TLDR & TLDL: We all knew the housing supply and winter power crunch for poor renters was awful, but the latest revelations emphasise the need for even more massive new supply of housing and a root and branch restructure of the electricity market.

It is a scandal that the Government is not building many, many more homes — or at least signalling hundreds of thousands in the years to come — while at the same time prioritising ‘keeping a lid on debt’ in its spending plans. And all at a time when real interest rates on Government debt are negative, and going lower.

It is also a scandal that state-controlled power companies are allowing an independent power retailer specialising in helping poor families needing power in winter to shut its doors while selling cheap power to a smelter. More on that below.

Thomas Coughlan reports this morning from official figures in a Parliamentary written question that show that of the 7934 public homes added by the Government, only 3716 are actually "new". The rest were mainly existing homes purchased or leased on the private market.

Yet the Government appears to be punishing Community Housing Providers (CHP) that do the same thing by removing their ability to claim an Income Related Rent subsidy, Newshub’s Zane Small reported last night, citing comments from major CHP Monte Cecilia’s Bernie Smith.

He says now is not the time to make changes to a tool that works and that the change to remove the subsidy would force over 200 families - totalling over 1000 people, 700 of whom are children currently in Monte Cecilia accommodation - to wait years in temporary housing for the Kāinga Ora build programme to catch up.

"When Labour came to power there were just over 67,000 state houses and a waitlist of 5000. Five years later, the state house numbers have grown by less than a 1000 while the public housing waitlist has soared to 24,000.

"The decision to throw tools out of the toolbox at this time of crisis is utterly baffling, and what's doubly confusing is the Government's own 2021-2024 housing plan acknowledges the role of CHPs and states they are committed to ongoing investment in the sector." Bernie Smith

This is all at a time the need couldn’t be greater

The Child Poverty Action Group published a report this morning looking at the effect of Covid-19 on child poverty. It showed an extra 18,000 in poverty, with Maori and Pasifika children worst affected.

Meanwhile, Stuff reports independent power provider Nau Mai Rā, which specialises in offering power to households with credit problems, has had to ask 500 customers who are able to leave to do so, because wholesale power prices are so high. This is more proof the electricity market is failing for independents, competition and for provision for those in poverty.

“In New Zealand there is no retailer of last resort. There is a hole where people can fall through the gaps. That is a really bad thing when people need access to an essential service like electricity. Nau Mai Rā provide power to customers no-one else wants to take on. The difficult thing is they are buying electricity off the same market as everyone else, so it becomes very challenging.” Consumer NZ’s Powerswitch Manager Mike Fuge.

Nau Ma Rā co-founder Ezra Hirawani is trying to arrange wholesale power at long run prices, similar to that paid by Bluff smelter owner Rio Tinto to majority state-owned provider Meridian for power generated at Manapouri.

“The core issue of what is stopping us is the industry is not built to serve vulnerable consumers. So we are asking an industry to perform in a way that it is not built to do. What is key is that this is not the generators supporting Nau Mai Rā, it is the generators supporting vulnerable consumers. We cannot do this alone, we need to have a true demonstration of a Te Tiriti o Waitangi relationship with a generator.” Nau Mai Rā’s Ezra Hirawani.

Govt missing a massive opportunity to invest to solve these problems

My view: We have a Government that has $40b cash in its bank account and is headed back to surplus within a couple of years deciding to pull funding from social housing providers because it wants to save money. At the same time, it is not building enough houses because it believes to do so would ‘break’ the Government’s ‘keeping a lid on debt’ aims.

Meanwhile, the state-controlled power industry has sat by while independent retailers who have helped keep retail power prices from rising much in recent years have gone to the wall because of a wholesale market judged dysfunctional in a Labour Government report two years ago.

And all at the same time, real interest rates on Government bonds are negative. Overnight US 10 year government bond yeilds hit a record low of minus 1.127%. The Government is sitting on its hands as poor kids without power for heating are getting poorer, it is cutting funding to social housing providers helping to look after those kids.

All the while, the next generation faces a housing affordability and climate catastrophe that the Government is reluctant to do much about because it fears a group of mostly older (multiple) property-owning median voters who don’t want change.

Scoops and news breaking this morning

Signs o’ the times news

Amazon Job Posting Hints at Plan to Accept Cryptocurrency, as Bloomberg reports.

You have to wonder how China’s latest crackdown on private education companies will affect the likes of Jamie Beaton’s Crimson Consulting. More on the crackdown here from Bloomberg.

Singapore is set to reopen in September with an 80% vaccination rate, Bloomberg reports

One for crypto types to keep a close eye on. Here’s a piece on Bloomberg about Tether execs said to face criminal probes into alleged bank fraud.

Longer reads and listens worthy of your time

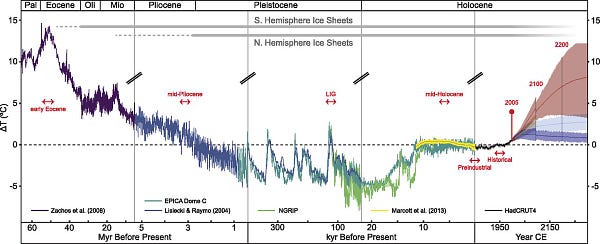

Chart of the day

Share this post