TLDR & TLDL: The global economy is growing solidly, but not so fast it needs immediate interest rate hikes. That was the conclusion over the weekend after America’s jobs market created 850,000 jobs in June, which was more than the 720,000 expected by economists.

But financial markets judged the rise as ‘not too hot and not too cold’, meaning it wasn’t so fast that the US Federal Reserve would have to put up interest rates too quickly. Most don’t see hikes there until later next year. That meant US stocks rose to fresh record highs on Saturday morning. Investors believe central bankers can keep printing money to support asset prices for some time to come. (CNBC)

Closer to home, there was good vaccine news late yesterday. The long-expected Pfizer shipment of 150,000 doses arrived two days early yesterday afternoon to be distributed to DHBs so the vaccination programme can continue. Some expected to run out by Wednesday without the shipment. (Beehive)

Scoops and news breaking this morning

Signs o’ the times news

Useful longer reads

Notable other views

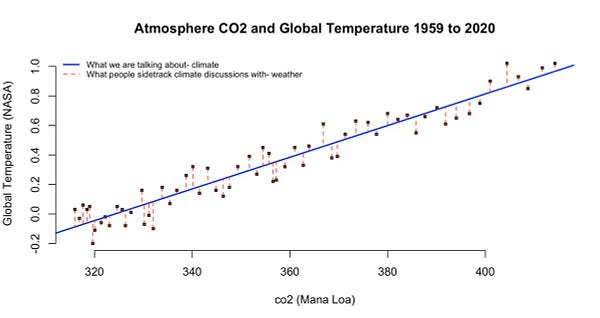

Chart of the day

Share this post