TLDR & TLDR: Last night, when the average temperature in Christchurch was minus one degrees celsius, Australia’s global mining and smelting giant Rio Tinto did an extraordinary thing that 100,000 New Zealanders living in energy poverty and our energy market regulators and state-controlled gentailers should know about.

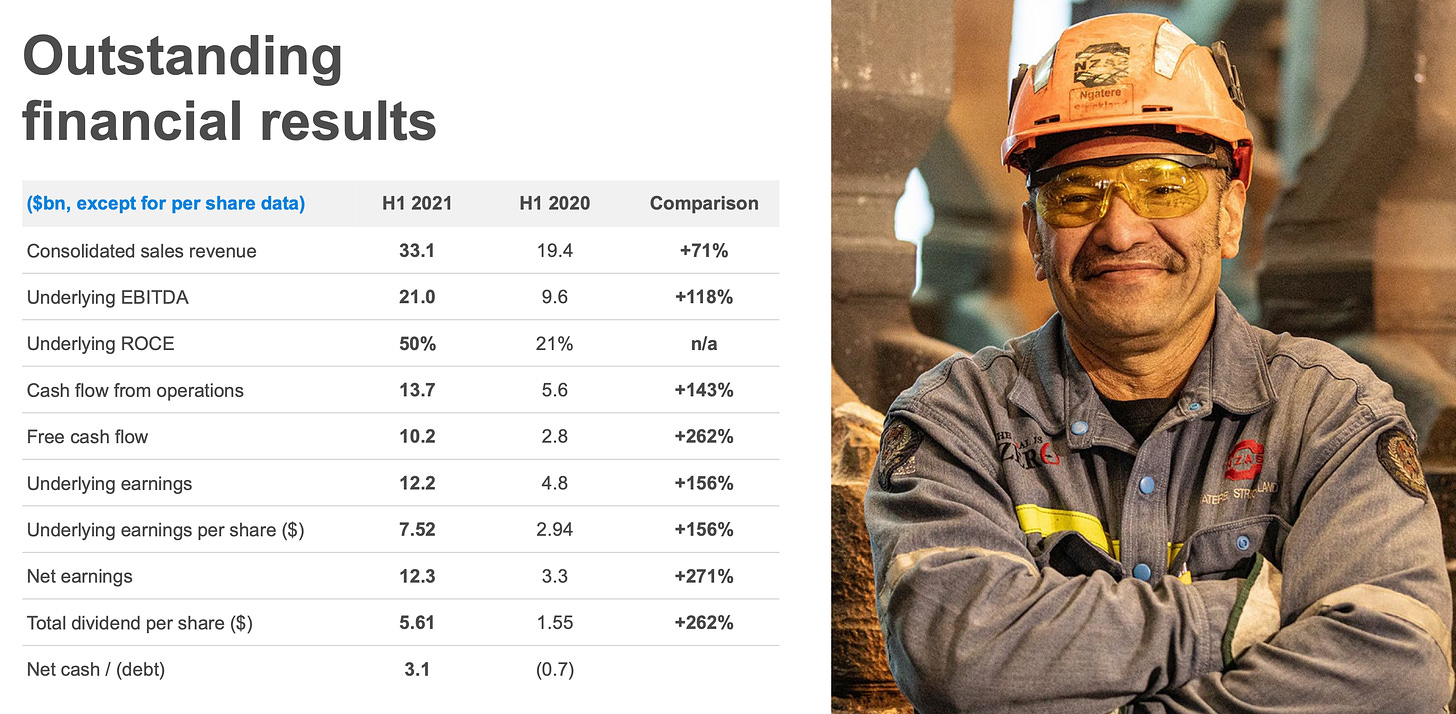

It effectively bragged to shareholders about how much its bluff to shut down the Bluff smelter had boosted its profits so it could pay them a record US$9.1b in cash dividends.

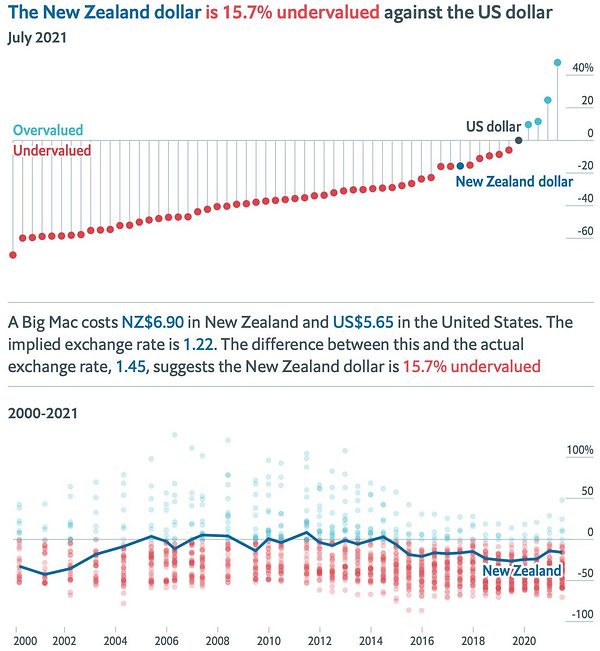

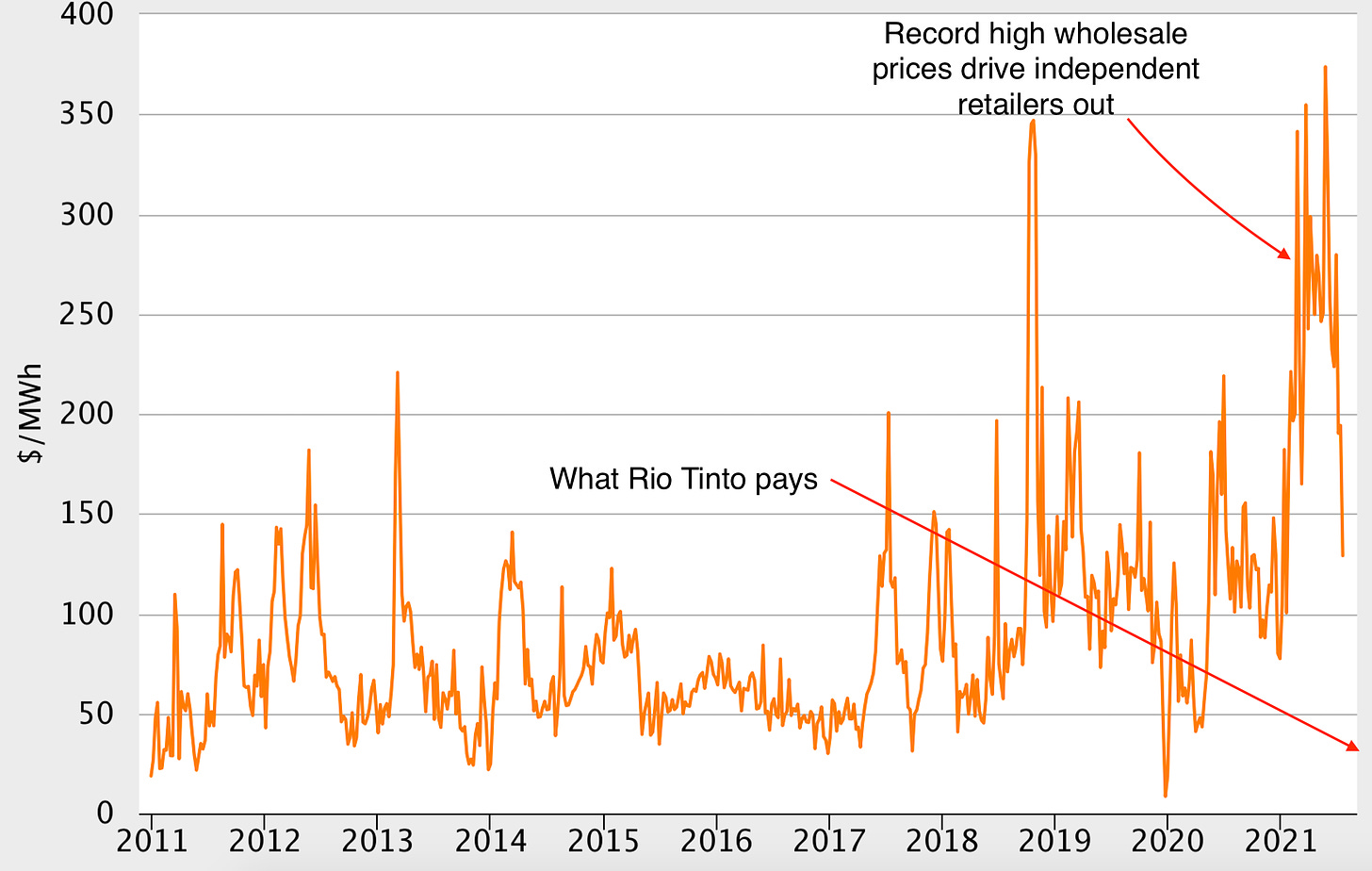

The owner of the Bluff Aluminium smelter noted in its results statement released late yesterday how successful its bluff to shut down the smelter late last year had been. The threat led 51% state-owned Meridian Energy to give a $60m per year electricity price cut to Rio Tinto in January which means the smelter now pays just $35 per megawatt/hr. That compares with the average wholesale electricity price since January of $239 per megawatt/hr and the price this week in the lower South Island of $103/mw/hr.

“Lower energy prices, on average, compared to 2020 first half benefited underlying EBITDA by US$43 million, mainly due to lower energy prices at our aluminium smelters, including the new agreement reached during the first half in relation to the electricity supply to New Zealand Aluminium Smelter (NZAS)” Rio Tinto results statement.

Rio Tinto reported this lower price deal had contributed to its record US$12.1b profit in the first six months of 2021 and its record high dividend payout of US$9.1b. It illustrated its “outstanding financial results” slide (8) for investors with a picture of a Bluff Smelter worker. Most of the profits and dividends came from surging iron ore prices as China fired up its economy last year with more steel and concrete, but tens of millions would have come from the profits from Tiwai Point.

So why does this matter?

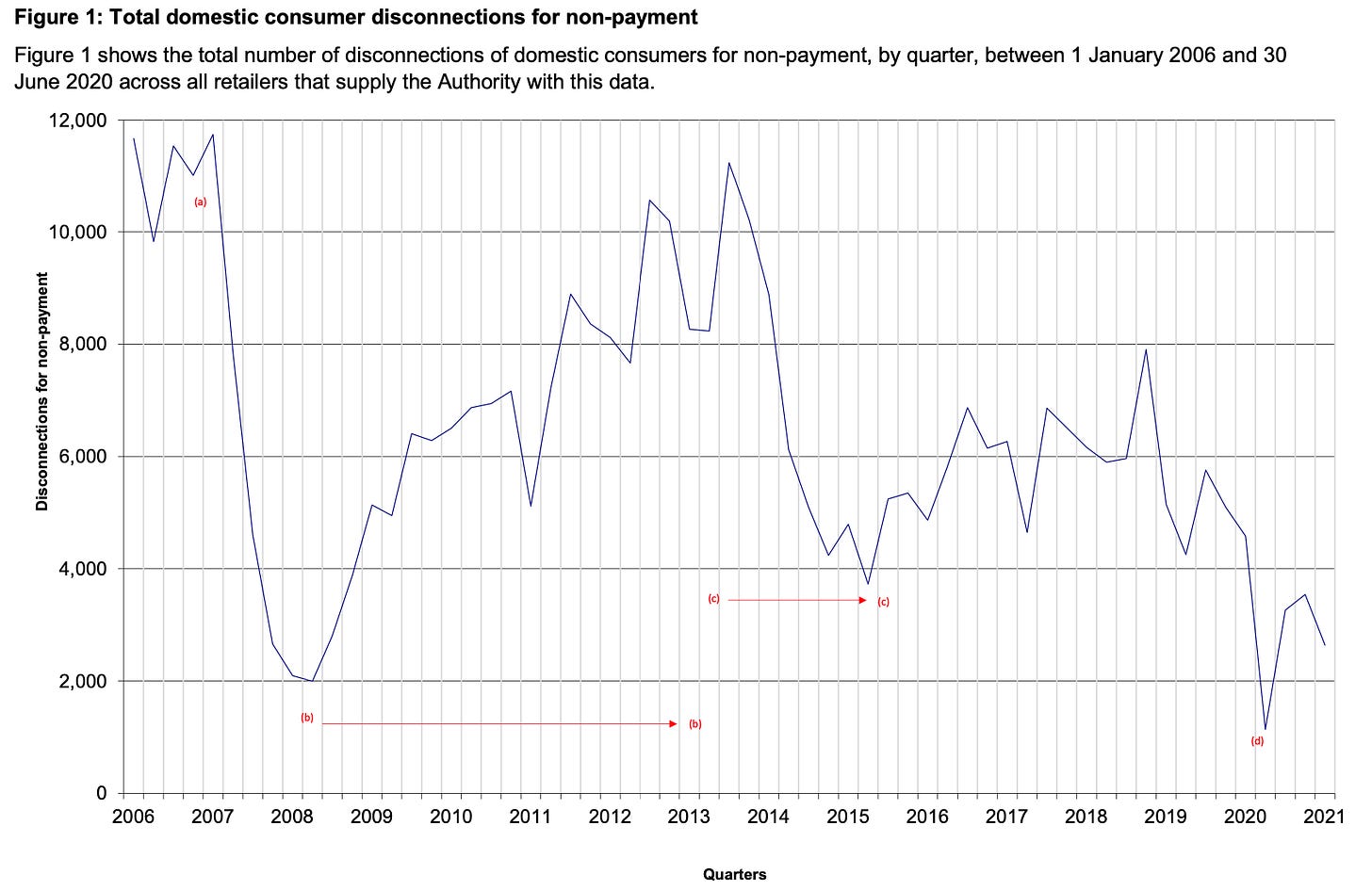

This winter at least 100,000 New Zealanders are living in energy poverty, spending more than 10% of their income on electricity, according to the official Electricity Price Review from 2019. Around 5,000 households are usually unable to pay their bills in three months of winter and have their power cut off. About 20,000 households each year are cut off because they can’t pay their bills. Further, tens of thousands of renters in private and state-owned rentals are choosing this winter not to turn on their newly installed heat pumps to keep their power bills down and avoid disconnection.

Part of the reason for that is electricity prices rose 48% faster than other prices between 2000 and 2019, triggering many complaints about the way the electricity market was created and is working. There had been hopes the growth of independent electricity retailers able to apply some competitive pressure downwards on prices from the five big ‘Gentailers’ (Meridian/Genesis/Mercury/Contact/Trustpower) would reduce that inflation. They have since 2015, but that restraint appears about to end.

Gentailers free now to hike prices again

Spikes higher to significantly higher wholesale prices over the last year and well into the future (on futures markets) have driven those independents out of the market. In recent weeks, ElectricKiwi, FlickElectric and Nau Mai Rā (which offers power to those unable to get power from others because of credit quality problems) have all pulled out of the market and started offloading customers.

Big wholesale power buyers, including the Glenbrook steel mill owned by NZ Steel, have indicated they may have to close with the cost of hundreds of jobs because of the high electricity prices. The gentailers have blamed low lake levels earlier this year, the closure of a geothermal plant for repairs, and gas supply shortages in Taranaki for the high wholesale prices, but independent retailers don’t believe the market is functioning anymore to provide something close to the long run marginal cost of new supply.

The wholesale electricity price has averaged $85/megawatt hour over the last 12 years, but has averaged $179/megawatt hour over the last year, despite falling costs for new wind and solar generation. New wind and solar power generation is seen costing $50-$100 per megawatt/hour. This has also meant record high amounts of coal have been burned at the Huntly power station to take advantage of the record-high spot prices.

There are also questions about why prices remain so high when recent rains have refilled the hydro electric lakes to ‘normal’ levels between the 10th and 90th percentiles, as this Transpower chart shows with the dark line going back into the dark green shade of ‘normal’. Independent retailers believe the Gentailers have drip-fed or spilled water in the past to ensure marginal prices stay high.

My view: It is galling to see tens of thousands of New Zealanders shivering through winter because of high retail prices in an uncompetitive market when we have abundant ‘free’ water generating electricity through state-controlled dams, in part because much of that cheap power is being used to bolster the profits of a foreign company. It is also infuriating to see New Zealand burning over one million tonnes of coal a year because of these high prices due to hydro and gas ‘shortages’.

This is unlikely to change any time soon. Despite the (albeit weak) recommendations of the Electricity Price Review questioning the ability of Gentailers to provide affordable power from ‘free’ water, the Government has done nothing to bring them into line, even though the state owns 51% of Mercury, Meridian and Genesis. Perhaps that is the reason, given these three have paid increasingly handsome dividends to the Government and private shareholders over the last decade.

Energy Minister Megan Woods has shown little appetite to take on the big power gentailers or argue for a better deal for consumers, particularly those in energy hardship. The Electricity Price Review came and went with little change. She has also allowed the not-so-slow strangulation of independent retailers, including one specifically designed to help the most vulnerable. The big five gentailers, meanwhile, have sat on their hands in the wholesale market and allowed the competition to fade way by refusing in some cases to provide futures contracts.

They are now expected to start hiking their retail prices later this year and early next year in the wake of the rise in wholesale prices. This is all despite flat demand and a rash of new wind farms, and will happen at a time when the Reserve Bank is expected to start hiking interest rates because of rising inflation.

Why the smelter won’t close to solve the problem

Those hoping that a closure of the smelter in 2024, as indicated in January, might solve the problem, are also sorely mistaken. As seen in the results overnight, Rio Tinto is making a mint from the smelter now because of the low power prices and a surge higher in aluminium prices.

The higher aluminium prices are partly because of high demand from car and other manufacturers looking for climate-friendlier metals that are lighter and therefore use less fuel to drag around, and are made without burning coking coal, as steel is. Rio Tinto’s Bluff-smelted aluminium is among the cleanest in the world because it is made from hydro-electric power. That makes it appealing for Rio Tinto to leave the smelter open, particularly with the prospect in future it could retool the smelter with its new ELYSIS technology that completely removes the climate emissions produced during the smelter process. Rio Tinto said last night it had already started installing ELYSIS at its Alma smelter in Quebec, Canada, which is also powered by hydro-electric power.

“The ELYSIS technology effectively puts an end to the use of carbon anode in the aluminium smelting process. It features the newly developed breakthrough proprietary materials that are stable and do not react during the process. Thus, it eliminates all direct greenhouse gas (GHG) emissions from the aluminium smelting process and is the first technology ever that emits oxygen as its by-product.” ELYSIS

Currently, the Tiwai Point smelter is profitable with a power price below $135 per megawatt/hour. That means it is making at least $100 of profit per megawatt/hour of electricity use. It is also currently pumping out about half a million tonnes of carbon into the atmosphere and uses about 13% of New Zealand’s power.

The non-closure of Tiwai Point is also important from a climate change planning point of view because it is the core assumption of the Climate Change Commission. It assumed the power freed up by a Bluff closure would help drive down wholesale power prices by 30% to encourage the conversion of New Zealand’s petrol-and-diesel-powered fleet to electric.

The Gentailers don’t want the smelter’s electricity on the open market

The Gentailers are also very reluctant for the power used at Tiwai Pt to go onto the market and drag down wholesale prices and profit. Last week Meridian and Contact proposed the creation of a plant in the lower South Island to turn that power produced from the Manapouri scheme into ‘Green’ hydrogen for export. There remain big doubts about the economic and technical viability of the plan, given it would currently require new unproven technology and big Government subsidies.

Some believe it is an attempt by Meridian and Contact, who sell power to Rio Tinto, to create some potential leverage in the next round of negotiations due before the current agreement expires in 2024. Currently, Rio Tinto has both the Government and the Gentailers over a barrel because an exit would hit Southland’s economy hard and force the Gentailers to dump power onto the market in a profit-destroying way. The Gentailers want a credible threat to fire back at Rio Tinto that they could use the power for something else.

My view: So what should happen?

Firstly, the Gentailers need to help the likes of Nau Mai Rā keep poor households connected to the grid at reasonable prices. They could do that overnight by selling it power at prices similar to the discounts provided to Rio Tinto.

Secondly, the Government needs to break up the Gentailers into generators and retailers so there is true competition in the market, as called for by the independents and as worked so well in telecommunications with the breakup of Telecom. Meanwhile, the Gentailers should ‘allow’ prices to fall and act properly as marketmakers offering futures contracts to independent retailers.

Thirdly, Transpower needs to finish the upgrades of the lines from Clutha to Upper Waitaki that would allow all the Manapouri power to be sold into the grid. It is currently on track to do that by May 2022, having decided last year when Rio Tinto threatened to leave to accelerate the work’s completion from June 2023.

Fourthly, the Government should look at helping or subsidising efforts to put solar panels and batteries onto roofs and into homes, particuarly Kāinga Ora homes, so that consumers don’t have to rely so much on the Gentailers and the lines companies don’t have to spend so much on beefing up their networks ahead of the arrival of large numbers of car-charging households.

Fifthly, the Climate Commission and the Government need to drop the idea of an ‘easy’ solution to the transition to carbon zero through a Tiwai Point closure. That means having to do much more politically harder work reducing transport emissions by reconfiguring roads for cycling, pedestrians and buses, along with stopping building more motorways. Dropping the smelter closure assumption means having to be much more ambitious in its preparations over the coming months in planning its Glasgow conference contributions offer.

Scoops and news breaking this morning

Signs o’ the times news

Charts of the day

Notable other views

Some fun things

Ka kite ano

Bernard

Share this post