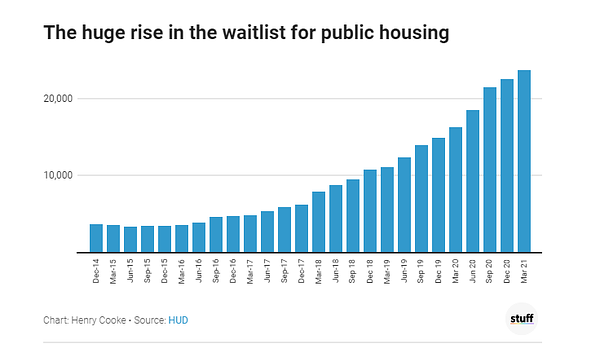

TLDR & TLDL: It’s like the great Auckland Unitary Plan battle for the housing future of the city all over again. The DomPost’s Damian George reported yesterday Wellington City Council officials had halved the amount of medium density housing zoned in its draft response to the Labour Government’s National Policy Statement on Urban Development (NPS-UD).

A campaign by NIMBY ratepayers appears to have effectively knobbled attempts by the Government and housing activists to increase the supply of medium density and less-unaffordable housing for younger and poorer people to live in. However, this is a draft at this stage and the councillors have to approve it in a final vote in the coming weeks. It may yet to be overturned by Green and Labour councillors, but it’s very much up in the air.

Just as Auckland’s Councillors initially had to vote on a proposed version of its Unitary Plan (AUP) in 2016 that would have rezoned much of the isthmus, now Wellington’s Councillors have to do the same. A NIMBY backlash blocked the higher density early version of the AUP, but the-then National Government of John Key and Bill English managed to cajole the centre-right Auckland councillors to approve a watered down version of the AUP. Large swathes of Ponsonby, Parnell, Mt Eden, Grey Lynn and Herne Bay avoided changes to the mostly single-house single-storey zoning.

A fight to house the young and poor

The battle has begun in earnest in Welllington and currently it’s 40-love to the NIMBYs. This debate is a crucial flashpoint in the ongoing debate about housing supply, as the AUP debate was. Despite an apparent victory for the densifiers in Auckland, the end result entrenched much of the inter-generational wealth transfer and is blocking the necessary redesigning of our biggest city, in part because decisions about squeezing infrastructure funding unnecessarily (in my view) have tied in nicely with the NIMBY attempts to block development.

This fight in Wellington is also a test of the solidarity of the Greens, where the older Values Party rump of the party more interested in stopping inner-suburban development and saving trees has no sympathy for the apartment building and public-transport-loving youth wing of the party. Some of Wellington’s councillors are older and Green-aligned and there is a fierce battle brewing there.

National also has some internal tensions to deal with. National’s Housing spokesperson Nicola Willis favours more intense housing development, as does former Transport spokesman and National’s current Leader of the House Chris Bishop. National’s older suburban voters and anti-Island Bay cycleway campaigners, along with many MPs, are less keen.

We’ll also see whether the Labour Government uses some of its political capital to align itself with young councillors and inner-city voters wanting apartments and townhouses and pedestrianisation of the inner city, against the suburban home-owners wanting to retain leafy single-story inner city landscapes.

So will interest rates rise now?

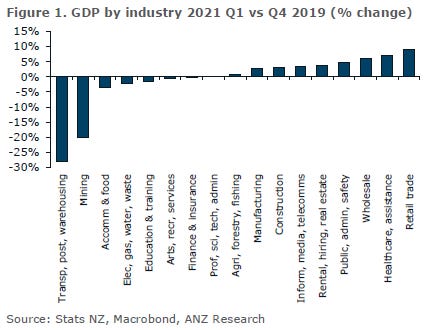

The other big news yesterday was the much-stronger-than-expected 1.6% jump in March quarter GDP reported by Stats NZ. Economists had revised their forecasts up in recent weeks, but only around 0.5% to 0.8% for the quarter. The Reserve Bank had forecast last month there would a -0.6% contraction for the quarter and Treasury forecast a 0.2% fall in the Budget last month.

GDP in the March quarter was up 2.4% from March quarter of 2020, just before Covid hit hardest. Economists had expected a 0.9% rise from a year ago. Jobs growth is strong and home owners are feeling the wealth effect of a $318b increase in their home equity since Covid.

"Households spent more on accommodation, eating out, and purchasing big ticket items such as furniture, audio visual equipment, and motor vehicles. This helped support the growth in retail trade and accommodation industry and wholesale trade industry." Stats NZ National Accounts senior manager Paul Pascoe

But will all that asset price inflation flood through into higher goods and services prices, forcing the Reserve Bank to act early to put up interest rates?

Economists brought forward their forecasts for the first Reserve Bank hike to earlier next year than the current July start pencilled in by the central bank itself. The consensus is settling around May, or possibly even earlier. Wholesale interest rate markets now see a less-than-10% chance of a first rate hike in November, with a 50% chance of one in February.

My view: I want to see the whites of the eyes of widespread consumer price and wage inflation before we start putting up interest rates. I still think the Reserve Bank will hold back longer than many think, in part because there’s a risk New Zealand goes out well ahead of other central banks and is exposed by an interest-rate driven flow of capital into the NZ dollar.

However, exporters got some help (sort of) last night as commodity prices tumbled and dragged the kiwi dollar briefly below 70 USc. It is currently just over 70 USc. The Fed’s indication of a 2023 start to rate hikes unnerved a few people who had bet on very strong global growth. Although it’s noticeable US stocks remain strong and the US 10 year Treasury bond yield fell (yes fell) overnight by seven basis points to 1.50%.

The drums are beating for a late 2022 rate hike in Australia now after 115,000 jobs were created there in the March quarter, driving the jobless rate down to pre-Covid levels of 5.1%. The result was double economists’ forecasts and has seen markets pull forward their expectations for the Reserve Bank there to start hiking in December next year, about three months earlier than previously seen.

News breaking this morning

Signs o’ the times news

Notable other views

Some fun things

The sun rose at 7.46 am in Wellington today. It will rise at 7.46 am on Monday, which is the shortest day of the year.

Share this post