TLDL & TLDR: The reverberations from yesterday’s big AUKUS deal to arm Australia with nuclear-powered submarines have already started for us. China just put us on the spot to choose it over Australia, the United States and Britain in a trade deal.

Early this morning, China formally applied to New Zealand to join the CPTPP trade deal, that Australia is a part of and Britain wants to join, but which America opted out of under Trump. New Zealand is the keeper of the documents for the deal and has a special role as a sort of gatekeeper on who can apply to join. (SCMP)

Allowing China in against the wishes of America, Britain and Australia would be embarrassing, but the alternative would mean outright rejection of the wishes of our largest trading partner. PM Jacinda Ardern will have to do some fairly fancy footwork to avoid offending all or some of our friends and trading partners.

What should we do? Comments below please.

My view: We should agree to let China apply and say it’s up to all the members to agree to join. We should also invite America to reapply and see whether Joe Biden is more amenable than Donald Trump. That then puts us in a position to get a sort of free trade deal with America via the CPTPP, which is the one big one we lack. We may as well use some leverage.

We can legitimately claim we’re all for free trade and the more the merrier. America would then have to reject our call to join an agreement that was originally designed as a US-led bulwark against China, but was then crippled by Trump’s decision to pull out. Australia already has free trade deals with America, China, Britain and (of course) us in the form of CER (so many years ago…) Hard to see them complaining at us wanting free trade with everyone. And by the way, Britain needs to get a move on and give us our FTA. They’ve already done one with Australia.

Our only real power is as a rules-based free-trading ‘honest broker’ who wants to be friends with everyone and prefers ‘jaw jaw’ to ‘war war’. Choosing to reject China would really mean we have sided with the Anglo-alliance, which is very much nuclear powered and armed. That’s something we have a law against.

Breaking in our political economy this morning

Finally we have a target - Ministry of Health Director General Ashley Bloomfield said he wanted more than 90% of New Zealanders vaccinated. That will be tough. The latest vaccine hesitancy survey shows only 79% want the jab, while 14% say they're unlikely to get it and 7.4% have ruled it out completely. (Newshub)

Legitimate crypto reasons? - A cryptocurrency entrepreneur and his employee flew by private jet from Auckland to Wanaka last Saturday morning, but Police say they did not breach lockdown rules because the flight was for “legitimate business reasons.” However, MBIE is now investigating. (Stuff)

‘Outraged and betrayed’ - China accused Australia, Britain and the United States of “gravely undermining regional peace and stability,” with their AUKUS deal for Australia to develop nuclear-powered submarines, but not nuclear weapons. France said it felt stabbed in the back by the deal, which means Australia abandoned its plan to build A$90b worth of French conventional submarines. (Reuters)

‘No skin off our nose’ - New Zealand was not asked to join, but PM Jacinda Ardern said our anti-nuclear legislation wouldn’t allow it anyway. She saw no ill effects on either ANZUS or Five Eyes. Taiwan welcomed the deal. (SMH)

“No, we weren’t approached but nor would I expect us to be. This is not a treaty-level arrangement. It does not change our existing relationships including Five Eyes or our close partnership with Australia on defence matters.” Jacinda Ardern at her 1pm presser yesterday.

Rates rising - ASB and ANZ have increased their mortgage rates slightly and financial markets are this morning pricing in a 40% chance of a 50 basis point rate hike by the Reserve Bank on October 6. This followed much-stronger-than-expected GDP growth figures for the June quarter. (Interest)

Rear view mirror - GDP rose 2.8% in the quarter, the third fastest on record after the September quarter of 2020 and the September quarter of 1999. The opening of the Australian bubble (now closed) boosted activity in the June quarter, along with plenty of retail spending and employment growth here. Economists had expected growth of around 1.1% and the Reserve Bank had forecast (in August) 0.7% growth in the quarter.

Higher currency - The two-year Government bond yield jumped almost 80 basis points to 1.12%, near a two-year high. The NZ dollar rose almost a cent to 71.4 USc yesterday, before easing back overnight.

Boing boing - But economists see GDP falling 6-7% in the September quarter, before a 9-10% rebound in the current December quarter, assuming Auckland’s lockdown ends soon. Bank economists see two 25 bps hikes this year, with at least a couple more early next year. Most see the OCR peaking around 1.5-2.0% by 2023.

‘We’ve got this’ - Finance Minister Grant Robertson announced yesterday after the GDP figures the Government had put an extra $7b into its Covid Recovery fund and also had $3b spare already in the fund. He repeated the Government didn’t need to increase its borrowing plans because of the stronger-than-expected economic growth. GDP is now 4.3% above its pre-Covid high, which is driving strong tax revenues.

Breaking overnight in the global political economy

Tapering worries - US retail sales in August rose 0.7% from July, which was much stronger than the 0.8% fall that economists had expected. US stocks and bond prices fell after the news, which again raised questions about whether the world’s largest economy is running too hot and may need interest rate hikes and a tapering of money printing sooner than expected. (Reuters)

This is a worry - China’s new Delta outbreak is widening in Fujian province, putting over 50 children in hospital. (SCMP)

Questions of the day

When will the Government help businesses mandate vaccinations, and also mandate vaccinations for public sector workers such as healthcare workers and teachers?

Will New Zealand agree to let China negotiate to join the CPTPP?

Will the rest of NZ go down to level 1 next Tuesday when Auckland is expected to be dropped down to level 3? Apparently not, given the PM said yesterday she wanted the rest of NZ to stay at the current level 2 (but with 100 allowed inside rather than 50) while Auckland is a level or two higher. But will there be other level 2 concessions?

Will the Reserve Bank really hike by 25 bps on October 6, as economists believe? Auckland will still be in bolstered level 2 lockdown at that stage, given the current timetable and a best-case scenario for new cases. The earliest it could get to level 1 is October 20. I think the RBNZ will hike, but shouldn’t. It should use DTIs sooner to slow the housing market, which has accelerated since April.

I welcome your questions in the comments below.

Chart of the day

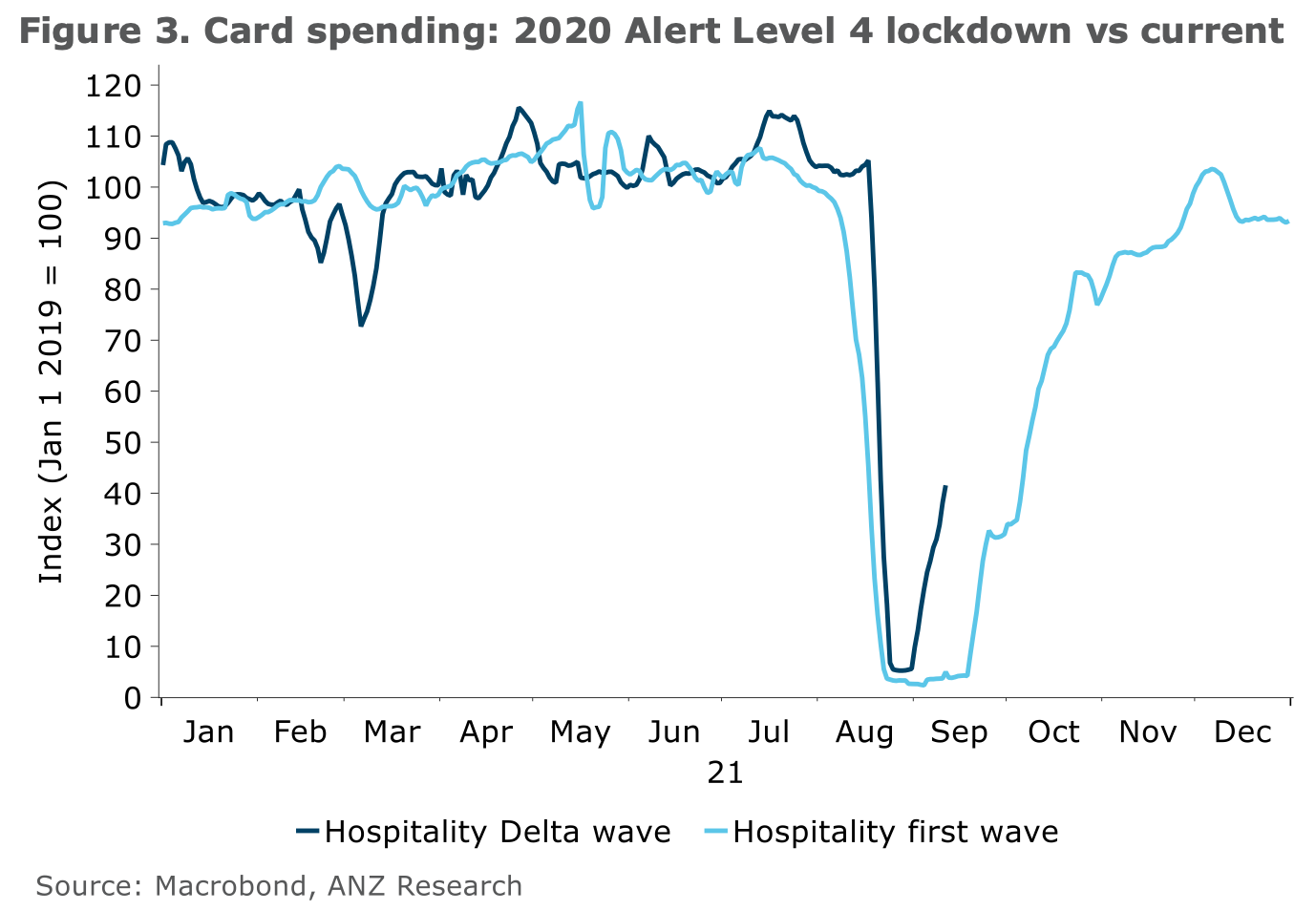

ANZ Economist Miles Workman cited internal ANZ card spending figures to show this year’s hard lockdown was not doing quite as much damage to hospitality spending as last year.

“Looking forward, we know renewed lockdown measures are going to drive a material contraction in Q3 GDP. We’ve pencilled in a 6% q/q fall, but with Auckland’s Alert Level 4 status lingering there are downside risks to that. That said, many businesses are now better prepared to work from home (chiefly those in services industries) and that’s expected to limit the impacts of lockdown on aggregate economic activity to some extent. So for a similar duration, we’d expect the current lockdown to have a smaller GDP impact than the 10% decline recorded in Q2 2020. Our internal card spending data certainly suggests a little more is happening through this lockdown, but there will be some inflation in here too.” ANZ’s Miles Workman in this ANZ note

Signs o’ the times news

Comment of the day from The Kākā’s subscribers

“The Don Brash invented inflation targeting should be seriously reviewed as it appears to be very outdated in world with significant disintermediation (Online Stores), Globalisation (Cheap offshore manufacturing) the Gig economy (cheap Labour) etc. To run most major global economies with the key objective to keep CPI in 0-2% or 1-3% band is insane. Why not accept that there is not inflation and allow small amounts of deflation, this should not cause debt defaults.

House prices are essentially a Bond as they have become an investment asset class rather than a home to live in. The key issue is that we don't have recessions any more, if there looks like one then we just follow what Greenspan did and print money or lower cash rates. The average 40 year old has not seen a true recession, so we all just keep leveraging.” Arthur in Wednesday’s Dawn Chorus article on 31.1% house price inflation.

Longer reads for the weekend

Some fun things

Ka kite ano

Bernard

Share this post