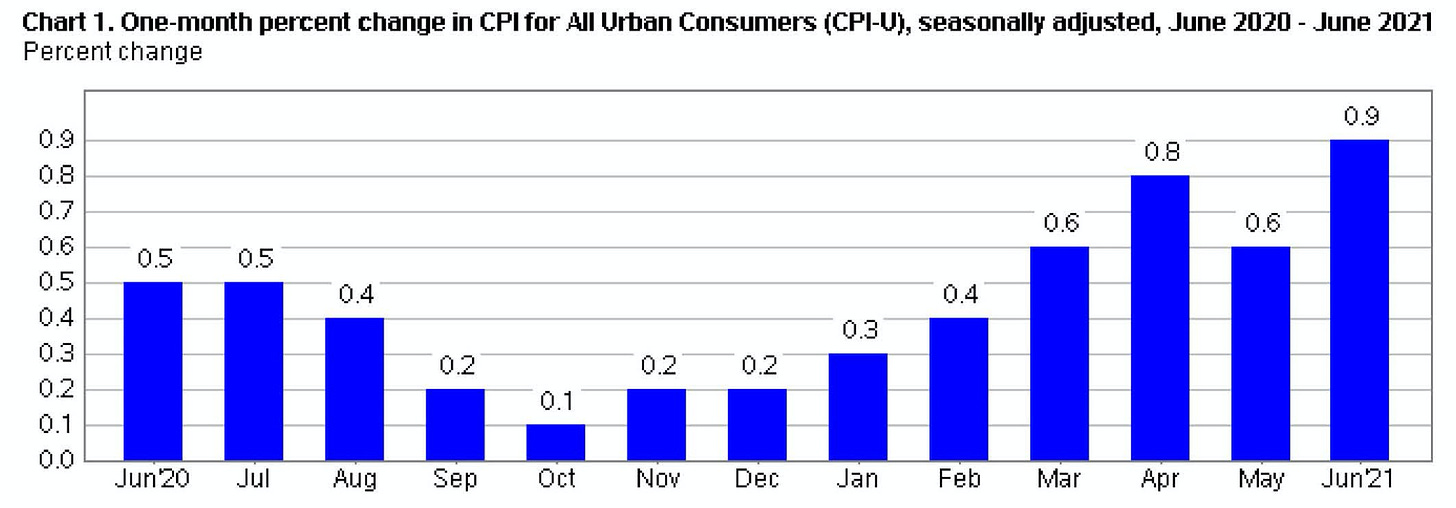

TLDL & TLDR: US inflation figures for June out overnight showed a big jump in used car prices and various logistics-linked hikes pushed the annual rate for the world’s biggest economy up to 5.4%, which was above economists’ forecasts of around 4.9%.

But US stock and bond markets were relatively unfazed this morning, with the US 10 year Treasury bond yield steady around 1.36% and the Nasdaq rising to yet another high. The inflationistas baying for rate hikes in March, known as the ‘reflation trade’ are now squashed back down, thanks to the US Federal Reserve promising to ‘look through’ what it sees as a temporary rise and continuing to print US$120b a month to buy bonds and hose down longer term interest rates.

Over a third of the increase was due to a 10.5% rise in used car and trucks prices in June from May, partly due to shortages of new cars linked to factory closures because of computer chip shortages. There’s also stronger demand for commuting vehicles as people return to work and many prefer driving to public transport post-Covid. The White House pointed out that core inflation excluding the logistics issues had actually fallen over the last three months to a monthly rate of 0.22% from 0.31%.

“We’re at a place where a set of pandemic related services are still normalising their prices back to where they were before the pandemic. We’re in a world where we see a very concentrated bottleneck around autos . . . and everything else in the core series we’re seeing deceleration,” a White House official said.

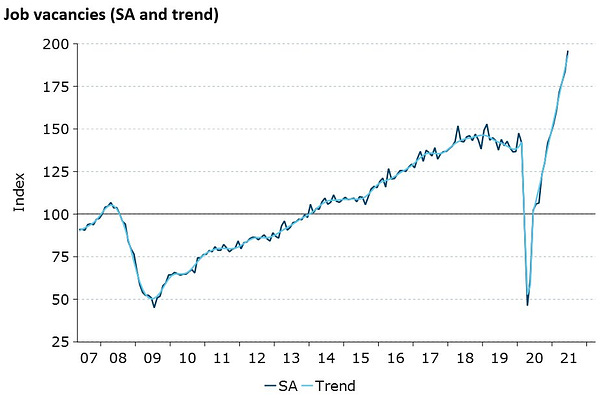

Why it matters: There are strong calls here now from inflationistas for quick and big rate hikes in Aotearoa-NZ, thanks to a similar surge in Covid-related hikes that is expected to push June quarter inflation vs a year ago to close to 3%. The numbers are due on Friday. Yet the US Federal Reserve is holding off early rate hikes, as is the Reserve Bank of Australia until next year or even 2023. The danger is that we get too far ahead of the rest of the world, pushing up the NZ$ and risking a third premature rate hike in a decade.

What to watch: We’ll get a better idea of whether the Reserve Bank here is also thinking hawkishly when it releases its latest monetary policy decision in a short statement at 2pm today, rather than in a full set of forecasts with a news conference, which is not due until August 18. No one is expecting a rate increase today, but markets have fully priced in a first hike in November, with a smaller possibility of one in August. Many will be watching for hints the Reserve Bank will begin hikes later this year. They may be disappointed if the Reserve Bank takes its cues from the RBA and Fed.

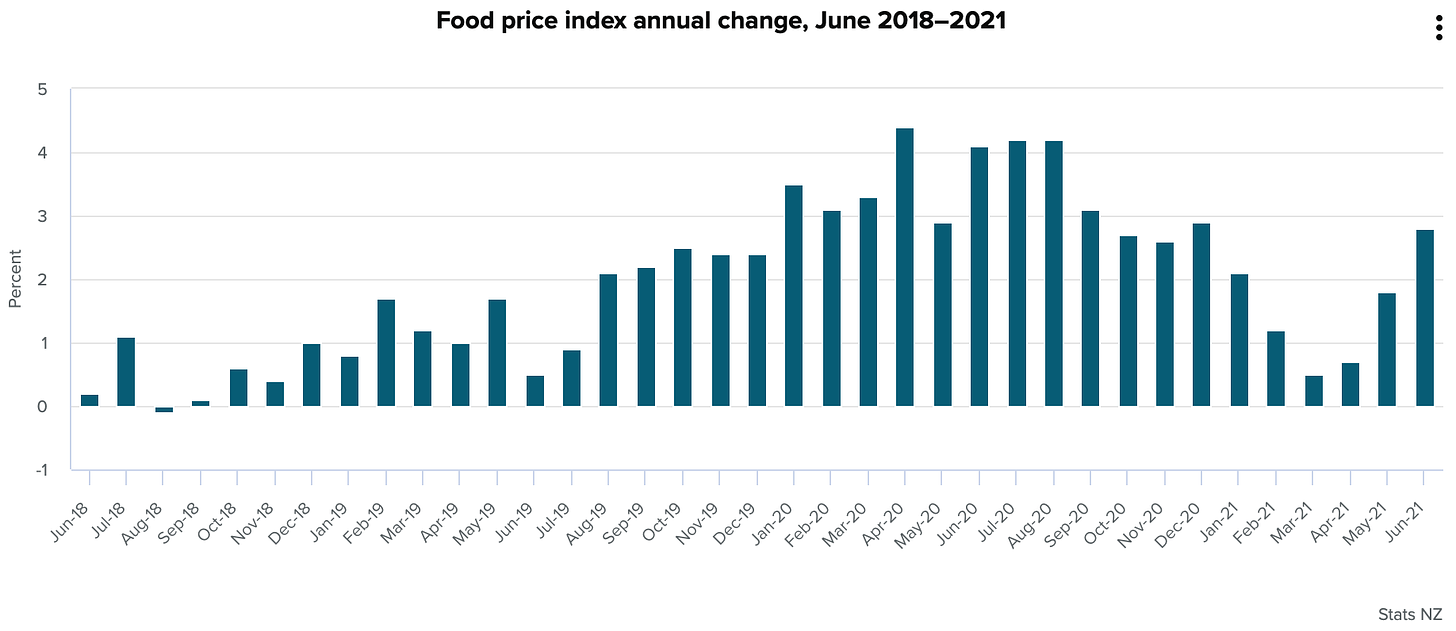

Some who worry about inflation here pointed to Stats NZ figures yesterday showing seasonally adjusted vegetable price inflation of 8.5% in the month of June as another sign of pressure building for rate hikes. Annual food price inflation overall was 2.8%.

There is also pressure from rents, with Stats NZ figures showing the ‘flow measure’ for rents up 4.9% in June from a year ago.

My view: It’s too early to pull the trigger yet and the jury is out on whether the logistics-linked price increases and the apparent stresses of skills shortages become embedded into 1970s-style wage and price spirals. My view is the factories, ships and containers that helped drive deflation for the last 20 years out of China are all still there. Covid hasn’t destroyed that equipment or containers or killed all those workers. They’ll take a year or two to reorganise and there’ll also be plenty of ship building and chip production over that time to bring the deflation back. Also, labour unions are much weaker than in the 1970s, and workers didn’t have to compete with AI and work platforms that are globalising labour supply for many services sectors. The other big difference is there was no iPhone or Android phones in the 1970s.

Scoops and news breaking this morning

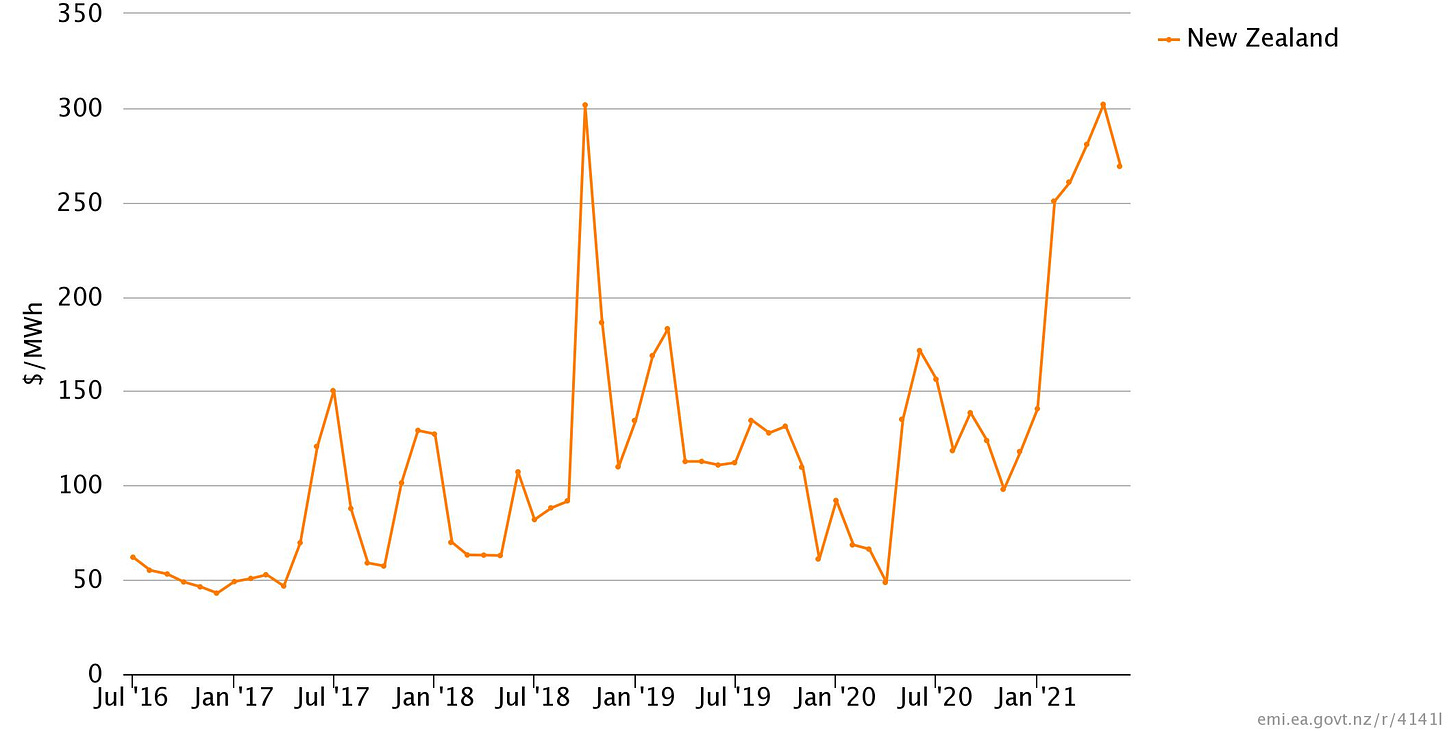

Electric Kiwi is reducing investment in New Zealand and focusing instead on Australia, saying in a letter to Energy Minister Megan Woods that the wholesale power market is broken. (NZ Herald-$$$)

“The current perverse wholesale market situation and deficient regulatory settings have forced us to significantly reduce our planned investment in New Zealand. This loss of investment and employment in New Zealand is small compared to the likely additional costs to New Zealand consumers that will flow from significantly reduced competition.” Electric Kiwi CEO Luke Blincoe in the letter to Woods.

My view: The electricity market is broken from the point of view of encouraging competition and ensuring consumers have the most affordable power. It is just fine for reliability, new renewable generation and profitability. It is another case of the network monopoly effect being operated by former-state-owned companies and a captured regulator. Yet the Government has done very little yet to rectify this, despite a full review in 2018 pointing out the problems. I’m doing my podcast with The Spinoff this week on this issue.

New Zealand has no hope of reaching carbon neutrality if it cannot operate its electricity market competitively to achieve affordable power that encourages switching from petrol to electric. Why would anyone swap when they know they’re putting their transport costs at the mercy of the electricity gentailers and monopoly lines and transmission companies that have increased power prices twice as fast as CPI inflation in the last 30 years? The Climate Commission predicated its assumption for getting to carbon net zero by 2050 on a 30% fall in wholesale power prices, yet they have trebled in the last 18 months.

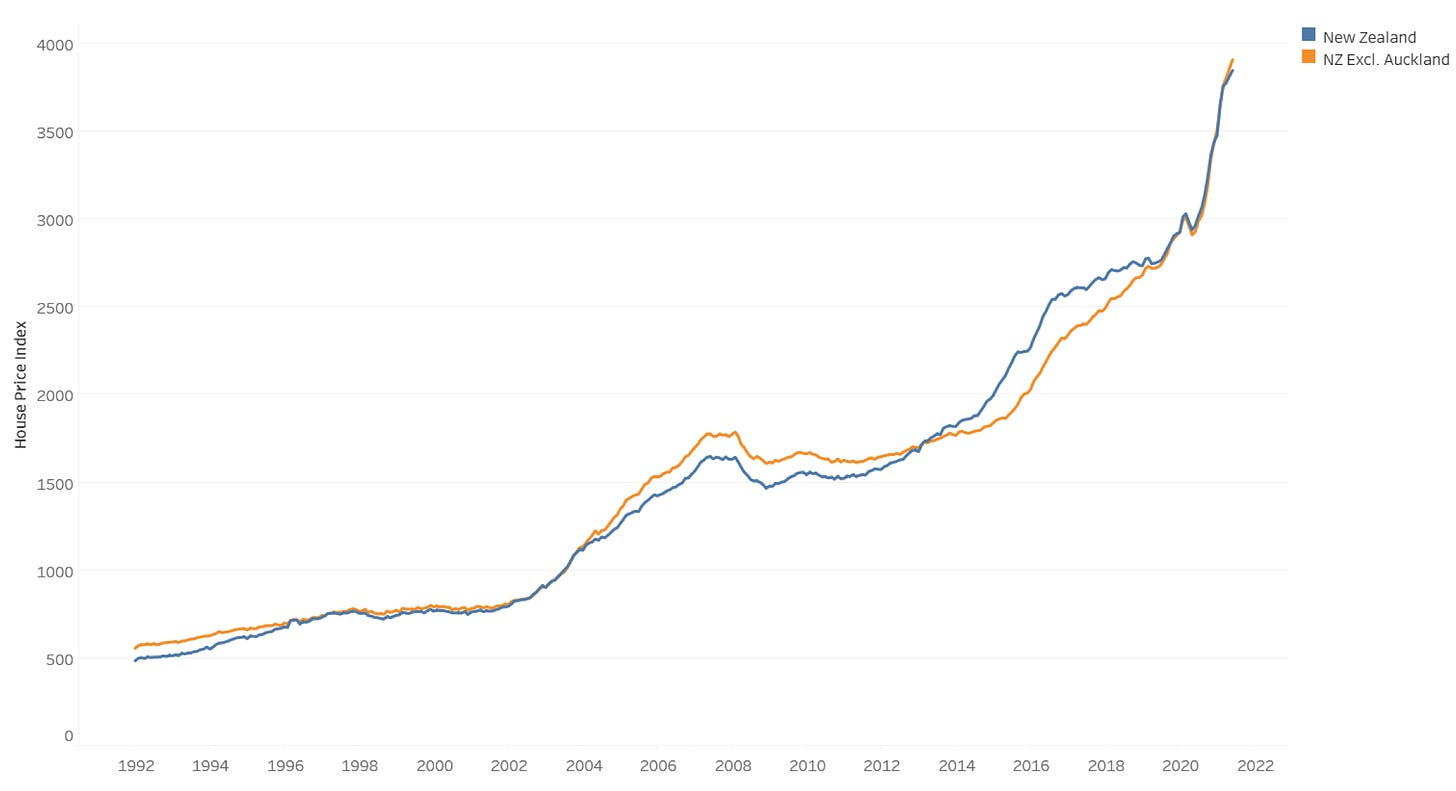

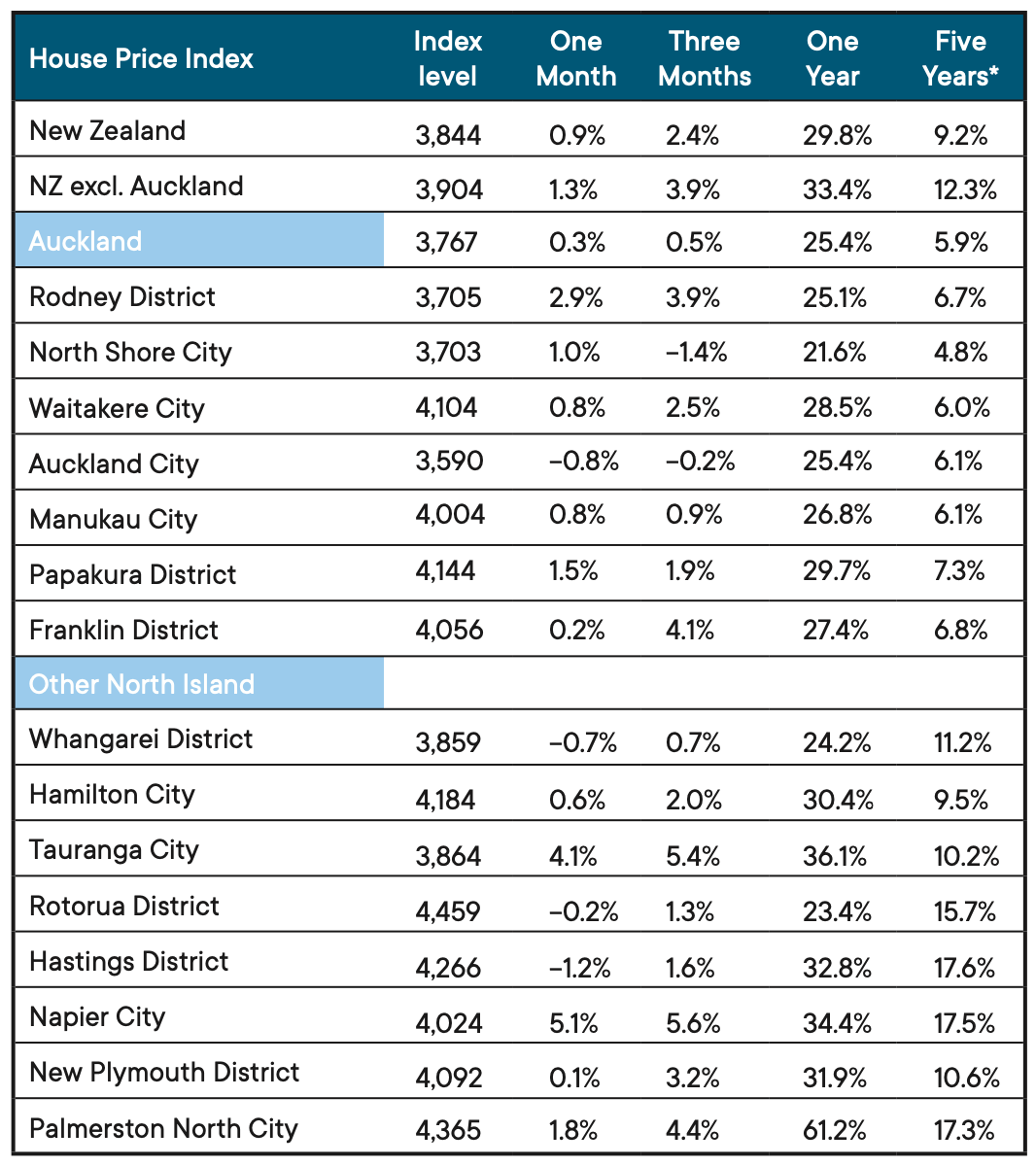

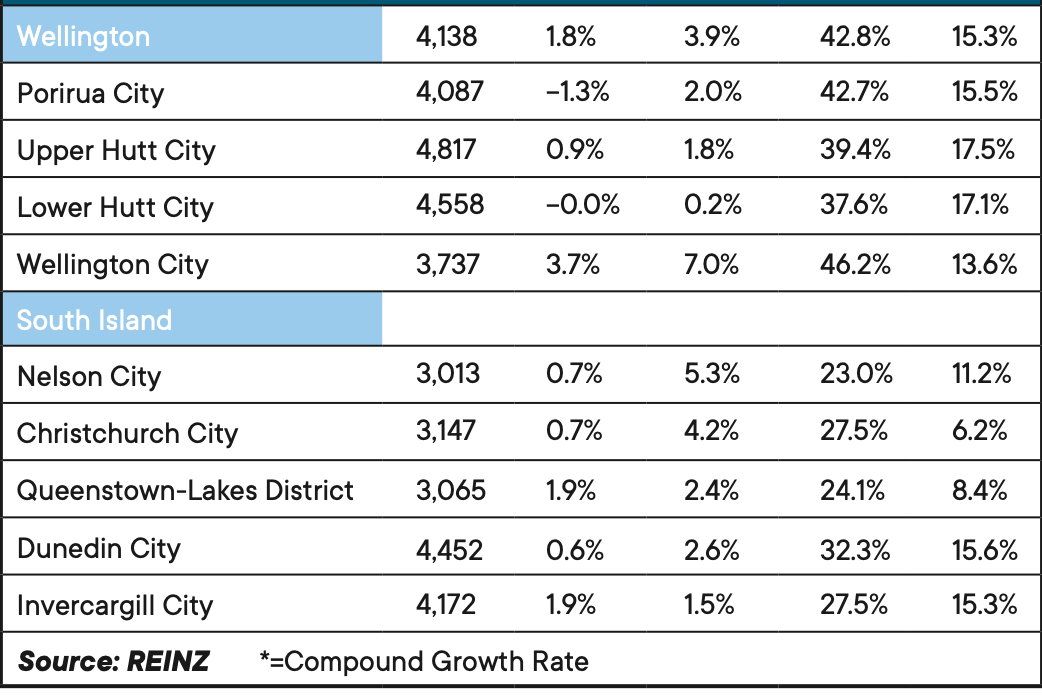

House prices doubling every six years beyond Auckland

REINZ reported sales and price figures for June yesterday that showed the monthly inflation rate slowing marginally to 0.9% nationally, but still at 29.8% from a year ago. Annualised inflation rates over the last three months since the Government’s March 23 tax deductability shock have still averaged over 10%, albeit down from over 20% in the previous three months.

The numbers are shocking in some places. The House Price index for Wellington City rose 46.2% in the last year to June. The index for Palmerston North rose 61.3% in the last year. The average compounding house price inflation rate out of Auckland in the last five years has been 12.3%. That rate means a doubling of house prices every six years.

My view: Jacinda Ardern’s Labour Government was elected in 2017 on a promise to deal with a housing affordability crisis. Since then house price inflation has risen at a rate that would double house prices every six years outside of Auckland and double prices in Auckland every 12 years.

This is a catastrophe caused by the Government’s enthusiastic adherence to the Public Finance Act’s insistence on debt reduction, meaning it underinvested in infrastructure at the same time as accelerating net migration and green-lighting massive monetary stimulus to rescue the economy by increasing the values of people’s houses. Deliberately. The Government is not changing any of these policies, or even discussing meaningful changes other than a vaguely argued and frankly shaky suggestion of tighter migration settings.

The Government is likely to crumble on that commitment as soon as the borders open and business owners unable or unwilling to change their business models lobby hard for a loosening. The PM’s cosmopolitan and urban values mean she is not strongly committed to it, and the fundamental changes required to invest very heavily in technology and training would require a major change in tax settings to discourage investment in land speculation and encourage investment in business capital. She has ruled out a capital gains tax in her lifetime and ruled out a wealth tax in this term last year.

Migration tightening won’t be extreme, says Deputy PM

Further to my scepticism above about the Government’s commitment to tightening migration settings, Finance Minister Grant Robertson gave a detailed speech to the Trans-Tasman Business Circle yesterday that sought to reassure business leaders about both the reopening and the migration settings review. The bolding is mine.

“At the moment we are hearing widespread concerns from the business sector as to the availability of labour, particularly given the necessary restrictions to inward migration as part of our response to COVID-19. It is not our intention that inward migration should switch from one extreme to the other.

“There are areas of high sectoral growth and requirements for specialist skills that New Zealand is unlikely to be able to be able to fill on its own. As I said earlier we are working closely with those sectors that are struggling with skills shortages during this period in order to prioritise what places are available within MIQ.” Deputy PM and Finance Minister Grant Robertson.

He later said the border reopening plans would come out in the “coming weeks,” while the PM said elsewhere she expected to put something out in “roughly four weeks.” (TVNZ)

“Recently we asked our public health advisory group led by Professor David Skegg to support our next update with a particular focus on requirements for travellers at our borders, we very recently received the first cut of that advice. We’ve asked some additional questions but are preparing to share that advice in a public forum... in roughly four weeks." Jacinda Ardern

The Government can plausibly afford to be vague on its migration settings while the border is closed, saying the border restrictions mean any return to ‘normal’ or even any substantial increase would be difficult until MIQ is no longer required for most entries. My view is that is now unlikely until late 2023 or 2024. Those hoping for a quick resumption to bringing in temporary workers should plan for years more of these restrictions. For years to come, Covid-19 will be endemic in the still-mostly-unvaccinated countries we bring most of these workers in from: India, the Philippines, Britain and South Africa. Only China has avoided massive outbreaks, and it is still mostly unvaccinated and will be for years.

Briefly in signs o’ the times news elsewhere

Crazy price of the day

Chart of the day

Useful longer read

Some fun things

Ka Kite ano

Bernard

Share this post