TLDR & TLDL: Interest rates fell sharply overnight on fears the war in Ukraine and the shock of higher oil and gas prices could freeze a post-Covid rebound in global growth and inflation in its tracks.

That’s great news for anyone worried that Aotearoa-NZ’s main asset prices in the housing market are about to start falling fast. Slower interest rate rises are being priced in, which will support global asset prices.

Elsewhere in the news this morning:

CoreLogic reported house price inflation fell to 17 month low in February and is seen going negative in the months to come (see a lot more on this below)

German 10 year bund yields fell back below 0% on a flight to safety in Government bonds and on fear the war in Ukraine will shock Europe into recession; and,

money market stress is growing and traders are suggesting central banks again flood the financial system with new US dollars to stop a market freeze.

An autumnal wind blows through housing

Aotearoa-NZ’s housing market is heading for a year or two in the chiller as 2022’s autumnal open home season begins, thanks to higher interest rates in the second half of last year and a joint Reserve Bank/CCCFA tightening of lending standards in November and December.

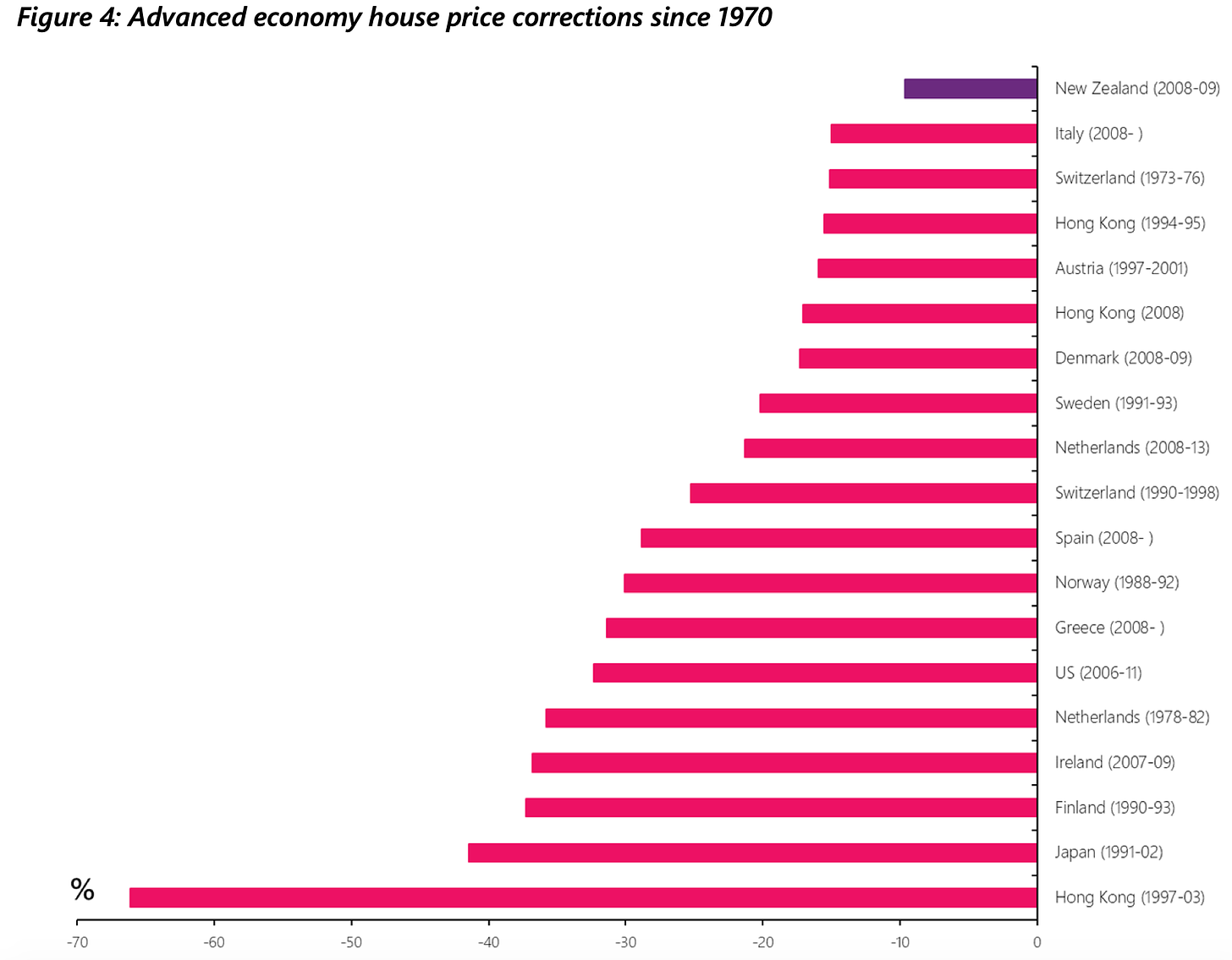

But, as with past housing downturns, our market tends to slow sales volumes to a crawl and prices tend to freeze rather than free-fall, leaving most sellers able to wait out ever-hopeful bargain-hunters until the inevitable (Government-Guaranteed) next surge in prices. Unlike other asset markets, our housing market tends to ratchet sharply up, but never down in any great way. Apart from the divorcees and estate sellers, most won’t accept significantly lower prices and their banks won’t force them to. Get ready for a blowout in the average time for properties to sell.

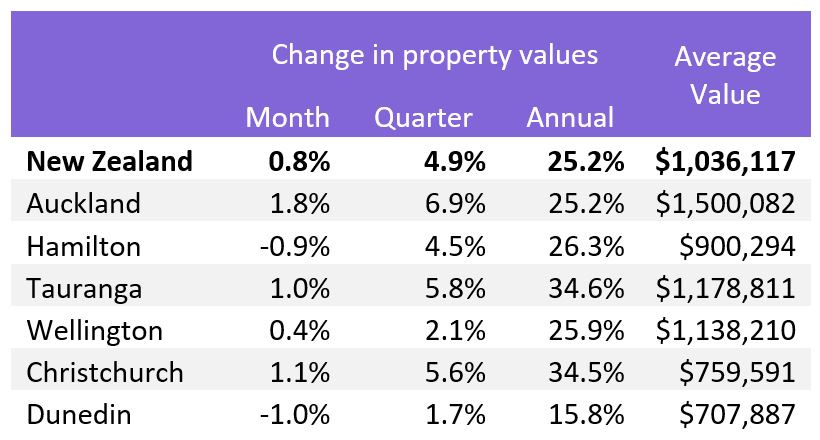

CoreLogic reports this morning the chilling of the housing market has already begun. It released figures showing there was still 0.8% House Price Index (HPI) inflation in the month of February, the lowest inflation rate since September 2020, but this is largely due to the lagged effect of massive inflation late in 2021 and the way CoreLogic smears three months of data through to the most recent month in its calculation.

New mortgage lending halves in two months

The more ‘bleeding edge’ but slower raw data from REINZ showed prices actually fell in December and January by a total of 2.7% from the peak in November. We won’t see REINZ’s February numbers for another week or two.

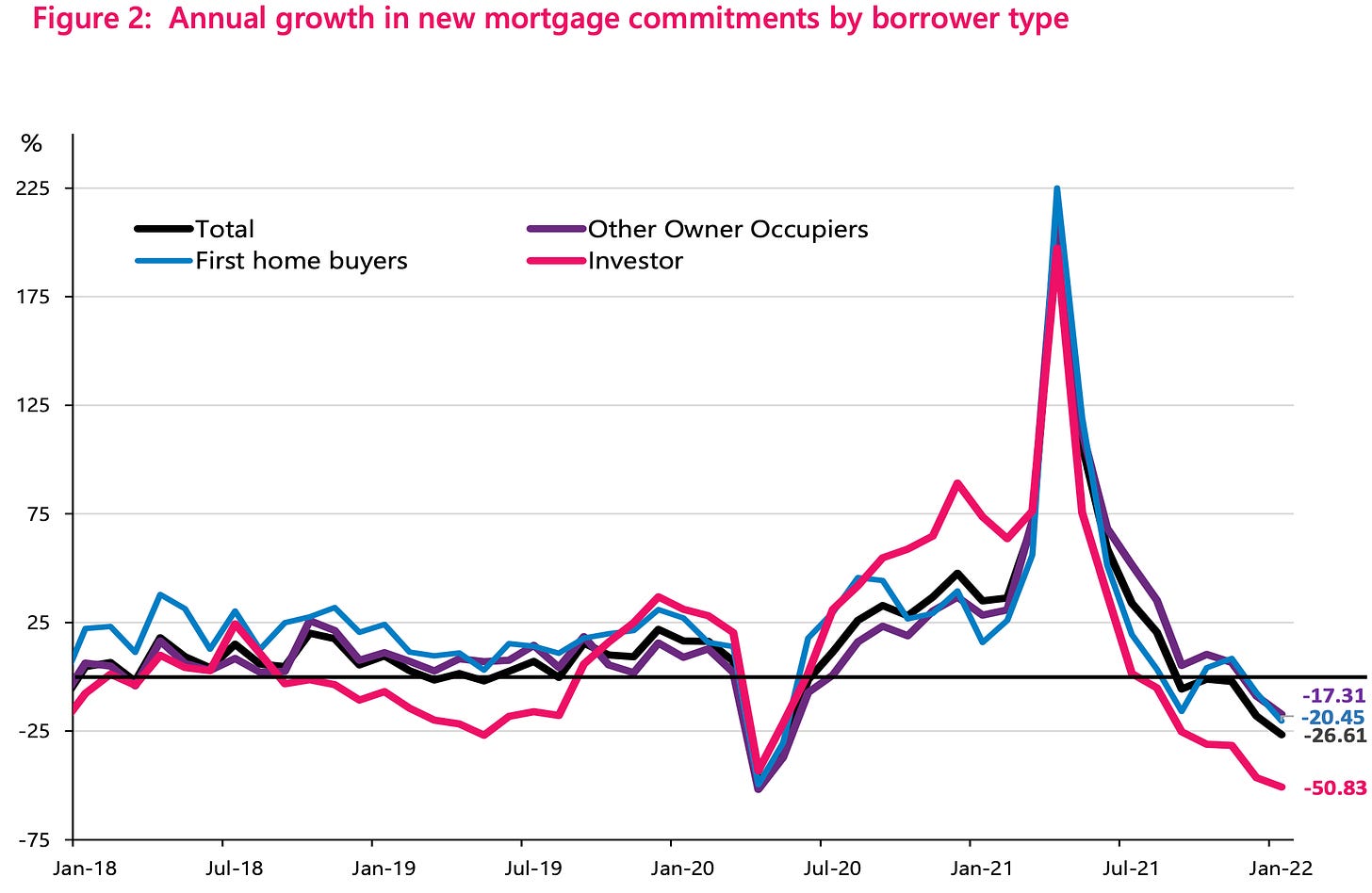

CoreLogic’s NZ Head of Research Nick Goodall points to Monday’s Reserve Bank lending data for January as both evidence and cause of the chilling effect of less credit being pumped into the market.

That data showed total new mortgage lending fell to $4.7b in January from $7.9b in December and $9.1b in November. Net overall mortgage lending rose just $1.7b in the month of January to $332b, which is down from an average monthly growth rate of $2.4b from April 2020 to November 2021, which is when the Reserve Bank’s tighter LVR restrictions kicked in and as the CCCFA was about to kick in.

“Recently published lending data for January from the Reserve Bank shows a significant drop in mortgage activity, adding additional weight to the worsening housing outlook. This trend is likely to persist, as stretched affordability and improved choice for buyers compounds the impact of tighter, more expensive lending.

“The lending data also showed first home buyers are being hit extra hard by recent changes in the credit environment, from the reduced allowance for low deposit lending and tighter income/expense checking under the Credit Contracts and Consumer Finance Act (CCCFA).” CoreLogic

‘A clear change in trend’

Goodall sees a continued cooling.

“Our expectation is the HPI will dip further over the coming months as continued rate hikes and tighter credit controls weigh on market conditions. The significant drop in the monthly rate of growth from January to February indicates a clear change in trend.”

“Regional differences will also start to appear, as local economies, recent first home buyers and property investors all react differently to the changing environment.” Nick Goodall

HODL and dip-buying

Those home owners looking to sell for lifestyle, empty nest or work location reasons will be able to hold without having to take a massive price cut. Even the Reserve Bank only sees another 6% or so of house price falls over the next two years because our market only ever gaps up, rather than gapping down. The Reserve Bank’s underpinning of bank stability and liquidity is a major reason for that.

Few expect any slide to be more than a further 5-7% over the next year or two, rather than the 30-40% implied by some sort of reversion to ‘normal’ house price to income and rent ratios seen overseas. That’s because unemployment is low, disposable income growth is high, equity levels are sky-high and because our banks don’t need to trigger mass mortgagee sales and won’t. They are well capitalised, very profitable and have been repeatedly backed by the Reserve Bank’s infinite ability to create cash to keep them liquid and the loans flowing.

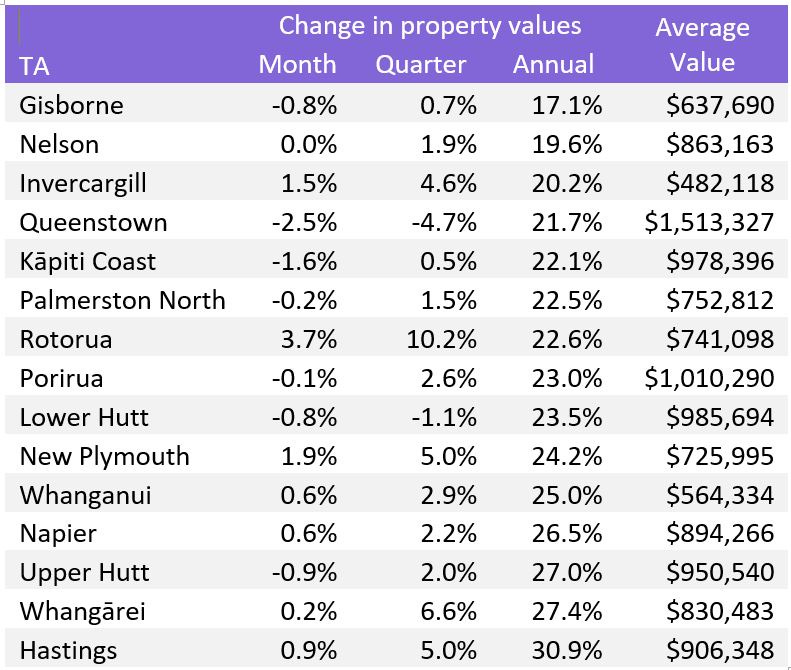

But some areas are falling

But as with any national market, there are some pockets of weakness showing through. Those smaller cities that have raced the highest and the fastest over the last two years are coming off the boil the most.

The cavalry may be coming

Usually at this point in the housing market’s ‘cycle’, home owners settle in to wait for another low-inflation surprise to signal another equally ‘surprising’ leg down in interest rates to put another fire under the market.

However, most think the current direction for interest rates is ever higher, possibly even in a structural way that reverses some of the last 30 years of falls.

That jury is still out though, in my view. Here’s the latest evidence that expectations of big and fast interest rate hikes are brittle at best.

Interest rates fell sharply overnight

Watching an increasingly intense and big land war exploding in Eastern Europe, global investors exited stocks and riskier corporate bonds overnight in a rush to buy US and European Government bonds seen as safe havens in a storm. That pushed up bond prices and pushed down yields. Some are even suggesting a global recession is possible later this year and next year if consumers react badly to further energy price shocks and real wage declines and if Europe’s economy is jolted to a halt.

The key US 10 year Treasury bond yield fell by 13 basis points to 1.71% overnight, its lowest level since January. The German 10 year bund yield fell back below 0% for the first time in month.

Traders are also dialling back their expectations for higher short-term official interest rates in the United States and the Euro zone. They now see the European Central Bank lifting its key deposit rate by just 20 basis points to minus 0.3% this year. They had seen a shift up to 0% before the outbreak of war. In the United States, investors have discounted the chances of a 50 basis point hike by the US Federal Reserve on March 16, seeing only a 25 basis point start to a series of five hikes this year. Previously they had expected six hikes this year.

Money markets becoming stressed

Further to my piece yesterday on the risk that the freeze of Russian central bank assets could rebound into dislocations in short term money markets globally, there were new signs of stress in these markets overnight, as Bloomberg reported via YahooFinance:

Money markets are showing the most stress since the early days of the pandemic as traders race for dollars in the wake of toughened sanctions against Russia, prompting calls for help from central banks.

The cost of converting both euro and yen payments into dollars using three-month cross-currency basis swaps hit the most since March 2020. The gap between future Libor and Federal Reserve rates, a key gauge of funding stress known as the FRA/OIS spread, also widened for one-month contracts by the most since March 2020.

The moves in funding markets have similarities to the global run on the greenback triggered by the coronavirus pandemic, though not on the same scale. That pushed the Federal Reserve to step in as the lender of last resort through swap lines, which eased a dash for dollars. Some swap lines between the Fed and major central banks are still in place, while others have been closed after the pandemic distortions receded.

The Fed in 2021 established a repurchase agreement facility for foreign and international monetary authorities, known as FIMA, to help alleviate pressures in global dollar funding markets.

“We are likely to see some emergency measures including EUR and USD swap lines in the coming days,” said Mohit Kumar, a London-based managing director of interest-rate strategy at Jefferies. “The immediate concerns of central banks would be to maintain a proper functioning of the funding markets and prevent any stress in the banking system.” Bloomberg via YahooFinance.

‘There’s always a bailout’

These latest signs of drama in global financial markets caused by a ‘black swan’ event such as a pandemic or war are just the latest in a string of instances where financial markets, banks and asset values are protected from falling substantially by central bank action.

Hence the now natural reflex of a generation of investors to Hold On For Dear Life (HODL) and buy any dips, so as to be sure to get the next leg of rising asset prices and in the surety that financial authorities globally have asset owners’ backs.

Those first home buyers and home owners wondering if the last month or two of falls in prices is a precursor of some sort of secular slump in asset prices caused by a multi-decade reversal in inflation and interest rate trends should be careful. We’ve been here before many times. And every time the fall has threatened to go into double-digits, there has been a central bank and Government reaction to stop that.

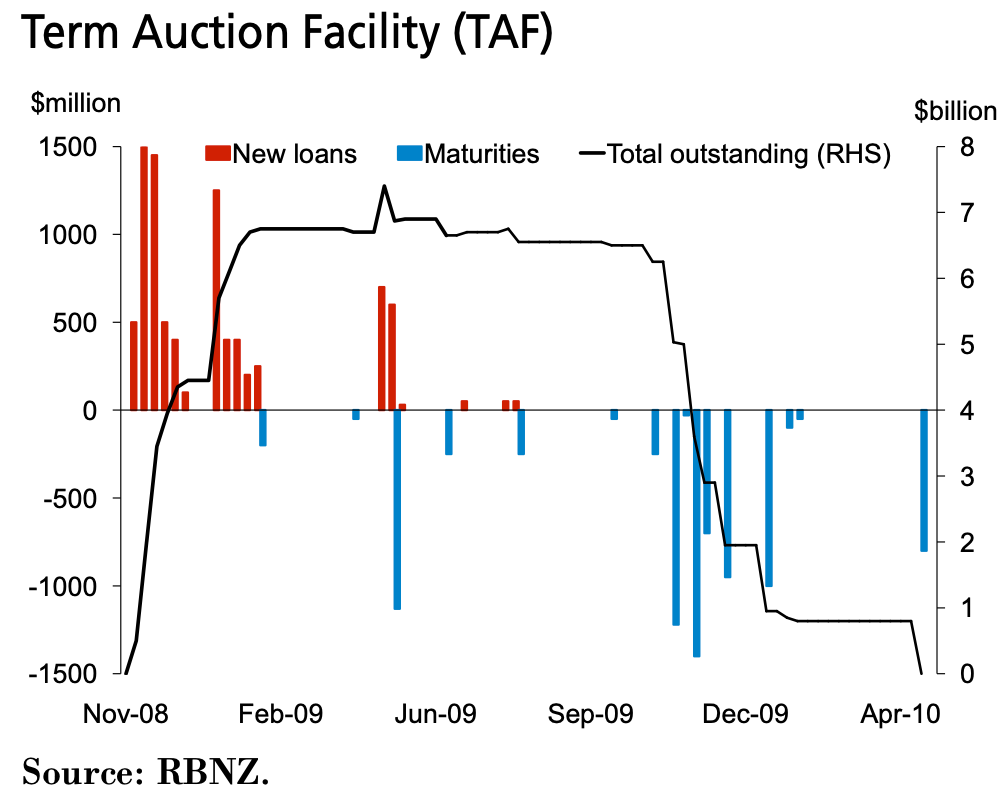

Two housing market bailouts in 15 years

It has happened twice here in the modern era, once in 2008/09 and again in 2020/21. The measures taken included:

between October 2008 and April 2009 the Reserve Bank lent our big four Australian-owned banks over $7b in freshly minted money through a Term Auction Facility (TAF) (see chart below) when they couldn’t get fresh ‘hot’ money from global markets frozen in the wake of the Lehman Brothers crash;

the Government (under both Labour and National) created a wholesale and retail deposit guarantee scheme within days in late 2008 to maintain confidence in banks and stop them having to launch mortgagee sales;

The Reserve Bank slashed the OCR from 8.25% in July 2008 to 2.5% by April 2009 and lent the banks the $7b to banks at a small margin over the OCR;

then-PM John Key decided not to accept the 2010 Tax Working Group’s recommendation for a 1% land tax because he feared the resulting 10-20% fall in land values would endanger confidence in the banks;

Key spoke repeatedly through 2010 and 2011 that the housing supply crisis he had talked about through 2007 and 2008 was no longer a problem and the Government did not need to encourage new house building and pressure prices lower;

on March 16, 2020, the Reserve Bank slashed the OCR from 1.0% to 0.25% just before Covid lockdowns;

it then created money to buy $55b of Government bonds to lower long term interest rates from March 2020 to July 2021;

it created a Funding for Lending loan facility in December 2020 that lends to the banks at the same rate as the OCR to encourage them to lend freely. It is still operating and $8.2b has been lent to banks as Monday;

it completely removed LVR restrictions in April 2020 for a year to ensure banks kept lending to home buyers, along with pausing a capital upgrade programme that would have forced banks to hold more capital, which usually slows their lending growth; and,

it exempted mortgages being deferred from its capital requirements for banks in late March 2020 for a year, which allowed banks to more easily defer mortgage payments.

‘It’s our role to reduce financial stress on the economy’

To give readers an idea of how the Government and the Reserve Bank saw its role, here is the commentary in a Reserve Bank paper from 2011 that reviewed the various measures taken during the financial crisis (bolding mine)

“Beyond the immediate aim of calming money market tensions and reducing short-term funding spreads, the supportive actions undertaken by the Reserve Bank were also intended to reduce the impact of financial market stress on the real economy.

By providing confidence in access to necessary liquidity during a period when wholesale funding was extraordinarily expensive, or unavailable, these policy measures probably reduced the risk of a very severe domestic credit crunch. That in turn may have limited the depth of the recession, complementing the effects of the very steep reductions in the OCR during this period.” Enzo Cassino and Aidan Yao in a June 2011 Reserve Bank research paper.

Why housing is so special

This willingness and requirement by Government to ensure house prices and banks do not collapse is one reason why New Zealand housing market is so special in being the least likely to fall heavily of any housing market globally, and certainly of any asset class.

Other assets such as shares, bonds, crypto and commodities show a volatility natural in any free market where demand and supply act to ‘clear’ a market and find an equilibrium. Housing is not allowed to, largely because of the way our housing market is so deeply intertwined into a banking system that is more exposed to house values than any other in the world, and has become much more so over the last two years.

The housing market is special because it is now too big to fail, or even fall much.

Could anyone imagine the Reserve Bank intervening to stop a 30% fall in share values, or cow values, or crypto?(!). No. But it will for housing. It has done so twice in 15 years and would do so again if the current softness turned from being a mild correction of less than 10%, which was what we saw in 2008/09 and what is forecast over the next 18 months by the Reserve Bank.

It’s morally hazardous and deeply unfair to young renters

There is, of course, massive moral hazard and inter-generational inequity built into the effective Government guarantee under our housing market. It not only stops that ‘ladder’ being let down for others to get onto it, but it actively ensures that the Reserve Bank and the Government ensure the ladder is pulled up to ensure the next group who make it into the tree house aren’t overloaded with debt.

It locks in place the biggest intergenerational wealth transfer in the nation’s history, and means the ‘natural’ mechanisms of the market cannot ‘clear’ to ensure an equilibrium that means housing supply is allowed to reach housing demand at a level in line with the long run marginal cost of new homes.

It is a broken market and the Government and the Reserve Bank are now so deeply invested in keeping it broken that that they regularly rebreak it to ensure it never heals properly through a proper correction. They do that because they have built a market that is too big to be allowed to fail, both for bank safety reasons and median voter winning reasons.

Scoops and news of note elsewhere

ACT and National called on Ashley Bloomfield to go after he admitted yesterday the Covid testing system had nowhere near the capacity he had previously indicated. (Stuff, Stuff, NZ Herald)

The Warehouse and Chemist Warehouse have started selling (and selling out of) RATs as Covid patients scramble and queue to get hold of them. The PM had said they would be free. (Stuff, Stuff)

Tex Edwards has told the Commerce Commission’s building materials market study that house building costs are three times what they could be (Stuff)

ANZ in a research note estimated up to 20,000 New Zealanders could leave to go and work in Australia over the next year.

Chinese state-owned bank (and NZ registered bank) ICBC stopped guaranteeing credit in dollar terms for bilateral trades with Russia to avoid secondary sanctions from US authorities. (Bloomberg)

Maersk, Hapag Lloyd, MSC and ONE have all suspended bookings to and from Russia, meaning almost half of the world’s container fleet by volume are boycotting the world’s 11th largest economy. (Reuters)

Visa and Mastercard blocked multiple Russian financial institutions. (Reuters)

Signs o’ the times news

Number of the day

Useful longer read

Thread of the day

Comment of the day on The Kākā

“Kia ora Bernard. In the same way you tend to see so many Aotearoa-NZ stories as housing market stories in drag, my main take on both Covid and Russia's invasion of Ukraine is that future generations will consider them both climate change stories. They're things that happened partly as side-effects of our ongoing failure to regulate ourselves out of the economic behaviours driving climate disaster (habitat destruction plus air travel, in the case of the pandemic; the Ukraine war requires drawing a longer bow, but by definition, if we'd solved the problem of electing leaders able to take us where we need to be going, we wouldn't be dealing with Putin right now, and we wouldn't have Trump's return looming on the two-year horizon). And they're also the distractions we're choosing to prioritise over climate sanity. Today's IPCC report is just the latest speeding ticket given to the drunk driver currently at the wheel of history: us. I keep thinking we're going to sober up at some point. Except it is, clearly, going to be a point well after the tipping points for the tundra methane deposit release and the melting of the ice cap. We're now counting on being the drunk driver who doesn't get themselves killed or maimed. I'm not being sarcastic when I say I wish us and our children all the luck in the world.” Leaflemming on yesterday’s ‘Opening up and closing down’ article.

A fun thing

Have a great day

Ka kite ano

Bernard

Share this post