TL;DR: - Transport Minister Michael Wood announced changes to the Government’s much-more-successful-than-expected Clean Car Discount scheme this morning that he talked up as increasing emissions reductions and increasing rebates for used electric imports.

That’s how the changes are initially being reported, but a closer look reveals a doubling of fees for double-cab utes such as the Ford Ranger and Toyota Hilux, a reduction in rebates for Teslas, and the removal of rebates for most small new and used petrol cars and hybrids, including hybrid used Toyota Aqua, Toyota Prius and Toyota Vitz, as well as the Suzuki Swift — all of which were being bought by poorer drivers.

In essence, the Government has reduced incentives to buy electric and low emissions vehicles to ensure a scheme designed to cost the Government nothing reverses a deficit that has already used up all of a $300 million loan from taxpayers. It was done to save money in the short term.

It begs the question: why isn’t the Government using some of the $3.6 billion left in its Climate Emergency Response Fund (CERF)1 to increase the loan by more than the extra $100 million committed today, especially when CERF spending in the about-to-end financial year is $157.7 million below its budget?

In my view, the Government appears to be again choosing reducing its cash deficit in preference to reducing emissions because lower inflation and lower interest rates help bolster residential land prices. Again, the Government is choosing the interests of median-voting land owners over reducing emissions generally, or a just transition to carbon zero in particular. The irony is that many of those median-voting outer suburban home-owners will focus instead on the doubling of the ‘ute tax’, rather than the effects on interest rates and land prices.

This punishes Ford Ranger man, as well as Toyota Aqua-buying Uber drivers

Paying subscribers can see more detail, charts, tables and analysis below the paywall fold and hear that analysis in the podcast above. I can send the full post wider later today if paying subscribers think it’s a good idea in the comments.

When fiscal neutrality trumps emissions reductions

This morning’s announcement about the Clean Car Discount scheme by Transport Minister Michael Wood was a masterclass in putting a good face on what was essentially a money-saving decision that reduces the size of emissions reductions that handicaps a scheme that had become a roaring success.

Here’s how he presented it (bolding mine), vs what the Ministry of Transport announced this morning from its 38-page review:

The Clean Car programme will reduce 50 percent more emissions than originally estimated by 2035, and 230 percent more by 2025

(It is) forecast to save New Zealand from importing 1.4 billion litres of petrol. At current prices the economy will save an average of $325 million a year on fuel

Adjustments to scheme to maintain momentum, including:

narrowing the focus to more fuel efficient vehicles earlier than planned;

reductions in rebates and increases in fees paid by higher emitting vehicles;

rebates for zero emission used import vehicles will increase from $3,450 to $3,507;

adjustment in eligible vehicles to promote EV uptake; and,

a special rebate for new and used low emission disability vehicles introduced.

Crown to increase the Clean Car Discount’s repayable Crown grant by $100 million in Budget 2023. Michael Wood statement

So what actually happened?

It’s true the programme will reduce emissions by more than originally estimated in 2021, but that’s because it was vastly more successful than expected in increasing purchases of low-to-no emissions vehicles. The changes announced today will reduce the trajectory of emissions reductions the scheme was on this year, before the announcement of changes.

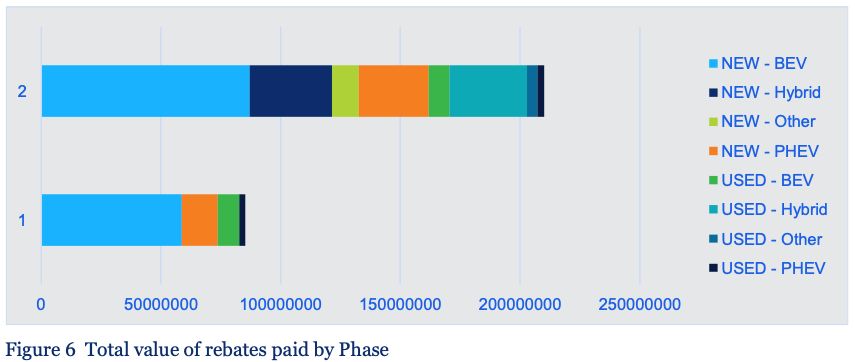

The scheme was vastly more successful than expected, especially in encouraging buying of both new all-battery cars such as Tesla 3 and Tesla Y, as well as much-cheaper used hybrids, such as the Toyota Aqua, Toyota Prius, Toyota Vitz and Suzuki Swift. The uptake of hybrids and used hybrids accelerated in phase two of the scheme that started in April 2022.

This meant the payouts for rebates was much higher than expected, while the income from fees on gas guzzlers was closer to expectations. The scheme was supposed to be back in surplus this year. Instead, the Ministry advised in the review finalised in March that the original $300 million fund would be exhausted by April — last month.

The fund was already depleted

Here’s the table of expected revenues and rebates from the original Cabinet paper on the scheme, including a scenario where the take-up is much stronger than expected, which was eerily prescient in this aside:

In 2023 if electric and hybrid vehicles are adopted at the highest modelled uptake

level (over 60,000 vehicles), there is a risk of rebates pausing in this year due to lack

of funding, supposing that fees were not raised that year. Original Cabinet paper

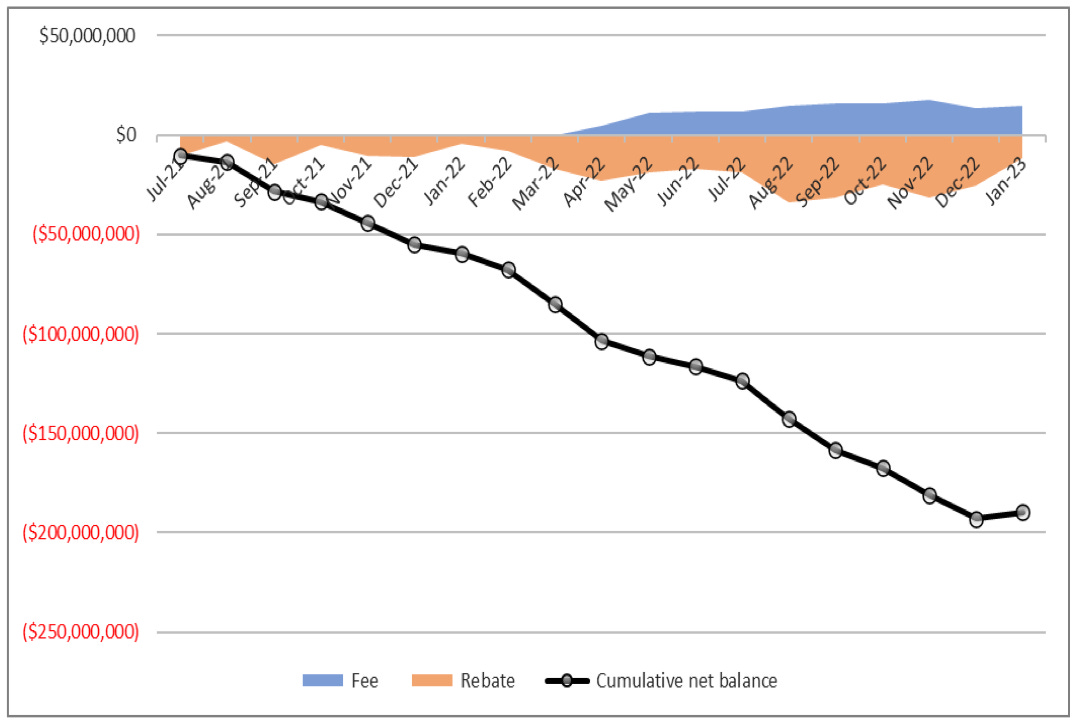

Here’s what actually happened, using data up to the end of December showing a $193 million deficit:

The Ministry of Transport noted in the March review (bolding mine):

Figure 3 (below) shows the fees collected, and rebates paid out for Phase 2 of the CCD from 1 April – 31 December 2022. During this data period, the rebate expense is growing to roughly twice the income from fees. Since August 2022, the proportion of brand new EVs has risen significantly.

The primary rebate cost is for brand new EVs (from which benefits also derive) and the second highest cost is from hybrids and low emission vehicles (split evenly between new and used).

Based on the monthly running totals of the net financial position, as of February 2023, Waka Kotahi has forecast that there are sufficient funds to last until April 2023.

The aside above suggested what officials thought the Government would have to do if it was ‘too’ successful: completely suspend the scheme. Instead, it chose to throttle the rebates for hybrid and Tesla buyers, and ramp up the fees for gas guzzlers. That will reduce emissions from double-cab ute drivers, but also restrict emissions reductions from those who now won’t buy hybrids. It punishes Ford Ranger man, as well as Aqua-buying Uber drivers.

‘Look at the Leafs, not the Aquas’

Wood’s statement was misleading in also pointing to an increase in the rebate for buyers of used all-electric cars, such as the barely-available Nissan Leaf, but not mentioning the lower rebates for new and used hybrids and low emissions vehicles such as the Toyota Aqua and Honda Fit hybrids, and not specifying the scale of the extra fees for buyers of double-cab utes and SUVs.

Choosing to throttle the benefits of the scheme and further punish double-cab-ute buyers without electric-powered choices is not only dumb policy. It is dumb politics.

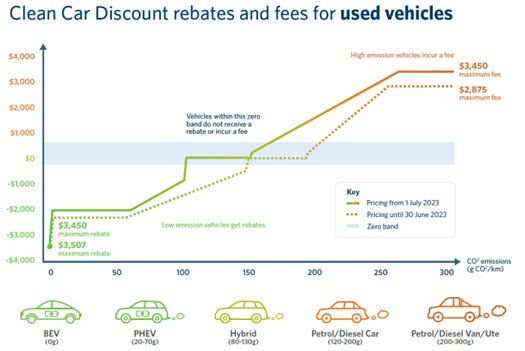

Here’s the changes below in chart form from the Ministry of Transport paper showing the higher fees for double-cab utes the lower rebates for hybrids and used low-emissions imports. The table below shows exactly how the fees and rebates change for new and used vehicles. The key things to note from that table are:

Ford Ranger fee doubles to $5,290 and Toyota Hilux fee rises 88% to $5,635;

New Suzuki Swift loses its $1,923 rebate entirely;

Toyota RAV 4 Hybrid loses its $2,387 rebate entirely;

Tesla Y and MG ZS rebates fall 19% to $7,015;

Mitsubishi Eclipse and Outlander plug-in hybrid discounts fall 30% to $4,025;

Toyota Corolla petrol goes from no fee to a $920 fee;

Honda Jazz petrol goes from a rebate of $1,098 to no rebate;

Toyota Yaris Cross SUV and Kia Stonic lose their $1,511 and $1,202 rebates entirely;

Used hybrid Toyota Aqua and hybrid Toyota Prius see their rebates drop from $1,615 and $1,409 respectively to $1,179 and $891 respectively; and,

Used hybrid Honda Fit loses its $1,285 rebate entirely.

The only improvements were increases in the rebate for used battery-only imports (VW Golf and Nissan Leaf) by $58 to $$3,508, which was the thing Wood focused on. He didn’t mention the rest in his statement.

If only the scheme was allowed to keep running

The scale of the need for increasing emissions reductions using the scheme was illustrated in the Regulatory Impact Statement in the original Cabinet paper, which estimated emissions reductions from the scheme of 2.6 million tonnes to 9.2 million tonnes between 2022 and 2050. This was pointed out by Treasury in its advice:

…current net emissions are in the order of 70 million tonnes per annum, and growing, but this needs to be 60 million tonnes (14% lower) every year from now until 2030 to reach our Paris Target

Even more importantly the cost per tonne reduced, the marginal abatement cost, was actually minus $170 to minus $199 per tonne. That means there was not a cost, but a benefit to the economy, as Treasury pointed out in explaining the negative abatement cost:

“This is primarily due to the significantly reduced ongoing fuel costs that New Zealanders would pay by being able to afford to buy a zero or low emission vehicle through this policy. This makes the Clean Car Discount an effective and efficient policy to reduce emissions.” Treasury advice in the Cabinet paper.

These changes now mean the emissions reductions will be lower than the current trajectory, yet Wood painted this as a positive:

“The scheme is also now forecast to reduce emissions by 3.4 million tonnes by 2035. That’s an additional 50 percent out to 2035 over and above what was forecast when it started. It will deliver twice the emissions reduction forecast between the start of the scheme and 2025.” Wood.

But how many more million tonnes could it have been? The 2021 advice suggested potential reductions of up to 9.2 million tonnes by 2050. I have yet to find the numbers of the potential reductions if the scheme had been allowed to run in its current form by 2035. Given the effective ‘free’ non-cost to the economy of minus $170 to $199 per tonne, it would have been justified in climate emissions accounting terms to keep going.

So why not use other climate funds to subsidise the scheme?

The Government had other choices, rather than to just throttle the scheme and limit the financial cost to another $100 million. It could have used the Climate Emergency Response Fund (CERF), which Treasury reported at the end of March still had $3.6 billion in it, and that spending in the just-about-finished 2022/23 financial year of $462.6 million was $157.7 million below the budgeted amount of $620.3 million. The amounts able to be spent from the CERF are forecast to go up to $791.5 million.

There was money there in the fund to keep going at full noise with the scheme, which Treasury has advised was not only a cheap way to reduce large amounts of emissions, but actually earned the economy more money.

So why decide to bottle it?

In my view, the Government’s focus on fiscal neutrality and getting the Budget back into surplus so as to reduce public debt and make interest rates slightly lower than would otherwise be the case is clearly its top priority.

It is prioritising lower inflation and lower interest rates help bolster residential land prices, choosing the interests of median-voting land owners over reducing emissions generally, or a just transition to carbon zero in particular.

Politically, the changes also aren’t that clever. The Government will further inflame the anti-ute-tax Groundswell constituency, while also losing the support of both its left-leaning voters and those reliant on second-hand Toyota Aquas and Suzuki Swifts.

The Government effectively chose the worst of both worlds: both alienating Ford Ranger Man and punishing Suzuki Swift buyers because of the success of its own policy, without getting credit for the short-term financial benefit in the form of a few basis points of lower mortgage rates.

It could have just left the scheme running, or even increased the incentives for electric car buyers, while reducing the fees for double-cabe ute buyers.

Choosing to throttle the benefits of the scheme and further punish double-cab-ute buyers without electric-powered choices is not only dumb policy. It is dumb politics.

The Craic

Cartoon of the day

‘This road is mine. How dare you take it off me’

A fun thing

‘Can everyone just look at these hopping lemurs.’ Nature is Amazing on Twitter.

Ka kite ano

Bernard

Govt throttles rebate scheme for electric cars