TLDR: As I wrote about on Friday, Liz Truss won an election of just under 142,000 Conservative Party voters to become the British PM-elect overnight. In true magical thinking fashion, she wants to loosen fiscal policy with tax cuts and energy subsidies, while growing a UK economy that she plans to cut off from Europe’s economy even more decisively.

All this means higher interest rates and inflation for Britain at the same time as Russia shuts off its gas supplies to Europe indefinitely, forcing rationing and interventions in electricity markets to rescue consumers and impose windfall profit taxes.

Paying subscribers can see more detail and analysis below the paywall fold and in the podcast above.

News in geo-politics, the global economy, business and markets

An ugly inbox - Liz Truss will be sworn in tomorrow as the new UK PM tomorrow after winning an election of Conservative Party voters overnight by 81,326 votes to 60,399 against Rishi Sunak. Truss faces having to spend up to £100b within weeks to support consumers and businesses facing massive spikes in winter energy bills.

Magical thinking - Truss has pledged to cut income taxes for the richest while also unravelling a trade agreement with the EU that could spark a trade war and further worsen inflation set to top 20%. The pound fell below US$1.15 this morning, near its lowest levels since the mid-1980s. The British 10 year bond or ‘gilt’ yield rose eight basis points to 3% for the first time since 2014 on fears of a fresh blowout in Government debt and a 1970s-style foreign exchange crisis.

Nyet more gas - European gas prices spiked 30% overnight after Russia said it would not restart gas supplies through Nordstream 1 until sanctions were lifted and a G7 plan to cap Russian oil prices was removed. The euro fell below 99 USc to a 20-year low this morning and European stocks fell as much as 2%. US markets are closed for Labor Day.1

Nicht so much profit - The EU is accelerating plans for electricity and gas market interventions to ease the pain for consumers and businesses. Germany announced windfall profit taxes on energy company profits over the weekend to pay for €65b worth of support for consumers.

Not so much oil - Opec+ surprised everyone overnight by announcing a 100,000 barrel per day cut in production to stabilise falling prices. Brent oil prices bounced more than $2 per barrel to over US$95 per barrel.

So what? - This is going to be an ugly winter for European consumers and democracies, let alone its economies and financial markets. Most see the various news events as both inflationary and recessionary for the global economy. That might mean less demand for our exports, but the strong US dollar is offsetting some of that pain. However, that weak NZ dollar (around 61 USc this morning) also heightens inflationary pressure from overseas.

The bottom line - Geo-politics right now equals volatility in interest rates, inflation, growth and asset prices. In the past, that led to lower interest rates, asset market bailouts and yet-more wealth-effect growth. Now central banks are pledging not to bail out asset owners again and instead get inflation down. We’ll see. The asset owners usually win these political battles.

Quote of the day

Geo-politics today

“European electricity prices could reportedly hit new highs this week, when the flood of problems already flowing from energy prices is already staggering: 6 out of 10 British manufacturers may go the wall; experts warn of energy rationing that could see Brits told not to cook until after 8pm, pubs close at 9pm, and three-day weeks at schools; aluminium smelters and steel mills are closing; fertilizer companies are shuttering; the Netherlands warns of a plunge in flowers, fruit, and vegetable output, with that of bricks also tumbling; Spanish output of ceramic tiles has halted; and a slew of Italian firms didn’t come back after the summer break. Regardless of gas storage levels for THIS winter, Europe faces an industrial supply-chain collapse – and just as it is has pledged to re-arm to face a worrying geopolitical future.” Rabobank economist Michael Every.

Number of the day

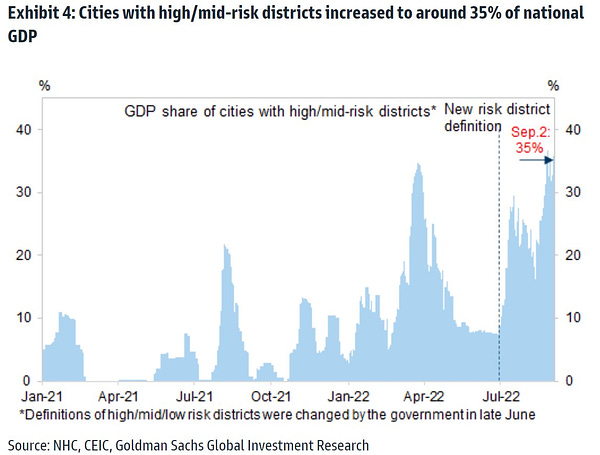

68 - The number of Chinese cities now in full or partial lockdown.

Chart of the day

A fun thing

Ka kite ano

Bernard.

I’m using the US spelling of labour for the US Labor day. I’m messing with the spellchecker’s head for fun. Small pleasures.

Share this post