TLDR & TLDL: There’s been some chatter in recent weeks that somehow borrowers have geared themselves up to the eyeballs and couldn’t handle much of an increase in mortgage rates, especially if they come quicker and go higher than expected because of some sort of wild and extended inflation outbreak.

Bank economists and markets here in Aotearoa-NZ now expect the Reserve Bank to start hiking the OCR from 0.25% as early as November to about 2.0% over the next couple of years. That, in theory, would push one and two year mortgage rates up from around 2% now to over 4%, which would double interest costs. The assumption is this would destroy borrowers and cause some sort of crisis in the housing market and the economy.

Nothing could be further from the truth.

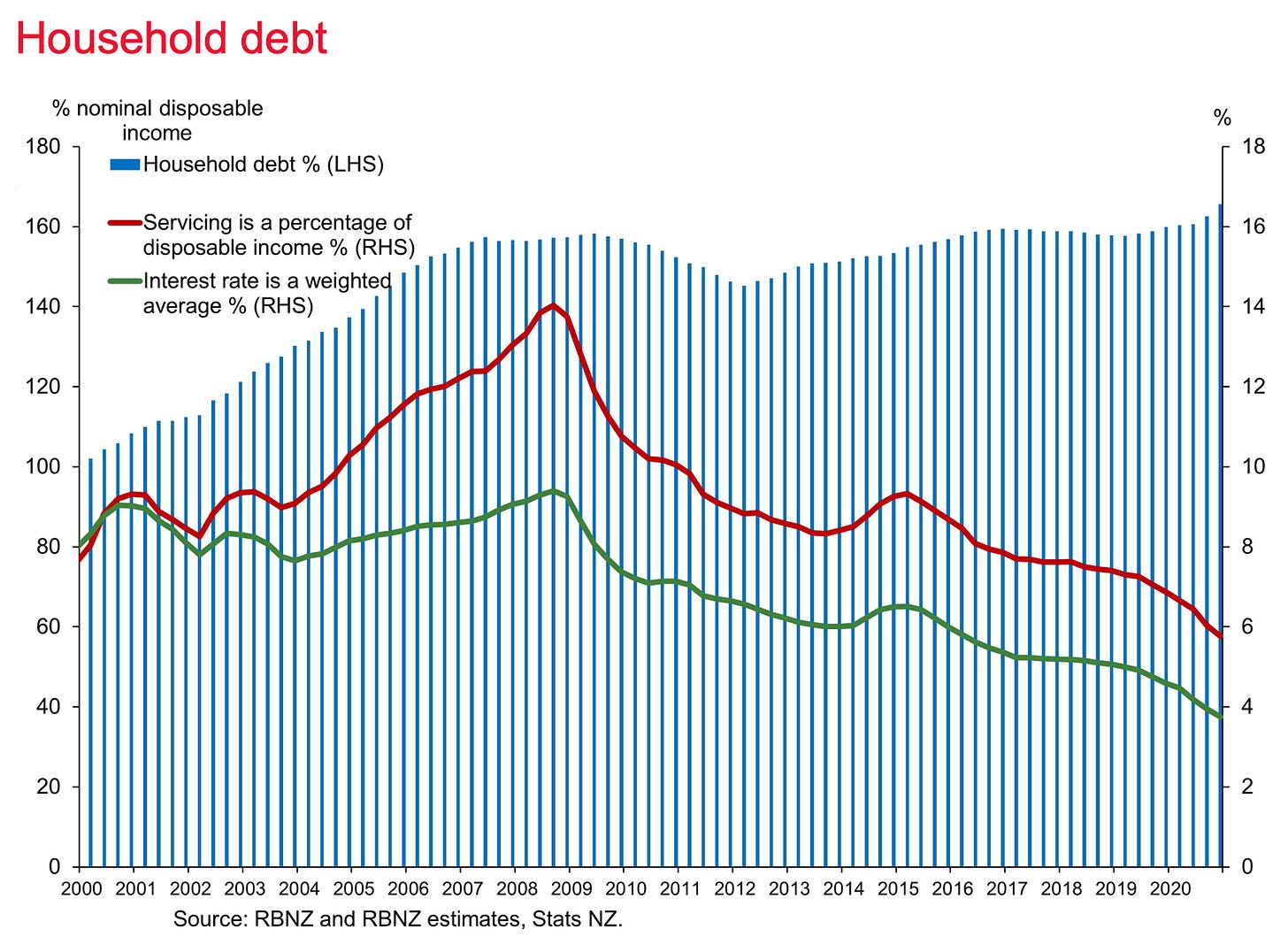

Borrowers currently pay around 6% of their disposable income to service their loans and a doubling would still leave that percentage well below the peak of servicing costs seen in 2008 and 2009 when interest rates rose over 10%, as this Reserve Bank chart shows with the red line being the servicing costs.

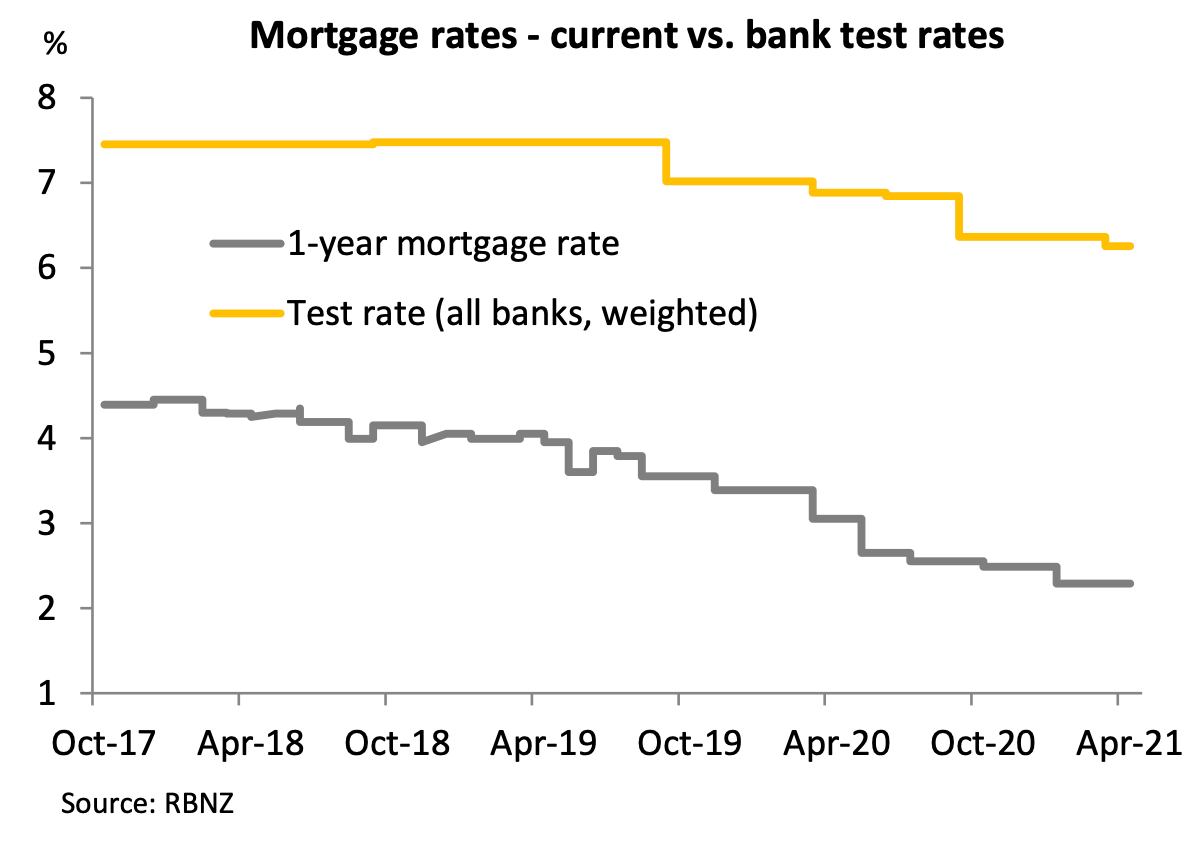

Also, banks check the ability of borrowers to handle interest rate rises, and the average serviceability threshold is now around 6.3%. That means the bank won’t lend to you if you can’t handle a mortgage rate of 6.3% or above, as this ASB chart below from this research shows. Even then, most borrowers have even more leeway. They may spend less on other items, including international travel (!), but they’ll be able to service their mortgage without any problems.

But what about going under water?

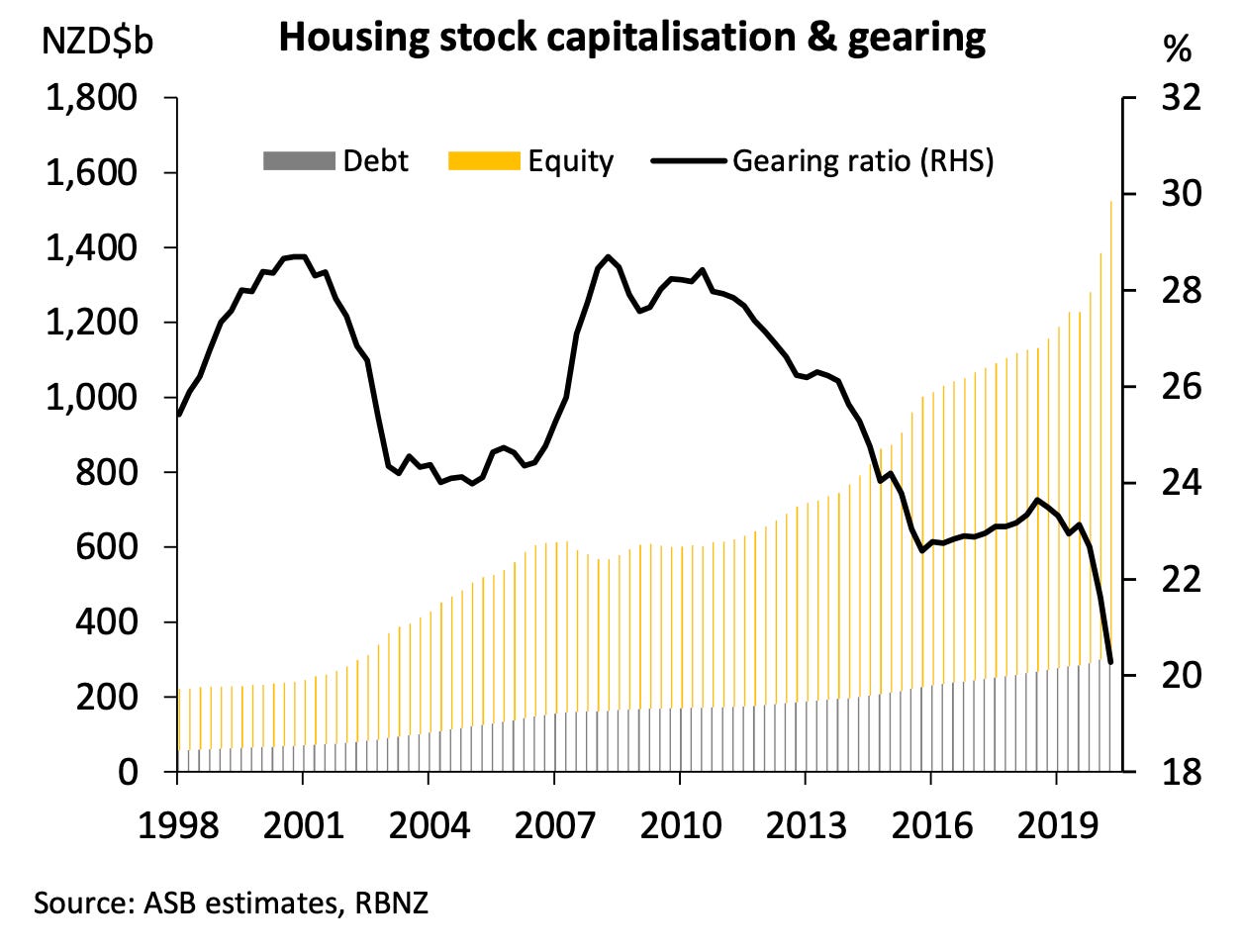

On the home equity front, there is also no burning platform. Only the most recent buyers in the last six months or so would have less than 20% equity, and even then that risk for a few is quickly dissolving as prices keep rising. Banks have wound back their lending above 80% dramatically since the introduction of LVR controls in 2013. The collective LVR of the housing market is barely 20%, as this ASB chart shows.

Thankfully for the economy and the Reserve Bank, it has been screwing down the amount of leverage in the housing market since 2013 and there is now little risk of some sort of crisis overwhelming the housing market or the economy. It may not feel like it for those trying to get into the market who realise they need deposits of over $150,000 and loans of over $600,000, but that is because they are last in. They won’t be able to get a loan if they can’t service a 6% mortgage rate, and they haven’t been able to get in for a long time. If they did with parental help, then the banks can extract cash from parents, who are also well able to afford.

If the Reserve Bank had not introduced LVRs and the banks were using 2% as their affordability thresholds then we would have a problem. But house prices would also average over $2.5m, rather than the $900,000 they currently do.

Also question the fast and big rate hike hypothesis

One argument made by those worried about rate hikes is that many borrowers who are currently on shorter term fixed rate deals or are floating will all rush out and fix for two, three and five year deals. That ‘rush to the exits’ would in turn push up mortgage rates even more than the OCR hikes for those longer term interest rates as banks rush to hedge their positions in the wholesale swaps markets in a sort of a brutal feedback loop that turns into an upward spiral in long term rates.

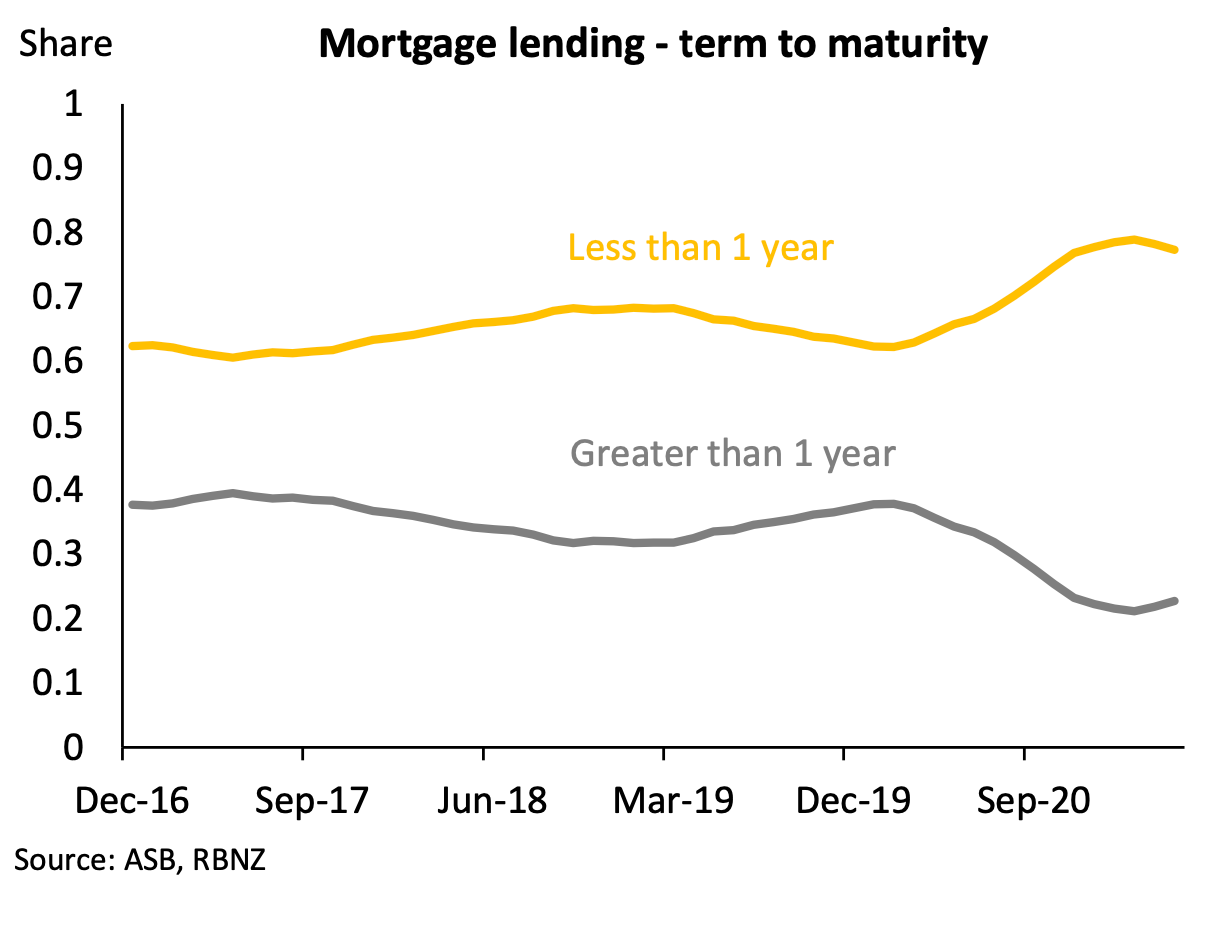

Currently over 75% of borrowers are on floating or fixed for less than a year, so that could happen if everyone thought interest rates were going to sprint over 5% in the next year or so.

Hold your horses e hoa

But many who have been in the market for more than the last five years will be wary of making that big jump into a more expensive three or five year deal, given many did that in 2010 and 2014, and were forced only a year or two later to have to break their fixed contracts with big fees when interest rates came back down again.

Those thinking about that fixing decision also need to understand that all those talking in New Zealand circles about massive inflationary pressures and very fast rate hikes are very out of line with what is happening overseas right now. The Reserve Bank of Australia and the US Federal Reserve are not expected to hike until 2023 and longer term wholesale interest rates have actually been falling overseas in recent months.

The delta variant of Covid-19 is starting fresh waves of infections across Europe and the United States, forcing fresh lockdowns. Also, China quietly announced an easing of monetary policy late on Friday because of an apparent slowing of its economy, which we’ll get more information on later this week. And last night European Central Bank President Christine Lagarde signalled in an interview that more loosening might be required after the ECB’s current QE programme ends.

My view: Don’t be so sure about quick and big rate hikes that last for years.

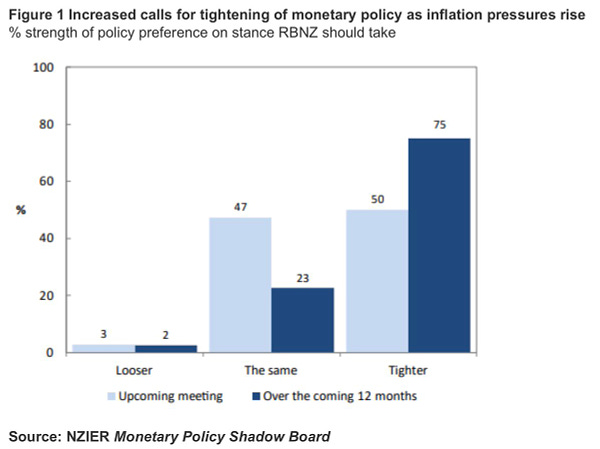

And just if you are wondering if New Zealand’s economists really are that hawkish, here’s the latest from the NZIER’s shadow board.

Scoops and news breaking this morning

A scoop from @henrycooke in Stuff this morning. Judith Collins is working with Don Brash on her latest iwi/kiwi-type campaign “I share Judith’s deep concern about the implications of the He Puapua report and have agreed to try to raise these funds,” Don Brash said.

There are problems for Johnson & Johnson’s one-shot Janssen vaccine being approved in New Zealand. The NY Times-$$$ reports this morning the chances of getting a rare nerve disorder after the vaccine were low, but three to five times higher than for other vaccines.

Signs o’ the times news

Focus grouping is definitely a thing for politicians making Covid-19 decisions, including in Aotearoa-NZ. Here’s how Labor’s Govt did it in Victoria. (The Australian-$$$)

Useful longer reads

Charts of the day

Some fun things

Ka kite ano

Bernard

Share this post