TLDR & TLDL: The case is growing here and overseas for the Reserve Bank to hold off on its rate hikes widely expected for Oct 6 and Nov 24, which is encouraging home buyers to double down on expectations of yet more inflation of the likes of the 31.1% seen in the year to August.

No one seems able to disconnect this perfectly tuned upwards spiral in house prices and leveraged tax-free capital gains, which is manna from heaven for property owners, and a doom loop for renters wanting a secure home and a chance for the future’s seemingly unending and definitely unearned spoils.

The only immediate useful and available option for policymakers wanting to slow the sprial is for the Reserve Bank to itself double down on lending restrictions, including a further toughening of Loan to Value rules and the introduction of Debt to Income multiple tools that would hurt first home buyers the most.

In theory, that buys time for the Government to unleash a storm of new housing supply and limit population growth to remove the fundamental drivers. In reality, the reluctance of both major parties to deliberately change inflation expectations by causing a crash is cementing in prices and inequality that keeps ratcheting ever higher.

Meanwhile, homeowners’ actual expectations are that prices will keep doubling every decade, and they have been more right than politicians and central bankers for 20 years.

My view in summary: The multi-decade trend to ever-lower inflation and interest rates in tandem with low inflation-targeting central banks able to print money at will is the most effective wealth creation tool for existing asset owners in our lifetime, but has also pulled up the ladder and locked out the next generation from secure social and financial futures.

Yet no one in power or close to power is suggesting either the removal of the Reserve Bank’s powers to independently target low inflation and print money to do it. And the current political balance in and around Parliament is to do nothing to change the status quo with a supply shock.

Prices double every 10 years and it’s Government Guaranteed

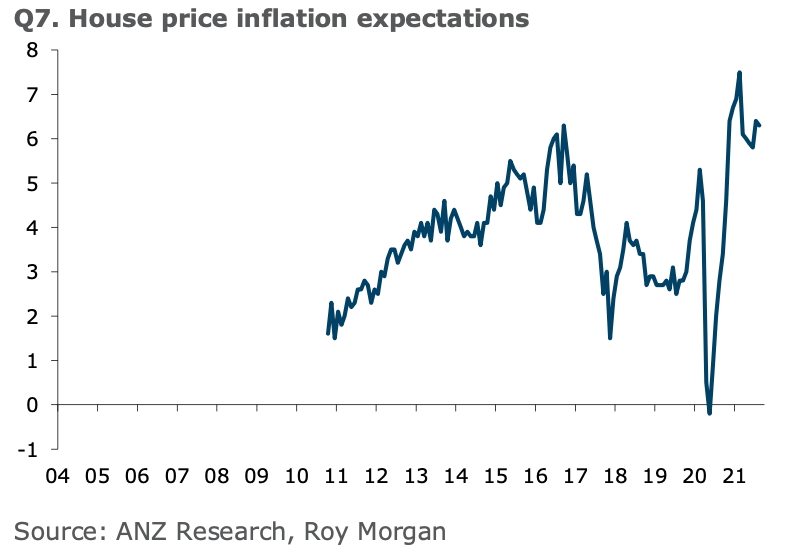

No wonder 58% of respondents in ASB’s last investor survey expected house prices to keep rising, while 74% expected higher prices over the next two years in the latest ANZ Roy Morgan consumer confidence survey. The Roy Morgan survey respondents in August thought house prices would rise 6.3% per year for the next two years, which is a rate that would see house prices double every 11 years.

The ANZ survey shows that for the last eight months New Zealanders have expected house prices to double every 10-11 years. They’ve learned the market has an effective political and monetary policy guarantee of outsized gains, and no losses. They learned that (again) after the Reserve Bank cut interest rates in March, removed LVR restrictions for most of last year and printed over $60b to keep longer term interest rates low and to use the resulting ‘wealth effect’ of the housing market to stimulate the economy.

The last time New Zealanders thought house prices would double every 10 years was in mid-2016 when National looked sure to be returned for a fourth term, which would have removed the threat of a capital gains or wealth tax. That threat has been progressively removed by PM Jacinda Ardern, starting in the week before the 2017 election by abandoning a CGT in her first term, and then confirmed it was off for the forseeable future in 2019 when she ruled out a CGT in her political lifetime. She then ruled out a wealth tax in last year’s election campaign.

Now the home owners know the Reserve Bank and Government has their backs, those expectations are being embedded again at even higher levels.

Where’s the political and business response?

Do young renters and their parents, who are now the first resort for help with deposits and guarantees, not understand this upward spiral is politically, economically and socially unsustainable in the long run?

Do business owners and employers not understand that our largest cities cannot keep young staff in those cities and motivated if there is no realistic prospect of home ownership and family security, unless they are born into the land-owning class?

How can an economy and society be sustainable in the long run when its Government settings are actively driving wealth and passive income to a consistently smaller and smaller group of consumers and voters?

How do the asset owners and business builders think this will end? Or do they think there is some magical way to keep the whole housing market show doubling every 10 years without renting voters, who will eventually outnumber owners, noticing and voting to destroy the status quo?

I’d welcome your thoughts on the sustainability:

of low interest rates forever with repeated bouts of money printing;

an inflation-targeting central bank able to print money and inflate asset prices without a political over-ride;

a politically settled view that governments should not take action to lower house prices and would prefer ongoing inflation of around 4% per year;

house buying and renting affordability rates that are three to four times above their averages globally and from 30 years ago.

Why do you think rates will stay on hold near 0%?

Some may question where I’m seeing all this talk of low rates for significantly longer. Surely, they ask: doesn’t everyone think rates are about to rise? That’s true now, but the background is shifting.

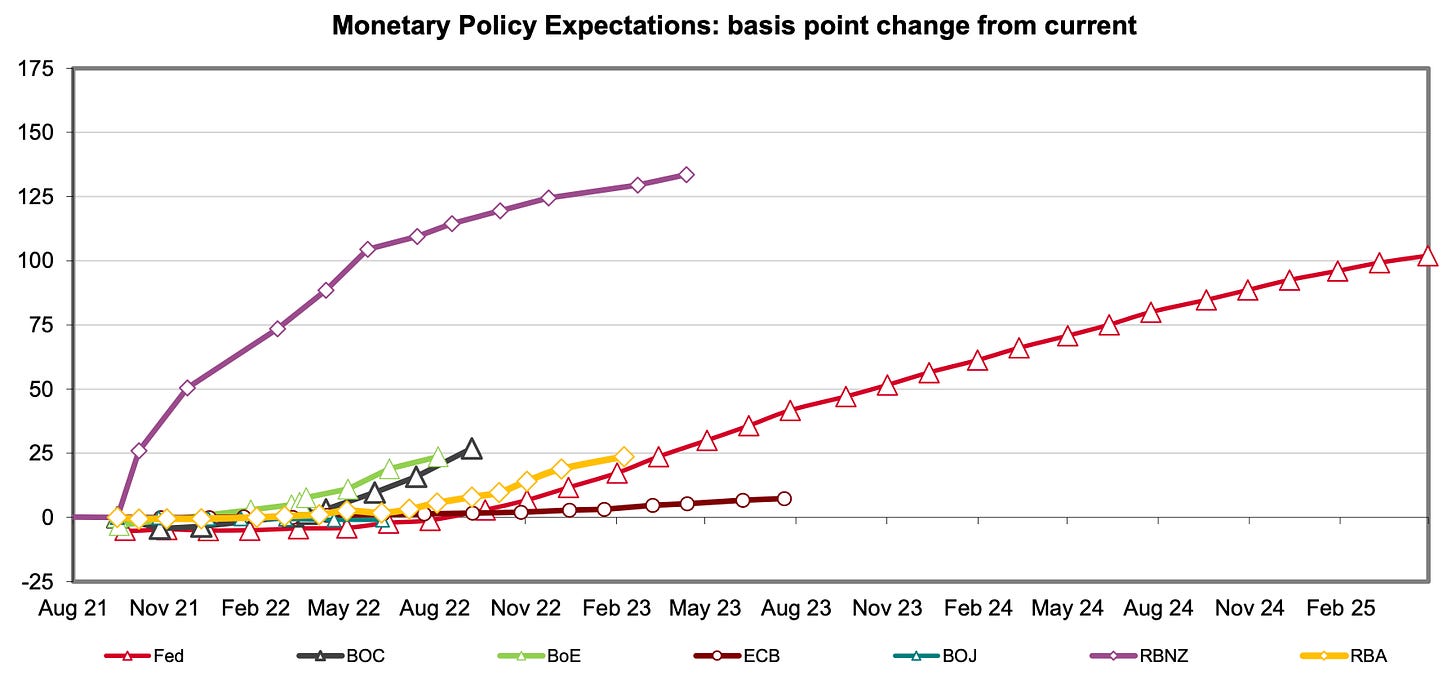

Financial markets and bank economists here are currently still expecting the Reserve Bank to hike the Official Cash Rate from 0.25% now to 0.75% by the end of the year, with 25 basis point hikes at each of its Oct 6 and Nov 24 monetary policy decisions. You can measure those expectations through the OIS (overnight indexed swap rate) markets, where traders bet on where overnight rates will be in the future.

Currently, New Zealand is expected to hike rates years before the rest of the world’s major central banks, as this Westpac chart shows.

But the mood music on global financial markets and locally is turning against that view. That includes in just the last 24 hours:

Last night the world’s largest economy reported its core consumer price inflation was coming off the boil, as its central bank has predicted repeatedly this year in the face of those fearing a 1970s-style blowout in inflation;

Annual total US CPI inflation fell to 5.3% in August from 5.4% in July, which was in line with economists’ forecast that inflation is coming off the boil, reassuring those hoping the US Federal Reserve will delay its eventual tightening of monetary policy (Reuters);

Core inflation was weaker than expected at 0.1% for the month and 4.0% for the year, which was the smallest increase since February and lower than economists’ forecasts for 0.3% core monthly inflation (BLS);

The US 10 year bond yield fell six basis points to 1.26% this morning as investors dialled back their expectations of higher interest rates, and US stocks fell around 0.6% as investors worried about the effects on profits of slower economic growth suggested by the weaker inflation figures.(Reuters);

China’s latest Covid outbreak in Fujian is widening with a doubling of cases in a day to 55 reported overnight, while Putian, with a population of 3.2m, was locked down yesterday (Guardian);

Heavily indebted Chinese property developer Evergrande announced it may default on its debt, raising fears of a 'Lehman moment' for China's financial markets as angry investors gathered outside Evergrande's HQ in Shenzhen to demand their deposits back (Reuters);

The New Zealand Government’s latest 30 year bond issue to raise $3b was four times subscribed and was priced at the lower end of yield expectations at around 2.2%. The 10 year Government bond yield fell 5 basis points to 1.93%.

There’s also a rash of highly respected central bankers in our part of the world who simply don’t believe what the hawks in financial markets are saying, and they’re calling out those expecting rate hikes here and in Australia. Actual investors just bought NZ Government bonds that don’t mature for 30 years for an average yield of 2.2% per annum, and that’s before the Reserve Bank’s inflation target of around 2%.

Let that sink in. Actual investors with their savings on the line are happy to accept a real yield of 0.2% for 30 years if they believe the Reserve Bank will keep inflation around the 2% midpoint of its 1-3% target range. Or even worse, they see inflation well below 2% for the next 30 years. Currently, the so-called ‘breakeven’ rate, which measures market expectations of inflation by comparing inflation-indexed bond yields with nominal bond yields, shows market expectations for inflation of about 1.6% per annum for the next decade. That is not an inflation breakout and it’s not worrying those who look most closely at consumer price inflation.

It would also imply investors are so risk averse they are happy to accept a real yield of around 0.6% for at least the first decade of the next three decades.

A hawk turns dovish

Former Reserve Bank of NZ Assistant Governor John McDermott wrote in an NBR-$$$ column yesterday it would be foolhardy for the RBNZ to hike rates, regardless of what’s happening with Covid, as many in markets expect. In the past he has been seen as hawkish and he has consistently called for rate hikes for most of this year. Here’s his key quotes (bolding mine):

“The economy is not always self-correcting and often needs active monetary and fiscal policy to stabilise it. With this lesson in mind, it seems foolhardy for the Reserve Bank to promise to increase interest rates regardless of the Covid outbreak.

“Despite this, financial market commentators are expecting the central bank to start raising rates irrespective of the lockdown. Such action would increase the cost of working capital for businesses and mortgage payments for households; heartless when so many are struggling with the lockdown.

“Waiting to normalise policy until after the lockdown has eased will allow the bank time to assess whether the economy has lost momentum, reducing the risk of prolonging the recession. Moreover, with economies in North America and Asia currently slowing in the wake of Delta, the bank may have other reasons to delay its policy normalisation plans.” John McDermott in NBR-$$$

Also, current Reserve Bank of Australia Governor Philip Lowe said in a major speech yesterday he doesn’t expect to raise rates there until 2024, and not just because of the latest Sydney and Melbourne lockdown pain. Here’s the quotes (bolding mine):

In particular, the Board has said that it will not increase the cash rate until actual inflation is sustainably within the 2–3 per cent target range. It won't be enough for inflation to just sneak across the 2 per cent line for a quarter or two. We want to see inflation around the middle of the target range and have reasonable confidence that inflation will not fall below the 2–3 per cent band again. Our judgement is that this condition for a lift in the cash rate will not be met before 2024.

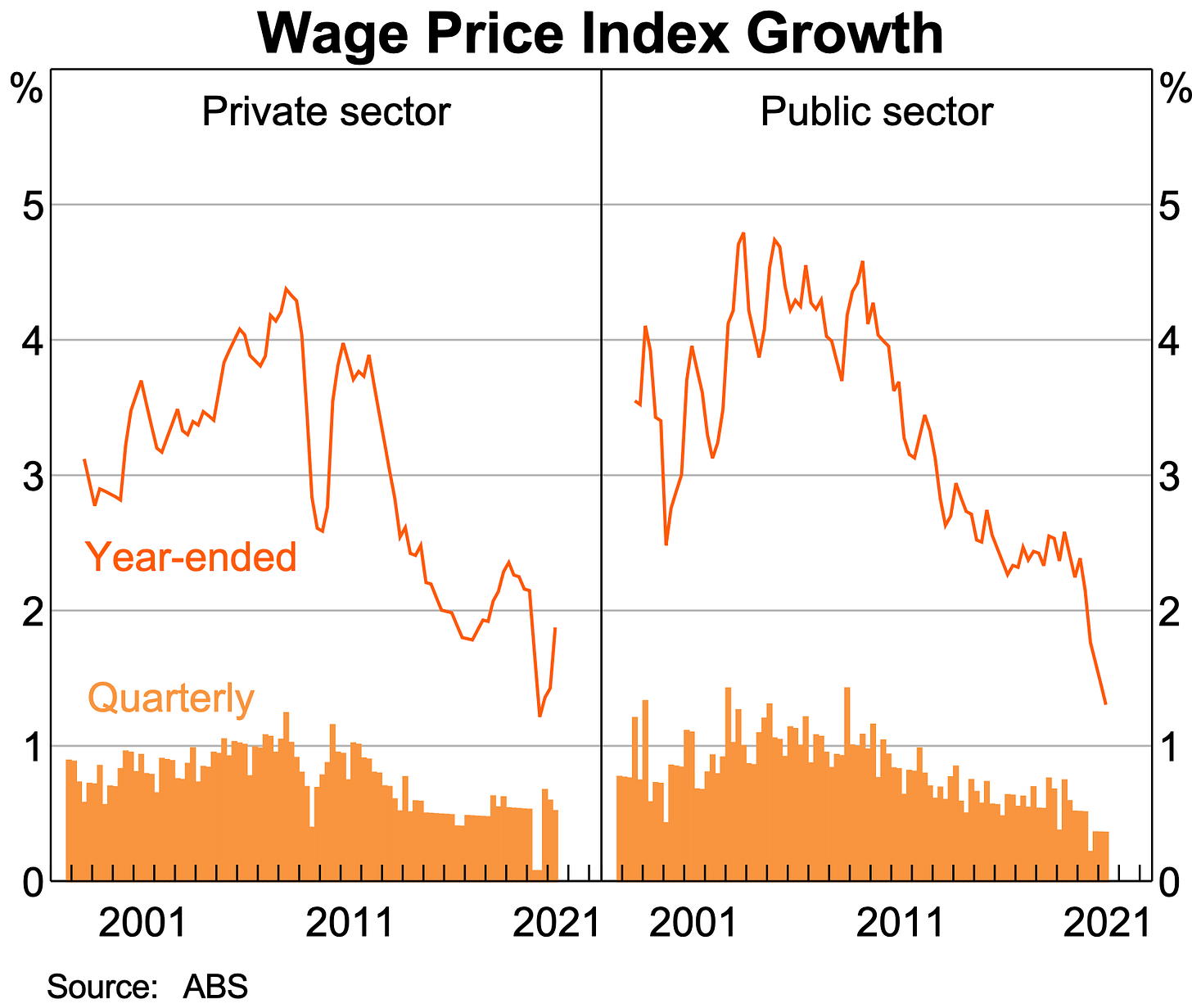

Meeting this condition will require a tighter labour market than we have now. Our assessment is that wages will need to be growing by at least 3 per cent. We remain well short of this. Even in industries where there has been strong demand for labour, wage increases remain mostly modest. This assessment was confirmed by the latest reading of the Wage Price Index, which showed an increase of just 1.7 per cent over the year to the June quarter, with wages growth slower than this in the public sector doesn’t expect to hike rates there until 2024 and our lockdown economic pain is growing.

This chart shown by Lowe immediately after that assessment tells the story. Despite all the talk of labour shortages and the death of the multi-decade slide in worker power, wage inflation is still falling in Australia.

Briefly elsewhere in the political economy and business this morning

Name suppression lapsed last night on the Auckland couple who travelled to their holiday home in Wanaka last week in breach of lockdown orders. They are equestrian business owner William John Lawrence Willis, 35, and Hannah Rawnsley, 26, a lawyer. (Stuff)

They said they sought suppression because they had a “genuine fear for their safety.” After suppression lapsed, they said in a statement their actions were “completely irresponsible and inexcusable. We are deeply sorry for our actions and would like to unreservedly apologise to the Wānaka community, and to all the people of Aotearoa New Zealand, for what we did.” (NZ Herald)

Education and Covid-19 response minister Chris Hipkins is expected to indicate at the 1pm presser today whether to bring forward school holidays by a week to help out struggling Auckland parents. Principals are opposed. (Stuff)

Judith Collins is on the brink of oblivion, her former PR person Janet Wilson says in this Stuff column and tells The Spinoff’s Duncan Greive in this even-more-damning interview. (See more below in quote of the day)

Apple launched its newest range of iPhones this morning, including phones with 2.5 hours longer battery life and a camera with ‘cinematic’ mode. The launch of Apple’s first iPhone unleashed the app economy, which has been the engine room for global deflation for a decade. The iPhone 4’s use of 4G data and its front-facing camera super-charged that megatrend. (Apple)

Quote of the day

“She prizes loyalty above all else. But then her ugly stepsister, paranoia, steps in, and she has these almost paranoid storms. I think Friday's speech to the National Samoan group on Siouxsie Wiles was completely unacceptable in a National party leader. Completely unacceptable.

“There is no doubt in my mind that the electorate will look at this and see it for what it is, which is a cheap shot at someone who's... Whatever you think of Siouxsie Wiles is neither here nor there. Empathy will always be extended to Siouxsie because of this attack by a political leader. Why aren't we talking about all the other things that New Zealanders are really, really worried about right now?” Janet Wilson on her former boss Judith Collins in this Spinoff podcast.

Chart of the day

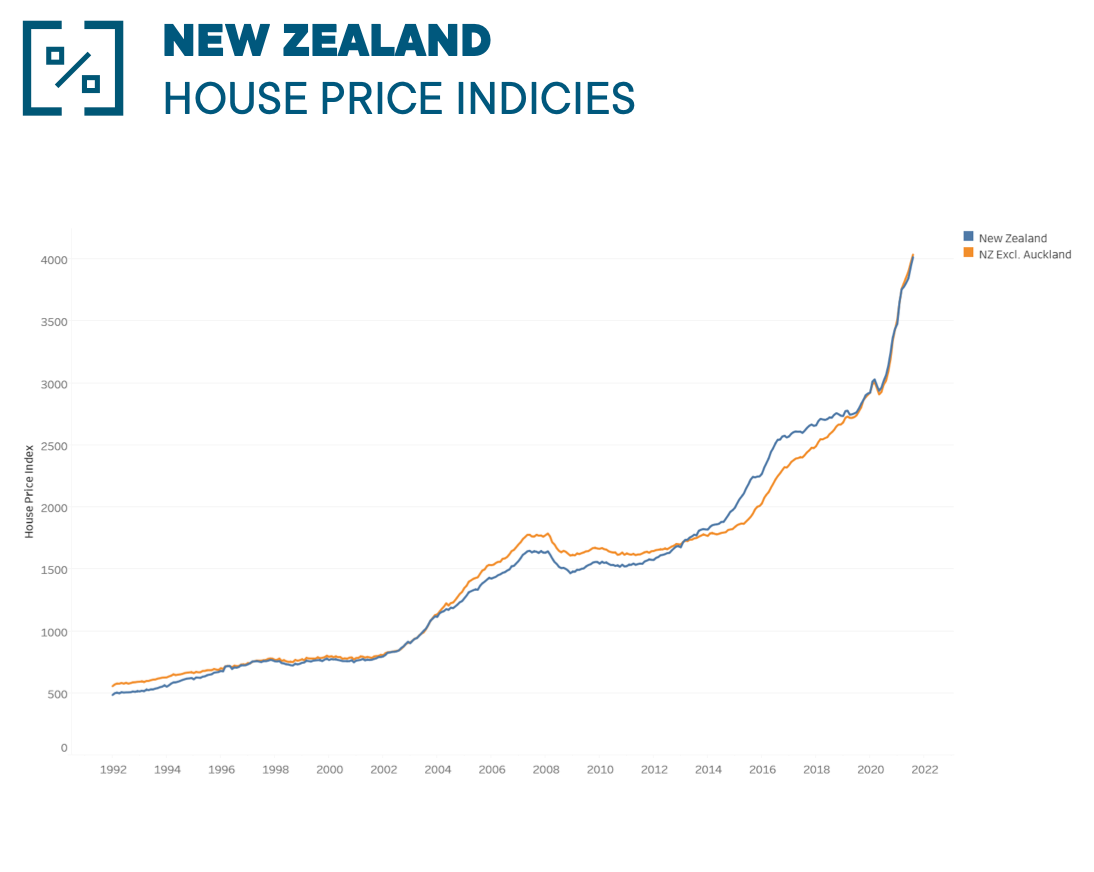

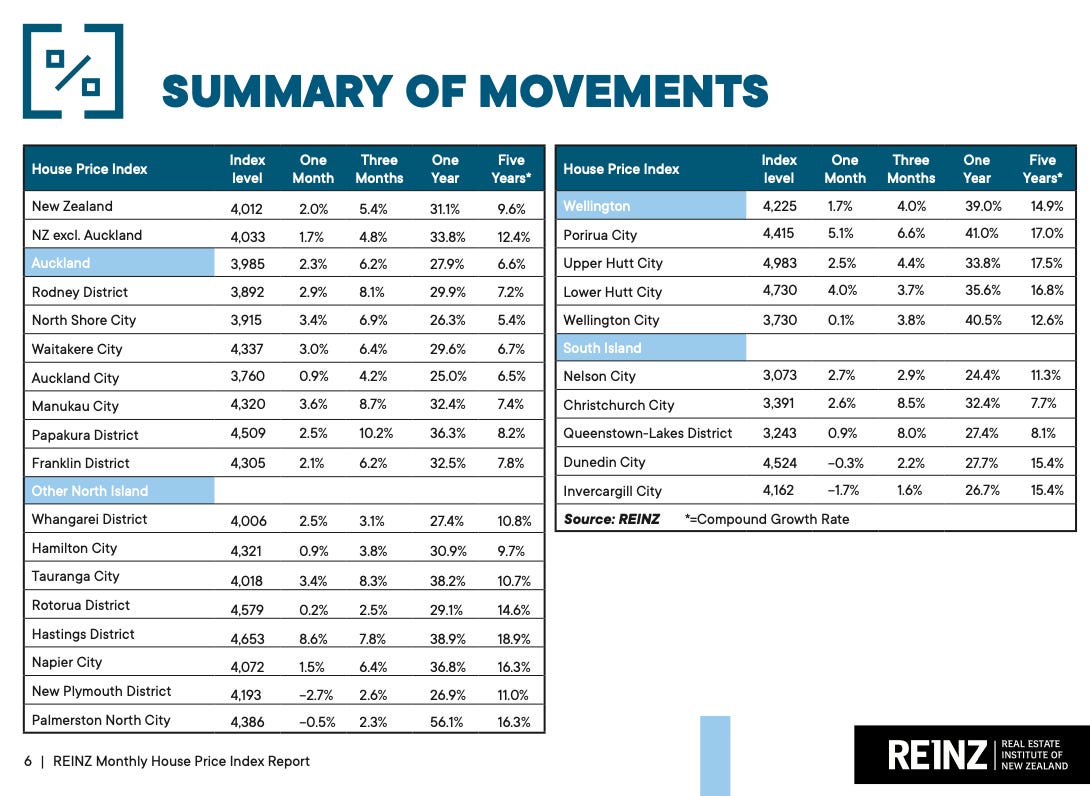

This is not a market that is slowing down much. This chart shows the REINZ House Price Index. It rose 31.1% in the year to August and rose 5.4% in the last three months. Annualised, that quarterly inflation rate is still over 20%. Prices rose 2.0% in the month of August, half of which was in lockdown.

Table of the day

This REINZ House Price Index table shows prices are up 56.1% in the last year in Palmerston North and 40.5% in Wellington City.

Some fun things

Ka kite ano

Bernard

Share this post