TLDR & TLDL: A visitor from Australia spent the past weekend in Wellington before testing positive for Covid-19 on returning to Sydney, raising concerns a weekend trip will turn into a super-spreading event in the capital. (RNZ)

New South Wales Health issued the alert late last night, saying passengers on QF163 from Sydney to Wellington on Friday night and NZ247 on Monday morning should self-isolate for 14 days and get tested. The Australian alert gave no details of Wellington locations. Our Ministry of Health announced early this morning it was now working out where the case went to in Wellington over the weekend and that four cases had already been identified and were self-isolating.

“Based on the time of their symptom onset and CT score it is most likely they contracted the virus in Sydney prior to their visit to New Zealand. Genome sequencing is underway in Australia to see if the case is linked to the current outbreak in Sydney. This is the first time an Australian traveller has brought COVID-19 to NZ, and since gone home.” (NZ Ministry of Health)

The bolding is mine. Earlier, the Ministry announced a 72-hour pause of the travel bubble with New South Wales after 10 new community cases were found in the state.

Briefly in the global political economy

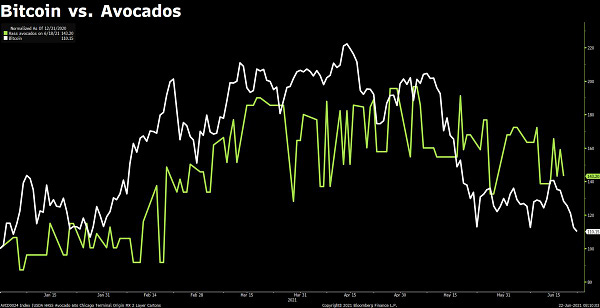

Overseas, overnight, Bitcoin extended its slump from its April peak to more than 50% and under US$30,000 as fears grew about China’s crackdown on miners and users of bitcoin, including by telling state banks to hunt down bitcoin users and transactions. (CNBC)

In Australia, there was a couple of pieces of good news on the climate front. New National Party leader and Federal coalition partner Barnaby Joyce indicated he could allow Australia to pledge to get to carbon zero by 2050 at the Glasgow climate conference in November, as long as farmers get compensated. (SMH) Also, the Liberal/National coalition lost a vote in the Senate to expand the Australian Renewable Energy Agency’s mandate to include ‘blue’ energy, which refers to the use of gas to make hydrogen. (The Conversation) Australia’s Cabinet is also looking at proposing nuclear power plants at the next election. (The Australian)

In Australian fiscal news, the New South Wales Government presented its budget overnight, including the payment of A$100 vouchers for swimming lessons for toddlers, inner-city restaurant meals for city workers and hotel nights in the CBD. NSW will be back in surplus by 2024/25, powered in part by strong stamp duty revenues from a roaring housing market. (News.com)

In more Covid-19 news, Joe Biden admitted America was unlikely to get to his target of being 70% partially vaccinated by Independence Day on July 4. It is likely to get to 67%, the New York Times estimated.

Time to invest for the long term?

Elsewhere, Treasury Secretary Caralee McLiesh gave a speech yesterday in Wellington to a macroeconomic workshop on fiscal and monetary policy in the wake of Covid-19 that I attended.

She talked about the potential for lower interest rates and the Crown’s solid balance sheet as an opportunity to address longer term issues such as climate change by borrowing for investments, as long as the cost/benefit analysis stacked up and interest rates remained low.

McLiesh did not indicate how much headroom the Government had or which type of investments it could focus on, indicating only that while interest rates were below the GDP growth rate the case could be made to invest in welfare-enhancing investment.

I’ll cover this in more detail later today on The Kaka.

Bids open for $1b of housing infrastructure capital

Also, I spoke to Housing Minister Megan Woods yesterday about her announcement with details of the criteria for Councils and others to apply for $1b of the $3.8b Housing Acceleration Fund (HAF) to build infrastructure to unleash new housing. The HAF was announced on March 23 alongside the surprise move on tax deductibility. My interview is on the end of the dawn chorus audio above.

The fund is being administered by Kāinga Ora and will go to projects in the big growth cities of Auckland, Tauranga, Wellington and Christchurch with at least 200 homes, with smaller cities such as Rotorua, Palmerston North and Nelson being able to apply for projects with at least 100 homes.

Elsewhere, briefly in our political economy

A Roy Morgan landline and mobile phone poll of 952 voters showed support for Labour rose 3.5 percentage points to 45% in May from April, while support for the Greens dropped 2.5 points to 11%. National fell one point to 28.5%, while ACT was unchanged at 9%. The Maori Party dropped by one point to 1.5%. NZ First rose one point to 2% and The Opportunities Party was up one point to 1.5%.

Useful longer reads and listens

Charts of the day

Share this post