TLDR: House prices in the bleeding edge suburbs of Auckland City and Wellington City are about to trough out around 15-20% below their late 2021 peaks. They and the rest of the country’s housing markets are set for strong rebounds from late 2023 if, as markets and opinion polls currently suggest, mortgage rates are falling and there’s a National-ACT Government by then.

That rebound will likely be super-powered by the repeal within the first 100 days of the new Government of various new taxes on landlords, a freeze on housing infrastructure and transport investment and an unleashing of migration-driven population growth that softens inflation, drives down Budget deficits and sucks mortgage rates ever lower.

Our economy is already a housing market with bits tacked on and has been for 20 years. The market’s ups, downs and ups again from 2020 to 2025 are set to extend that maxim to being: Aotearoa-NZ’s entire society and future is a housing market with bits tacked on.

House prices set for late 2023 rebound after 15-20% fall

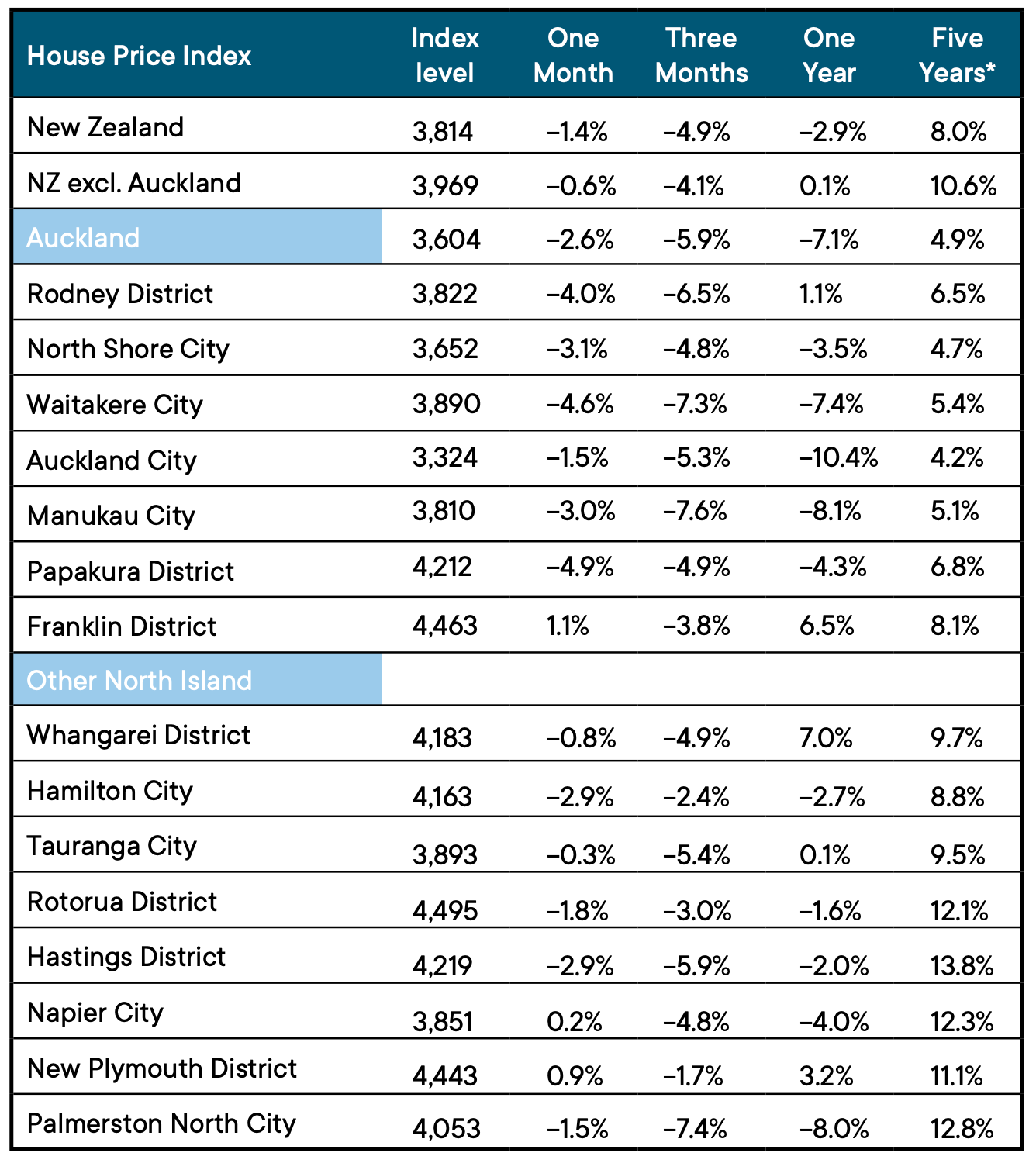

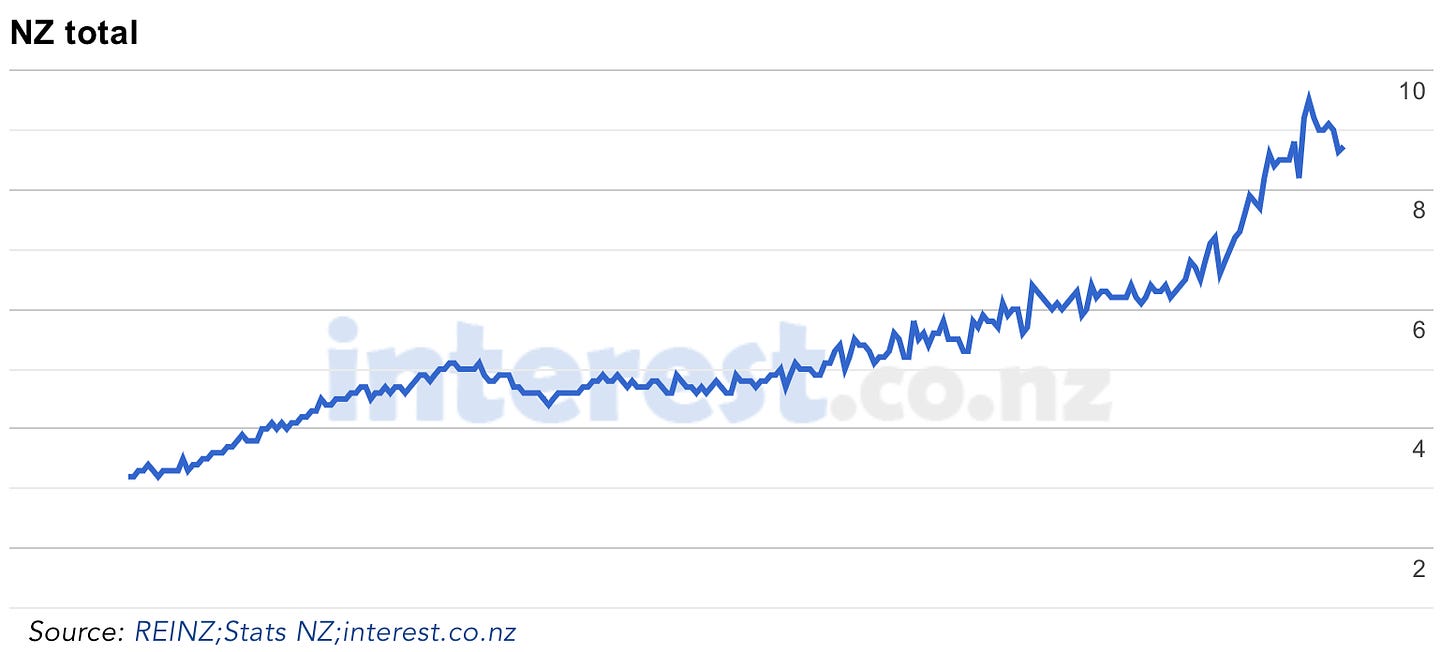

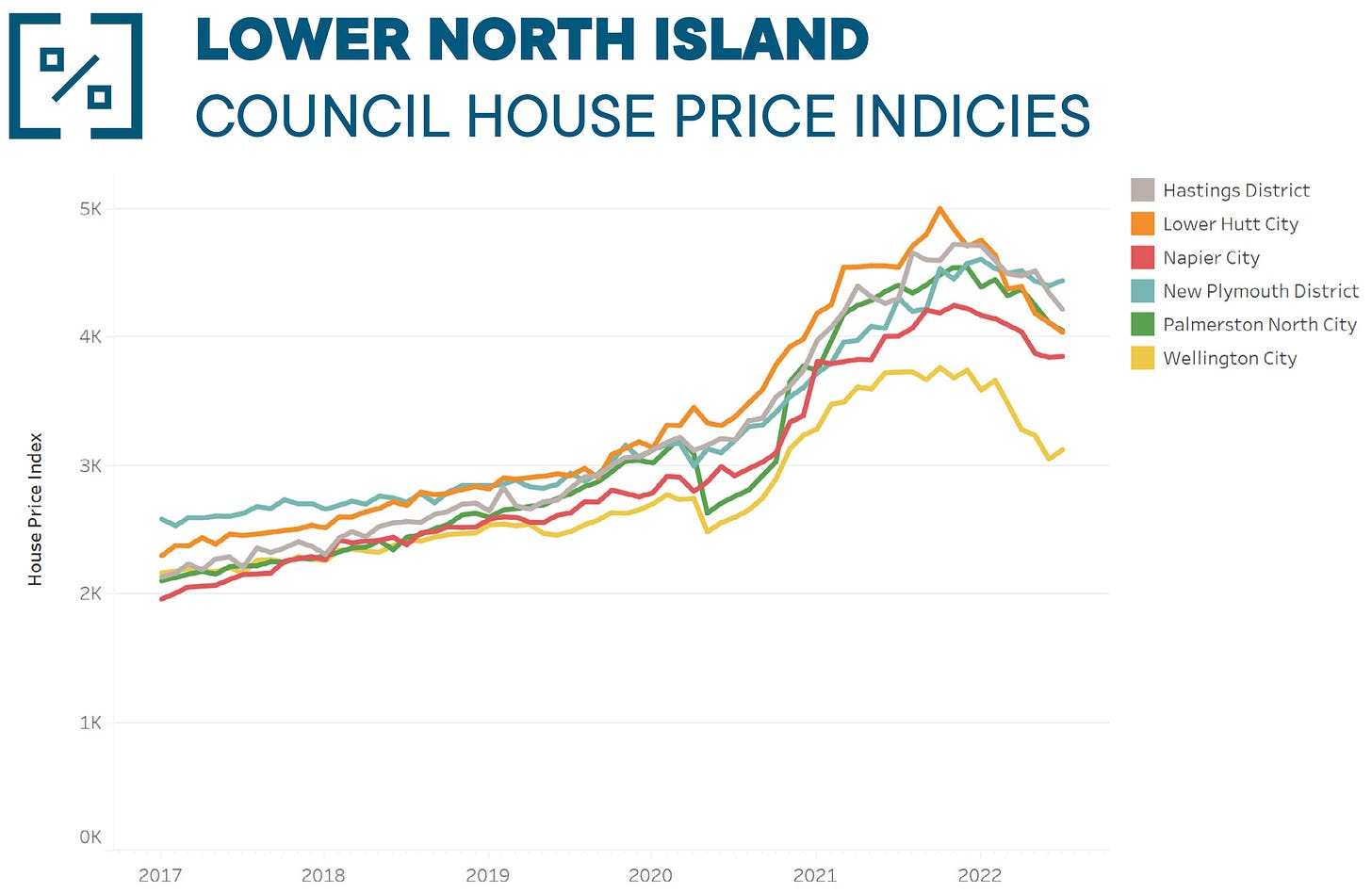

Are we there yet? - The REINZ reported yesterday its House Price Index (HPI) for Aotearoa-NZ fell 1.4% in July from June and was 2.9% down from a year ago. That meant prices nationally have fallen 10.9% from their peak in November last year. Prices in Auckland City are now down 17.2% from their November peak and Wellington City prices are now down 18.8% from their October peak, although they bounced 2.4% in July from June. Wellington City’s peak-to-trough fall was 20.1%.

So what? - The Reserve Bank and most economists have forecast falls from peak to trough of around 15% by the end of this year, with the most pessimistic seeing falls of around 20%. These figures suggest we’re about two-thirds of the way through that fall, with a bit more than that to go in places outside of Auckland and Wellington.

But there are tentative signs of a plateauing out in the bleeding edge areas such as Auckland City and Wellington City. Interest rates have stopped rising, migration is restarting and many investors are becoming more hopeful of a change of Government late next year, which would see interest serviceability, ring-fencing and bright-line taxes repealed, along with a softening of expensive rules forcing landlords to make homes warmer.

The bottom line - First home buyers wondering if they should wait for prices to keep falling back to their pre-Covid levels should stop wondering. It won’t happen. Home owners look set to retain at least half of the 45% gains they saw in their house values between March 2020 and November 2021. Cooling inflation, falling fixed mortgage rates and the now-likely reversal of the tax hikes on landlords mean waiting for prices to fall much further is risky.

In my view, house prices will bounce strongly again in the final months of 2023 and return to their 2021 peaks within a year or two from there. In my view, anyone who wants to buy their first home to live in and can financially manage it, should be very careful before choosing to ‘wait for prices to fall further’. Those who feared missing out in early 2020 when the Reserve Bank removed LVRs and printed $55b were right to panic. That FOMO may have been temporarily been replaced by FOOP (Fear of Over Paying), but FOMO will always trump FOOP in the long run.

Our society is hardwired to drive house prices to infinity and beyond. Let me go a bit deeper on this.

What’s really driving our housing market

This is not financial advice. Just the facts of life in our political economy.

I have a rule of thumb I tell every young renter I see. It’s not financial advice. Everyone’s situation is different. It’s my long-held opinion on the political economy of house prices in Aotearoa-NZ in the long run. That is:

always, always buy a house to live in as soon as you can to ensure you have stability and control over your future, especially if you’re thinking of starting a family;

do whatever it takes to get a deposit and the biggest possible mortgage your bank will let you have to get on the ladder so you too can get the leveraged and tax-free capital gains that median voting home owners depend on for their financial futures and to support their current lifestyles and small businesses;

don’t wait for the ‘grown-ups’ to fix the supply shortages or change the tax rules to improve affordability, or for the ‘markets’ to restore sanity to housing affordability; and,

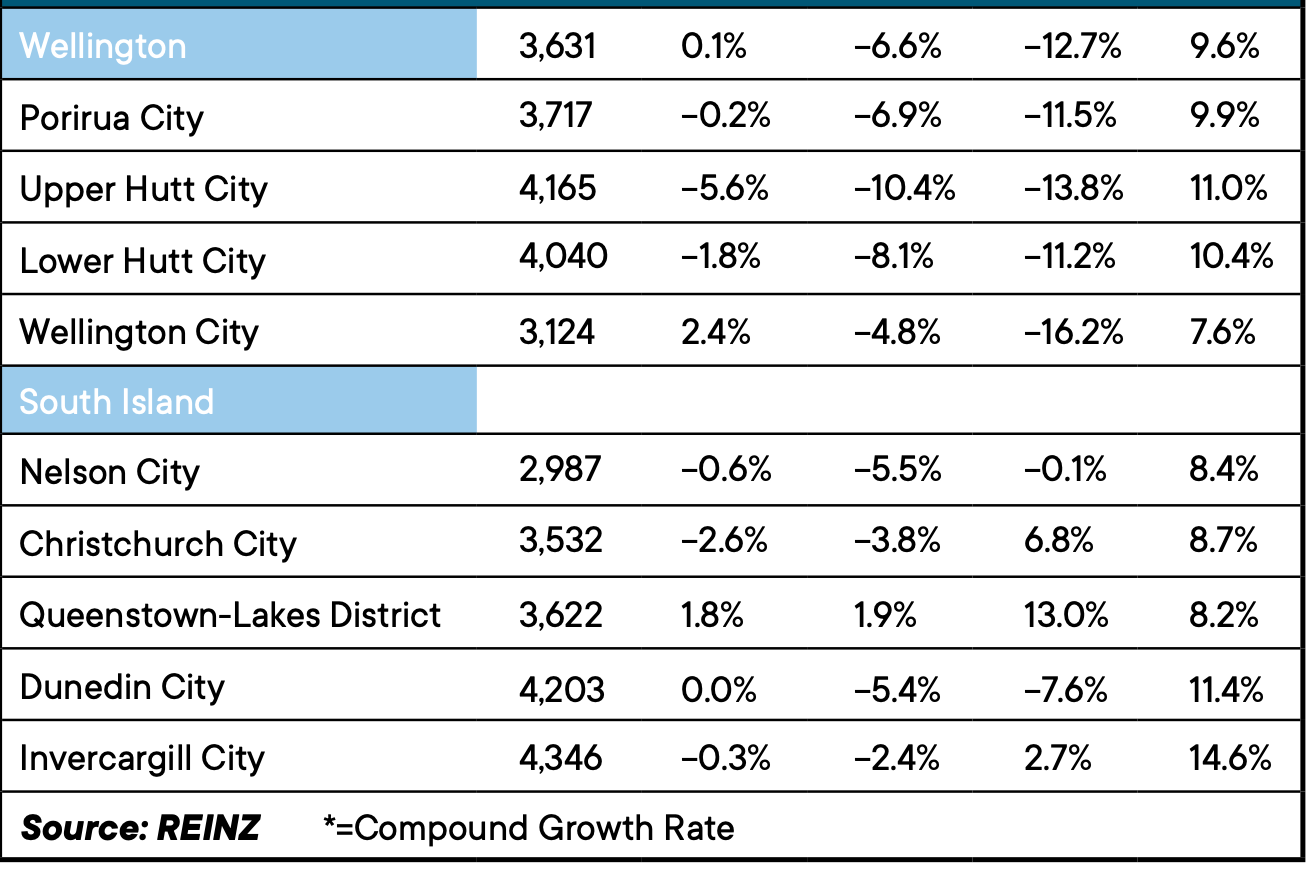

don’t believe politicians or central bankers who say the authorities have the situation under control or suggest things will improve in a short enough time for you to sensibly afford a house for something like three to five times income, as was the case 20 years ago (see the house price to income multiple chart below), because prices would have to halve from current prices within a year or two to achieve that.

Why won’t the market return to a 2000s-type equlibrium?

That is not going to happen because neither the Government (of whichever flavour) nor the Reserve Bank would allow that. Also, the extra housing supply coming onto the market now would dry up immediately. The Government would get kicked out by the home-owning and mostly older median voters living in the outer suburbs of the big cities and in the smaller cities and towns of provincial Aotearoa-NZ.

Their voting rates are almost twice those of young renters in inner city areas in general elections, and more than three times their rates in council elections, which in many ways are more important because they determine the extent of the housing supply response. This ejection of any Government allowing house prices to fall at double-digit rates is what we’re likely to see next year, and it’s why National is promising to repeal the various taxes trying to make rental property investing less attractive.

So what happens now?

As the Reserve Bank wants and has forecast, house prices will settle another five percentage points lower nationally through the rest of the year, and may have already troughed in Auckland and Wellington.

If, as financial markets are now indicating, inflation is now under control and interest rates keep falling, there is a growing chance of a strong bounce-back in house prices from the day after a change of Government in the final three months of next year, fueled by lower mortgage rates, a rapid increase in migration and a freeze of new housing infrastructure investment through councils, NZTA and Kāinga Ora’s build programme.

That new National-ACT Government will then repeal the property taxes, release migration restrictions and slash Government investment spending to ensure interest rates stay low, or even fall further.

Everything in our political economy drives everyone (politicians, bankers, central bankers, real estate agents, mortgage brokers and newspaper editors) to protect the leveraged tax-free gains of median voters who own their own homes, and often more than one home.

Aotearoa-NZ is a broken housing market with bits tacked on

That’s because those median voters’ financial and familial futures, let alone their feelings of self-worth and ‘tribal’ identification, are totally bound up in whether and where they own the house they live in, and how quickly they can then leverage up those tax-free and leveraged gains in equity to ensure they can continue to save more money from their houses than their jobs or businesses, many of which are also dependent on those gains.

They feel they need to keep this housing market elevated and preferably continuing to rise at the rates of the last 20 years to ensure a comfortable retirement for themselves, and even more importantly, enough equity to help their own children into their own homes.

There is no alternative that wouldn’t wreck those plans and force a change of life trajectory, career, investment approach and lifestyle.

I’ve said for more than a decade Aotearoa-NZ’s economy is just a housing market with bits tacked on. But the $500b-plus surge in house and land values through the first 18 months of Covid has strengthened that situation.

We also now have a society, a workforce, a political system, a financial system and a demographic trajectory for lifespans and population size that is dominated by our housing market. We vote to keep house prices and rents high. We vote to keep public investment low and population growth from migration high. We lend to profit from those investment preferences, and not to real businesses. We run our Government finances to protect the status quo of low infrastructure investment that keeps housing supply squeezed and ensures interest rates are the lowest they can be.

About half our kids are growing up in private rentals, with about a half of those in financially and physically stressed households where they bounce from one cold, moldy and ruinously expensive rental to another just-as-debilitating rental or emergency housing situation. This 25% cohort of kids bounce from school to school, hospital A&E to hospital A&E, and eventually ‘graduate’ into the workforce, often without the educations, life skills, familial support or physical health to be settled, productive and healthy members of society.

Surely there must be a way out?

In my view, the only ways the situation above might change is if:

those median voters that determine general election results and that dominate council election results change their minds about wealth taxes to redistribute some of their unearned and leveraged capital gains into building infrastructure for housing and public transport investments that massively improve affordability and achieve our emissions reduction goals; and,

there’s a substantial increase in political engagement and voter participation among young renters, especially those from Māori, Pasifika and first generation migrant backgrounds in Auckland, Wellington and Christchurch.

Both of these are unlikely any time in the next decade or two, in my view. Both National and Labour are committed to the 30/30 principle that blocks new wealth taxes or an increase in infrastructure investment.

So what should young renters do?

In my non-financial and non-specific advice for people wanting to put down roots and start a family, it makes sense to:

save, beg, borrow, marry and schmooze your way to a deposit with the help of family, friends, Lotto, Bitcoin and anything you find down the back of the couch;

do whatever it takes to get the biggest loan you can from a bank to buy the biggest bit of residential land you can, even if it’s connected to an apartment or townhouse of some kind;

campaign, vote and argue with median voters (especially parents) to tax themselves and increase investment to change the situation above, at least until the very moment you get yourself on the ladder, and then your incentives flip to wanting ever-lower interest rates, housing supply restrictions and no tax on leveraged capital gains on land value appreciation.

For those without the time or inclination or belief that this is possible, the best hope of building a stable and prosperous future is immediately buy a one-way ticket to Australia and hope Prime Minister Jacinda Ardern is able to convince Australian Prime Minister Anthony Albanese to follow through on his promise to announce solid pathways to full Australian citizenship for New Zealanders in Australia.

For those looking for leverage in debates with homeowning family members and bosses upset about your migration plans, suggest to them that they make those tax and investment changes or they’ll have to watch their grandkids grow up on social media and via fleeting visits, or also move to the lucky burny country.

But whatever you do, don’t kid yourself or believe others who say that you can afford to wait for prices to come back to meet you some time in the next few years.

Charts of the day

Number of the day

47 - The median numbers of day to sell a property across Aotearoa-NZ, up 16 days from July 2021.

Quote of the day

“The urgency seen in the market from mid to late-2021 has fallen off, the combination of increased stock taking the pressure off and buyers waiting to see if prices will decrease further.” REINZ CEO Jen Baird

Elsewhere in the news overseas this morning

Deflationary trends - Average US petrol prices fell overnight to US$3.99/gallon (NZ$1.70/litre) for the first time since Russia’s invasion of Ukraine overnight, adding fresh ammunition to ‘Team Transitory’s’ calls for more cautious central bank rate hikes. US stocks rose another third of a percent this morning, taking the Nasdaq’s bounce from its trough earlier in the year to 20%. Reuters

Lower producer prices - US producer prices fell 0.5% in July from June, which was the first monthly fall since April 2020 and meant annual inflation was 9.8%, which was down from June’s annual rate of 11.3% and lower than economists’ forecasts for about 10.4%. US jobless claims also rose this week to 262,000, the highest since November and another sign of a slowing of the world’s largest economy that reduces inflation pressures. Reuters

But European power pain - European electricity prices jumped another 5% overnight to fresh record highs of €452.50 per megawatt hour, which is five times higher than it was a year ago. Russia’s decision to squeeze its supplies to Germany to 20% of usual levels through Nordstream 1, plus a heatwave, low wind speeds and a drought that is stopping coal barges travelling down the Rhine, are driving the power prices higher.

So what? - The world’s two largest economic trading zones, North America and the Eurozone plus the UK, are both headed towards recession and their inflationary pressures are receding thanks to the demand destruction of earlier this year that is now dragging down on commodity prices and easing pressure in supply chains. It’s why banks here kept cutting (yes cutting) their fixed mortgage rates.

Some fun things

Ka kite ano

Bernard

PS: Here’s the link for paying subscribers to join the live ‘hoon’ webinar at 5pm.

Share this post