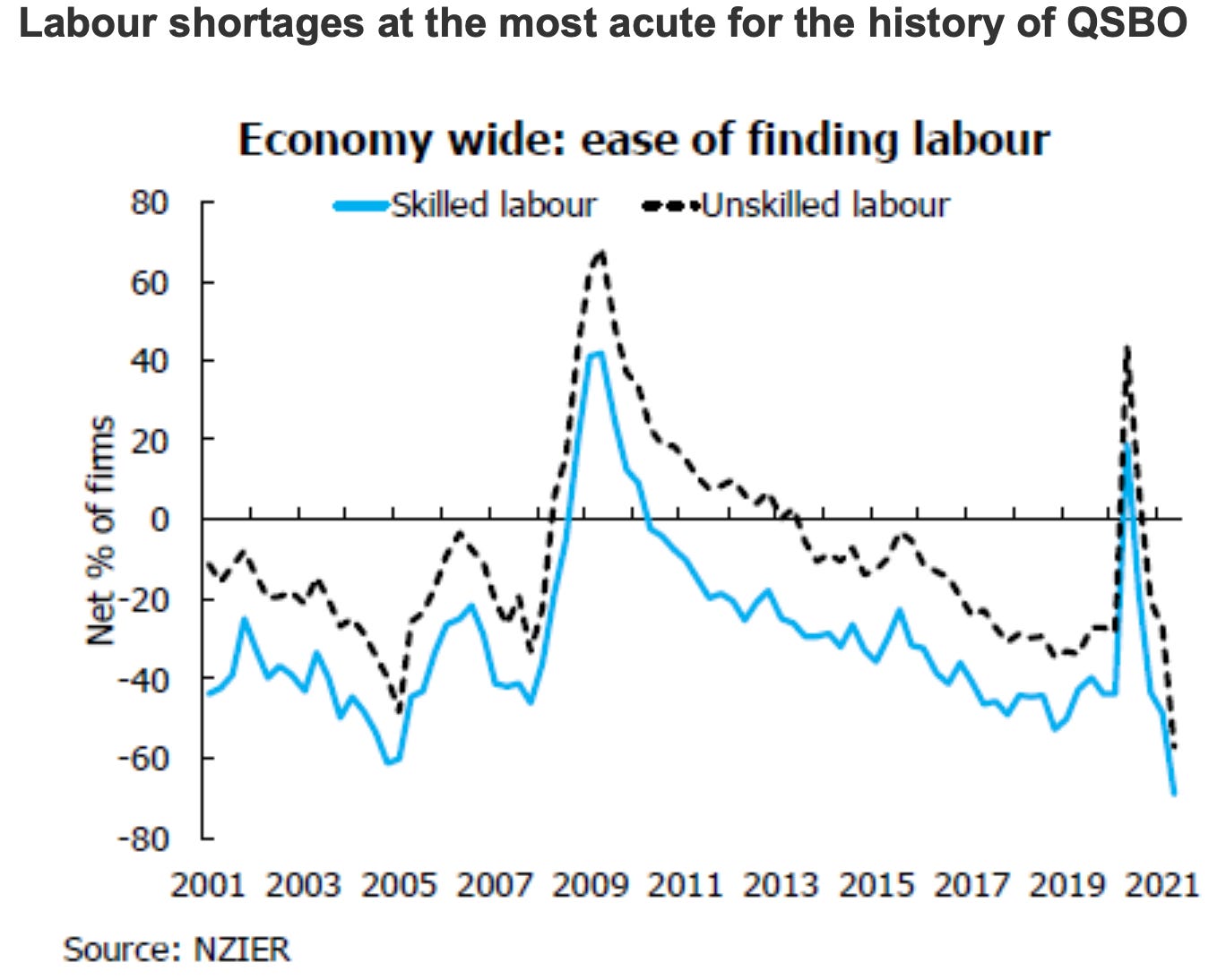

TLDR & TLDL: Economists from ASB and BNZ have accelerated their views on when the Reserve Bank will have to put up interest rates to dampen inflationary pressures after fresh signs of labour shortages. (Stuff)

They now see the Reserve Bank hiking the Official Cash Rate from its current 0.25% as soon as November this year. Previously most economists saw the rate hikes starting in early to mid-2022, while the Reserve Bank itself forecast in late May it expected to start hiking from mid-2022.

This follows a series of data releases showing the economy appearing to be straining at the seams to grow. The NZIER’s quarterly survey of business opinion released yesterday showed businesses saw the ease of finding skilled and unskilled labour at its worst ever levels since the survey started in 1961.

Really?

However, we have yet to see inflation figures showing a permanent outbreak and there is a risk New Zealand gets well ahead of the rest of the world. The Reserve Bank of Australia held its OCR at 0.1% yesterday and dialled back its QE by A$1b/week to A$4b/week, but said it didn’t expect to hike the OCR until it saw actual CPI inflation rise over 2% and wage inflation rise substantially, which it saw as not until 2024.

Also overnight, the US 10 year Treasury yield fell six basis points to 1.36%. New Zealand’s inflation hawks are squawking, but the wisdom of the crowds in global bond markets are less concerned.

The key sign that these inflation fears are real and permanent are when wages start to increase substantially and businesses are able to pass on their cost increases in the form of higher prices. So far, that hasn’t happened.

Also, it’s worth knowing that the RBA and Fed and ECB are all now running ‘whites of the eyes’ average inflation targeting policies that wait for actual inflation before they pull the trigger, which is different from the ‘shoot first, ask questions later’ policy used pre-Covid that saw central banks, including ours, prematurely hike in the last 10 years.

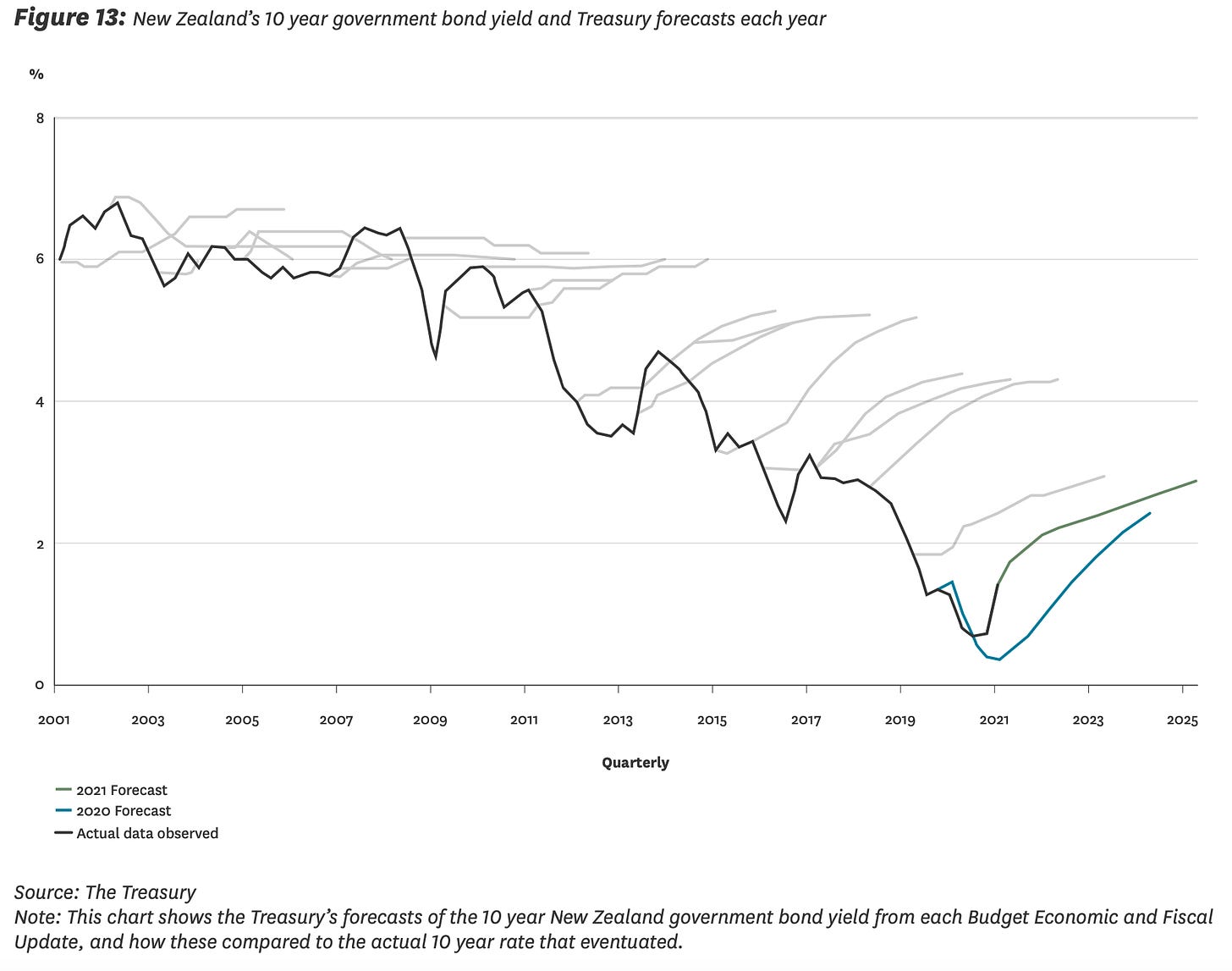

Our Reserve Bank is still using the old policy of acting in advance of actual evidence. By the way, here’s the Treasury forecasts for interest rates over the last 20 years or so, and the actual interest rate track.

Scoops and news breaking this morning

Signs o’ the times news

Charts of the day

Useful longer reads and listens

Share this post