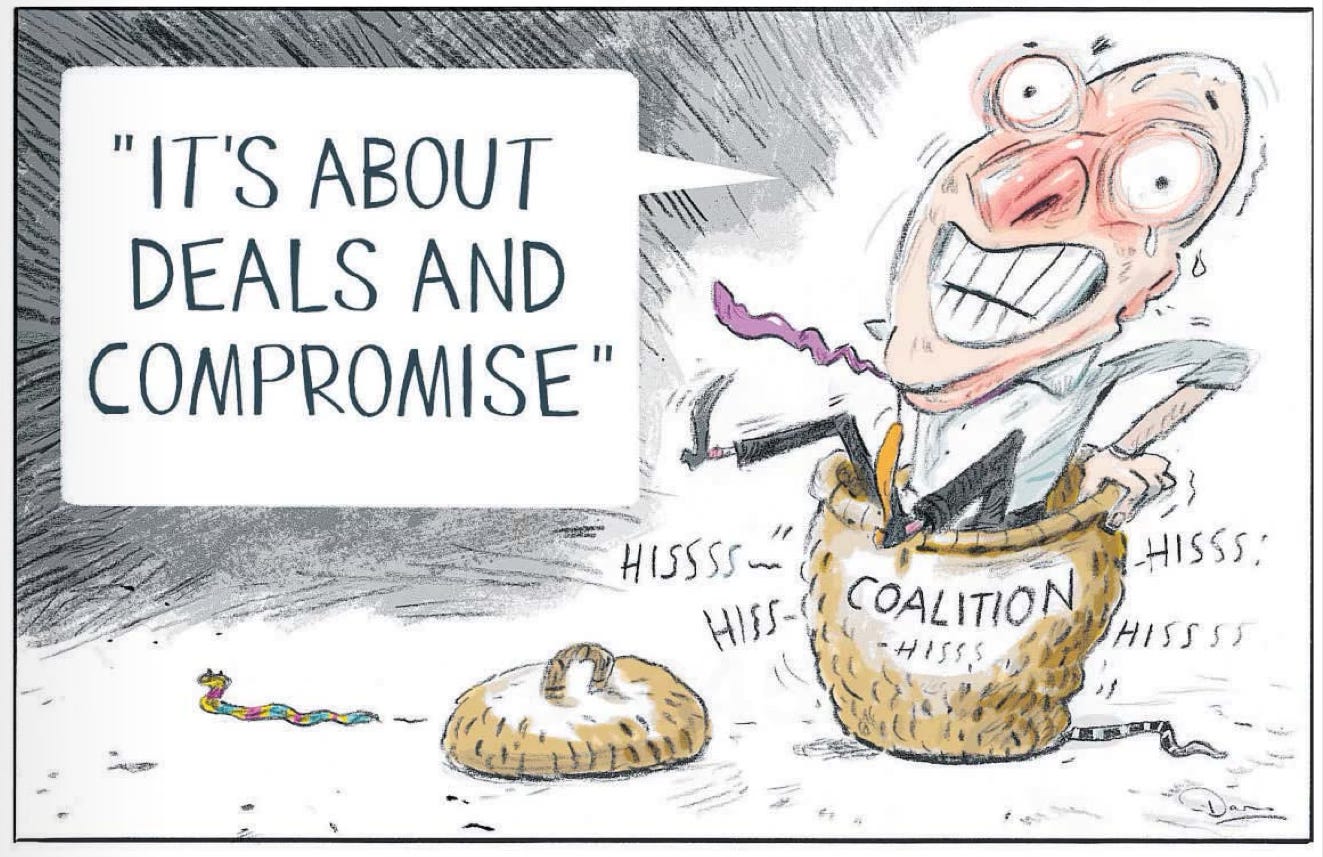

Cartoon du jour: Snake charmer?

Timeline-cleansing nature pic of the day:

Ka kite ano

Bernard

Share this post