TLDR: Global stocks resumed their slump into bear territory this morning, discarding yesterday’s surprise gains after the Fed’s jumbo rate hike. Fears about big rate hikes forcing a global recession returned as both the Bank of England and the Swiss National Bank hiked rates overnight. British inflation is set to hit 11% by October.

Elsewhere in the news overnight and this morning here and overseas:

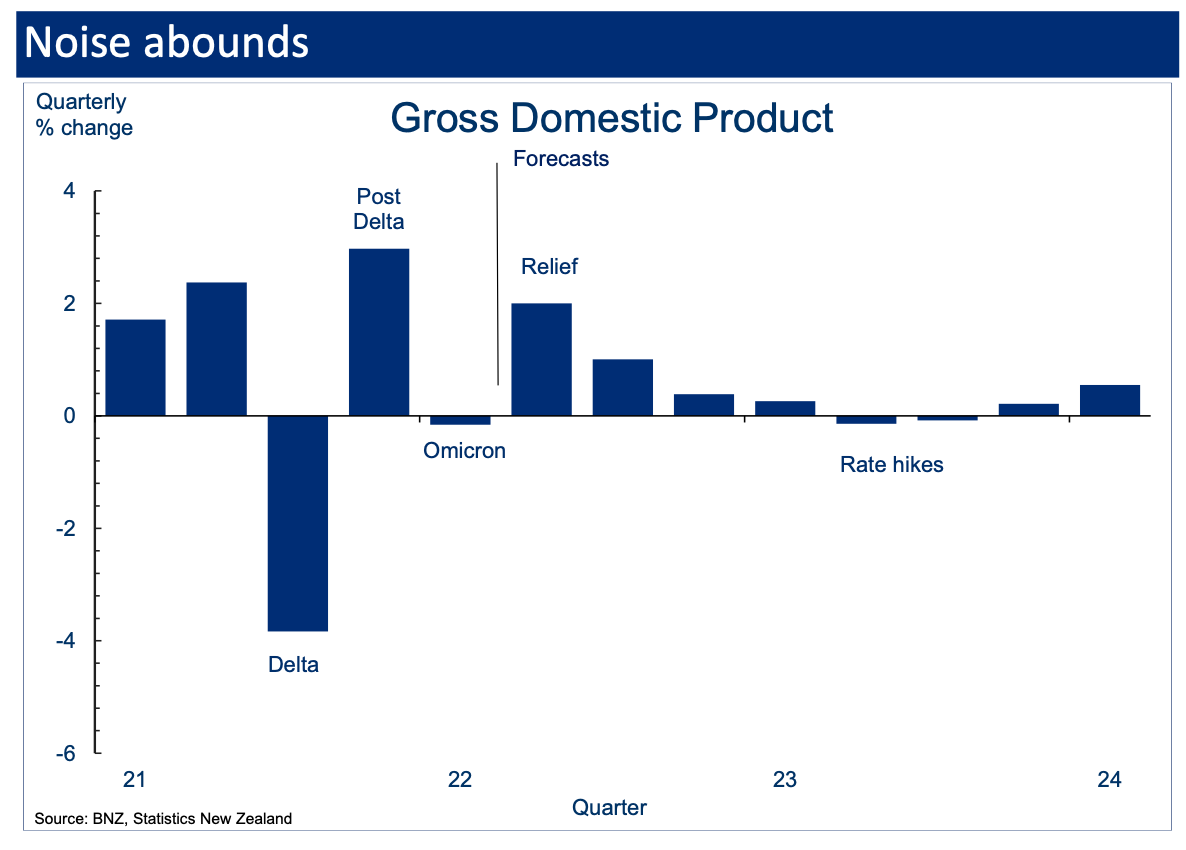

forecasts of a mild recession in Aotearoa-NZ later this year emerged after a surprise 0.2% fall in March quarter GDP was reported yesterday;

concerns are growing about hospitals being swamped by winter flu, with one patient with a headache who was turned away from Middlemore dying of a brain hemorrhage overnight;

Fletcher Building promised to supply an extra one million square metres of Gib by July ahead of a crisis meeting with shareholders later today;

New South Wales’ Government told Sydney residents overnight to turn off their power for two hours to avoid blackouts caused by coal and gas shortages;

Russia further squeezed gas supplies to Germany and Austria overnight, forcing European gas prices up another 30%; and,

Revlon went bankrupt overnight because its Elizabeth Arden and Revlon brands are being outsold by other brands linked to Rihanna and Kylie Jenner.

Paid subscribers can see more analysis, source links and detail below the paywall fold, along with the quote, number, comment and chart of the day. I’ll also be sending invites to paid subscribers to our weekly Ask Me Anything session at midday and our weekly hoon live webinar at 5pm with special guests. The link to join the webinar is below the fun things.

The global selloff resumes

The S&P 500 and Nasdaq were down 3% and 4% respectively by 6.30 am NZT as investor fear returned about fast rate hikes causing recessions. European stocks also fell 2-3% after the Bank of England hiked its cash rate by 25 basis points to 1.25% and the Swiss National Bank surprised investors with a 50 basis point hike, albeit to minus 0.25 from minus 0.75. Stock markets gave up all their gains from their surprise rally after the Federal Reserve’s jumbo 75 basis point hike yesterday morning.

Elevating the fears that central banks will have to clamp down even harder on economic growth to get inflation under control, the Bank of England forecast annual inflation there would rise to 11% by October.

There were also fresh signs a US recession is likely later this year or early next year. US housing starts fell 14.4% to 1.5m in May from April, which was below the 1.8m pace in April and below economists’ forecasts of around 1.7m. The US house-building sector has come off the boil sharply in recent months as the US 30-year mortgage rate, which is closely linked to US Treasury yields and expectations of future inflation, has jumped from 3% to almost 6% in six months.

Russia squeezes European gas flows even more

Germany protested again overnight after Russia’s Gazprom further tightened the screws on gas flowing through its Nord Stream One pipeline. Gazprom cut supplies to Germany by 30% on Wednesday and extended those cuts to 60% yesterday. It blamed technical problems linked to some Siemens gas turbines having to be sent to Canada for repairs, and then being held in Canada because of its sanctions against Russia.

Germany sees the move as an attempt to squeeze the European economy to try to break an increasingly shaky consensus of support behind Ukraine. Deputy Chancellor Robert Habeck appealed on Twitter for Germans to do whatever they could to reduce energy use. Gazprom also cut its supplies to Italy, Slovakia and Austria.

So far, the cuts have yet to cause blackouts or factory shutdowns because much of Northern Europe is bathed in summer heatwaves that mean boilers and heaters are off, and air conditioners are not as widely used in Northern Europe.

European gas prices rose another 30% overnight to €146/megawatt-hour and have risen 70% this week, adding to the inflation and recession fears sweeping Europe’s financial markets.

A recession here by the end of the year?

Stats NZ reported yesterday GDP fell 0.2% in the March quarter and was up 1.2% in Q1 from the same quarter a year ago. GDP in the year to the end of the March quarter was up 5.1%. The result was below market expectations that ranged from no growth to as high as 0.7% growth by the Reserve Bank in its April Monetary Policy Statement. Covid illness and the after-affects of the lockdowns in the second half of 2021 were blamed.

Economists said the result hadn’t changed their views on what the Reserve Bank would do with the Official Cash Rate on July 13 because the labour market and inflation pressures remained very tight. They still see another 50 basis point hike to 2.5%, although markets have been flirting with the prospects of a 75 basis point hike in recent days.

Most see GDP rebounding around 1.0% in the June quarter to avoid the technical definition of a recession, which is two quarters of lower GDP in row. However, BNZ Economist Stephen Toplis said last night a mild recession was possible later this year. See more in Chart and Quote of the day below.

Quote of the day

A warning of a mild recession

“We're just starting to feel the impact of rising interest rates, but those interest rates are going to keep going up. And it's going to take a while for them to really flow right through the economy.

"Most developed countries in the world are experiencing high inflation, rising interest rates and if everyone attacks it in the same way at the same time then that risks generating a much nastier world for us.” Stephen Toplis on RNZ’s Checkpoint last night.

Number of the day

A fall in real disposable income

Down 0.5% - Stats NZ’s GDP stats include real gross national disposable income (RGNDI), which measures the volumes of goods and services that New Zealand residents have command over - ie the real purchasing power of the country’s disposable income. It takes into account changes in the terms of trade (the relative prices of our imports and exports, the country’s net investment income, and net transfers to the rest of the world in the form of dividends and interest payments).

RGNDI fell 0.5% in the March quarter because GDP, net transfer flows, and net investment income on our international investments all decreased, overwhelming a slight improvement in terms of trade. The 0.5% fall in RGNDI, coupled with a population rise of 0.1% also meant RGNDI per capita fell 0.5%. RGNDI rose 4.7% in the year to March and was up 4.3% in the March quarter from the same quarter a year ago.

Chart of the day

A recession before the election?

A fun thing

Ka kite ano

Bernard

PS: Here’s the link for paid subscribers to join the ‘hoon’ live webinar at 5pm today.

Share this post