TLDR (The Gist): The US dollar surged to 20-year highs overnight because financial markets now expect the Fed to quadruple the world’s key interest rate in three months in a belated attempt to crunch inflation lower. Paradoxically, that creates a risk the Fed creates a hard landing that drags global interest rates down (yes down) next year.

That would be happening just as opinion polls convince home buyers here that a National election victory and the delivery of its promised tax cuts for home owners would fire up the housing market again. I think there’s now a high prospect that if National are still ahead in the polls in the winter of next year and the global economy is slowing because the Fed tightened too quickly, house prices will spring back strongly in the weeks before and after the election. (See more below and in the podcast above. I’ve opened this up to all given the public interest involved.)

In geo-politics, the global economy, business and markets

Buckle in for a long war - US President Joe Biden asked Congress overnight for US$33b in funds for more weapons and aid for Ukraine, adding to fears the war in Ukraine will turn into a protracted and bloody proxy war. NATO also said overnight it was willing to send arms to Ukraine for years. Reuters

King dollar resplendent - The US dollar ramped up to its highest level in 20 years overnight when measured against a basket of currencies. It has risen most against the euro, yen and renminbi on financial market expectations the US Federal Reserve is set to hike the Fed Funds rate by 150 basis points (three consecutive 50 point hikes) to 2.0-2.25% by the end of July. Elsewhere, the Bank of Japan and the European Central Bank are still printing money and the Peoples Bank of China is easing policy to avoid a Covid-and-apartment-development-growth slowdown in China. CNBC

Yen slump and euro slide - The Japanese yen hit a 20 year low vs the US dollar this morning after the Bank of Japan appeared to double down on its stimulus because its inflation (1.2%) is much lower than elsewhere. The central bank pledged last night to keep printing to keep longer term interest rates low.

The euro hit a five-year low of 1.04 US$ overnight as fears grow the shock of the war in Ukraine to consumers and businesses will drive it into a recession. Euro parity with the US$ is now seen possible. Reuters

So what? - The higher US dollar will help suppress inflationary forces coming from overseas, but will also slow its exports a tad. The bigger concern is this very fast tightening of US monetary conditions via both higher interest rates and a higher currency could cause a hard landing. The weakness of the other currencies also indicate growth in Asia and Europe are trending much weaker than many had expected.

NZ$ dips too - All this has meant the New Zealand dollar has fallen under 65 USc overnight and is 64.9 USc just before 8am. That’s near a two-year low. That’s great for exporters, but will add upward pressure to imported prices. It’s also a reflection of the changing interest rate differentials between Aotearoa-NZ and the United States, given our Reserve Bank stopped money printing earlier than the others and its forecasts for interest rate rates are already ‘baked in’ to our wholesale interest rates.

This quote catches the mood in currency markets:

“We had two decades of the benefits of low inflation, but now central banks are trying to win back their inflation-fighting credibility. But the ECB is facing stagflation and will struggle to keep with the Fed, and the BoJ isn’t even coming to the party. With lower exposure to China, and lower exposure to Ukraine, the US stands out as resilient.” Nomura foreign exchange strategist Jordan Rochester via FT-$$$.

Unexpected US contraction - Reinforcing those fears of a Fed mistake, the US Bureau of Economic Analysis reported this morning the US economy contracted unexpectedly at an annual rate of 1.4%. Some of it was temporary, including a windback in inventory build-ups connected to Covid supply chain dramas. But there was also slower business investment and the US house building market is slowing after the fastest rise in key mortgage rates in history. The key 30 year mortgage rate there has risen 220 basis points to 5.3% in 12 months. Reuters

Why BTFD and HODL probably works for housing too

And for us? - My longer term view is the very-fast rate hikes in the United States and the slowing growth engines in China, Asia and Europe will take the heat out of global inflation faster than most expect. That means our Official Cash Rate (now at 1.5%) may not rise to the 3.4% peak the Reserve Bank currently expects or the 4.0% the market expects. The Fed lost its ‘transitory’ nerve late last year and looks set to over-react to inflation being reported now that was caused last year.

Team Transitory, which I’m still in … albeit with a longer timeframe for transitory :), would say the Fed is about to make a pro-cyclical monetary policy mistake that will cause a hard landing and shock those betting on higher interest rates for longer. The deep structural forces underpinning low inflation, including the cloudification of services, the globalisation of services and labour supply and weak labour power remain firmly in place, especially while China remains in the global economy (which it is).

Housing rebound quite possible here next year - If the rate hikes don’t eventuate later this year and early next year, then the pressure for fixed mortgage rates will be to fall and not rise. The likely non-approval of DTIs next year and expectations of a change of Government would then put a stronger floor under house prices around the current levels of being down 5-10% from the November 2021 peak.

National has promised to repeal the 39c tax rate, cut taxes for higher income asset owners, restore interest deductibility for landlords and wind back the brightline test for taxing capital gains from house trading. A National win late next year just as fixed mortgage rates are falling would be highly likely to spark a house price rebound in late 2023 and early 2024. Especially as DTI limits are now highly unlikely under either National or Labour.

Big China in big trouble

China in trouble - Shanghai’s Covid numbers dropped again overnight, but there are growing concerns about tough lockdowns looming in Beijing and other big northern industrial cities. Factory shutdowns, truck driver shortages and restrictions on inter-city travel are crippling supply chains inside China and at some ports.

A well-connected private equity fund manager in Hong Kong, Weijian Shan, told investors the Chinese economy was in the worst shape he’d seen in 30 years, with “draconian” Covid restrictions “semi-paralysing” large parts of China’s economy. His comments were in a private video subsequently made public via the FT-$$$. His PAG group manages US$50b in funds.

“The market sentiment towards Chinese stocks is also at the lowest point in the past 30 years. I also think popular discontent in China is at the highest point in the past 30 years.

“China feels to us like the US and Europe in 2008. While we remain long-term confident in China’s growth and market potentials, we are very cautious towards China markets.” Weijian Shan

Shanghai closed to refrigerated shipping - Fonterra disclosed yesterday that all refrigerated shipping into Shanghai, the world’s biggest port, had been suspended because of Covid disruptions, Rebecca Howard reported this morning for BusinessDesk-$$$

“With the announcement of suspension of bookings for reefer services into Shanghai by the major shipping lines, we have been working with our in-market teams to reroute product via other ports and to manage timing of delivery.

“Transportation disruptions in and around Shanghai are also contributing to the logistical challenges that we are currently facing.” Fonterra’s director global supply chain Gordon Carlyle as quoted in BusinessDesk-$$$, although he noted Fonterra had been able to re-route shipments successfully for the rest of Covid.

Freightwaves reported on April 11 that all carriers were diverting ‘reefer’ shipping away from Shanghai because of a lack of dock storage space connected to the Covid lockdowns.

Economists said Shanghai’s lockdowns were more damaging than the ones in Wuhan in early 2020 because the industrial and logistics operations were much bigger on the east coast.

“The supply chain impact from this lockdown will be at least as bad, if not worse, than in spring 2020. Wuhan as an industrial base is not as important as Shanghai.” Nomura’s chief China economist Lu Ting quoted in FT-$$$

Rhodium Group head of China markets research, Logan Wright, told the FT-$$$ the easing of Covid restrictions in cities was not helping much because inter-city traffic remained restricted. He estimated that road traffic in the Jiangsu and Zhejiang areas bordering Shanghai had fallen 50-70% from the same week a year ago.

Keeping its palm oil - Indonesia, the world’s biggest palm oil exporter, decided overnight to restrict exports of refined palm oil to ensure it had enough local supplies. The move is expected to further inflate global prices of the key ingredients of hundreds of consumer products, including cooking oil.

Palm oil prices have been rising and shortages developing because of lower exports from the the world’s largest sunflower oil producer, Ukraine, and lower production of soybean oil and canola oil elsewhere because of droughts. Palm oil is estimated to be in 50% of all packaged products in supermarkets globally. Reuters

“We have had really almost a perfect storm. You almost couldn't make it up how bad it's been. We've never really tested this kind of situation. It will be the poorest in big countries or countries in Africa who will almost certainly have to bear the brunt.” LMC International Chairman James Fry via Reuters

Scoops and news of note here this morning

Expensive pines - Thomas Manch reports this morning via Stuff that taking pine forests out of the ETS could cost $64b.

Please extend - Employers want the successful apprenticeship subsidy scheme set up at the start of Covid to be extended beyond August. ODT

For the record here yesterday

Taihoa - The Rotorua Council paused progress on its controversial representation bill before Parliament after a ruling it breached Human Rights laws. (Stuff)

Quote of the day

If you’re wondering why Russia and China are jumpy, and others too…

This is the official British line now in this speech below from the UK Foreign Secretary Liz Truss. It’s doubling down on arming Ukraine and has committed to push Russia out of Ukraine completely. It also wants NATO to have the ability to defend Taiwan. (Bolding mine)

“We cannot be complacent – the fate of Ukraine hangs in the balance. But let’s be clear – if Putin succeeds there will be untold further misery across Europe and terrible consequences across the globe. We would never feel safe again.

“So we must be prepared for the long haul. We’ve got to double down on our support for Ukraine. And we must also follow through on the unity shown in the crisis. We must reboot, recast and remodel our approach.

“My vision is a world where free nations are assertive and in the ascendant. Where freedom and democracy are strengthened through a network of economic and security partnerships. Where aggressors are contained and forced to take a better path.

“We also reject the false choice between Euro-Atlantic security and Indo-Pacific security. In the modern world we need both.

“We need a global NATO. By that I don’t mean extending the membership to those from other regions. I mean that NATO must have a global outlook, ready to tackle global threats.

“We need to pre-empt threats in the Indo-Pacific, working with our allies like Japan and Australia to ensure the Pacific is protected. And we must ensure that democracies like Taiwan are able to defend themselves.” UK Foreign Secretary Liz Truss in this speech at Mansion House for the Lord Mayor’s Banquet

In my view: Hoo boy.

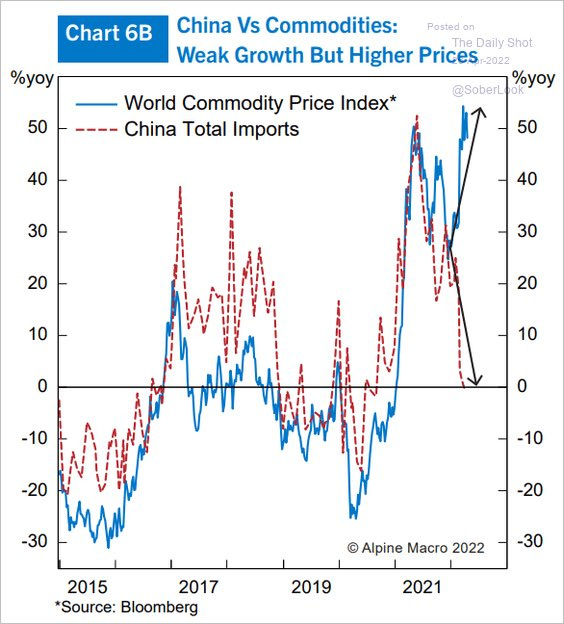

Chart of the day

China’s imports and commodity prices are curiously divergent

IMF revises inflation outlook up, but still 2.5% next year

Numbers of the day

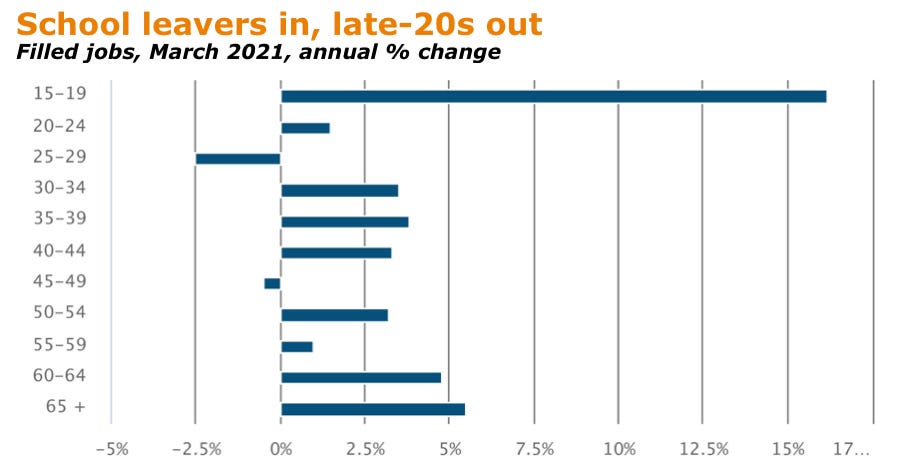

The brain drain’s started, as seen via this Infometrics chart from Stats NZ jobs figures

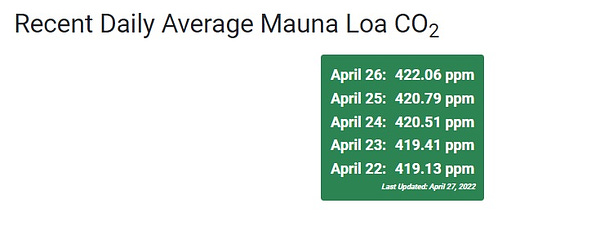

422 on 4/22 in 2022 for first time in 4.22m years

Profundities, spookies, curiosities and feel-goods

The toys being made for this Christmas

A fun thing?

Ka kite ano

Bernard

Dawn Chorus: National win would fire up housing market again