TLDR: European economies and its financial markets face a fresh round of turmoil after the European Central Bank was forced to tighten monetary policy for the first time in 11 years and by twice as much as expected to fight euro zone inflation now running at 8.6%.

The biggest euro zone rate hike in 20 years came just as Italy’s debt crisis returned with a vengeance because of the resignation overnight of Italian Prime Minister ‘Super Mario’ Draghi, the man who rescued the euro during Europe’s last debt crisis a decade ago.

So what? Brace for more global financial and geo-political turmoil that may deepen recessions already expected in the Northern Hemisphere and ensure inflation continues coming off its mid-2022 peaks.

That may allow central banks to return to money printing eventually to again rescue banks and asset owners from the pain of lower asset prices. It all depends on whether inflation comes off the boil. I think it will, but that’s not a consensus view, to say the least.

Paid subscribers can see and hear more detail and my analysis below the paywall fold and in the podcast above about what the latest European financial drama means for the global economy, and for borrowers, savers, workers and managers closer to home, especially if the inflation goes away as I, but few others, expect.

Elsewhere in the news this morning here and overseas:

A Covid cough - US President Joe Biden tested positive for Covid overnight, but has mild symptoms and is already being treated with Paxlovid. The White House said the 79-year-old was fully vaccinated and twice boosted. It reported he had a runny nose, fatigue and an occasional dry cough. Reuters

Still squeezed - Russia’s Gazprom turned the gas supplies back on to Europe through its Nordstream 1 pipeline overnight after a 10-day scheduled maintenance outage. That eased some fears it would stay completely closed going into the Northern Winter in a way that would force gas rationing and hammer European GDP 2-3% lower next year. But the flows remain constrained at 40% of normal levels and the European Union’s call on Wednesday for 15% cuts in consumption still stands. CNN

Amazon pounces - Amazon announced overnight it would buy US primary healthcare provider One Medical for US$3.9b in a move to expand further into telehealth and monthly subscriptions for individuals wanting access to doctors, nurses and health advice. Amazon has already transformed retailing and cloud computing. Health is another massive part of the global economy yet to see the full deflationary power of shifting services into the cloud. CNN

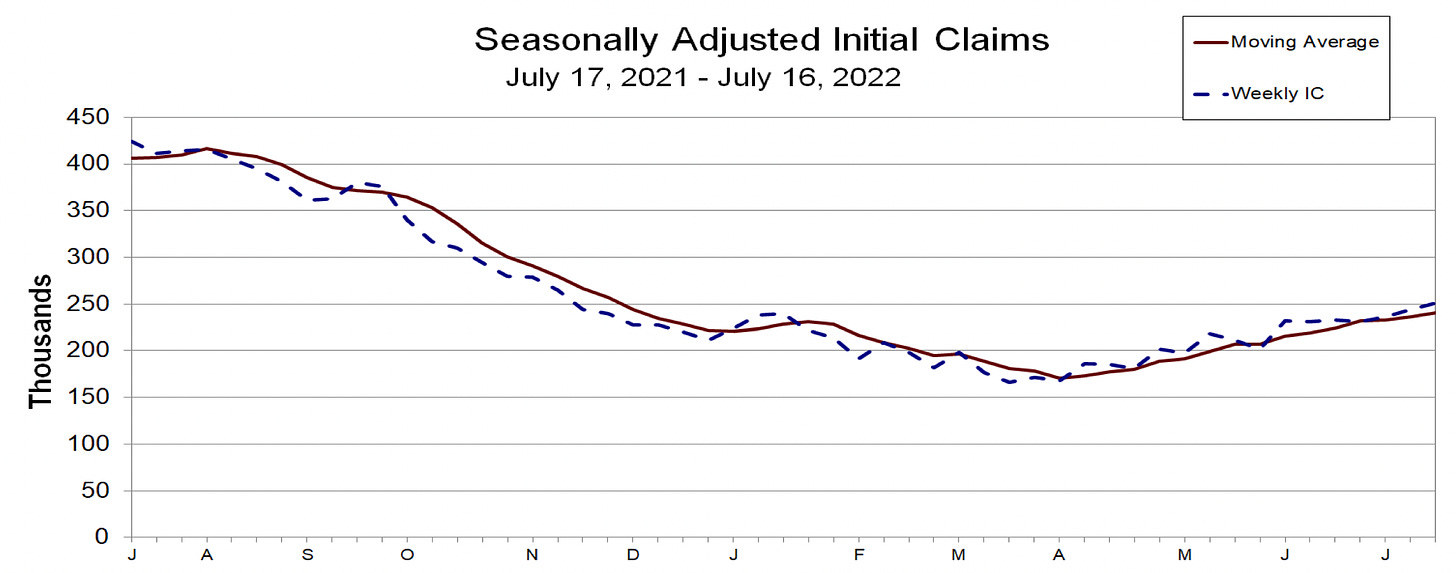

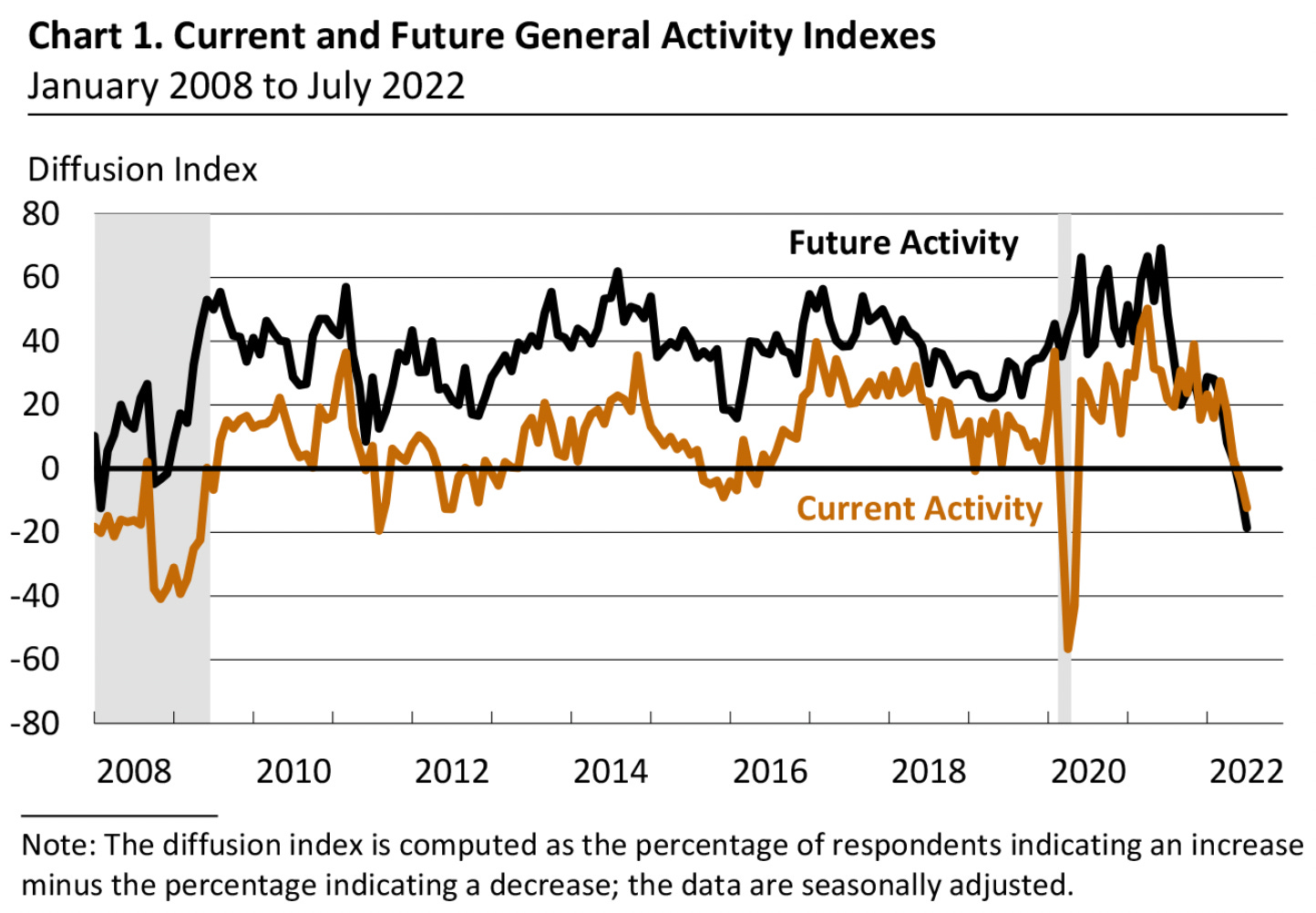

Cooling economy - US jobless claims rose in the week to July 16 to 251,000 from 244,000 the previous week and was above economists expectations for claims of around 240,000, indicating a red-hot jobs market in the world’s largest economy is coming off the boil and also softening inflationary pressure. Also, the Philadelphia Federal Reserve’s monthly survey of mid-Atlantic manufacturing activity contracted in July for the second consecutive month at a rate that was worse than economist expectations. MarketWatch

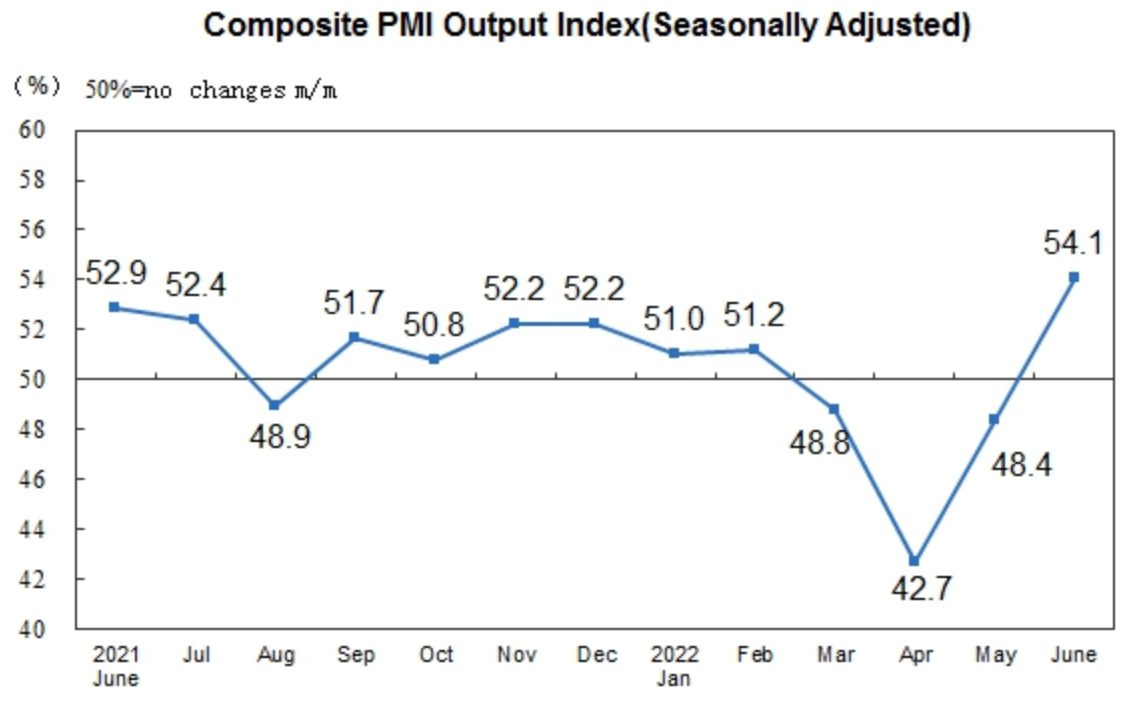

New outbreak - China's southern industrial city of Shenzhen, which has 18m people, vowed last night to "mobilise all resources" to squash a Covid outbreak that curretly has 12 cases. The measures include wide-spread testing and temperature checks, along with lockdowns of Covid-hit buildings. China’s economy has been wracked by lockdowns in the last six months as President Xi Jinping clings to his elimination strategy ahead of a key Chinese Communist Party conference expected in November to confirm his ‘leader-for-life’ status. Reuters

Briefly elsewhere:

Ovato, the largest magazine printer in Australia and New Zealand, announced yesterday it had been put into voluntary administration.

Goldman Sachs announced it had appointed former Australian Treasurer, Josh Frydenberg, as a ‘Senior Regional Adviser for the Asia Pacific’.

The latest Covid wave filling Aotearoa-NZ’s hospitals appeared to have peaked, Keith Lynch and Hannah Martin reported at Stuff this morning.

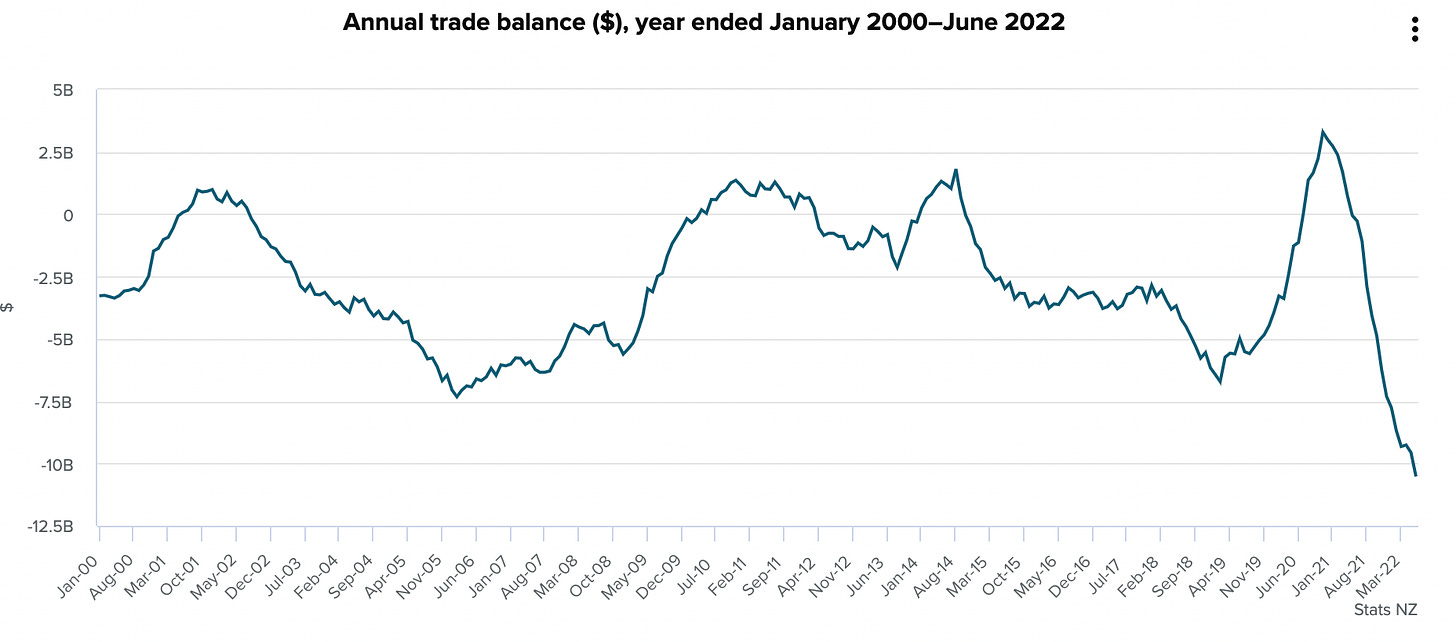

Chart of the day

Trade deficit record after Marsden Point refinery closes

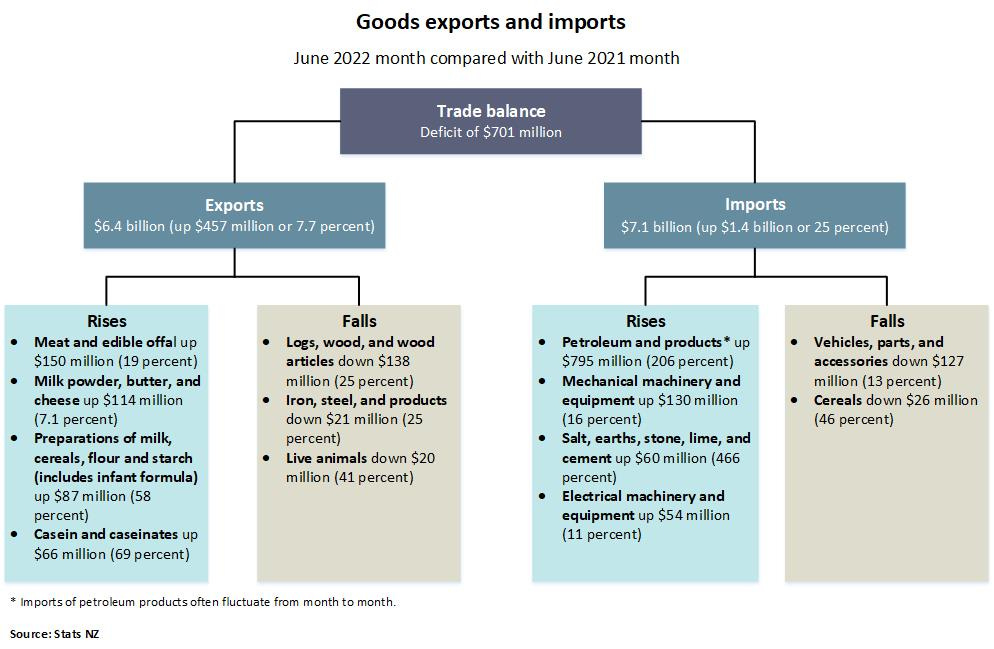

Stats NZ reported yesterday New Zealand’s annual merchandise trade deficit hit a record-high $10.5b in the year to the end of June 2022, up from a deficit of $277m the previous year. Goods exports rose $7.2b to $67.6b, but imports rose $17.4b to $78.1b, driven partly by a surge in the cost of petroleum imports due to the closure of the Marsden Point refinery and higher underlying oil costs.

“Since the recent closure of the Marsden Point refinery, more refined petrol and diesel are being imported. The value-adding, which occurs offshore prior to arriving in New Zealand, contributes to the increases in the total import value.” Stats NZ international trade statistics manager Alasdair Allen.

Here’s a deeper explanation via a Stats NZ diagram of a deficit of $701m for the month of June.

Quotes of the day

‘Whatever it takes’ version 2.0

“The ECB is capable of going big. We would rather not use (the new programme), but if we have to use it, we will not hesitate.” European Central Bank President Christine Lagarde speaking overnight after the ECB hiked its deposit rate by 50 basis points to 0.0%, which was twice market expectations and previous ECB suggestions for a 25 basis point hike.

The deposit rate had been negative for eight years. The ECB also launched its ‘defragmentation’ bond-buying programme overnight, which is designed to buy Government bonds from EU countries in stress to lower their interest rates.

Lagarde also said overnight the programme had ‘no limitation,’ echoing the now famous (or infamous) comment from then-ECB President Mario Draghi in July 2012 that he would do ‘whatever it takes’ to rescue the euro during a previous debt crisis.

Back then, Greek, Italian, Spanish and Portugese bond prices collapsed (which mean yields or interest rates spiked) well above the yields of northern European Government bond yields, putting the euro under intense stress. Reuters

A perfect storm in Europe’s financial markets

“The combination of a brewing giant stagflationary shock from weaponised Russian natural gas and a political crisis in Italy is about as close to a perfect storm as can be imagined for the ECB.” Krishna Guha, head of policy and central bank strategy at US investment bank Evercore, just ahead of the ECB decision, via FT-$$$

Number of the day

229 basis points - The spread or difference between the German 10 year Government ‘bund’ yield and the Italian 10 year Government bond yield is seen as an indicator of the stress in Europe’s financial and banking system. It rose a further 15 basis points overnight and is up more than 100 basis points in the last year.

The higher the spread goes, the bigger the fear that Italy might default on its debts. That’s a problem because the European Central Bank has been buying all of Italy’s new bonds in the last decade or so and Italian banks are also big holders of Italian Government bonds.

An Italian default would wreck the balance sheets of Italy’s banks and, in theory, force the ECB to rescue them, much to the chagrin of voters and bankers in Germany. That would put the euro and the European economy under intense stress. A rise in the spread to over 250 basis points is seen as a ‘red line’ that could cause the ECB to intervene again.

Some fun things

Ka kite ano

Bernard

PS: We’ll have our regular weekly Ask Me Anything for an hour today at midday and our weekly ‘hoon’ live webinar on the week’s news with Peter Bale for an hour at 5pm today. The link for paid subscribers to join at 5pm is here.

Share this post