TLDR & TLDL: Incomes for 100,000 low income families rise by around $60/week from today, but child poverty activists are calling for further inflation adjustments and tax credit extensions to further narrow a cost-of-living gap that has blown out to over $300/week for some families over the last year.

See more analysis below this morning’s news and in the podcast above. Normally this is just for paid subscribers, but I’m opening it up to both paid and free subscribers given the public interest. Paid subscribers support this work and I’d love you to join The Kākā community.

Elsewhere in the news this morning:

China widened and extended its Covid lockdowns overnight in the key financial, manufacturing and shipping hub of Shanghai for as much as another 10 days, which worsened fears of a consumption and production slowdown in the world’s second largest economy; (Reuters)

Russian President Vladimir Putin demanded overnight that foreign buyers pay for Russian gas in roubles from Friday or else have their supplies cut, which has already forced Germany, Austria and Spain to prepare for gas rationing that may shut factories; and, (Reuters)

President Joe Biden announced the United States would release a further 1m barrels a day from its strategic oil reserve for the next six months to take pressure off global oil prices, which triggered a 5% fall in Brent Crude prices to US$108/barrel this morning (USA Today).

Coming up today for paid subscribers, look out for my Ask Me Anything invite email comment thread just before midday, where I’ll discuss the week’s event for an hour until 1pm. Then at 4pm, I’ll send out the invite email with the zoom link for the weekly ‘hoon’ live webinar with Peter Bale and guests to chew over the week that was.

Benefits go up, but remain painfully inadequate

The Government has again trumpeted benefit and Working For Families (WFF) changes from today that will increase average weekly incomes for 100,000 families by about $60/week. Here’s Child Poverty Reduction Minister Jacinda Ardern re-announcing today’s increases and Social Development Minister Carmel Sepuloni also re-announcing the changes.

But anti-poverty activists as as Fairer Future, the Child Poverty Action Group (CPAG) and the Auckland City Mission have called today for further improvements across both benefits and WFF to fully respond to the recommendations of the 2019 Welfare Experts Advisory Group (WEAG). Fairer Future estimated earlier this week that some families would still be over $309/week short of the income recommended by WEAG to live with dignity, even after today’s increases.

CPAG and the City Mission recommended today:

that the WFF’s $82.50/week In-Work Tax Credit (IWTC)be extended to all families with children and not just those whose parents are working;

that the IWTC be indexed to wage inflation as other benefits and NZ Super are now; and,

that the abatement rate increase from 25% to 27% from today to claw back income earned over $42,500, and that the threshold also be adjusted for wage inflation.

CPAG Spokeswoman Susan St John described how Aotearoa-NZ’s welfare system for the children of the unemployed was even meaner than Australia’s.

"The Government can significantly reduce the burden of the deepest income poverty by first, ensuring the full Working for Families reaches the 150,000 children living in the severest income poverty who currently miss out

“Let’s catch up to Australia where there is no such discrimination in their tax credits against the poorest children." Susan St John.

Auckland City Missioner Helen Robinson also called for the IWTC to be extended to the families with parents out of work.

"WFF is designed to limit assistance to the worst-off families and that lifting these worst-off up requires making the full package (ie the IWTC) available to all on benefits. It can be done simply and would recognise that parenting is work." Helen Robinson.

They also pointed out the inflation adjustment included in today’s benefit and WFF increases were only for price increases up to the end of September 2021, when much of the inflation in fuel, food and rent prices has happened after then. Economists are forecasting that prices for beneficiaries will have risen by a further 5.8% between the end of September last year and the end of June this year.

Susan St John wrote an excellent piece for Newsroom last week on the scale of the need and the relative ease of the fix for a Government that gave $20b in cash to business owners over the last two years.

“What can be done immediately? First the IRD could flip the switch overnight and pay the full WFF to all low-income families. It won’t cure child poverty on its own, but it is an obvious start, targeted at only those with greatest need. It would commit the government to spending around an extra $650 million per annum and be an excellent stimulus as it would be spent immediately, saving parents precious time and anguish in queuing for food parcels and hardship relief. It requires letting go of a failed neoliberal ideology that withholds a poverty-reducing payment for the poorest children in the name of a work incentive.

“All aspects of WFF should also be annually indexed like NZ Super and the tough tax rates on low-income families in low-paid work must be reduced. The clawback should be reduced from its April 1 new rate of 27 percent to its former rate of 20 percent. Other bold steps such as for housing are of course also urgently needed to avert social crisis of hunger and despair brewing in Aotearoa and provide the promised transformation.” Susan St John

Inflation much more painful for the poorest

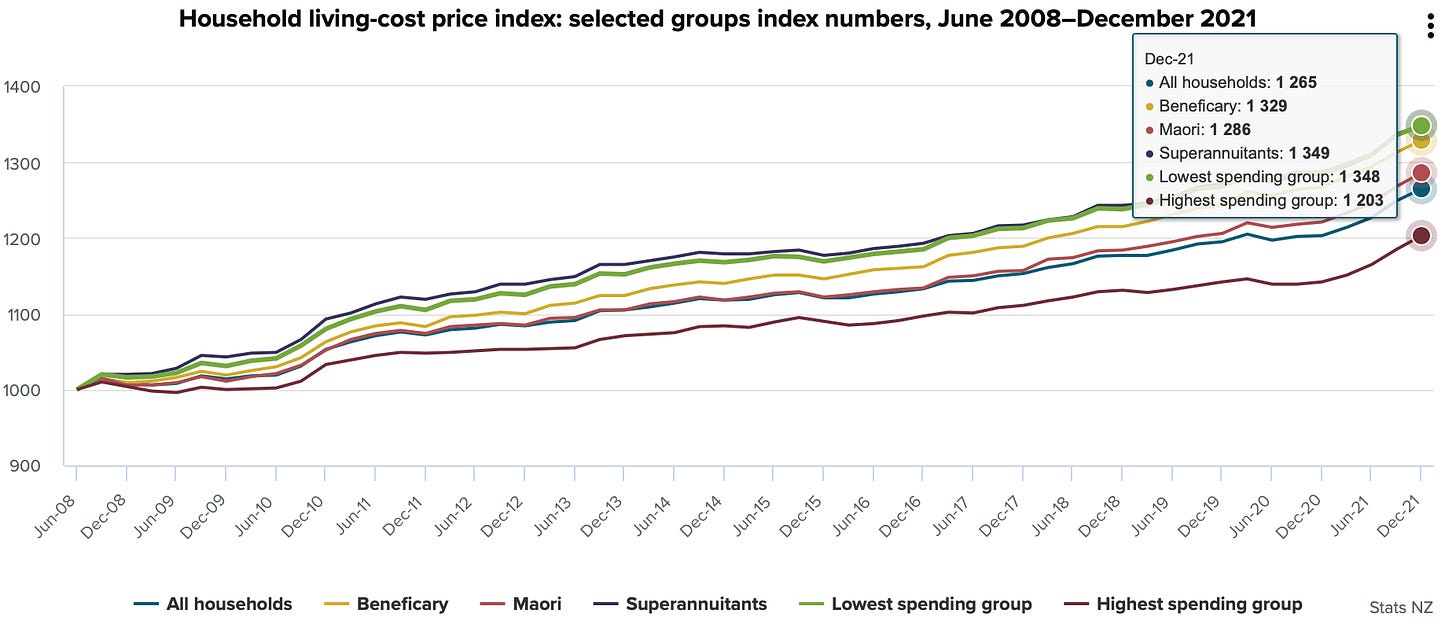

Inflation for beneficiaries, Maori, the lowest earning quintile and superannuitants has been significantly higher over the last 13 years than for the highest earning quintile and home owners in particular because rents have exploded relative to mortgage costs and fuel and food costs have risen faster than other costs. Those on lower incomes spend a bigger portion of their income on fuel, food and rent than those on higher incomes, who typically own their homes and save bigger chunks of income.

Here’s the Stats NZ chart showing inflation since 2008 for those lower earning groups was 32.9%, 28.6%, 34.8% and 34.9% respectively, while inflation for the highest earning group was 20.3%.

and

The very definition of an unjust transition

In my view, the true tragedy of the Labour-Green Government’s response to both Covid and now the energy-and-food-related inflation crises is that its is worsening the income and wealth inequalities present before Covid and storing up huge and uncosted liabilities on the Crown’s future balance sheet in the form of higher health, justice, education and welfare costs, along with opportunity costs of lost productivity and health benefits from a much fairer response.

The only reason Labour has given for not responding is that it would cost too much at a time when the Government should be tightening its fiscal stance to reduce net core crown debt back to the 20-30% of GDP north star that both Labour and National Governents have targeted since the early 1990s under the tutelage of Treasury.

The extension of the IWTC to all 150,000 children in poverty is not only a no-brainer. That’s the bare minimum that should be done, along with:

the necessary wage inflation adjustments for benefits and WFF’s tax credits and abatement thresholds up to April (not September 30)

the reversal of the effective tax increase in the increase in the abatement rate in recent years from 20% to 27% at the $42,700 income threshold; and,

a repeat of the doubling of the winter energy payment that was done in 2020.

Are you proud of your work?

Another generation of children are being sacrificed on the altar of keeping core crown debt at less than half the level of our AAA-rated OECD peer countries, and because Treasury has failed utterly to properly estimate the true long-term liabilities of our climate inaction, ongoing housing unaffordability and gruelling child poverty.

Just quietly, I’d like to ask every one of the Treasury, DPMC, MSD and MBIE advisers and executives who subscribe to this email whether they are proud of their advice to ministers, and whether that advice is truly free and frank.

And to those Labour and Green and National MPs who also get this email: is this the Aotearoa-NZ you really want to hand over to your and our tamariki when you finish your time in Parliament?

Here’s more useful coverage on the benefit and WFF changes today from Amelia Wade at Newshub, Glenn McConnell at Stuff and reporters at RNZ.

For the record yesterday

Anti-hospitalisation cavalry in a pill - Andrew Little announced 60,000 doses of Pfizer’s Paxlovid, a pill that prevents sick Covid patients from being hospitalised, arrived this week and will start being distributed next week. He said Pharmac had also gotten access to AstraZeneca’s Evusheld, which can prevent people who can’t have vaccines from getting Covid, although it is yet to be approved by Medsafe.

“Access to Paxlovid will be tight to make sure it gets to the people who need it most. It will be prescribed by doctors, with factors such as age, disability and being immuno-compromised taken into account.” Andrew Little.

Useful longer reads

Just BTFD and HODL dude…

The FT has a (free to read) good deep dive here on why financial markets are so chilled about the war in Ukraine. Global stocks are now above their pre-war levels. (Yep. Go figure…) In my view, this is all about the BTFD and HODL crowd betting on yet more money printing and eventual rescues. They don’t want to miss out on the almighty rebound…

This chunk of foreboding resonated with me.

“Financial markets are what scientists call a complex adaptive system, like our planet’s climate, an ant colony or the human body, where a multitude of independent components can interact in unexpected ways. That can lead to collective behaviour that is hard to predict from observing each factor individually. Complex adaptive systems are inherently hard to understand. They can also be both impressively resilient and cataclysmically fragile, often dynamically adapting to setbacks but occasionally succumbing to a toxic combination of seemingly minor independent failures.” Robin Wigglesworth in Oslo, Philip Stafford and Tommy Stubbington in London for the FT (free to read.)

The end of globalisation? Really?

This free-to-read thinkpiece via the FT and Chartbook from Adam Tooze is an excellent challenge to the Larry Fink letter to BlackRock shareholders last week about the Russian invasion of Ukraine putting an end to the last 30 years of globalisation.

Tooze calls bullshit on Fink, who talks about deglobalisation, but remains heavily invested in China.

“There is a lot of talk about reshoring and rebuilding supply chains, but far less action on the substance. Apple, to cite the most prominent example, actually increased its reliance on China last year. For now at least, feverish talk about Russia’s attack on Ukraine ending globalisation as we know it should be taken with a pinch of salt. Imagine Fink championing an economic war against China! When that no longer seems “non-planetary”, we will know that we are really in a new world.” Adam Tooze

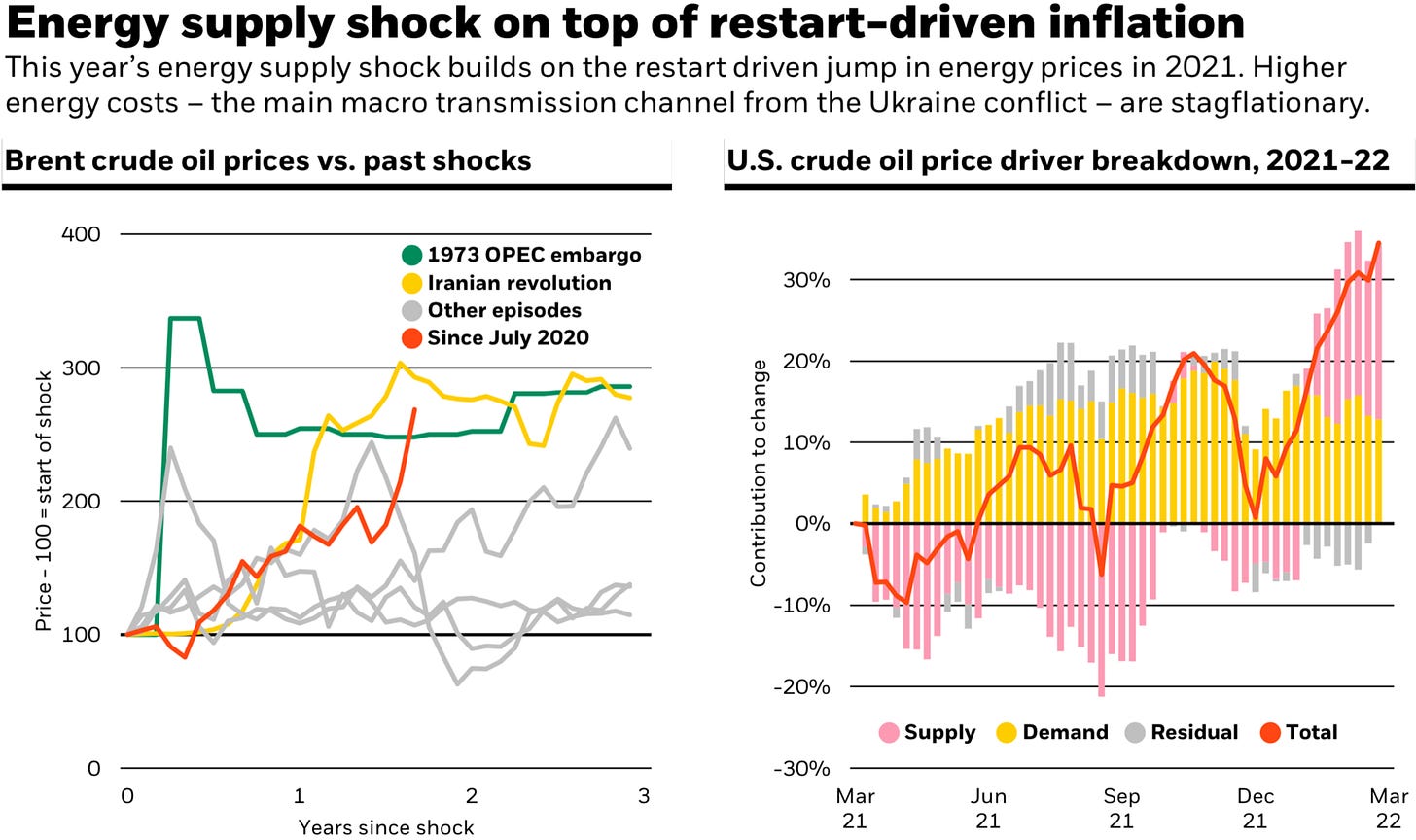

Chart of the day

This is a real oil shock, as BlackRock’s latest chart pack shows.

Quotes of the day

They sound pretty friendly still

Russian Foreign Minister Sergei Lavrov and Chinese Foreign Minister Wang Yi met in Beijing yesterday and said lovely things to each other.

"We, together with you, and with our sympathizers will move towards a multipolar, just, democratic world order." Sergei Lavrov

The ‘multi-polar’ line is reminiscent of the thinking of Aleksandr Dugin. Remember him? FYI a repeat of the link to the explanation via Kim Hill on RNZ last weekend.

And there’s still no limits…

"China-Russia relations have withstood the new test of the changing international situation, maintained the correct direction of progress and shown tenacious development momentum…. China-Russia cooperation has no limits." Wang Yi

Comment of the day on The Kaka community

The PPP Kool Aid is on tap at the Infrastructure Commission

“Do you really think there won't be another PPP? The Infrastructure Commission, which has establishing PPPs firmly embedded in its DNA, appears to be focused on ways to improve PPP establishment and operation rather than questioning the choice of using a PPP in the first place. Looks like the 'no true Scotsman' fallacy in operation. And, as you've pointed out, with the low debt level targets still in place there is a strong incentive to move projects off balance sheet with PPPs or SPVs (at least there is a chance of value capture in the SPV levy setting). I would not be surprised that in a few years there will be another PPP that will be prepared to fight the last war, and will find a whole new method to privatise the profits and socialise the losses.” Andrew in yesterday’s piece on Transmission Gully.

Thread of the day

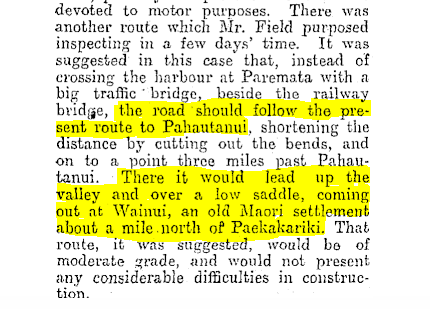

Stepping back in time

Spookies, profundities, curiosities and feel-goods

The Craic

A fun thing

Ka kite ano

Bernard

PS: Here’s the zoom link for the 4pm ‘hoon’ with Peter Bale until 5pm.

Share this post