TLDL & TLDR: CoreLogic reports the big tax deductibility shock in March and new LVR restrictions on landlords has had no real impact on the red-hot housing market as ANZ reports inflation actually accelerated last month. It’s D-Day for Wellington’s housing supply outlook today with the Council set to vote on a watered down plan (while under level 2 Covid restrictions that applied from 6pm last night).

Overseas in climate change news, AFP reported from a leaked draft of the next IPCC report due in February that the climate is set to warm a catastrophic 3.0 degrees from pre-industrial levels this century without transformational reductions in climate emissions quickly. That sort of heating would trigger disastrous feedback loops and tipping points for the arctic ice caps and Amazon, lifting sea levels, unleashing extreme climate events and killing tens of millions prematurely through heat waves.

Also overnight, Audi said it would stop making petrol and diesel vehicles from 2033, while Honda became the first Japanese car maker to set an end date for building new internal combustion engines. It will stop in 2040.

In interest rate news in the last 24 hours, the US Federal Reserve Chair Jerome Powell rejected suggestions in Congressional testimony yesterday of a 1970s-style inflation breakout and reiterated the Fed would wait to see the ‘whites of the eyes’ of permanently higher inflation before tightening. This reassured financial markets. The Reserve Bank of Australia’s Assistant Governor Luci Ellis also reiterated in a speech the Australian central bank saw the current inflation spike as temporary and would keep policy very loose.

Nothing can stop this market

CoreLogic reports this morning the March 23 tax deductability shock and other Government moves to cool the housing market have not had any real impact in the first two months of sales since the announcement.

“Overall, our data and analysis shows the tax changes on their own haven’t had any real impact so far,” CoreLogic Head of Research Nick Goodall said.

“But it’s really important to reiterate that it’s hard to isolate the effects of one rule from another. It’s also early days, and we think the tax changes will in fact bite harder as time goes by,” he said.

CoreLogic found valuation volumes ordered by banks, which is an early indicator of demand, remained “pretty solid,” adding that a shortage of listings was limiting sales.

CoreLogic’s Chief Property Kelvin Davidson said prices showed some small evidence of a slowdown.

“Using data from our very latest unconfirmed sales records, the premiums buyers are paying over and above CVs have eased back in the past month or two, but not dramatically so,” Davidson said.

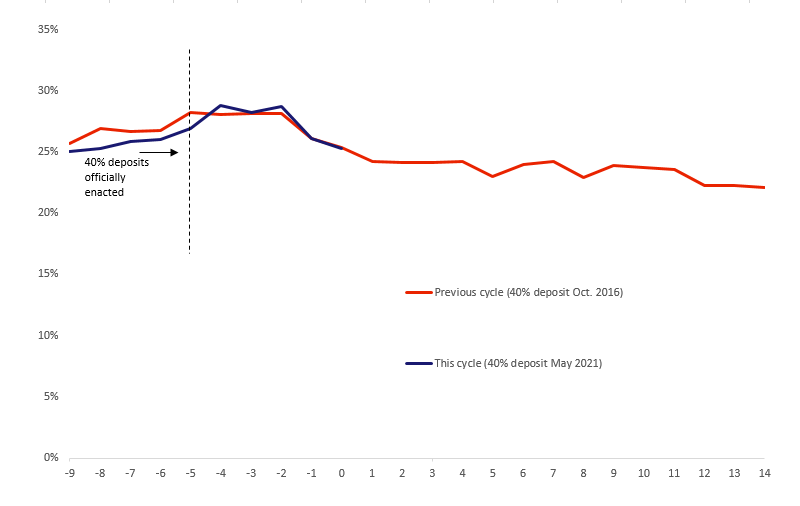

Investors were buying proportionately less, with the investor share dropping to 25% in May from 29% from January to March.

“But even then, it’s more likely that this is actually due to measures other than the March tax changes, such as the fact that investors have been required by lenders to stump up a 40% deposit for the past five to six months now,” Davidson said.

“Compared to the last time investors were required to have 40% deposits (from October 2016 to January 2018), the evolution of mortgaged investors’ market share has so far been similar in both cycles, but with the extra attention investors are getting this time around, there surely has to be a chance that their share will ultimately fall below the previous trough,” he said.

Briefly, other news in our political economy

D-Day in the capital: Wellington Council will vote on its spatial plan today in what is shaping up as a decision for the ages on whether the city will create enough space for the next generation to be able to affordably buy or rent in the capital. NIMBYs pressured officials to gut thousands of medium-density homes from an earlier draft and Council will vote today on whether to reinsert those homes. This Tom Hunt preview in today’s Dominion Post is a good primer.

Sign o’ the times news

Useful longer reads and listens

Charts of the day

Some fun things

Share this post