TLDR: The world’s biggest economy fell into a surprise technical recession in the June quarter, forcing wholesale interest rates lower overnight and extending Wall St’s rally because stock investors love lower interest rates.

Elsewhere, geo-politics is no calmer. China’s President Xi Jinping warned US President Joe Biden in a phone call overnight not to ‘play with fire’ by allowing US house speaker Nancy Pelosi to visit Taiwan next month.

And just in case we’d forgotten about North Korea with all the drama in Europe, Kim Yong Un said overnight the Korean peninsular was on the ‘brink of nuclear war’ because of major military exercises planned for next month by US and South Korean forces.

Paid subscribers can see more detail and analysis below the paywall fold and in my podcast above. Paid subscribers are also welcome to jump on to my weekly Ask Me Anything comment threat at midday today for an hour and then join co-host Peter Bale and myself for our weekly ‘hoon’ webinar to wrap the week’s news in geo-politics for an hour at 5pm. We may have special guests. Here’s the link.

America appears to be in recession already

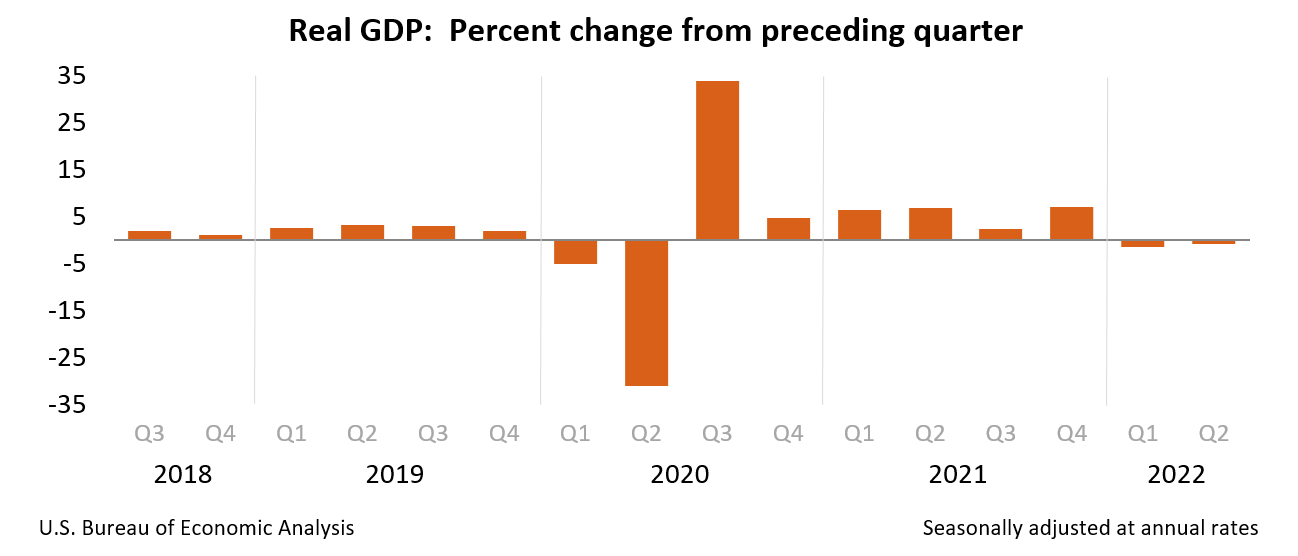

US GDP fell - The US Bureau of Economic Analysis reported overnight that real US GDP fell at an annual rate of 0.9% in the June quarter, adding to the revised 1.6% fall in the annual rate in the March quarter. Real GDP fell 0.9% in the June quarter from the March quarter, after it fell 1.6% in the March quarter from the December quarter. This was worse than the flat result most economists had expected.

However, the United States actually has a special ‘X Factor’-style judging panel on whether there has been a recession or not called the National Bureau of Economic Research. US unemployment is still very low at 3.6% and few see it likely the NBER would declare a formal recession. Consumer spending and investment fell, but the biggest reason for the fall was a fall in inventories, which is one of those topsy-turvy GDP factors that shows falling numbers, but could actually be good news if the inventories were falling because businesses were selling heaps of stuff.

That bad news looked like good news to investors

Investors celebrated the ‘bad’ news - Yeah I know. Go figure, as the Americans might say. But markets are in a weird place right now where bad news is good news because it means interest rates are likely to fall and the US Federal Reserve is seen less likely to have to hike interest rates until the pips squeak. That’s why the S&P 500 was up 1.3% and the Nasdaq was up 1% at 7.30 am NZT, extending big rallies from Wednesday night.

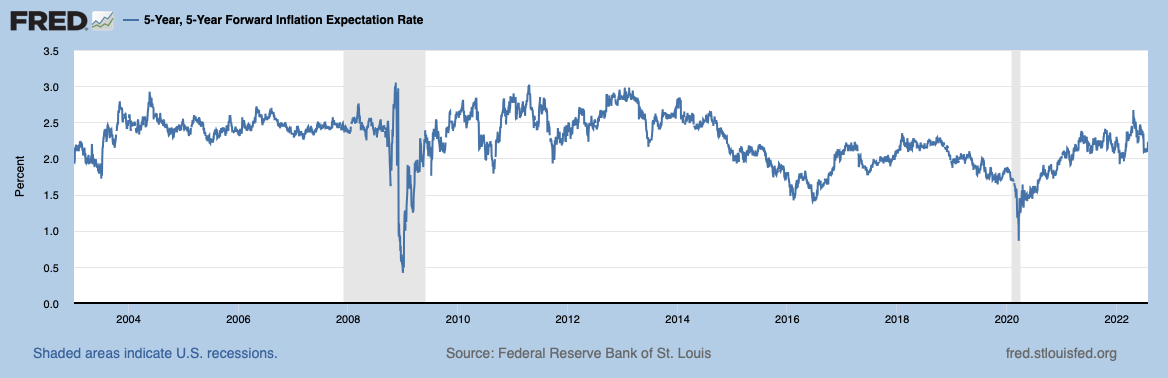

The US two-year Treasury bond yield, which is often seen as a proxy for what markets think the Fed will do in the next couple of years, fell nine basis points to 2.87%. The US 10 year Treasury yield, which is a reflection investors’ inflation expectations and how much ‘real’ return investors expect, fell five basis points to 2.68%. Yeah I know. Go figure. Again. That means US Treasury investors are apparently happy with a real yield (ie after the effects of current inflation of 9.1%) right now of minus 6.5% or so.

The other thing we can deduce from these market yield figures is what investors in the world’s most liquid financial markets are expecting for US inflation over the next five or so years. This can be measured by subtracting out the inflation expectations in the inflation-indexed Treasury bonds from the non-indexed ones of the same maturity. You end up with something called the 5-year, 5-year Forward inflation indicator. Here’s the latest chart version from the Federal Reserve Board of St Louis (FRED).

So what? Global stocks are bouncing back on ‘hopes’ for a recession that take pressure off interest rates. Investors are collectively feeling the Fed is ‘pivoting’ to a looser stance, which will have boost asset prices again. Twas ever thus. A generation of investors have come to rely on the ‘Powell Put’ to rescue them. The previous generation had the ‘Greenspan Put’, referring to long-time Fed Chair Alan Greenspan.

Whether this ‘soft landing = Powell Pivot view’ actually turns out to be true is the thing to watch. If inflation doesn’t cooperate, all bets should be off.

My view (still) - But my long-held view (although I’ve been sweating on it a lot lately) is that the underlying deflationary forces of globalisation of services into Big Tech’s low-priced cloud, combined with still-weak labour power and the growth-sapping effects of rising inequality, will be more than enough for the low inflation to return. The caveats I’m keeping as my life rafts are a worsening of the war in Ukraine, wars in Taiwan and/or Korea (!), a new version of Covid that evades vaccines and a Trump re-election. Phew. Lots of outs there.

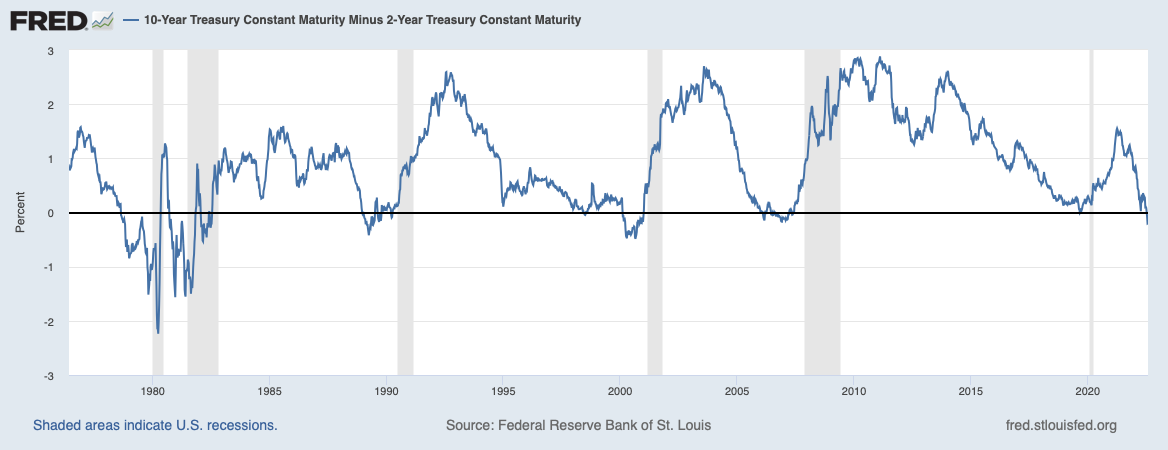

The US yield curve is inverted and that’s a reliable indicator

Yield curve inversion deepening - What those bond yields really indicate is investors and traders really expect this recessionary noise in the global economy to solve the Fed’s inflation problems without the Fed having to hike rates too much. The combined signal of the two and ten year yields is that the so-called yield curve (the 10-year yield minus the two-year yield) is flashing a red warning sign that there will be a recession. Last night’s data appears to show the United States is already in one.

Here’s FRED’s excellent measure of that so-called inverted yield curve. It’s a great leading indicator of recessions, which are the shaded lines in the chart.

So what? Global recessionary signals are most likely to force down Aotearoa-NZ’s wholesale interest rates too. They are the base for our fixed mortgage rates. So the noises we’ll all start hearing from the Reserve Bank and economists is that there isn’t such a need for such a high Official Cash Rate. The Reserve Bank and markets currently think it will have to rise from 2.5% now to 4% by the end of the year.

So what for house prices? - House prices here are falling here still, but they’re close to the trough of a 15% peak-to-trough fall from the November peak that is forecast by the Reserve Bank and some other banks. ANZ changed to a 15% fall last week. A big chunk of the outlook depends on the political outlook. Currently, National are ahead in the polls and are pledging to reverse the new interest serviceability rules, reverse the bright line extension and reverse the Healthy Home changes that made being a landlord less tax-advantageous and more costly. Along with that, National is likely to wind back or freeze infrastructure investments and Kāinga Ora’s building programme, which would depress the outlook for new supply growth.

So if National remain on track to win, there’s a combination of demand and supply factors that should see prices trough and start bouncing through into late 2023, including:

houses more attractive again for landlords;

mortgage rates falling again; and,

new housing supply drying up and subbies and apprentices leaving for Australia.

Again, all bets are off if National Leader Christopher Luxon keeps shooting himself in the toes and that (currently) more benign inflation and interest rate outlook turns ugly. That means I’m watching the poll results as closely as I can and watching what is happening with global and local inflation, and of course, what central banks say and do about those.

Surely there’s enough geo-political drama around already?

Xi issued a fiery warning - China’s President Xi Jinping and US President Joe Biden had their first person-to-person phone call since March overnight, in which they discussed plans by US Speaker of the House of Representatives Nancy Pelosi (who is formally third in line to the President’s throne in the US system) to visit Taiwan next month.

China has warned the United States against the visit, arguing it would breach its ‘One China’ policy that is supposed to not recognise Taiwan as a separate country. President Xi was quoted in a statement after the call as saying: “Those who play with fire will perish by it. It is hoped that the US will be clear-eyed about this.”

So what? - The Pentagon has advised Pelosi not to go. She has already delayed once because she got Covid. But there’s a whole bunch of anti-China hawks on both side of politics in the United States who are egging Pelosi on. Biden, in theory, should be telling her to back off to calm things down. We should all watch this more closely over the next couple of weeks.

But wait, there is even more geo-political drama…

Seriously? Give us a break - Last night North Korea’s leader Kim Jong Un accused the US and South Korea of bringing the Korean peninsula to the “brink of war” because the US and South Korean militaries are planning their first large-scale physical exercises in four years.

Just for kicks, Kim said North Korea would “wipe out” South Korean forces with nuclear weapons if a conflict started. Sheesh.

“Our armed forces are completely prepared to respond to any crisis, and our country’s nuclear war deterrent is also ready to mobilise its absolute power dutifully, exactly and swiftly in accordance with its mission,” North Korean media reported Kim as saying.

“It is a suicidal act, and absurd and extremely dangerous, to talk about military action against our country when we actually already have the most powerful weapon which you fear the most.”

The last big military exercises were scaled down in 2018 just before then-President Donald Trump met with Kim. Since then, they’ve been doing their exercises over the encrypted versions of Zoom.

Time for some light relief.

Some fun things. Unicorn edition

Ka kite ano

See and talk to you all in one form or another in the midday Ask Me Anything and the 5pm ‘hoon’ webinar.

Bernard

Share this post