TLDR & TLDL: Last night the European Central Bank formally adopted the more relaxed stances on inflation that the US Federal Reserve and Reserve Bank of Australia are using.

The Fed and the RBA are saying they want to see inflation rise above 2% before they start hiking, so as to be sure they don’t make the mistakes of the last decade and pull the trigger too early. Those early tightenings contributed to inflation being consistently closer to 1% than 2%. Now they’re indicating they’ll let inflation run above 2% for a while to ‘average out’ the inflation under 2% seen over the last decade.

The ECB now also says it will tolerate inflation above 2% and will be ‘symmetric’ about targeting inflation around that level. Previously it saw its role as driving inflation under 2% and keeping it there.

“When the economy is operating close to the lower bound on nominal interest rates, it requires especially forceful or persistent monetary policy action to avoid negative deviations from the inflation target becoming entrenched. This may also imply a transitory period in which inflation is moderately above target.” ECB President Christine Lagarde in a statement changing the ECB monetary policy approach.

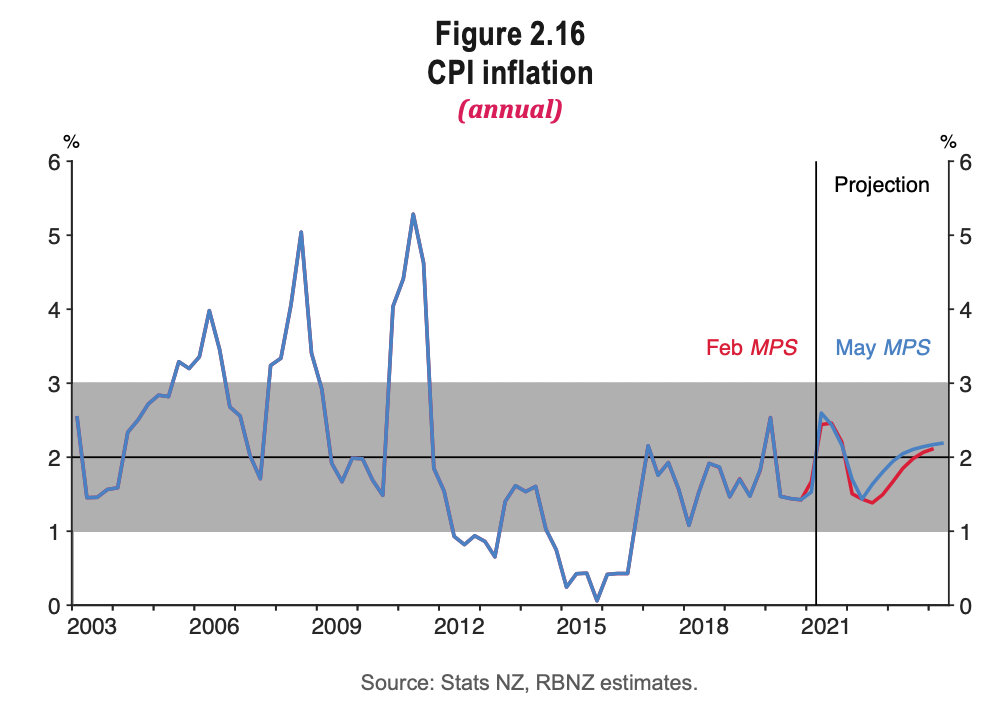

The bolding is mine. It shows the ECB will wait until it sees the ‘whites of the eyes’ of inflation before acting. Our Reserve Bank has kept to its target of one to three percent with a focus of around two percent, but in effect is still looking to hike interest rates before inflation is sustainably above 2%, arguing it needs to act 18 months or so beforehand to ensure it’s not too late. This is the regular pre-Covid and pre-GFC playbook.

My view: The Reserve Bank should let the economy’s engine race to blow out the cobwebs of very subdued wage growth and to get some inflation heat back into the economy so interest rates can be normalised at a higher level. The risk is that at the moment it may jump too early and embed expectations below 2%.

Its last set of forecasts showed it planned to hike from mid 2022 and that inflation would only get above 2% later in 2023 (see chart below). Economists now expect the first rate hike in November after a run of good economic figures and signs of skill shortages in the jobs market.

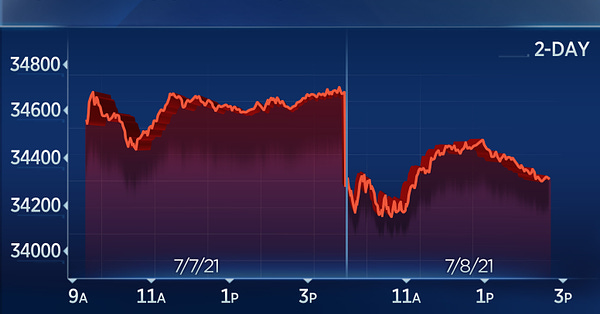

However, there are doubts this will continue overseas. US and European stocks fell as much as 2% overnight and the US 10 year Treasury bond yield fell to another four-month low of 1.27%. The German 10 year bund fell 3 bps to minus 0.323%. Fresh waves of delta variant Covid are now racing through well-vaccinated developed economies, slowing activity again, while China announced this week it may ease monetary policy because of a slowdown in its rebound.

New Zealand risks jumping well ahead of its peers and before inflation is well bedded in. This would push the NZ dollar further up well over 70 USc and risk stalling export growth.

Some may argue that lower interest rates for longer would put even more pressure on the housing market, which is true, but the Reserve Bank should use its LVR and new DTI tools to offset that pressure by further restricting riskier lending, rather than putting a squeeze on exporters and businesses.

Scoops and news breaking this morning

Other places I’ve written and spoken

Signs o’ the times news

Question for the minister

Useful longer reads and listens

Share this post