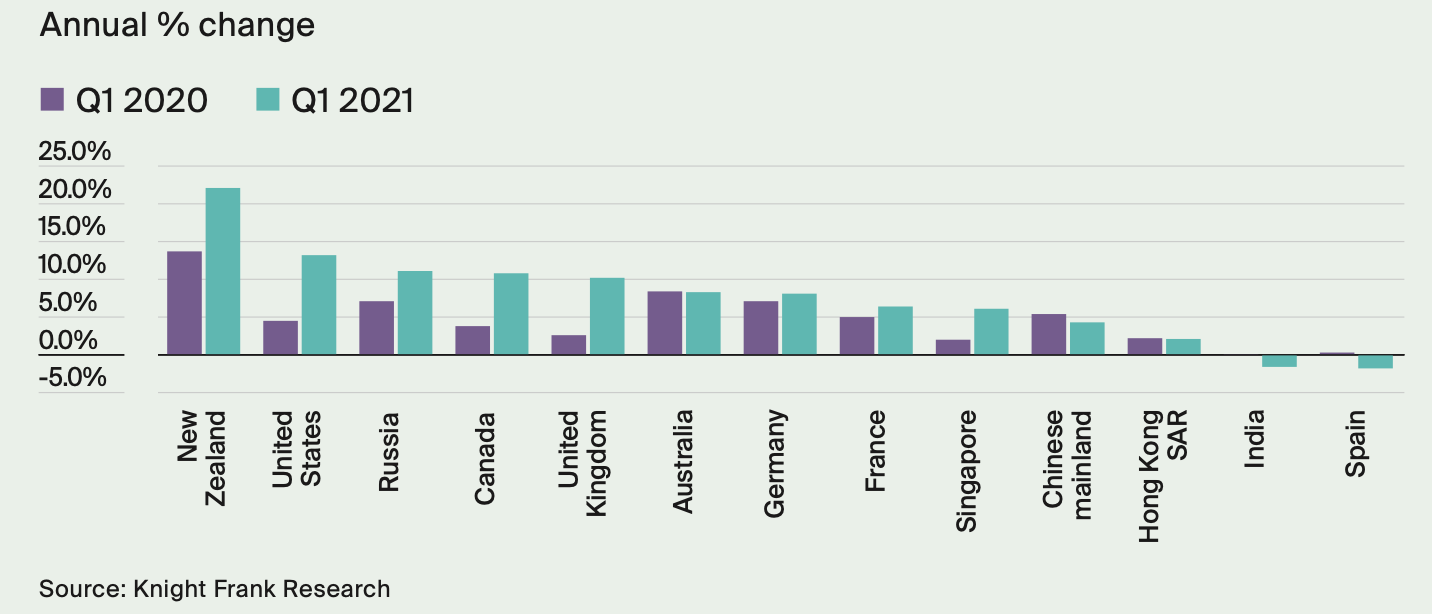

TLDL & TLDR: The world-beating scale of the house price inflation in New Zealand since Covid’s arrival is continuing to shock and amaze, even after the Government appeared to ‘pull all the demand and supply levers’ from November through March.

Knight Frank released its first quarter figures for its Global Residential Cities Index overnight, showing Wellington as the third hottest housing market in the world in the March quarter with annual inflation of 30.1%, up from 32nd fastest a year ago. Auckland was the 11th fastest with inflation of 19.6%, up from 101st fastest a year ago. The Turkish cities of Izmir and Ankara were the first and second fastest, thanks to a collapse in confidence in the local currency and very-fast inflation.

New Zealand had the fastest house price inflation in the developed world in the year to the end of March, Knight Frank’s measure shows.

An August hike? Really?

Meanwhile, the drums are beating even louder for early interest rate hikes here that would see New Zealand step out way ahead of its central banking peers in Australia and the United States. Economists at ANZ and Westpac yesterday brought forward their calls for the first rate hike to November, with ANZ even seeing a remote chance of an August hike in its note. We’ll next hear from the Reserve Bank with its statement-only monetary policy review and decision next Wednesday at 2pm.

However, there’s a risk here that New Zealand gets way out in front of others, which would put upward pressure on the currency. The Reserve Bank of Australia is not expecting to hike until 2024, while the US Federal Reserve is indicating a 2023 start to rate hikes. The Fed reiterated its more measured approach in minutes from last month’s decision published this morning showing it is still only in the early discussion phase of dialling back its money printing from a current rate of US$120b a month. Australia is still printing at a rate of A$20b a month and New Zealand is printing about NZ$800m a month.

Watch what global investors believe

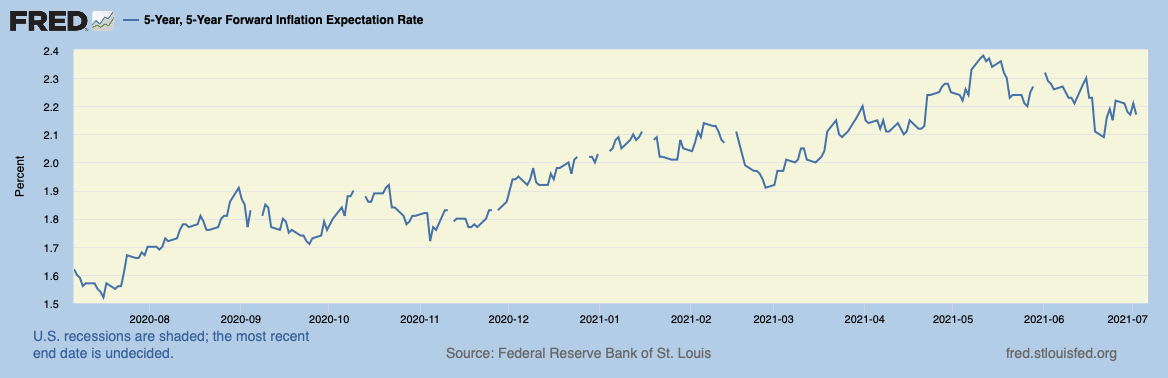

Also, the wisdom of the crowds in the world’s most liquid bond market is still staying inflation and interest rates will remain very low for a very long time to come. The key 10 year US Treasury yield fell again overnight to a four-month low of 1.29% and well down from its March high 1.77%. Financial markets overseas see the risk of further delta variant surges suppressing the global economic recovery and inflation pressures.

My view: There is a risk our Reserve Bank acts too quickly and has to reverse back towards zero in the next year or two, as happened in 2010 and 2014. Our central bank is still using the ‘shoot first, ask questions later’ approach to running monetary policy rather than the ‘wait until we see the whites of the eyes of inflation’ approach now used by Australia, the US and Europe.

This chart showing financial market expectations for US inflation over five years (the five year Treasury rate minus the five year Treasury inflation-protected yield) shows they’re down from 2.38% in May to 2.17% now. New Zealand’s inflation and interest rate watchers risk getting ahead of themselves.

Scoops and news breaking this morning

Questions for the Minister

Signs o’ the times news

Useful longer reads

Chart of the day

Share this post