TLDL & TLDR: Treasury has quietly released the first version of its latest once-every-four-years Long Term Fiscal Statement projecting what would happen to the Government’s finances over the next 40 years without any changes in tax or spending assumptions, and then applying the effects of our ageing population.

As in previous versions, the deficit and debt is projected to climb sharply in the latter years because of the risings costs as a share of GDP of NZ Superannuation and health as the population ages. The usual suggestion from Treasury is for some policies that reduce pension and healthcare spending as a share of GDP and that is repeated in this draft again.

However, for the first time, it has modeled the effects of these cost reductions, but also what would happen with an increase in tax rates, and suggested higher taxes on wealth in the form of capital gains taxes or a land tax.

Politically, these long term statements have been politely brushed aside as irrelevances in the 24 minute news cycle focused on the next election, particularly given the effects of ‘events, dear boy, events’ 1 But these forecasts can be useful chances to step back and look at the structure of the Government, the political economy around it and think about inter-generational issues.

Wealth tax the missing link

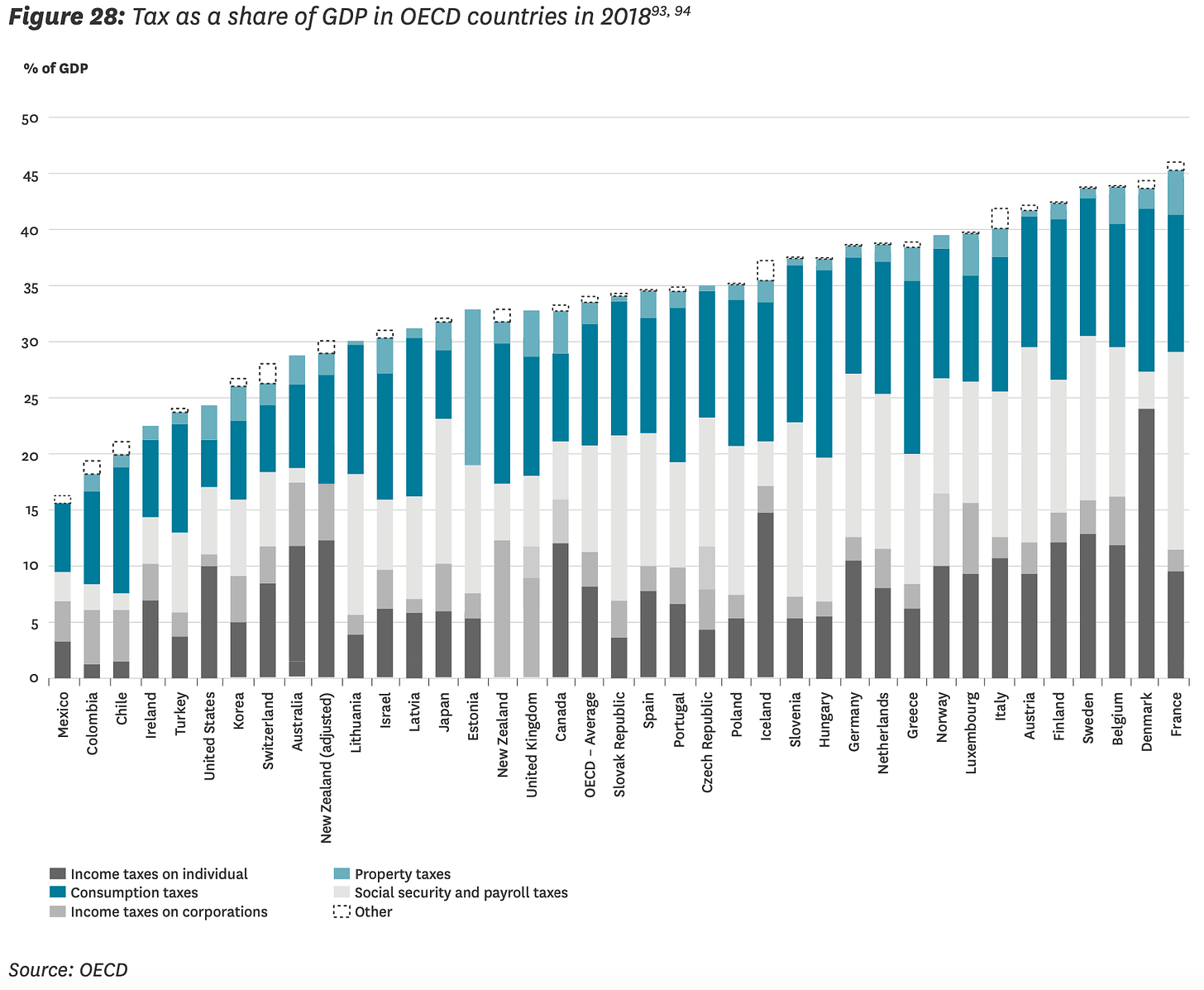

The most obvious conclusion from the draft is that New Zealand’s underlying tax share of the economy is too low for the obligations voters and politicians have signed up to. This chart shows how low our tax share is relative to other countries, and how it is much more reliant on GST and PAYE than other countries, which tax property and capital gains.

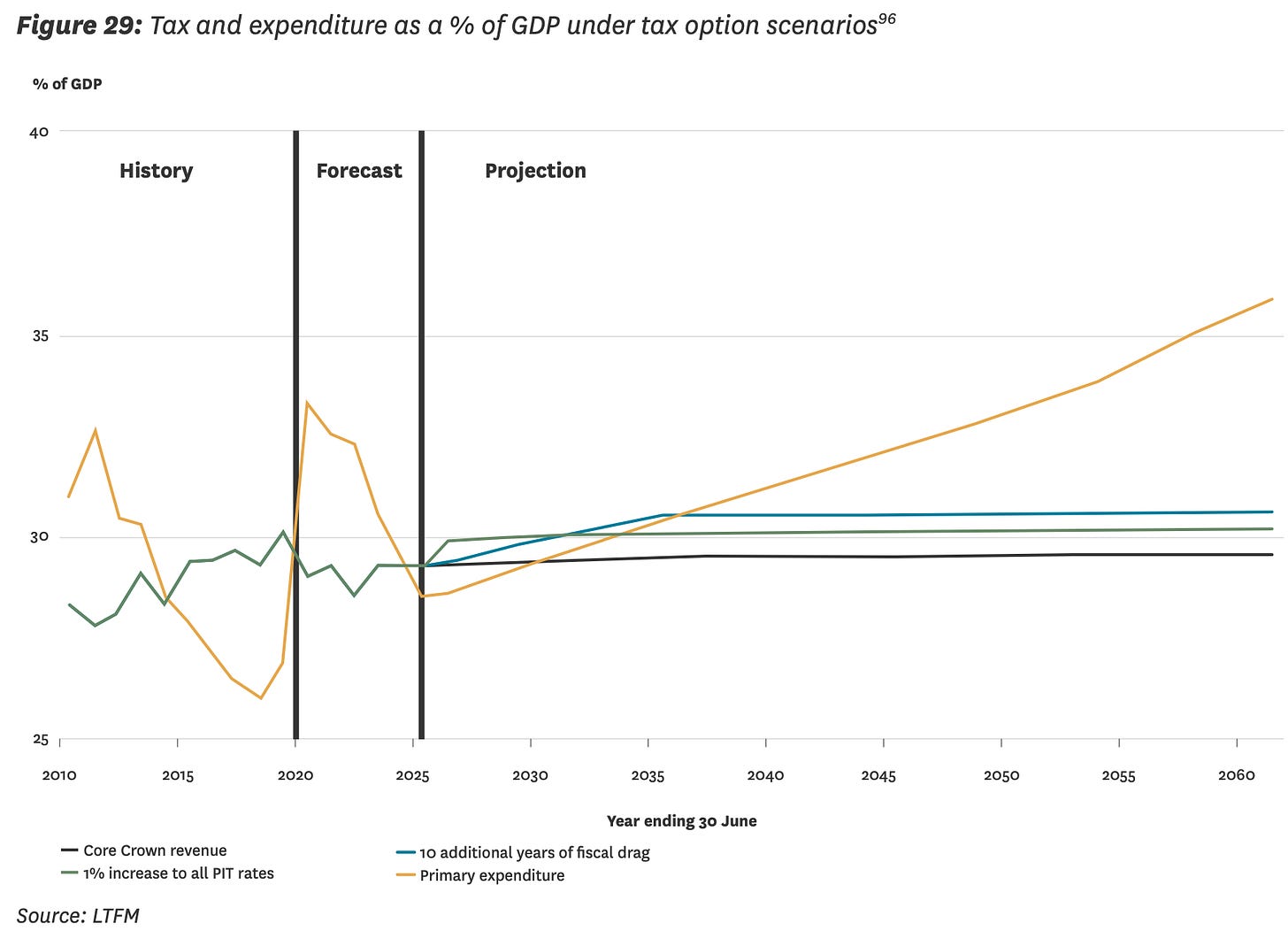

Either the obligations have to be cut, or the tax rate has to increase. For the first time, Treasury has looked in more depth at what higher tax rates would do and included a scenario where it increased all personal income tax rates by one percentage point, and a scenario where ‘fiscal drag’ is allowed to operate for 10 years.

The other points to note from the Long Term Fiscal this time are:

Treasury said it’s judgement was there was currently no need to reduce debt levels and that

It had stopped using the 50-60% ‘upper limit’ debt target adopted in 2019 because of Covid.

It reframed the ‘prudent’ upper debt limit idea as dependent on what level of debt the Government would default at, whether the Government still had market access, and, for the first time, a ‘wellbeing approach’.

Treasury referred to this paper on how fiscal strategy affects living standards when talking about this approach. “Understanding the living standards impacts of fiscal strategy can support governments to set fiscal strategy with a focus on intergenerational wellbeing,” the paper summarises.

My view: This wellbeing approach to the ‘prudent debt’ instructions of the Public Finance Act 1989 are opening a path to start using the Crown’s balance sheet (ie the ability to borrow) to rectify or reverse intergenerational wealth transfers launched by previous Governments and now embedded into the Government’s and society’s outlook. Previously, Treasury interpreted the Public Finance Act in a simple way of targeting debt reduction always and only using the balance sheet to respond to shocks.

It’s worth including the full quote on page 44 to spell out that ‘wellbeing approach’:

“…which considers the level of debt beyond which taking on more debt would generally reduce current and future wellbeing more than it enhances it. This is the preferred, but most judgement- heavy, approach and involves considering, for example, whether spending is likely to have long-term benefits that outweigh the long-term debt servicing costs and reduced fiscal resilience rent costs to society depending on the interest rates the Crown faces.”

This quote from the fiscal strategy paper is a good overview of this wellbeing approach:

“Depending on which generations benefit from and pay for government spending, fiscal strategies will have different implications for intergenerational equity. Therefore, fiscal strategies imply value judgements about how to weight different generations' living standards, and how to manage risk. New Zealand’s fiscal frameworks can support governments to realise their distributional and risk management objectives, consistent with a focus on intergenerational wellbeing.” Treasury’s Elle Hughes.

Scoops and news breaking this morning

Signs o’ the times news

Useful longer reads and listens

Share this post